Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

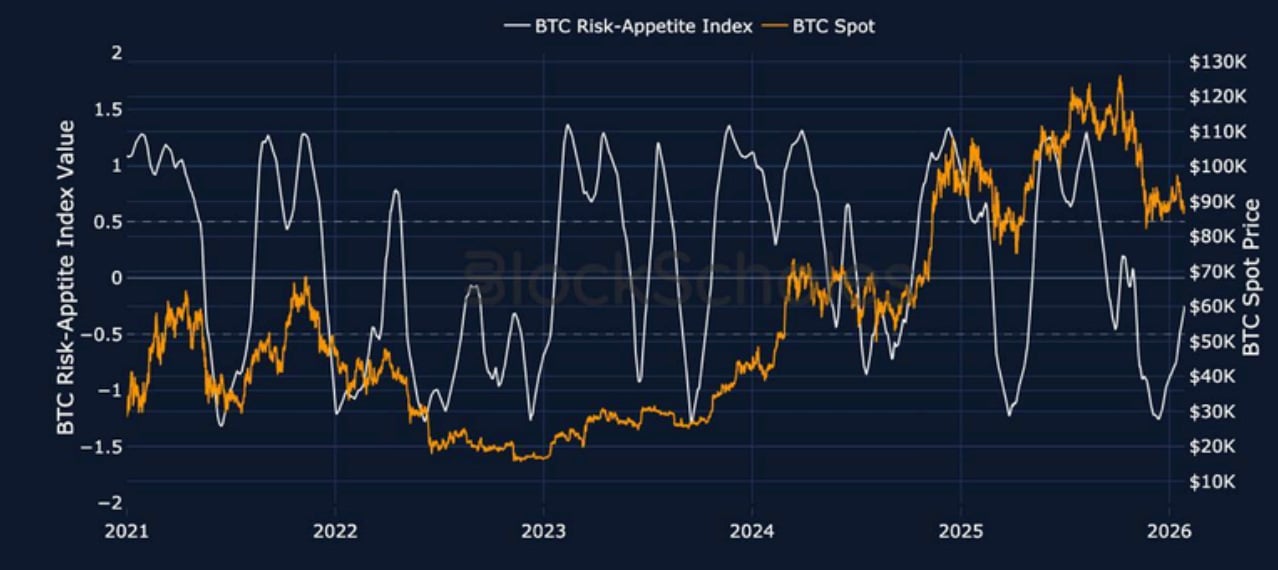

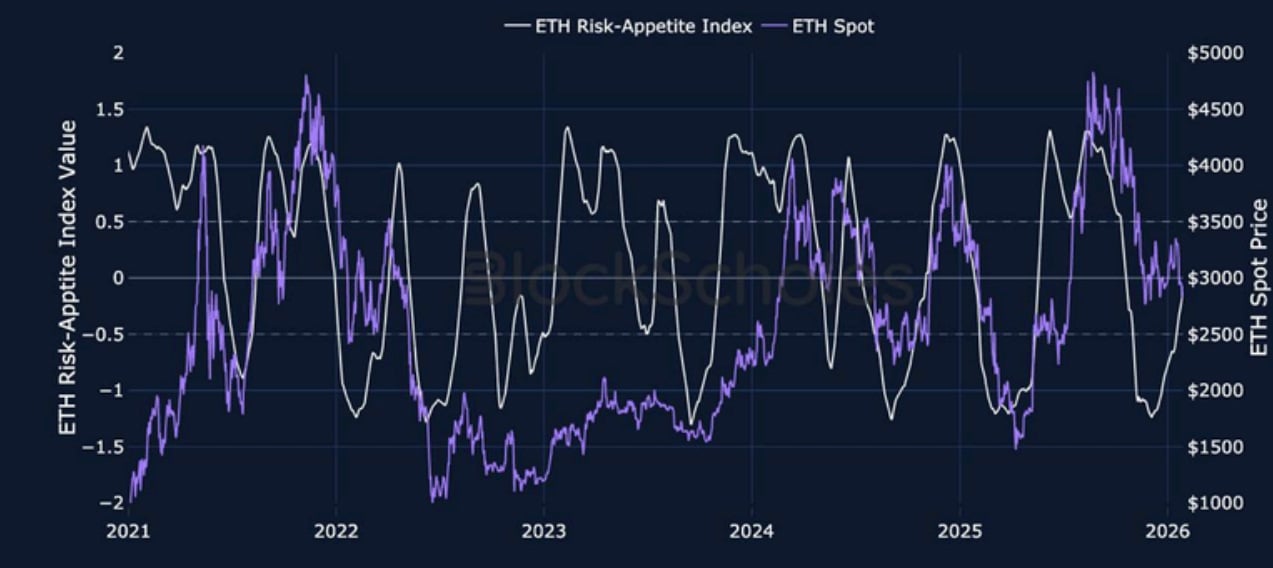

A spike in Japanese government bond (JGB) yields saw ultra-long bond yields spike to record highs, as another ‘TACO’ moment from President Trump over Greenland-related tariffs resulted in a drop below $90K for BTC and $3,000 for ETH. As such, volatility smile skews for both BTC and ETH fell to -9%, pricing in a steep premium for OTM put contracts over calls. Additionally, funding rates for ETH even briefly turned negative as macro risk factors spilled over into crypto. Despite the drops in spot price, our Risk Appetite Index for both BTC and ETH have continued to slowly move higher, with ETH now approaching the zero zone.

