Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Over the past week the derivatives market has shown a slight preference for ETH. The ATM implied volatility term structure for ETH inverted twice, reflecting demand for short-tenor optionality while BTC’s term structure has remained relatively steep. Implied volatility skew for both currencies indicates a preference for OTM calls across all tenors, signalling bullish sentiment. However, BTC’s skew sharp drops, whereas ETH’s skew has been more resilient, supporting a steadier positive outlook. Perpetual funding rates are similar for both assets, but ETH demonstrates a slight edge with higher levels favouring leveraged long exposure. Futures yields also align closely, except for short tenors where ETH shows higher levels.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

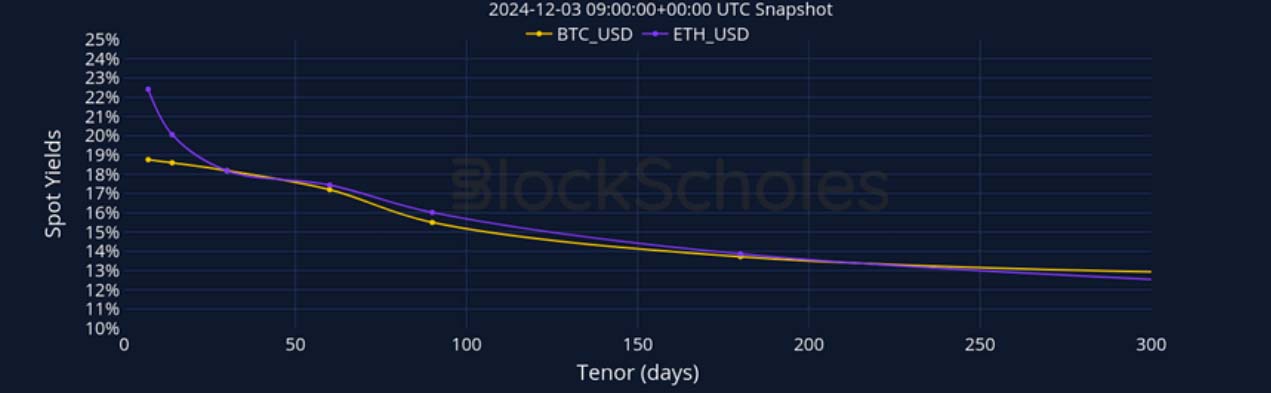

BTC ANNUALISED YIELDS – BTC’s yield term structure levels are at very similar levels to ETH’s across the term structure except for short-tenor futures.

ETH ANNUALISED YIELDS – ETH’s yield curve is strongly inverted and shows slightly higher levels than BTC’s at the front-end of the term structure.

Perpetual Swap Funding Rate

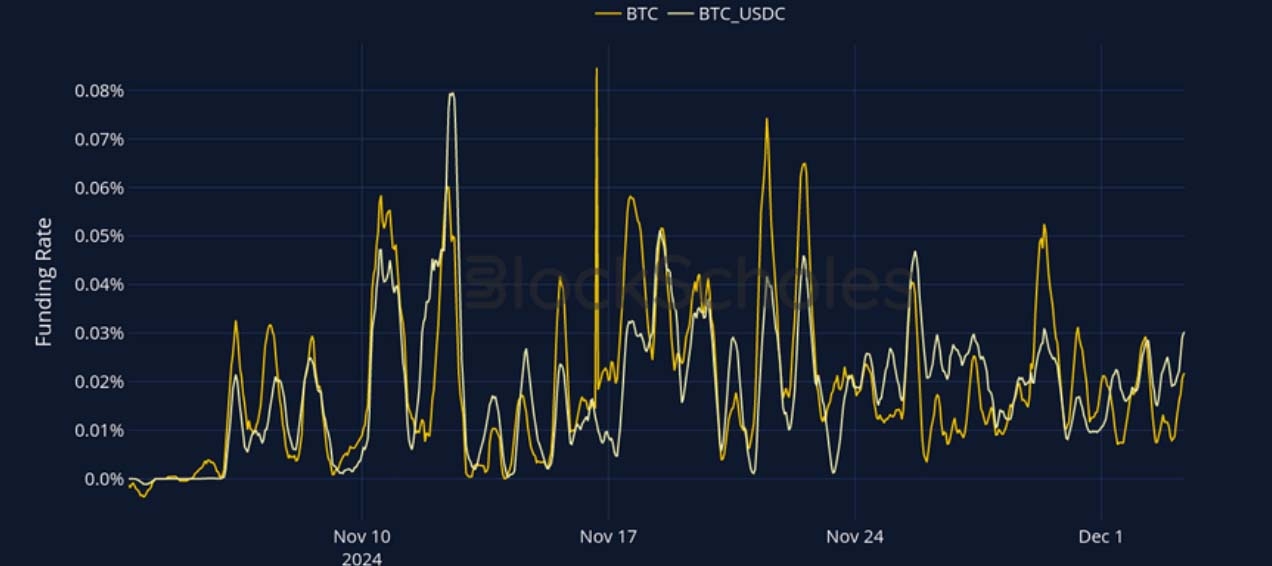

BTC FUNDING RATE – BTC’s perpetual funding rates remain strongly positive despite the recent pullback in prices.

