Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

We observe a clear kink in the term structure of ATM implied volatility for BTC, very close to the expected deadline date for several ETF applications. Notably, this kink is also present in ETH’s term structure, suggesting that markets expect to see an increase in volatility for both assets around this date. Similarly, the skew of both major assets’ volatility smiles shows a clear demand for upside exposure at tenors longer than 3M. This pattern is also echoed in the spot yields implied by the market prices of both assets’ futures, which trade at similar levels to each other for the first time since August.

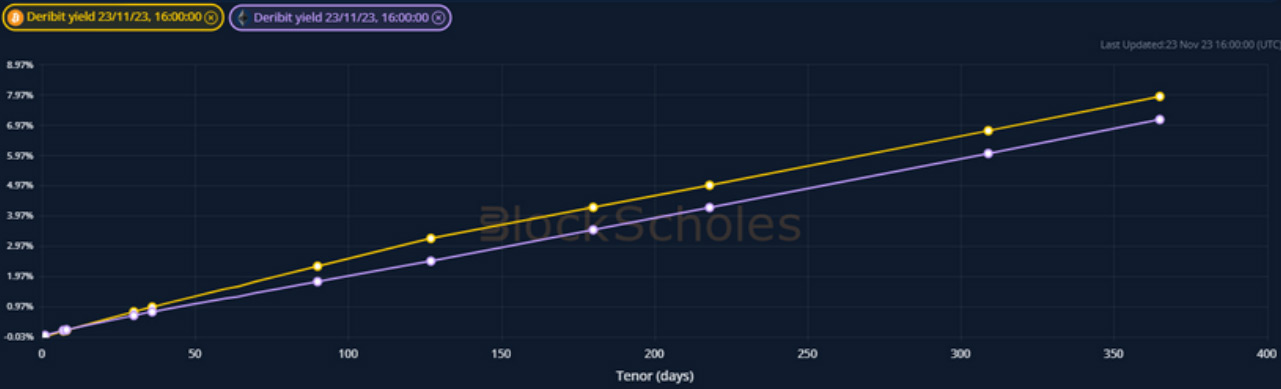

Futures implied yield term structure

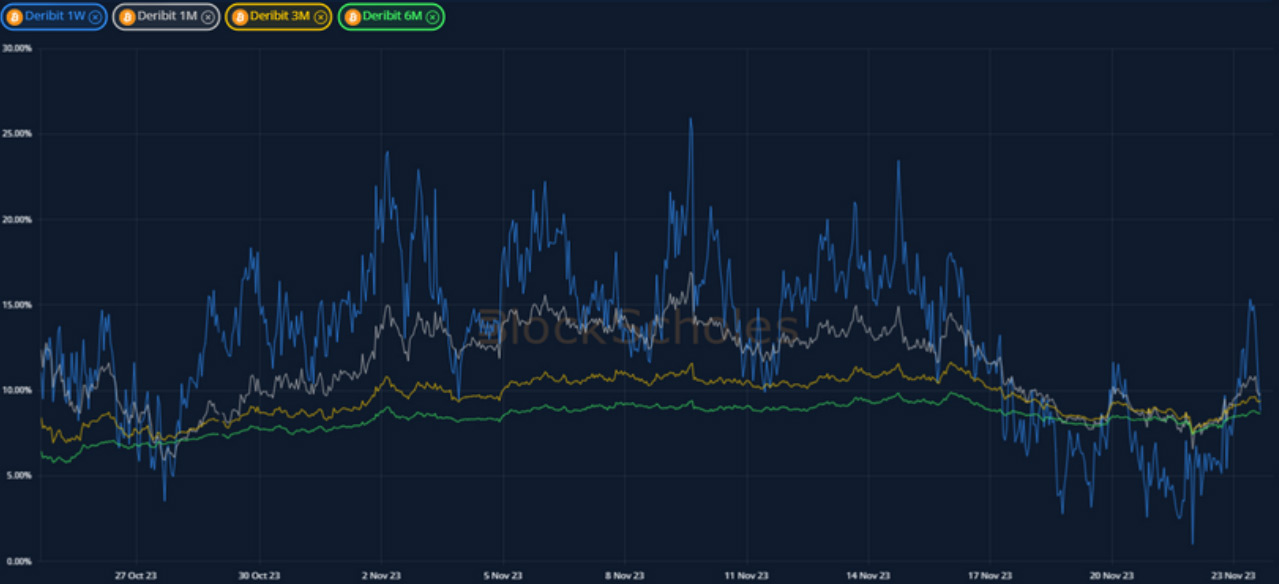

ATM Implied Volatility, 1-month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

BTC ANNUALISED YIELDS – have fallen over the last week to trade just below 10%, having re-inverting in the last 24 hours.