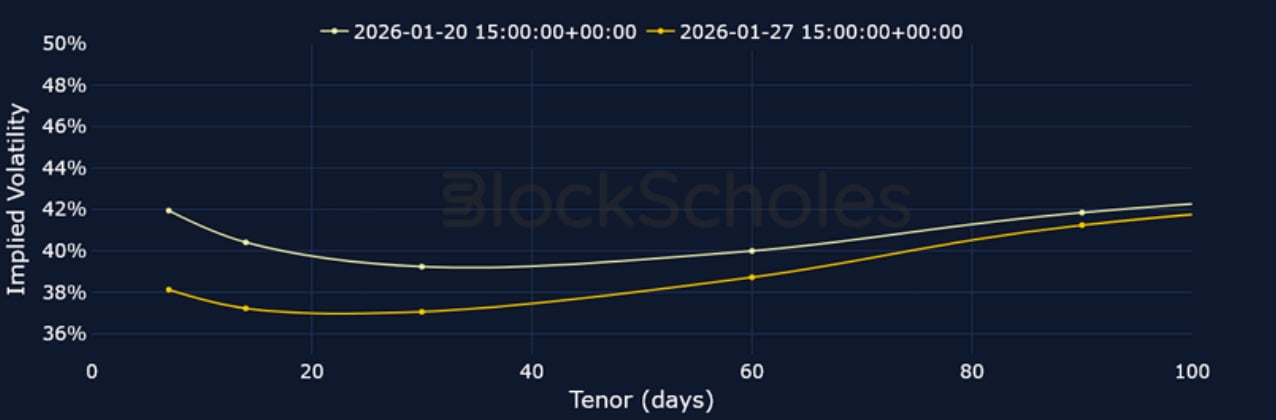

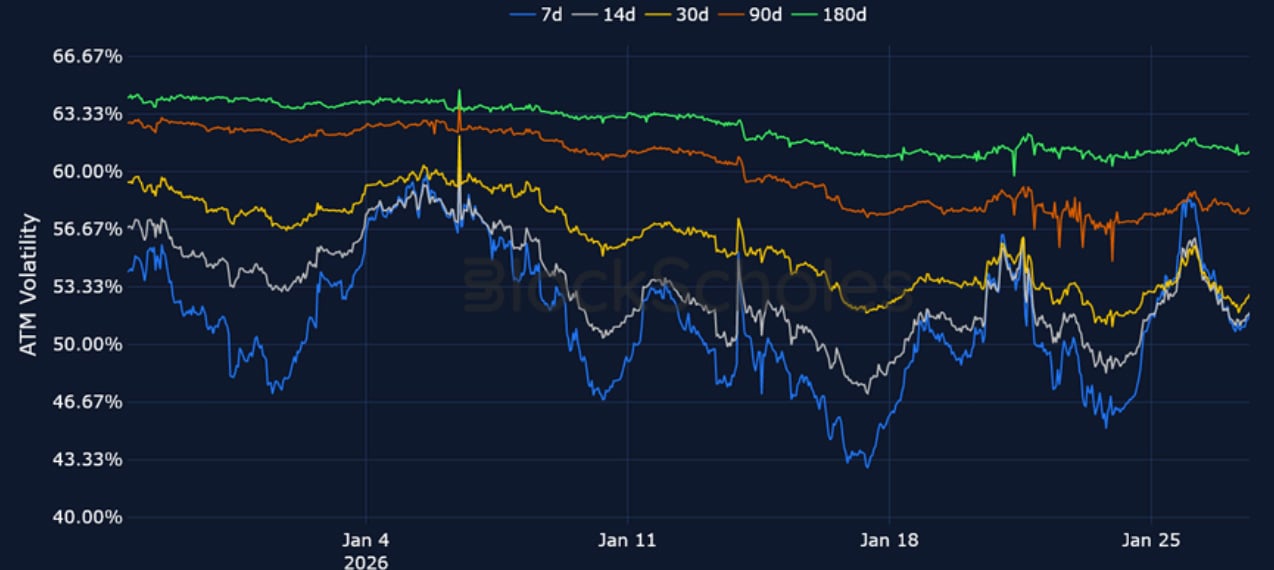

Short-tenor volatility for BTC and ETH briefly rose at the start of the week amidst the above mentioned macro events, though zooming out, 7-day ETH implied volatility trades at its lowest since October 2024, before the US election, while BTC volatility has continued to fall since its local peak in November 2025.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