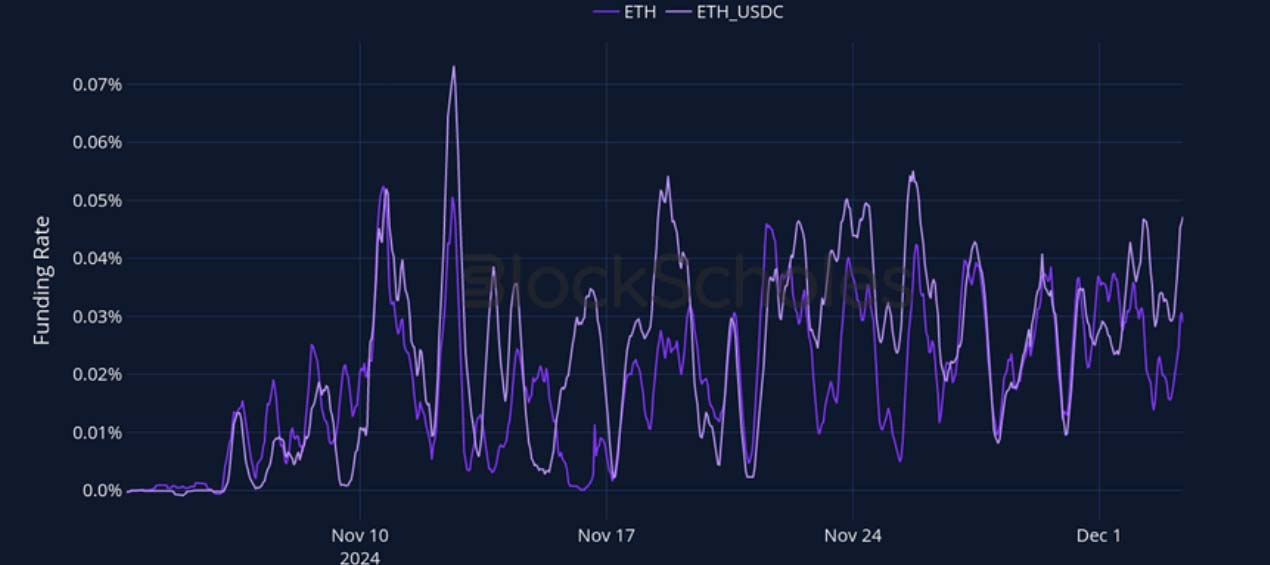

ETH FUNDING RATE – ETH’s funding rate remains extremely positive and bullish, showing slightly higher levels than BTC’s.

BTC Options

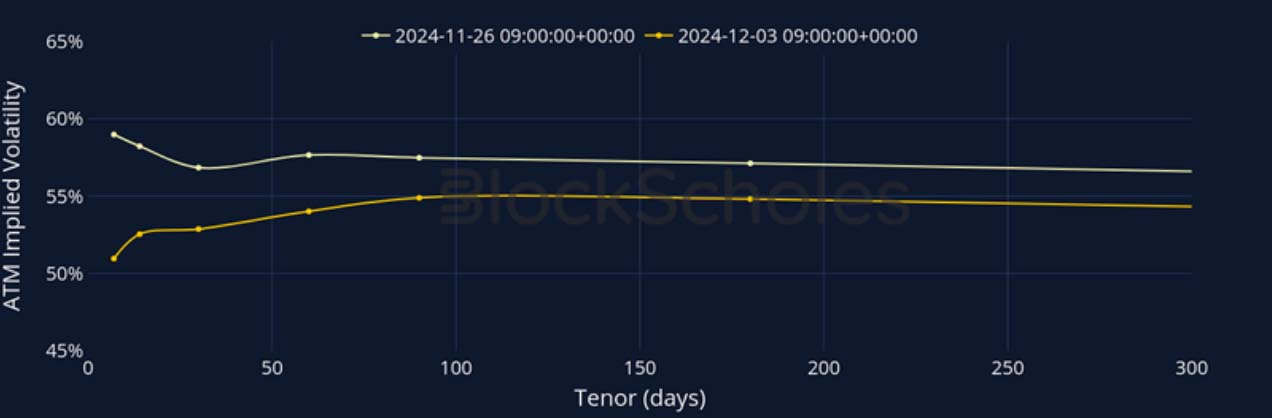

BTC SVI ATM IMPLIED VOLATILITY – Short-term implied volatility have risen recently, resulting in a ever-so-slightly steep term structure.

