Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Despite staging small, late-weekend recovery rallies in spot markets, the derivative markets of BTC and ETH both present mixed pictures of sentiment. Perpetual swap funding rates are low but positive after a dip negative at the end of last week. Futures yields remain constructive, but indicate that futures prices hold almost no premium above spot price in short-dated BTC exposure. However, the skew of short-dated volatility smiles remains strongly towards OTM puts, and has not been buoyed by the move higher in spot. Volatility remains elevated in both markets, despite only ETH’s term structure sporting an inversion, as traders refuse to price-out the end of a volatile beginning to November.

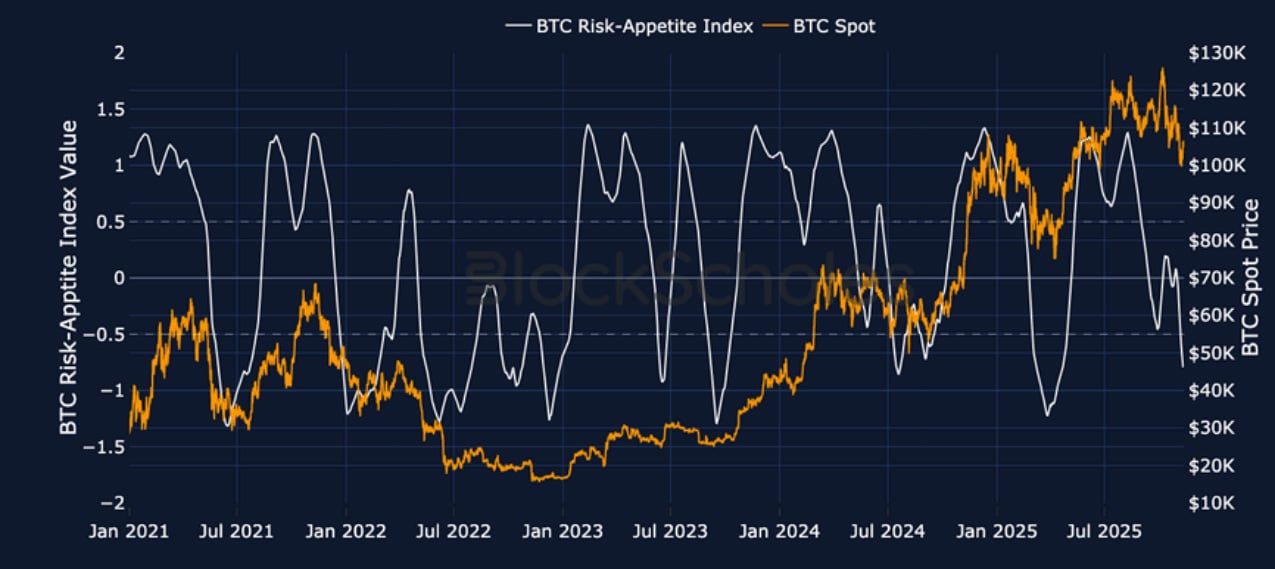

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

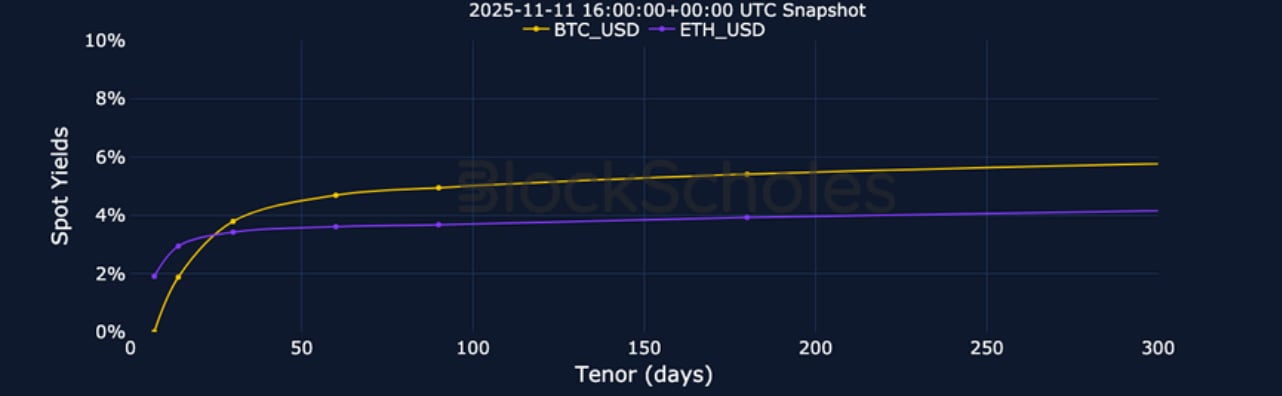

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

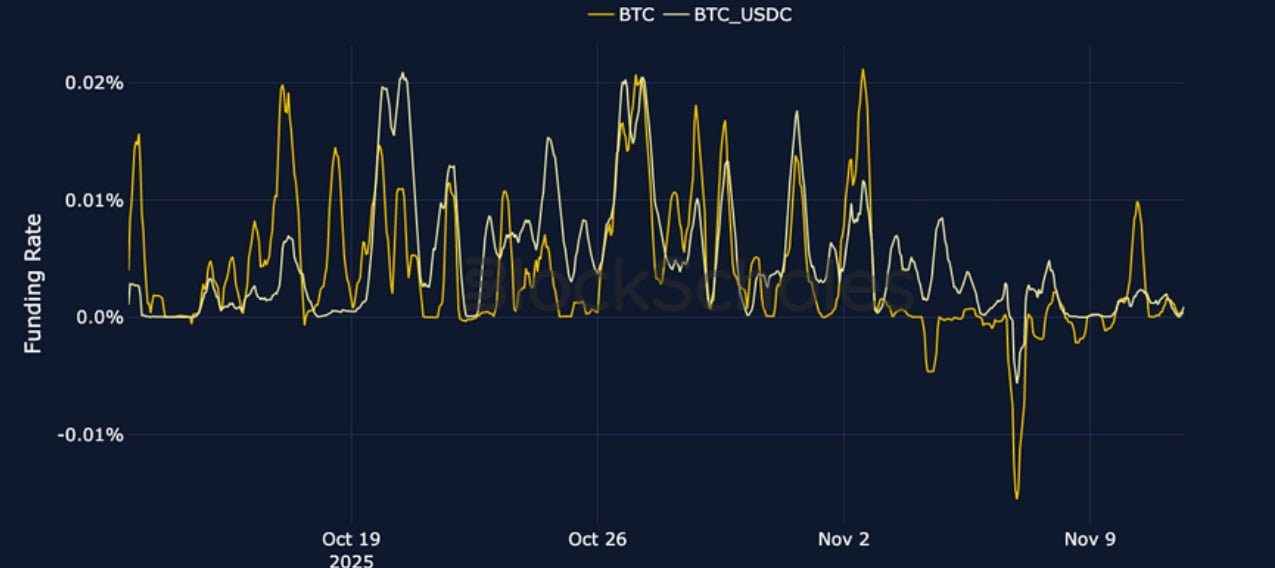

Perpetual Swap Funding Rate

BTC FUNDING RATE – A spike lower in funding rates at the end of last week indicates a sharp demand to close long positions or take short exposure via the derivatives contracts – that rate is now small but positive.

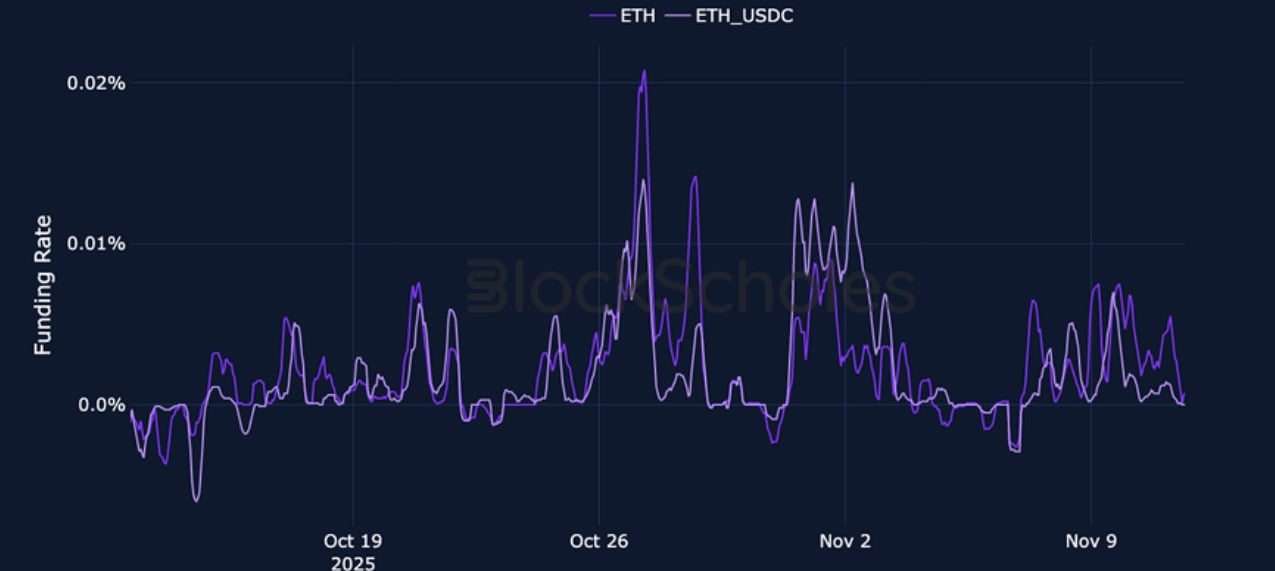

ETH FUNDING RATE – Funding rates reflect a moderately more bullish outlook than ETH’s negatively skewed options markets.