Futures Implied Yields

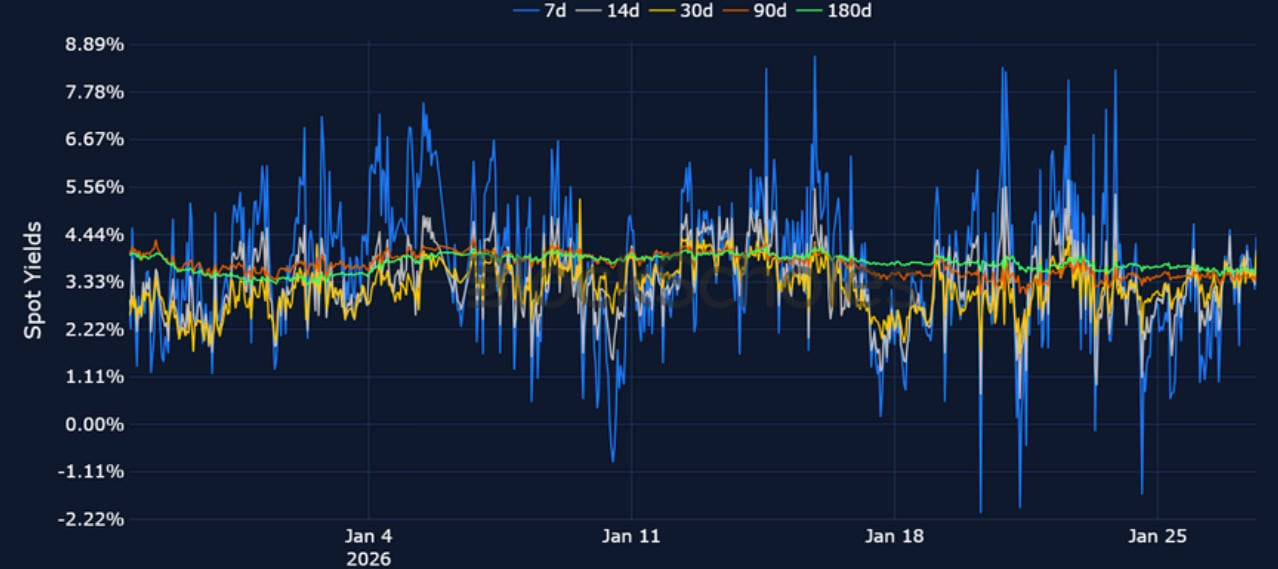

1-Month Tenor ATM Implied Volatility

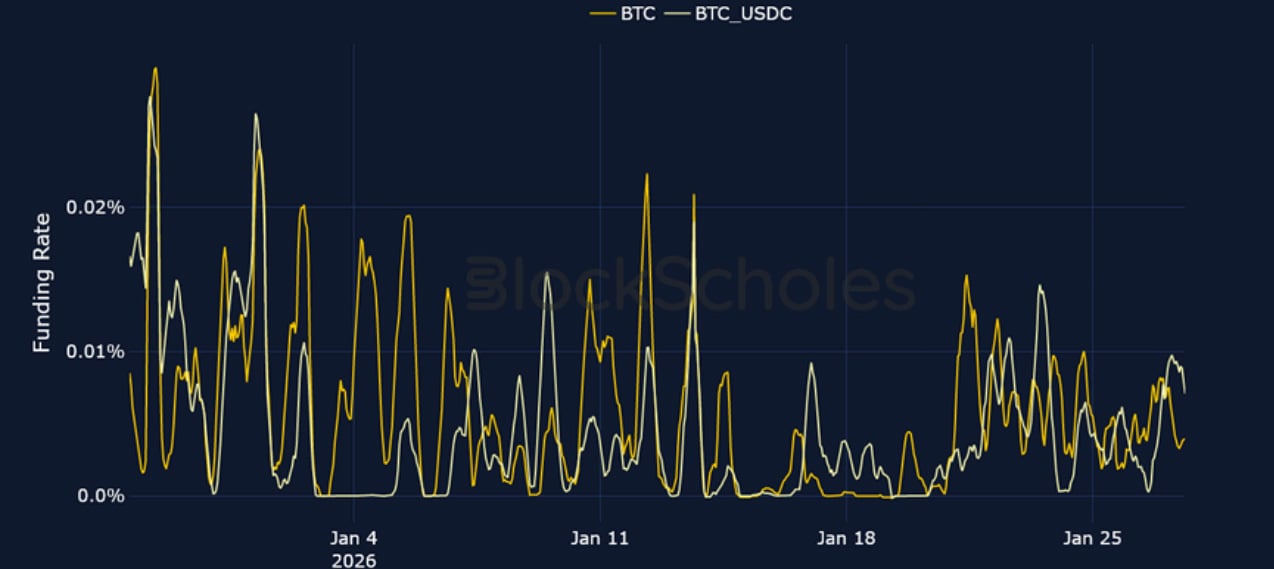

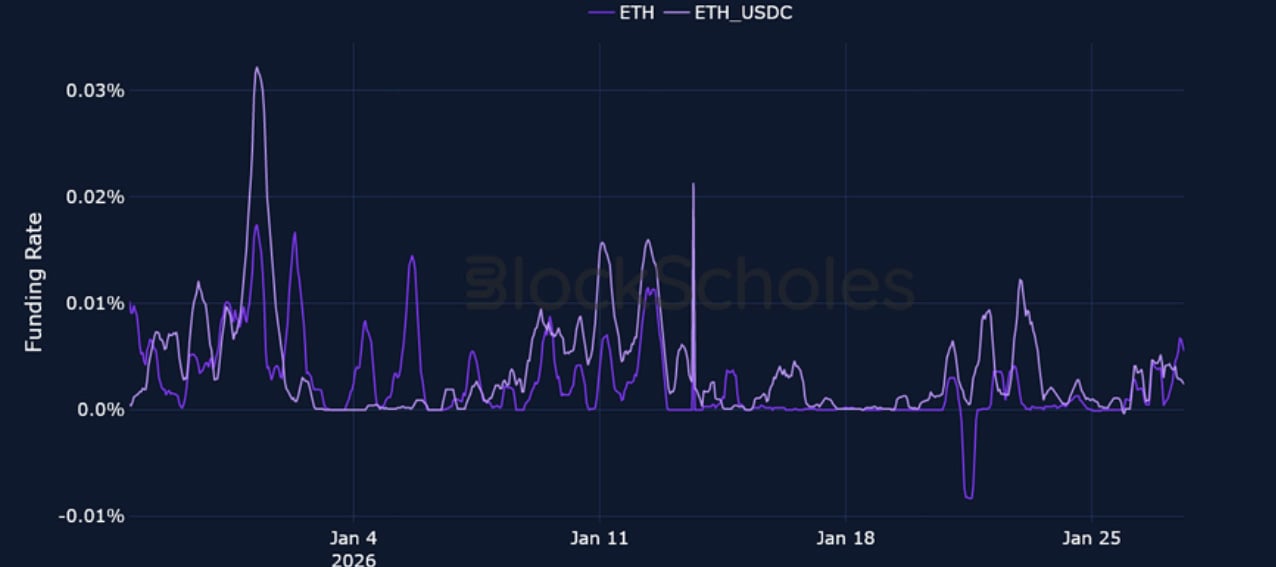

Perpetual Swap Funding Rate

BTC FUNDING RATE – Despite BTC spot price having fallen 5% over the past seven days, funding rates have remained positive – with longs continuing to pay a premium to shorts in order to keep their positions open.

ETH FUNDING RATE – ETH funding rates briefly turned negative as risk- sentiment deteriorated following a spike in Japanese government bond yields.

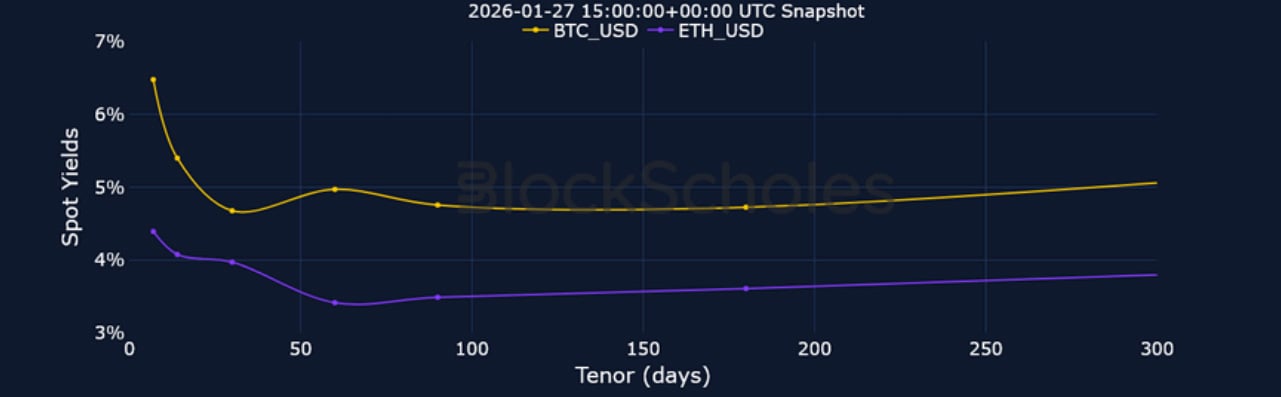

Futures Implied Yields

BTC Futures Implied Yields – The futures-implied yield term structure continues to be inverted, as short-tenor futures contracts trade with a higher premium to spot, relative to longer-dated contracts.

ETH Futures Implied Yields – ETH’s futures term structure is flatter, with futures contracts trading at a 3.4%-4.4% premium to spot.