BTC 25-Delta Risk Reversal – Skew has dropped again at the front-end while remaining high at the far-end, indicating contrasting sentiment across tenors.

ETH Options

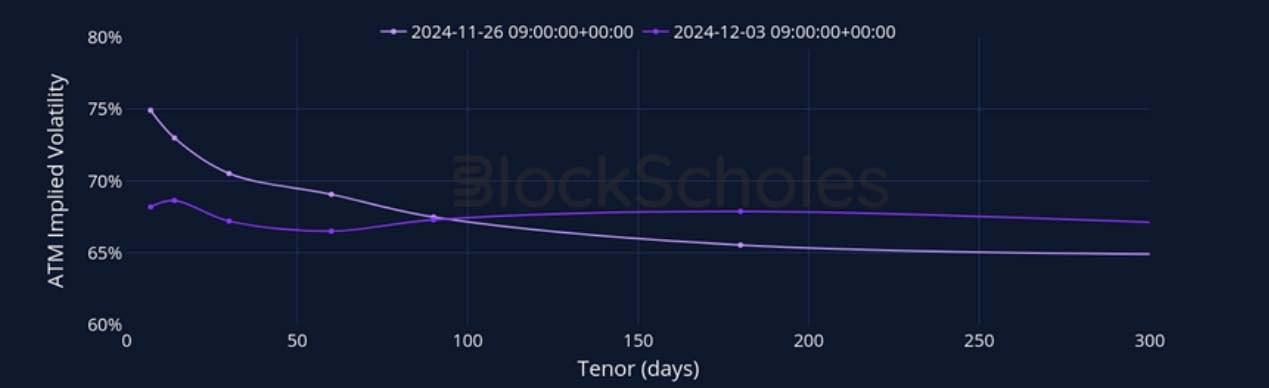

ETH SVI ATM IMPLIED VOLATILITY – ETH’s short tenor implied volatility levels have lost their momentum as the term structure becomes less inverted.

ETH 25-Delta Risk Reversal – Skew levels remain above BTC’s, showing a more bullish stance across tenors.