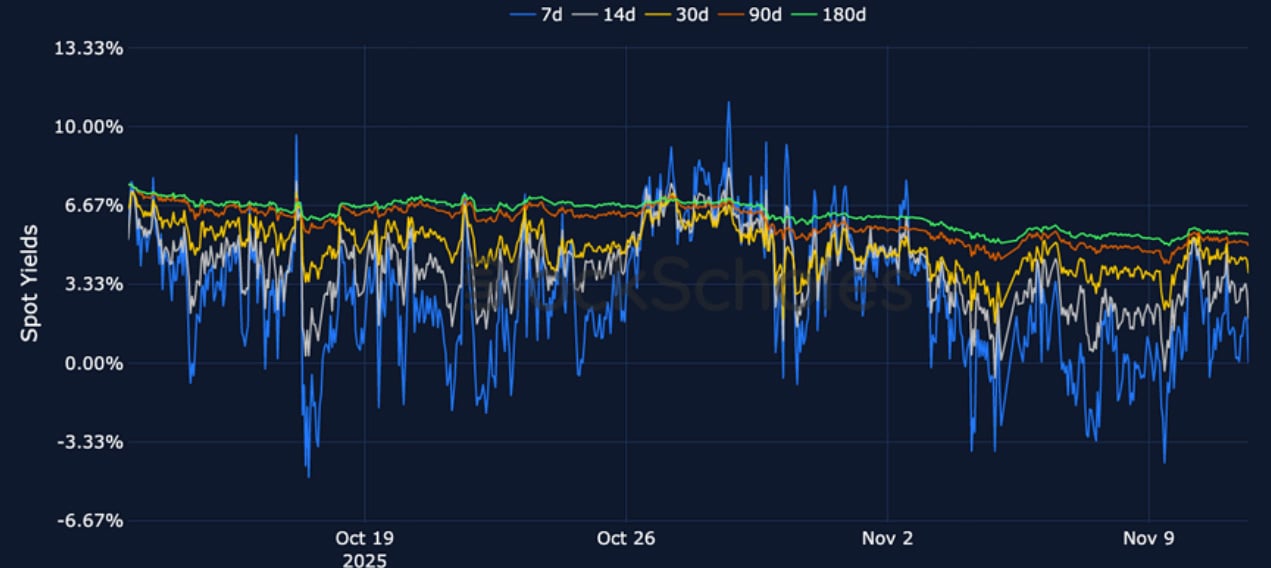

Futures Implied Yields

BTC Futures Implied Yields – Short-dated BTC futures trade very close to spot after a more sustained period of positivity at the end of October.

ETH Futures Implied Yields – 7-day futures yields remain modestly positive while options markets reflect bearish positioning in the short term.