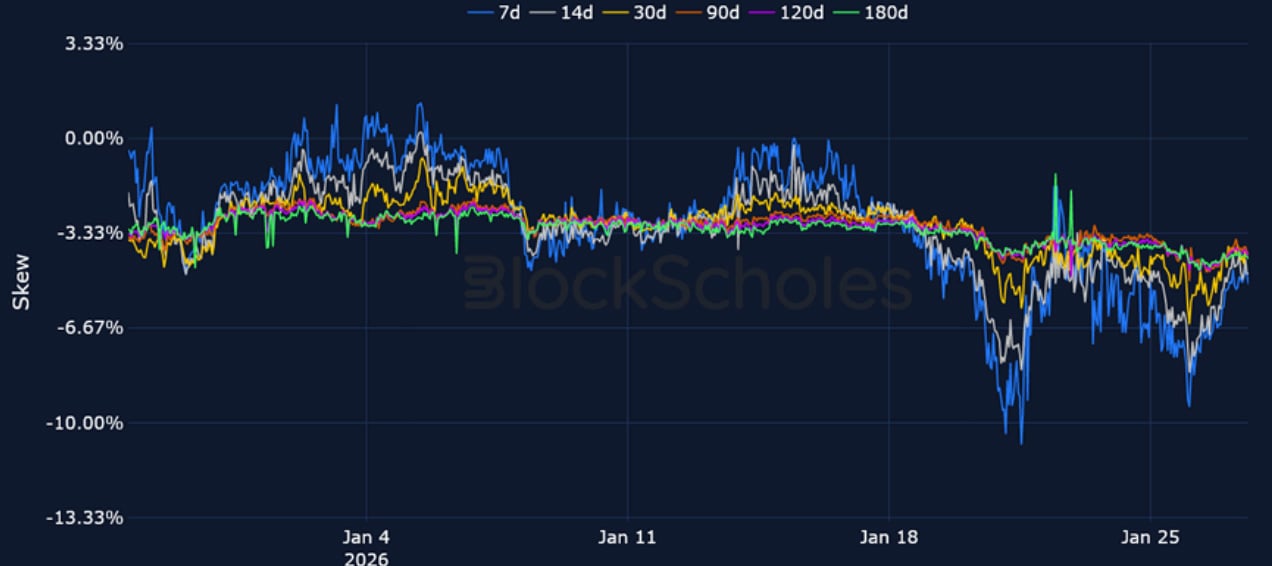

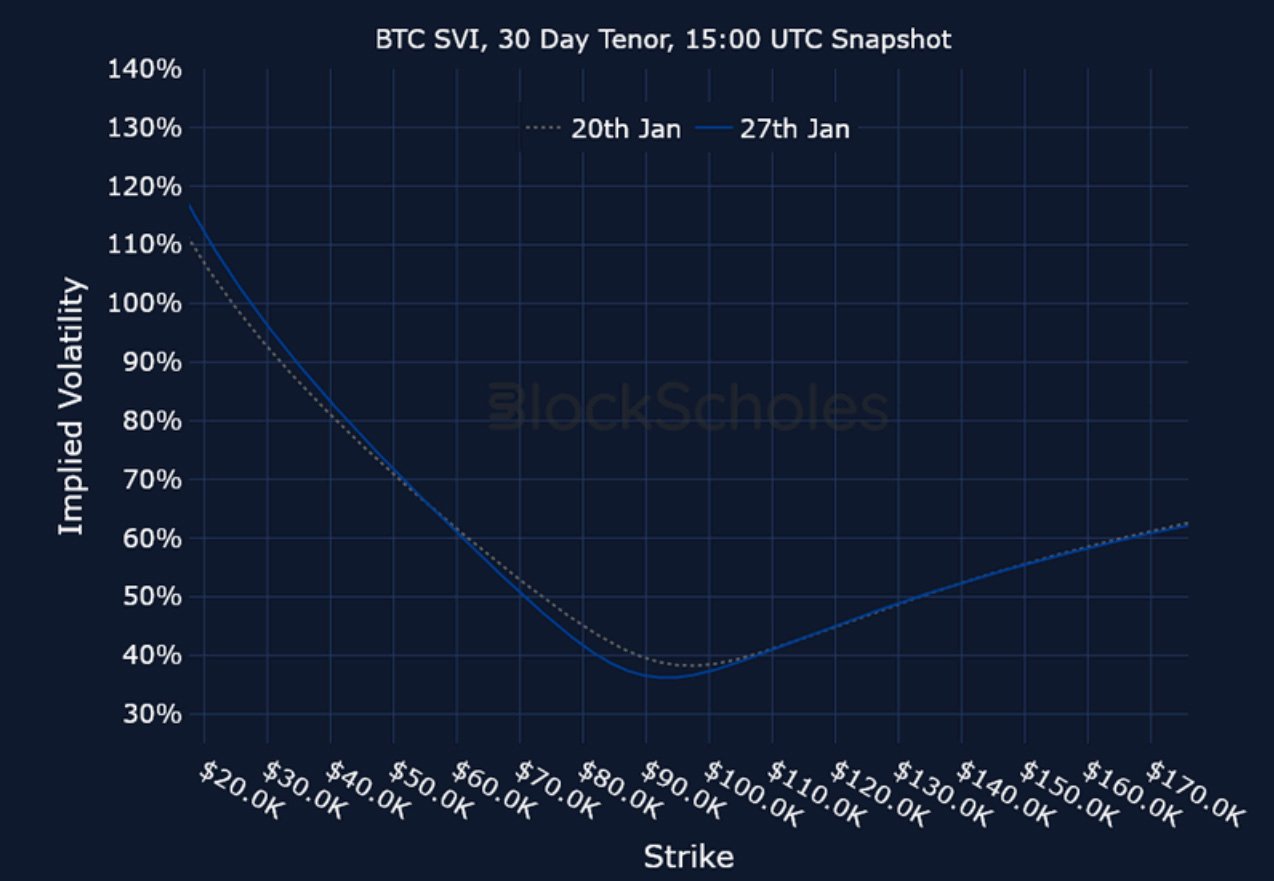

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-dated IV rose last week amidst broader macro tensions, though longer-dated options were mostly unchanged.

BTC 25-Delta Risk Reversal – Options markets continue to price in a bearish premium across the volatility surface, though skew has partly recovered since reaching -9% when BTC fell to $86K on Monday.