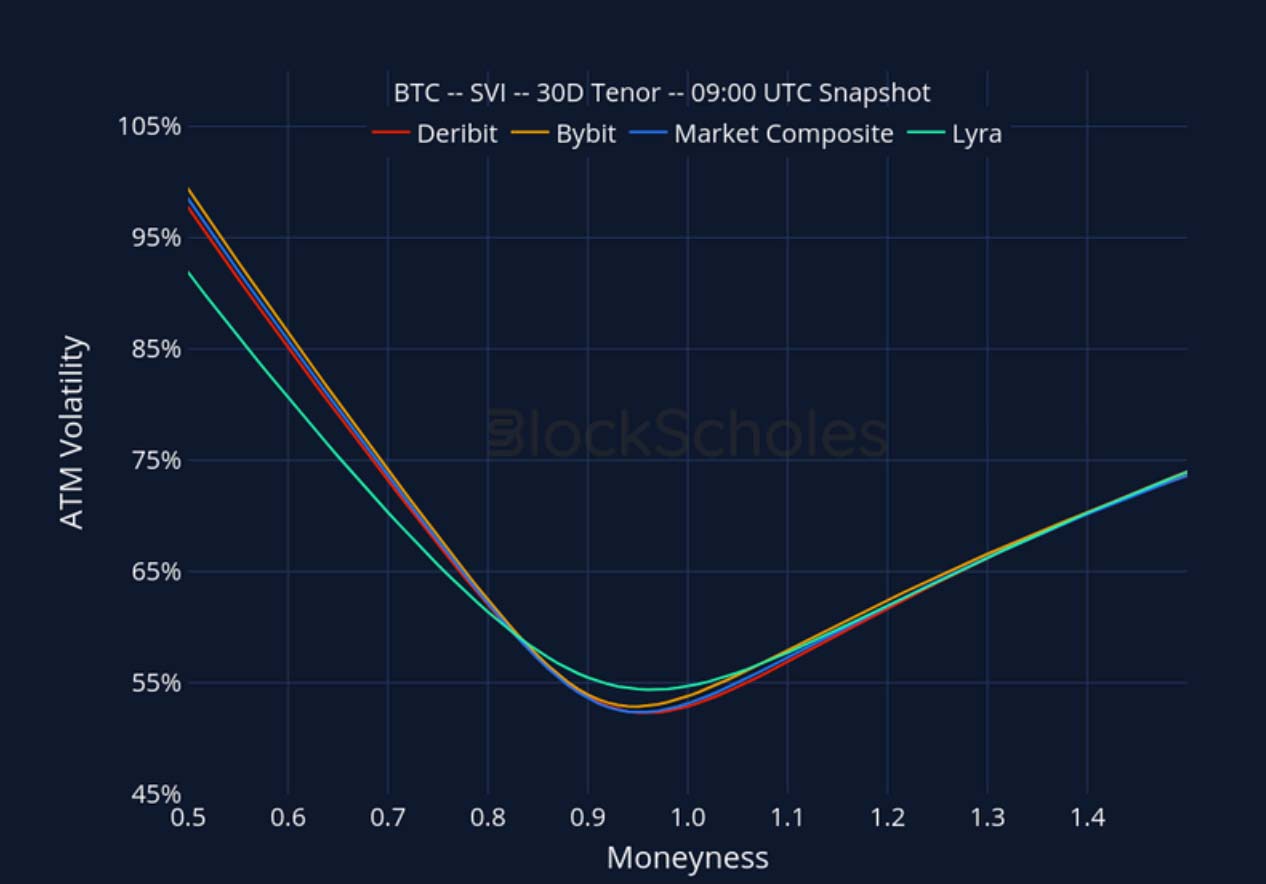

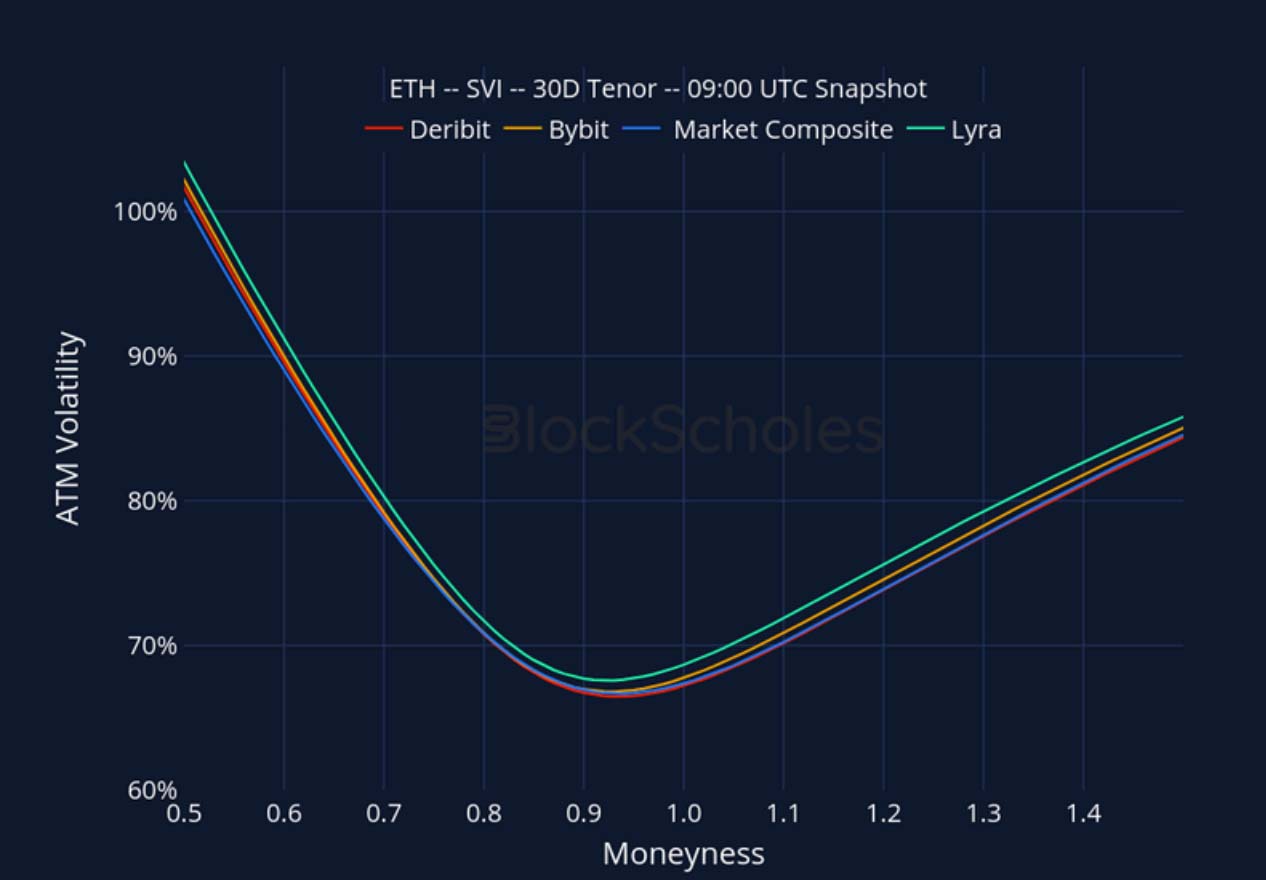

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