BTC Options

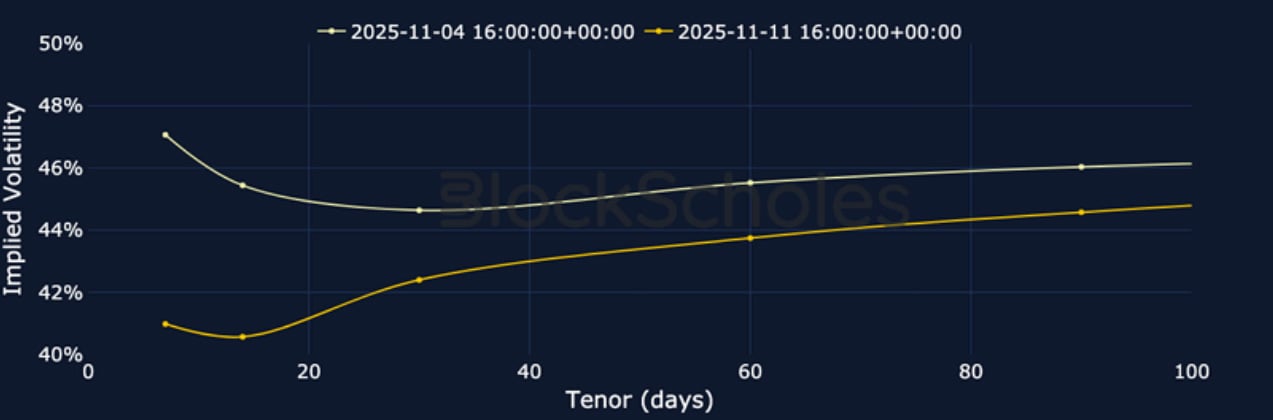

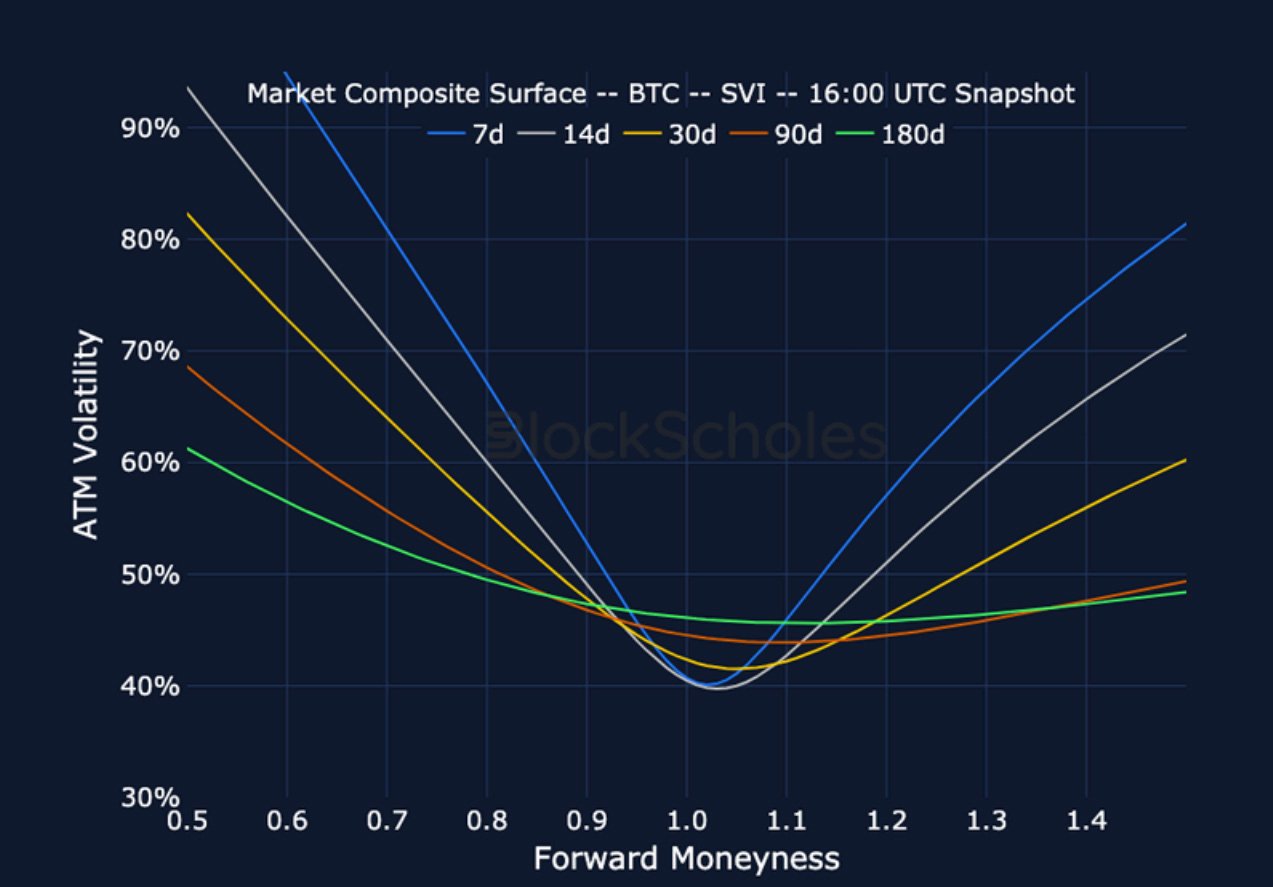

BTC SVI ATM IMPLIED VOLATILITY – The volatile moves that inverted ETH’s term structure have not had the same impact on BTC volatility surfaces.

BTC 25-Delta Risk Reversal – BTC volatility smiles are more bearishly skewed than ETH’s as we move further away from the weekend.