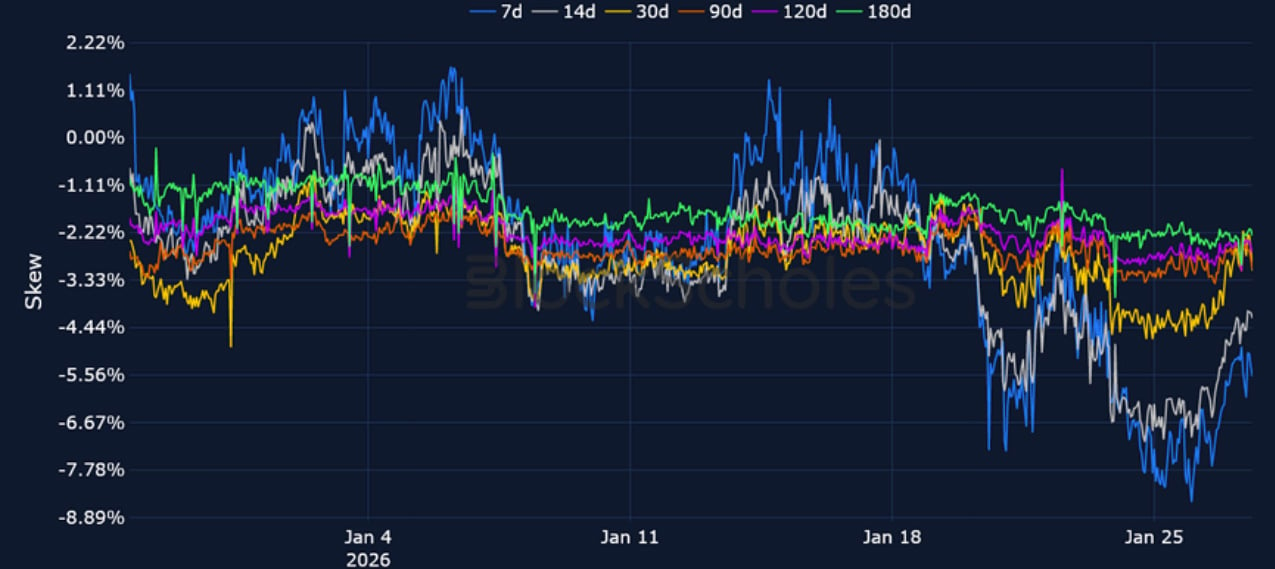

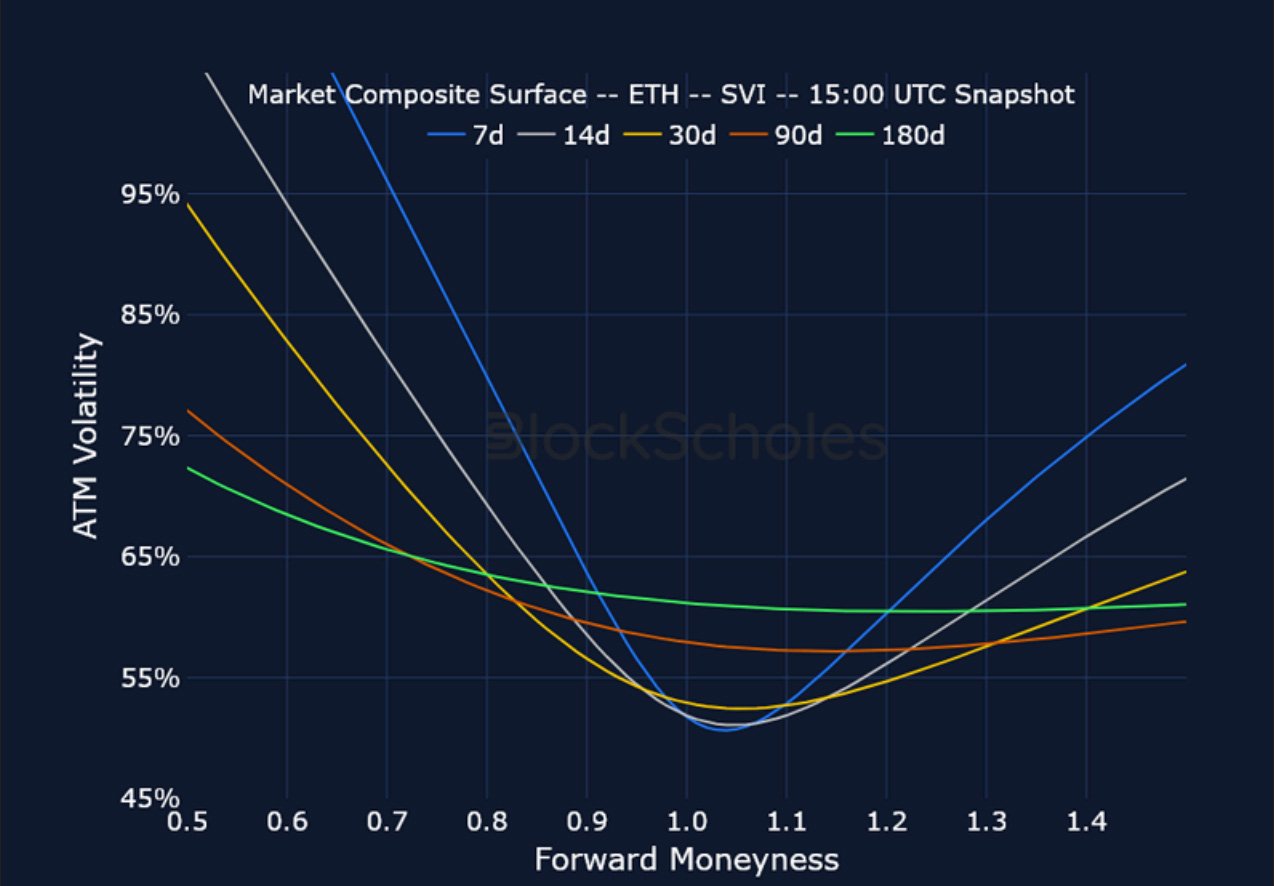

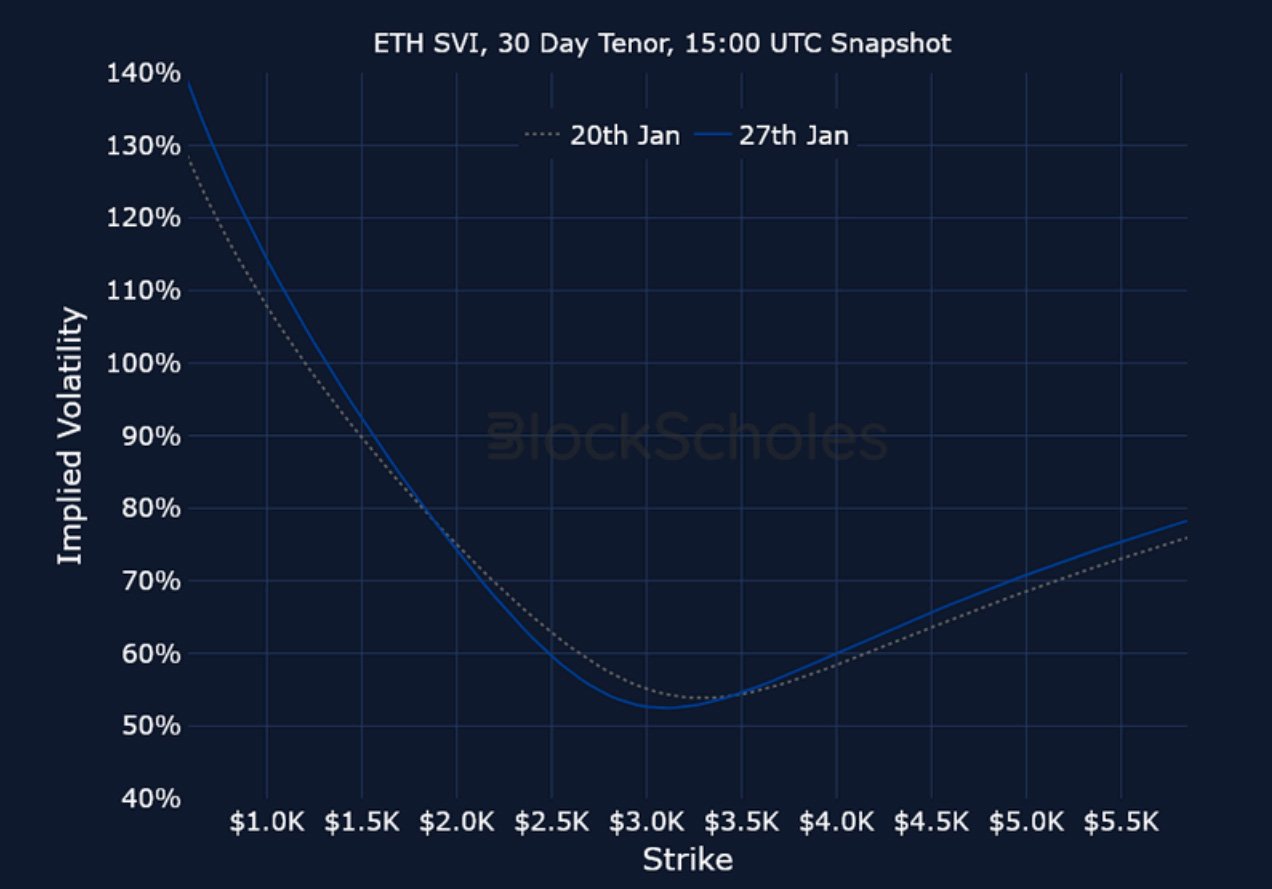

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH at-the-money implied volatility reached its lowest since September 2024 earlier in the month.

ETH 25-Delta Risk Reversal – Similar to BTC, ETH options trade with a negative put-call skew ratio at all maturities.