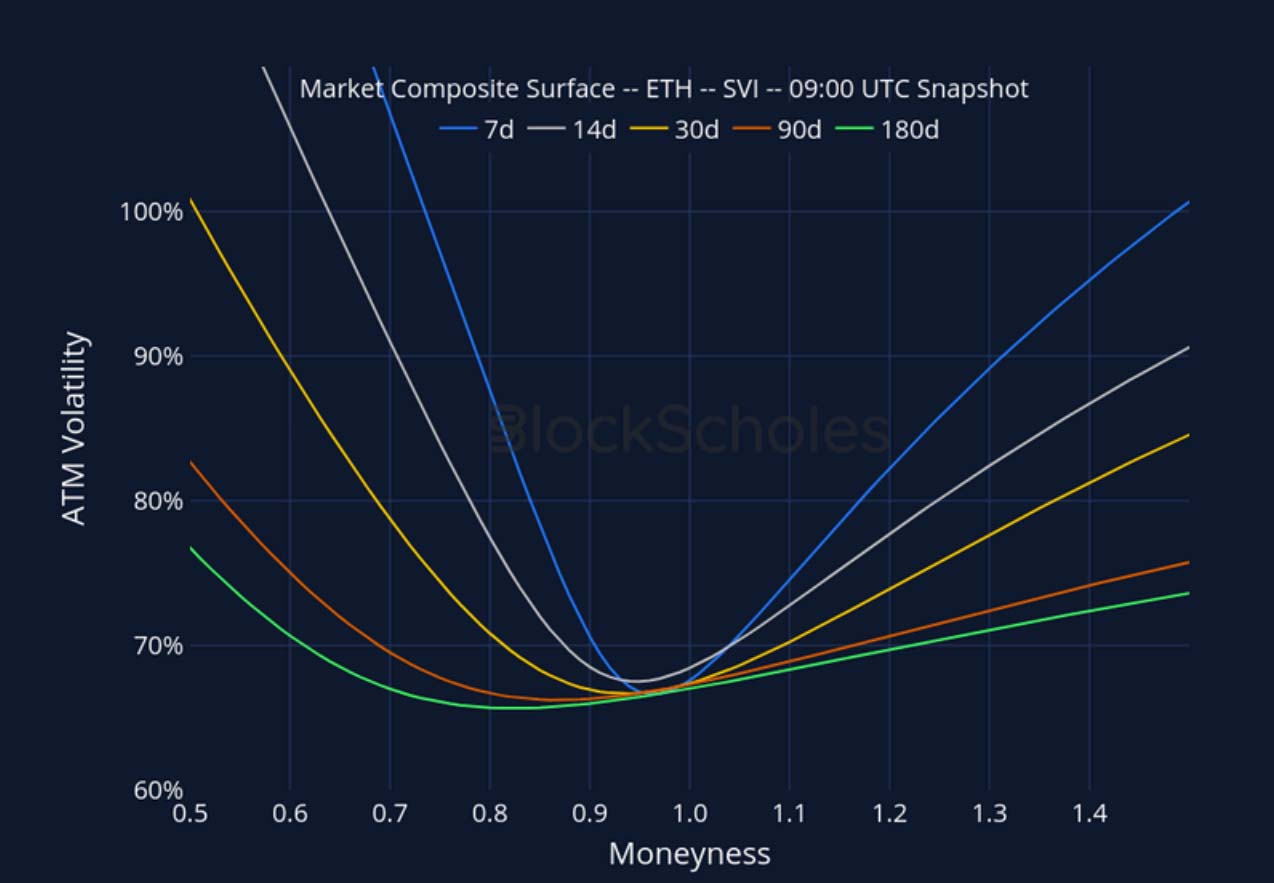

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