ETH Options

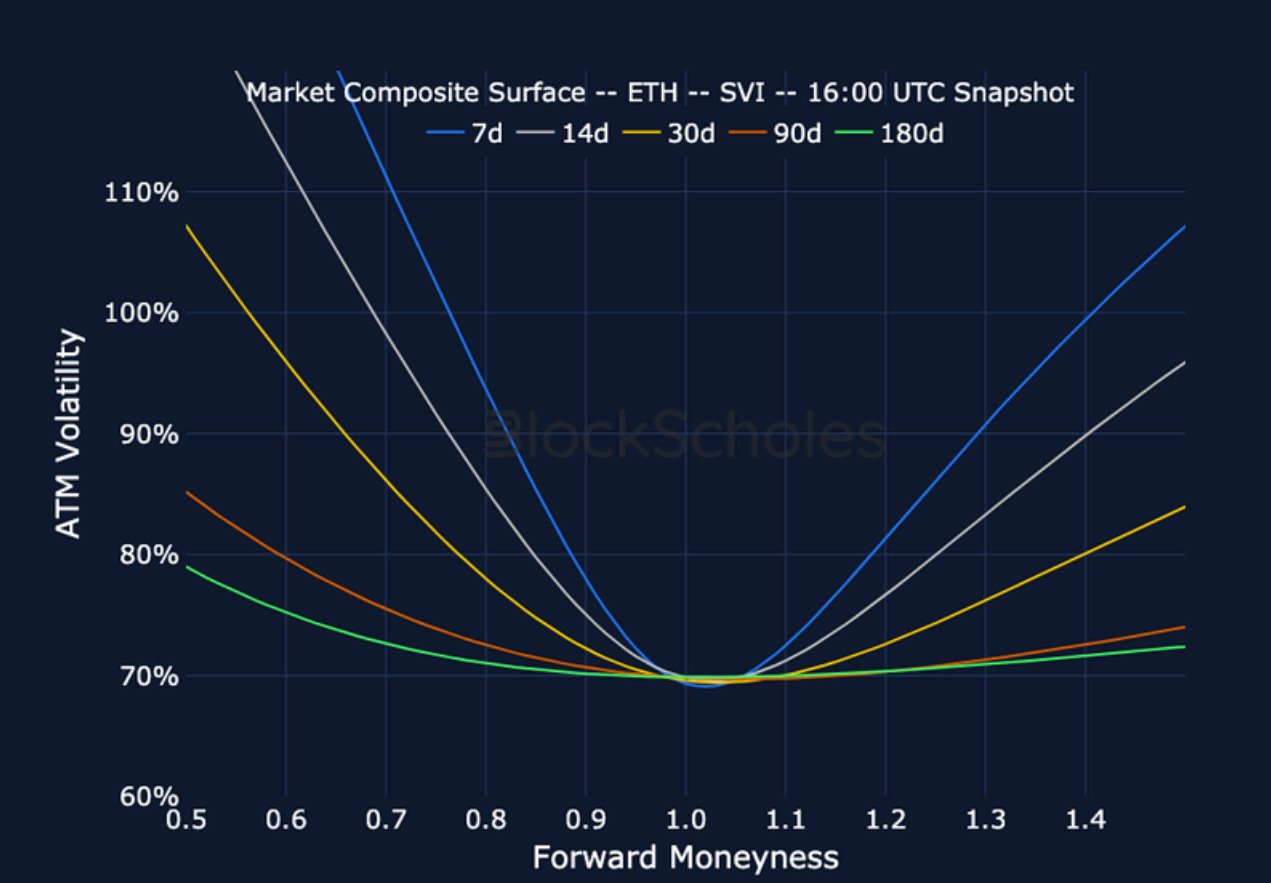

ETH SVI ATM IMPLIED VOLATILITY – Friday’s volatile spot moves resulted in another, brief inversion in the term structure that has yet to fully resolve.

ETH 25-Delta Risk Reversal – The move higher in ETH spot price over the weekend has not been backed by skew towards upside exposure in ETH smiles.