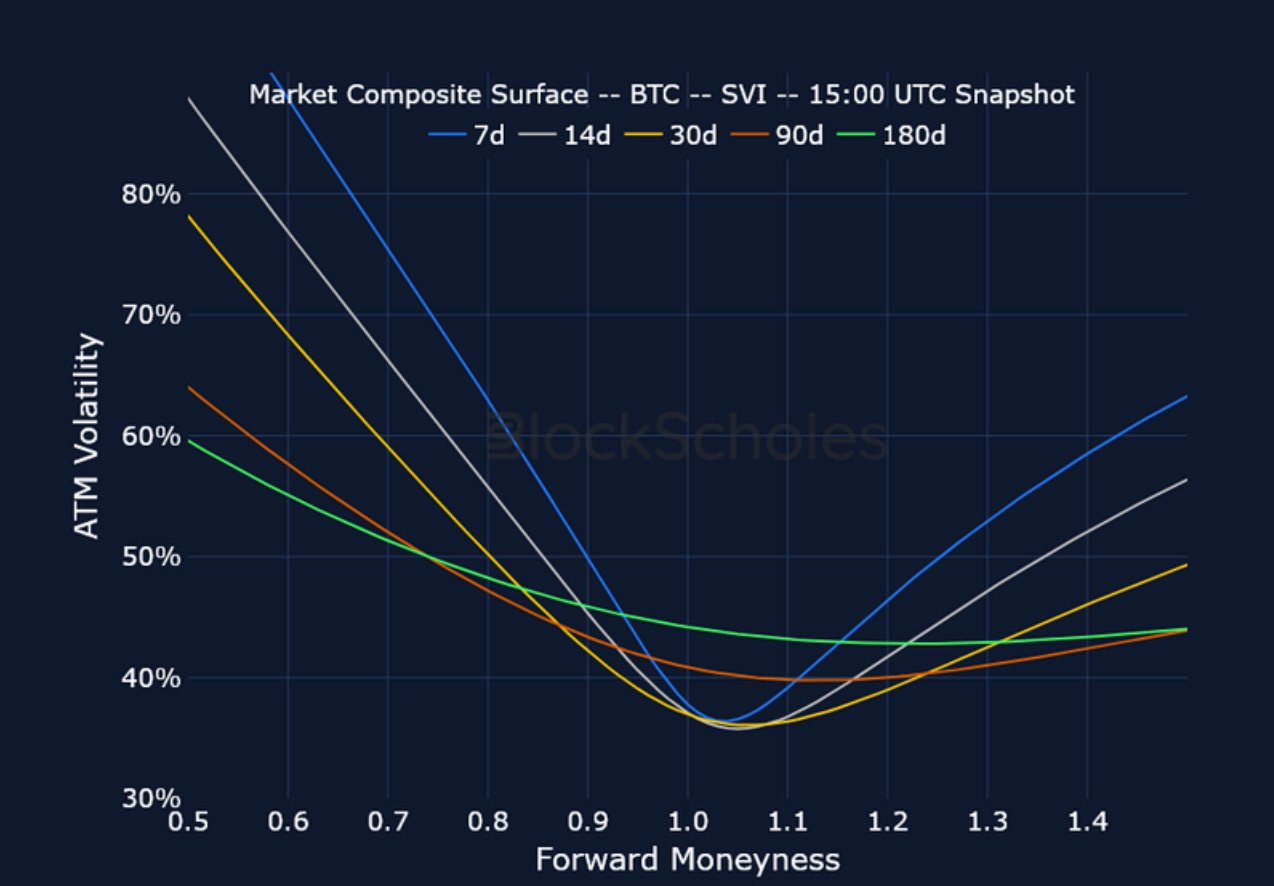

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

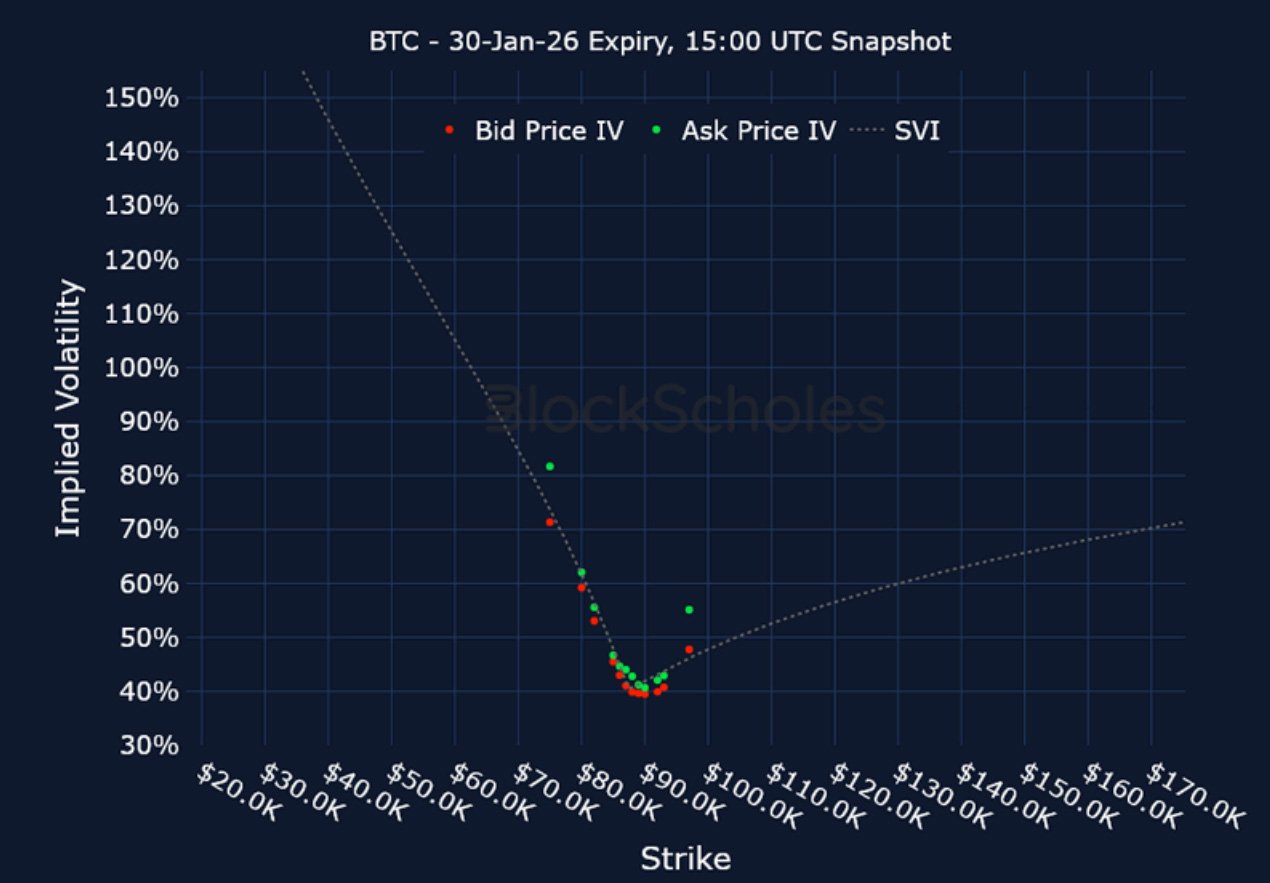