ETH ANNUALISED YIELDS – follow BTC’s trajectory, trading at similar levels to each other for the first time since August.

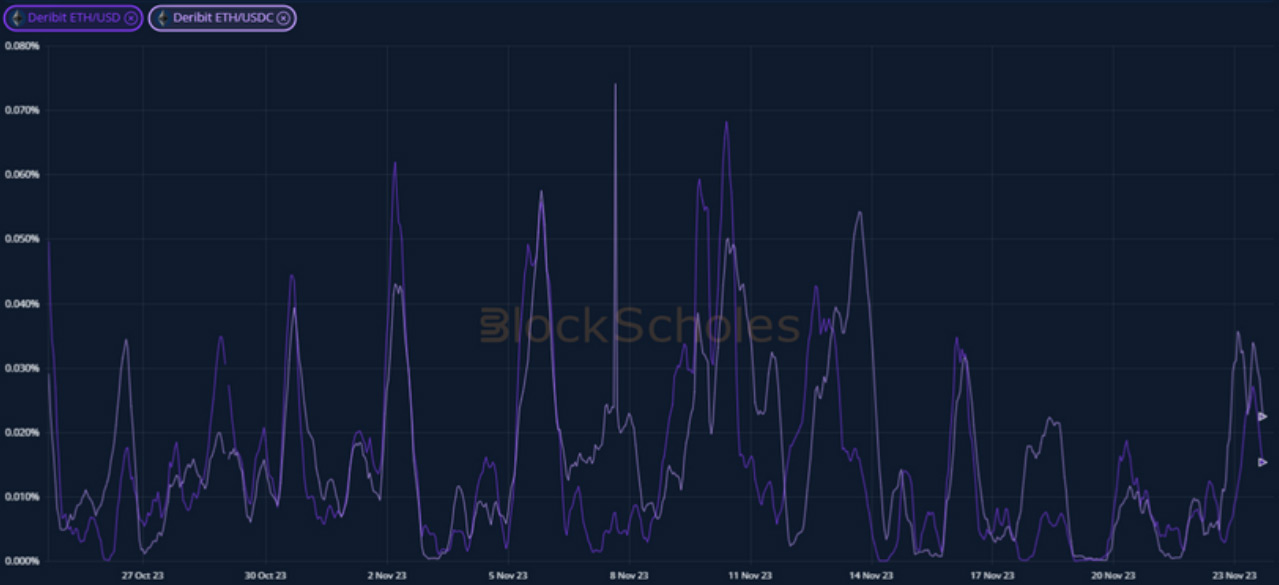

Perpetual Swap Funding Rate

BTC FUNDING RATE – have remained overwhelmingly positive, before the USDC margined contract dipped slightly negative in the most recent data.

ETH FUNDING RATE – has not seen the same drop negative as BTC’s has in the last 24 hours, remaining consistently positive over the last 30 days.