Listed Expiry Volatility Smiles

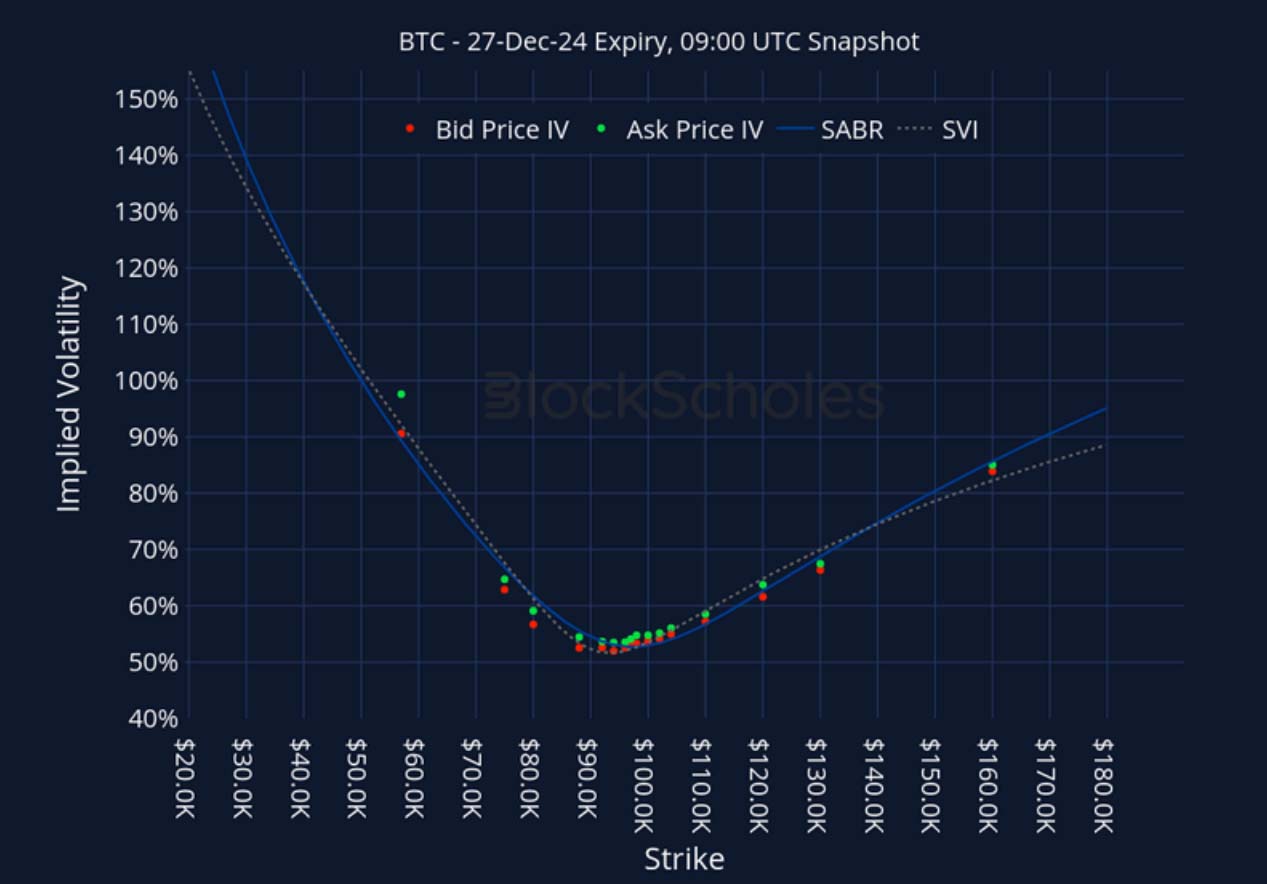

BTC 27-DEC EXPIRY – 9:00 UTC Snapshot.