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

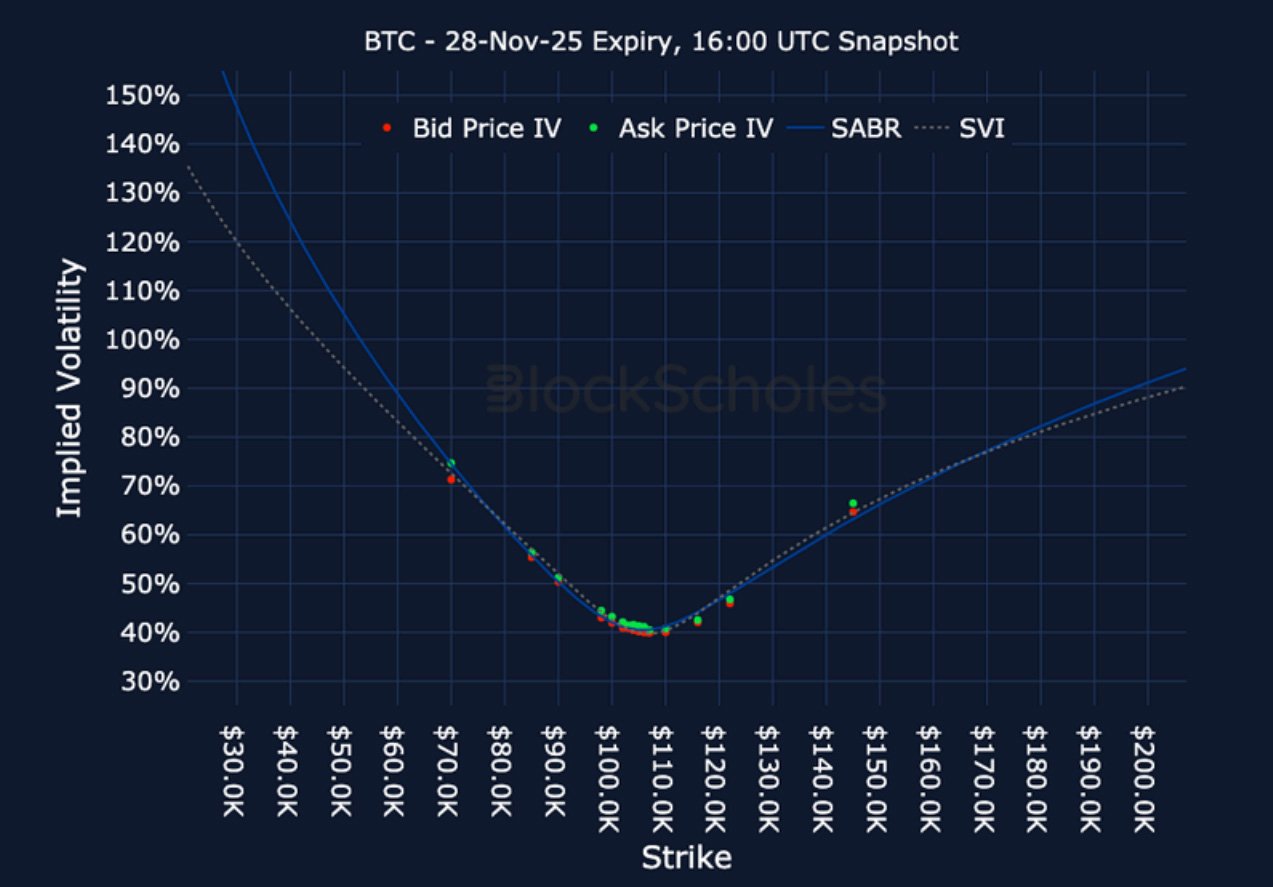

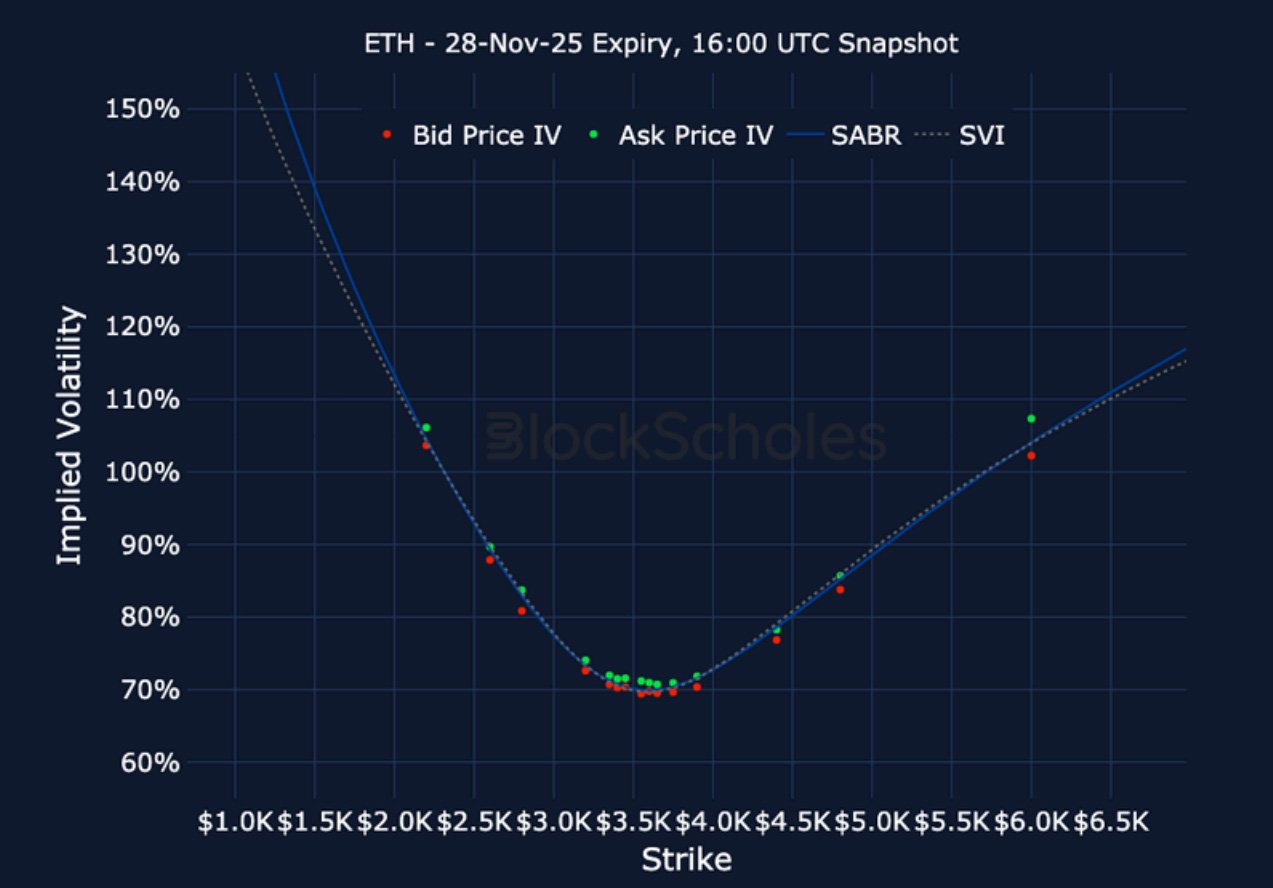

Listed Expiry Volatility Smiles

BTC 28-NOV EXPIRY – 9:00 UTC Snapshot.

ETH 28-NOV EXPIRY – 9:00 UTC Snapshot.