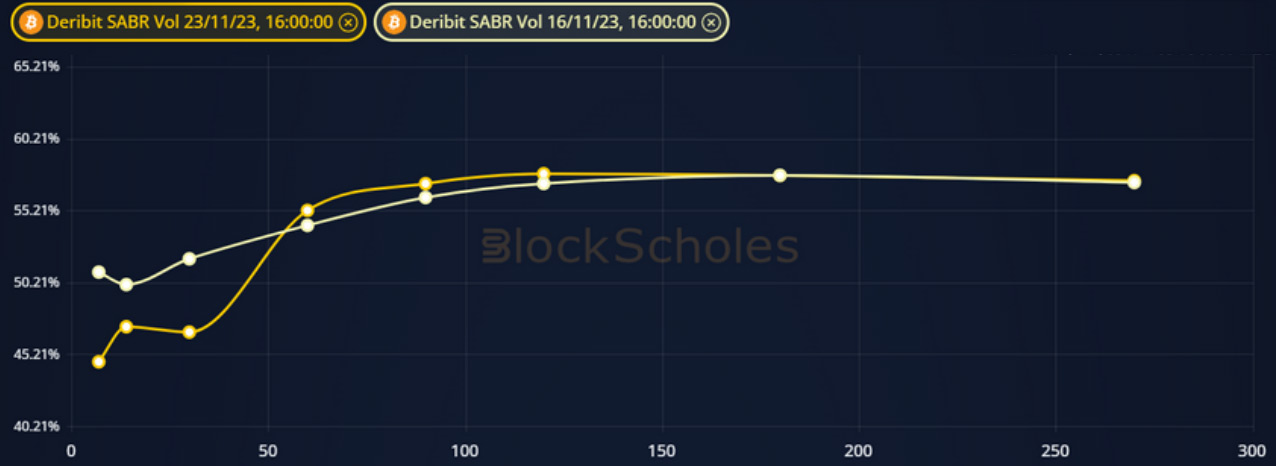

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – falls lower for short tenors while long tenors, near the date of an anticipated ETF decision, remain elevated.

BTC 25-Delta Risk Reversal – continues to trade with a stronger lean towwards OTM calls at 3M and 6M tenors, with short tenors close to 0%.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – does not show as large a spread between the 1M and 3M tenors, continuing to trade between 45% and 60%.

ETH 25-Delta Risk Reversal – shows the same gulf between short and long long tenors as does BTC’s surface, with longer dated upside in demand.

Volatility Surface

BTC IMPLIED VOL SURFACE – highlights the kink in the terms structure that delineates the expected deadline date for several ETF applications.

ETH IMPLIED VOL SURFACE – while not as strong a delineation as BTC’s at the 1M mark, ETH’s surface shows a similarly high relative demand for longer dated optionality.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