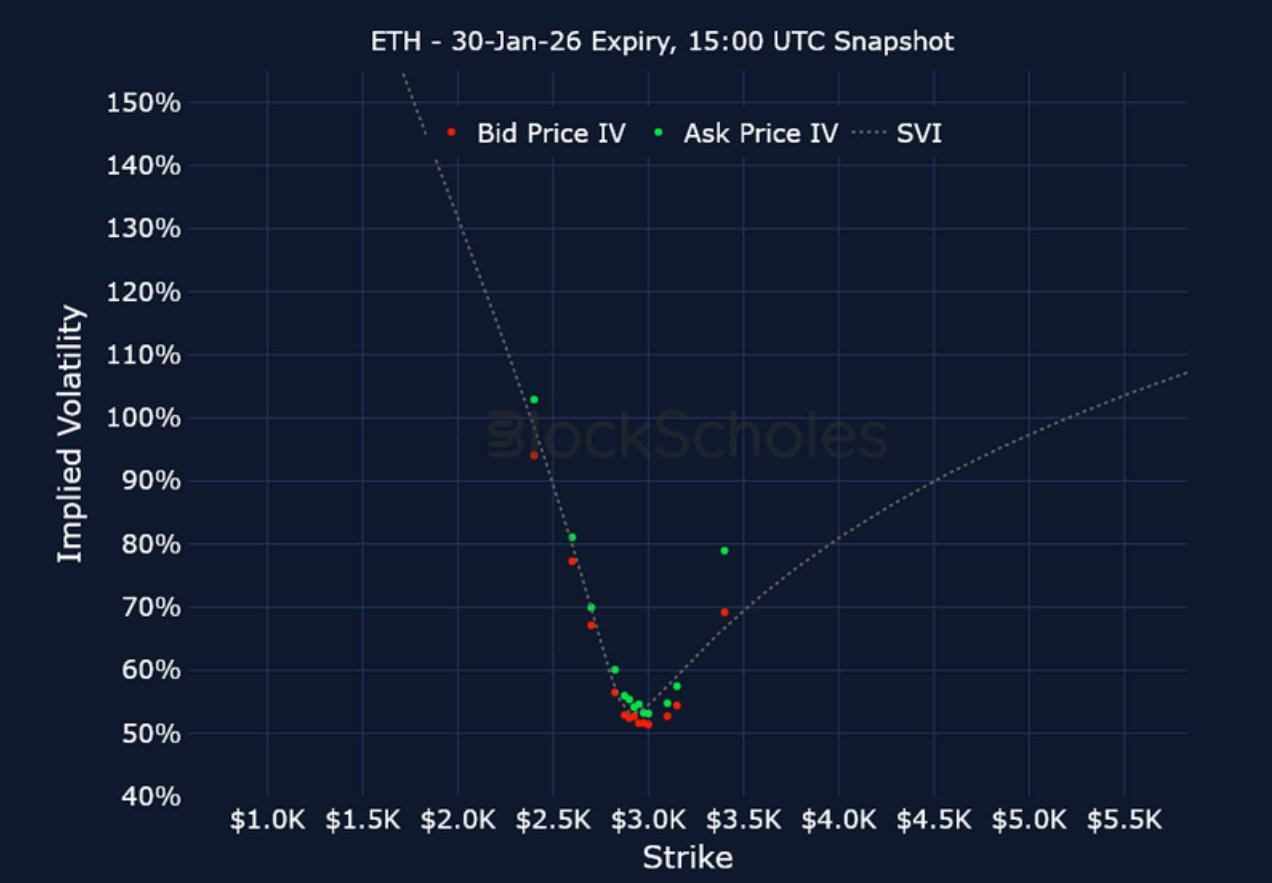

Listed Expiry Volatility Smiles

BTC 30-JAN EXPIRY – 9:00 UTC Snapshot.

ETH 30-JAN EXPIRY – 9:00 UTC Snapshot.