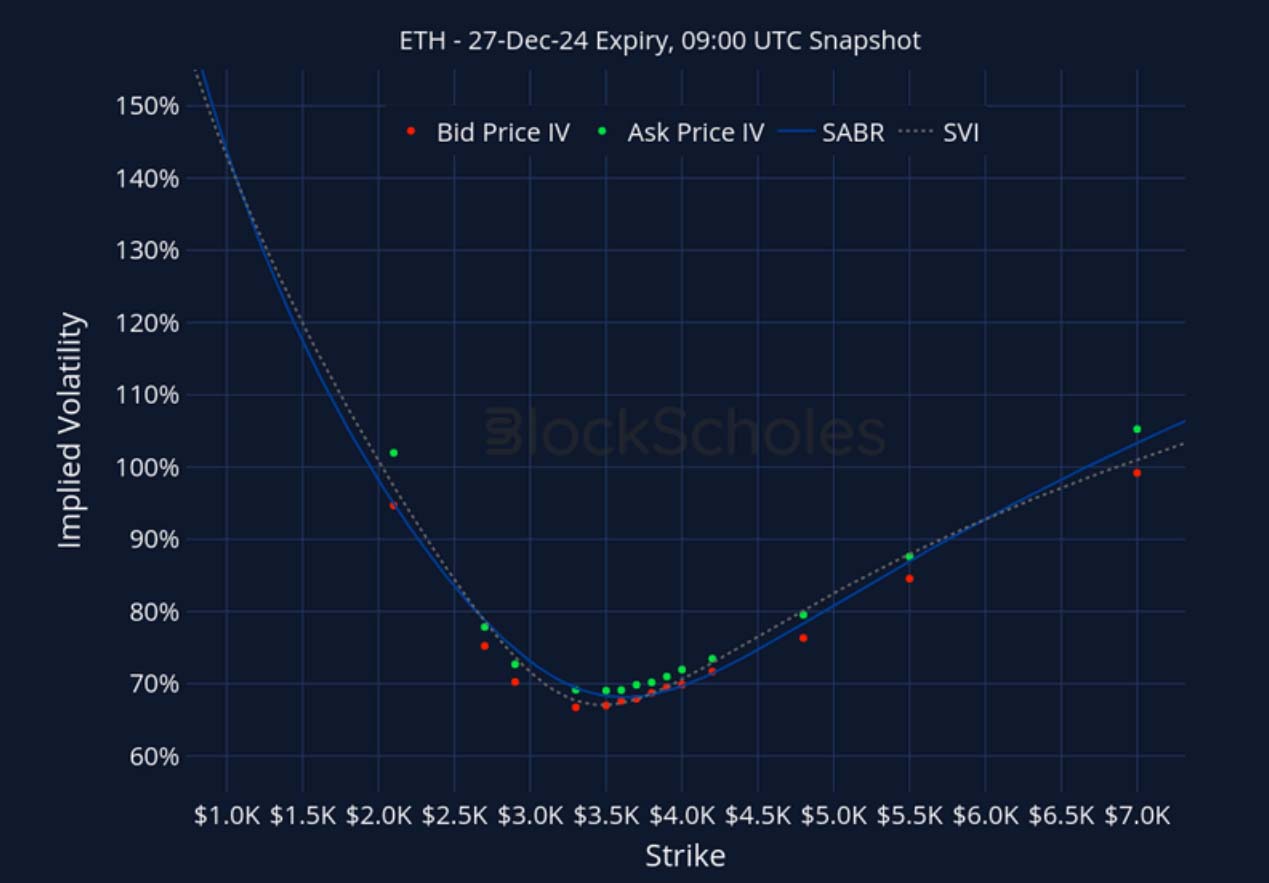

ETH 27-DEC EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