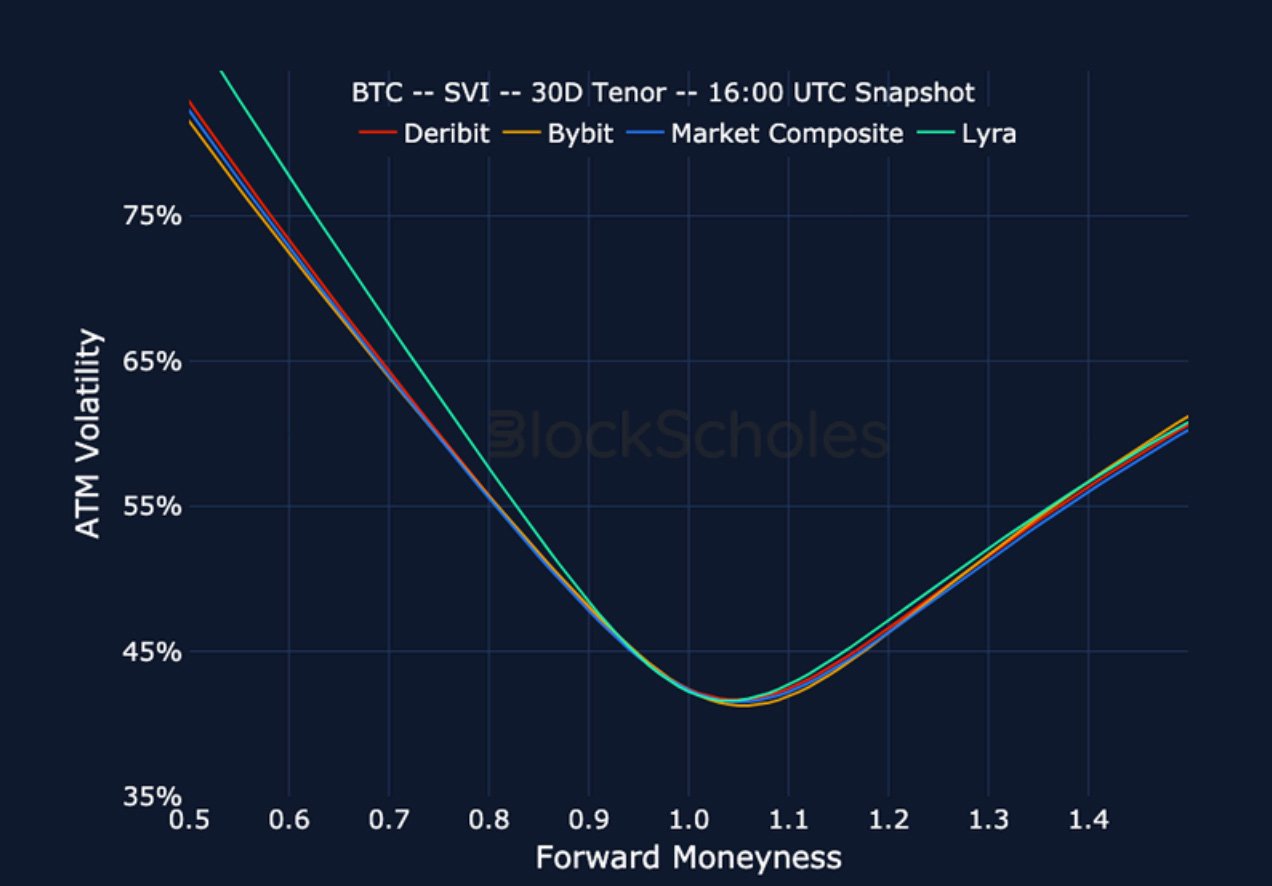

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

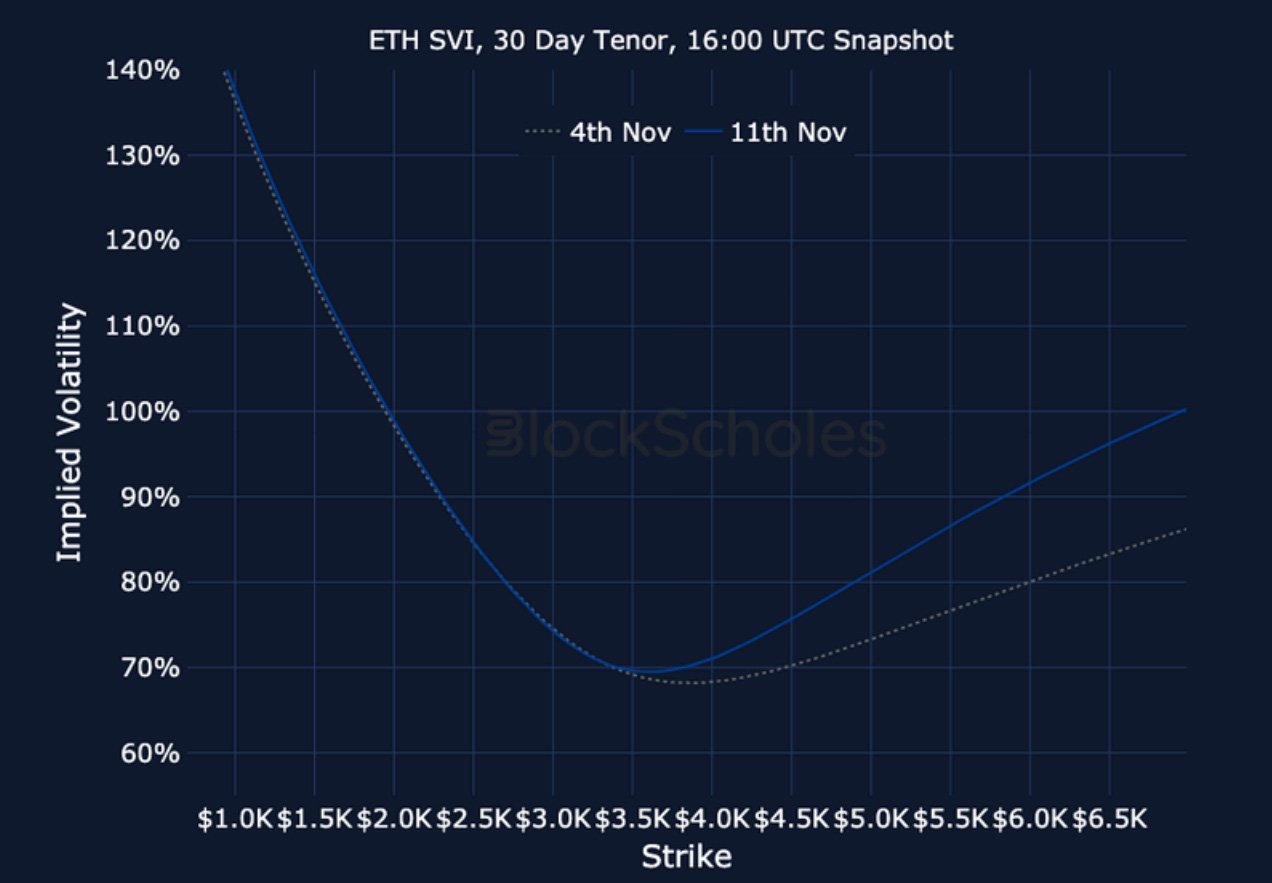

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)