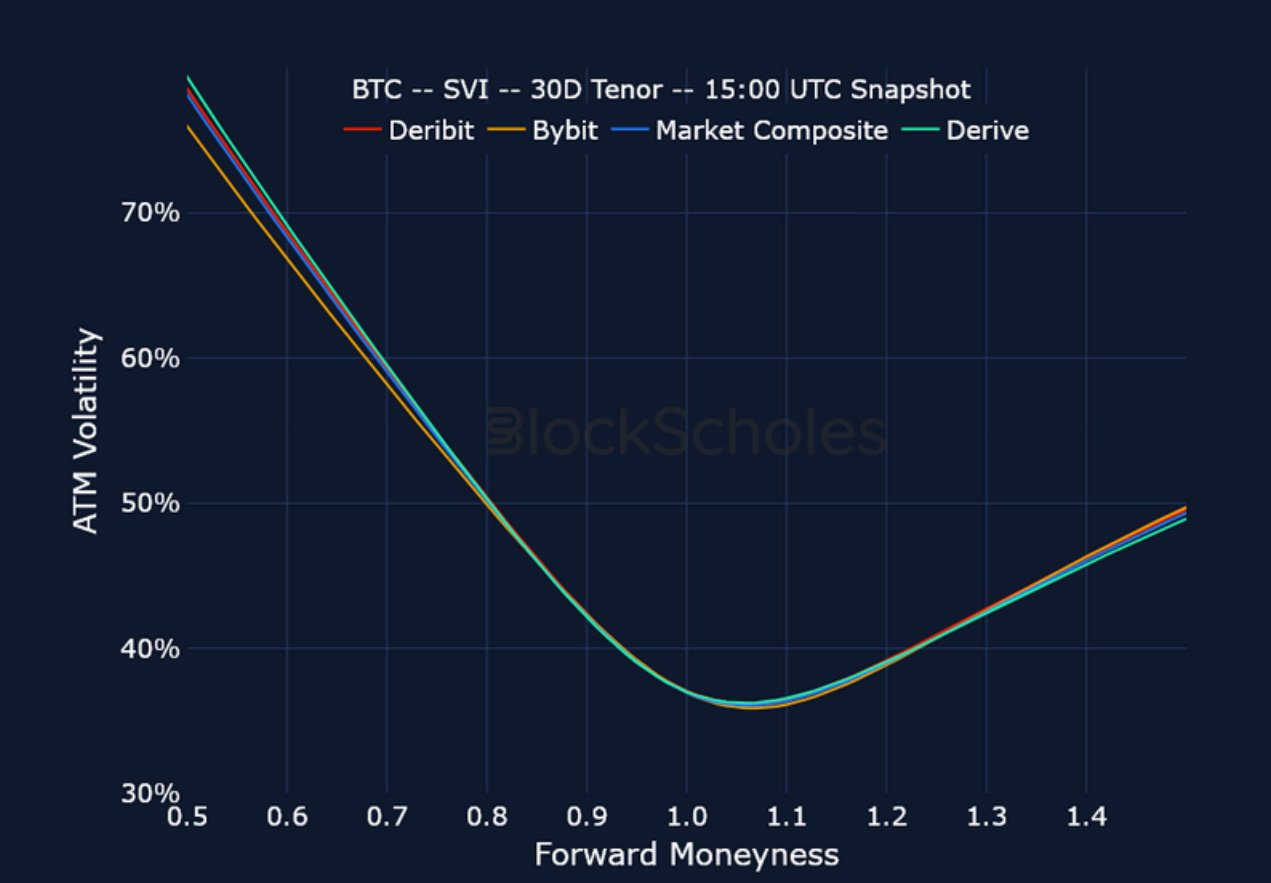

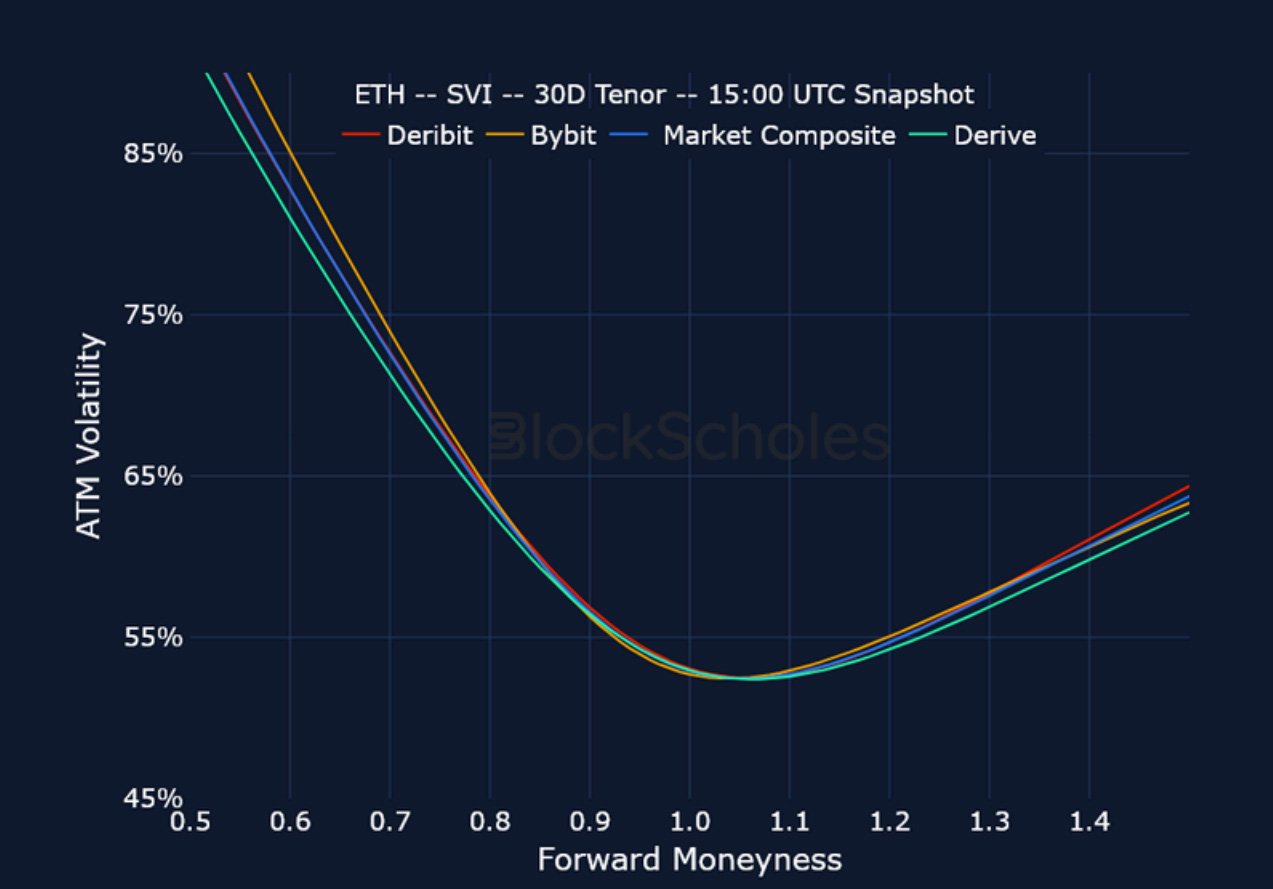

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)