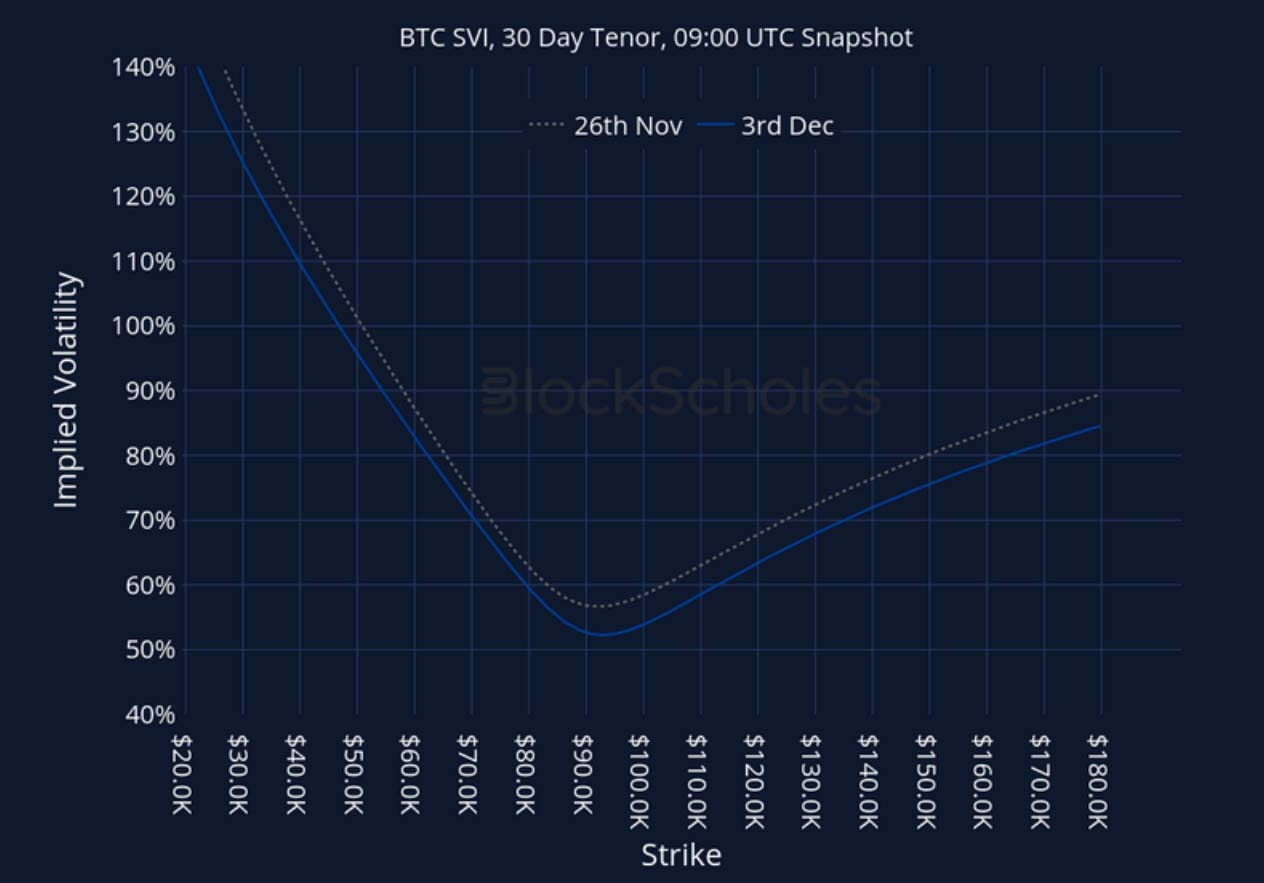

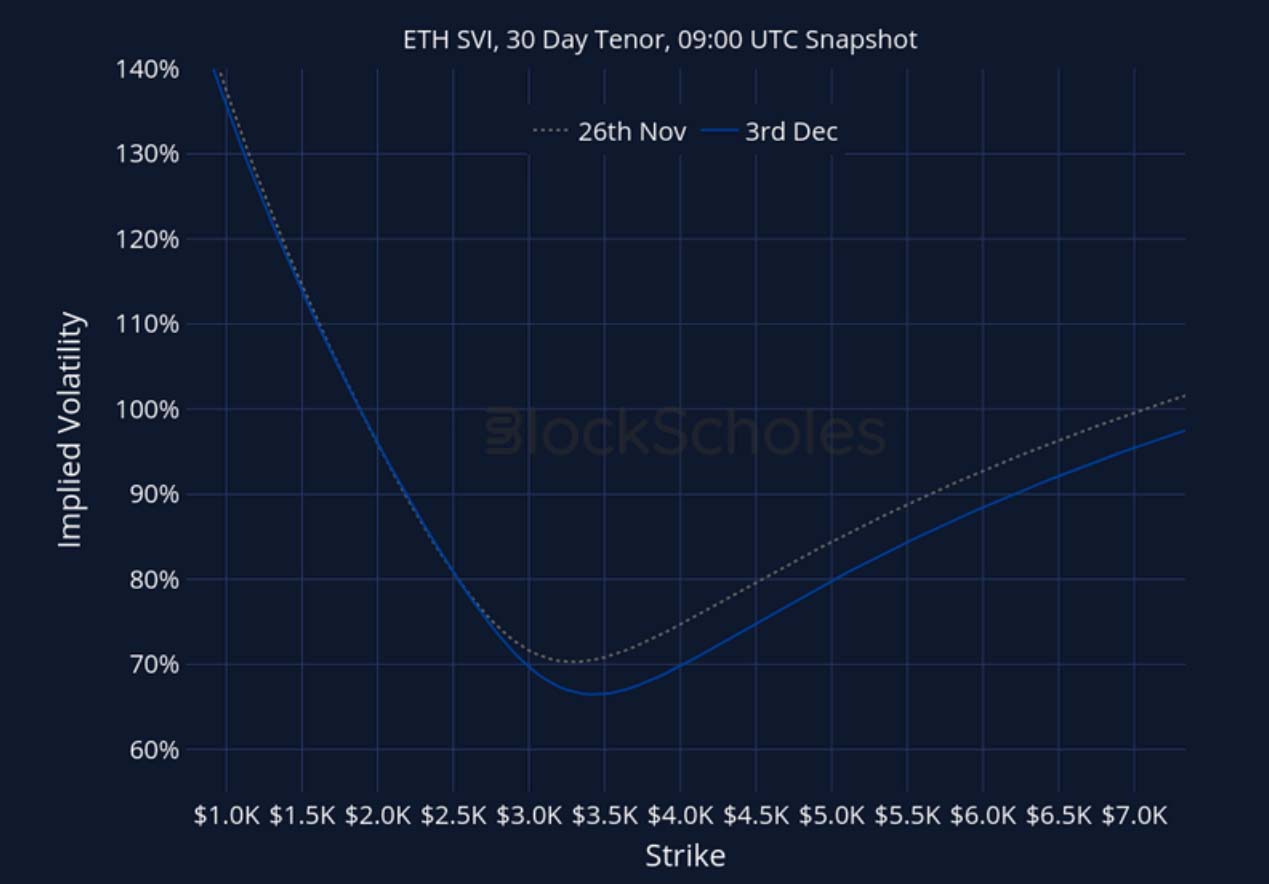

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)