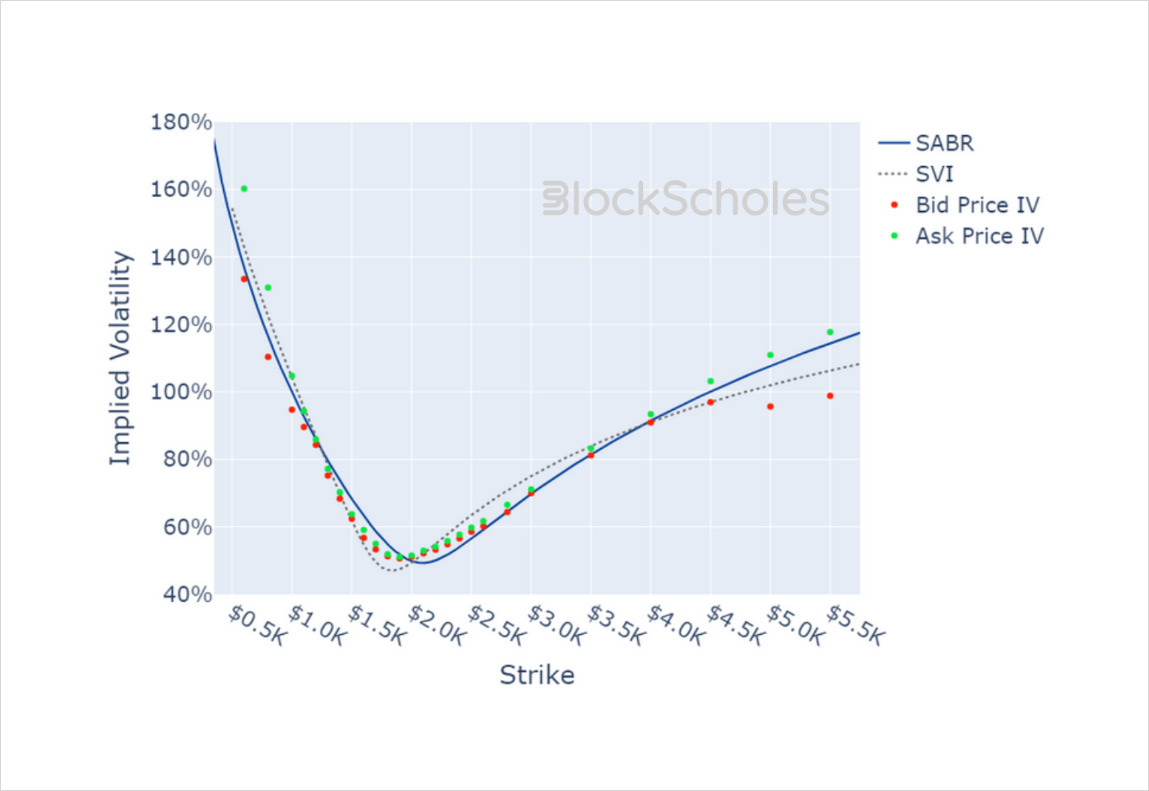

Volatility Smiles

ETH SMILE CALIBRATIONS – 29-Dec-2023 Expiry, 10:00 UTC Snapshot.

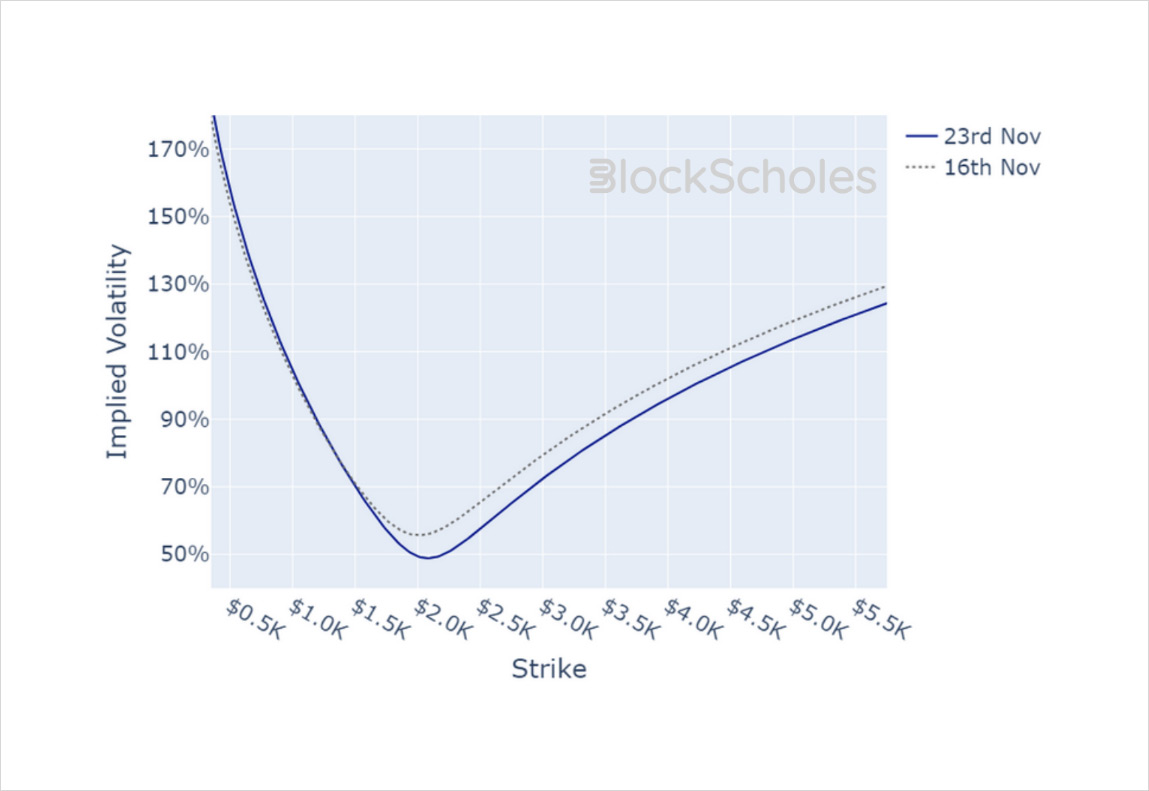

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)