Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

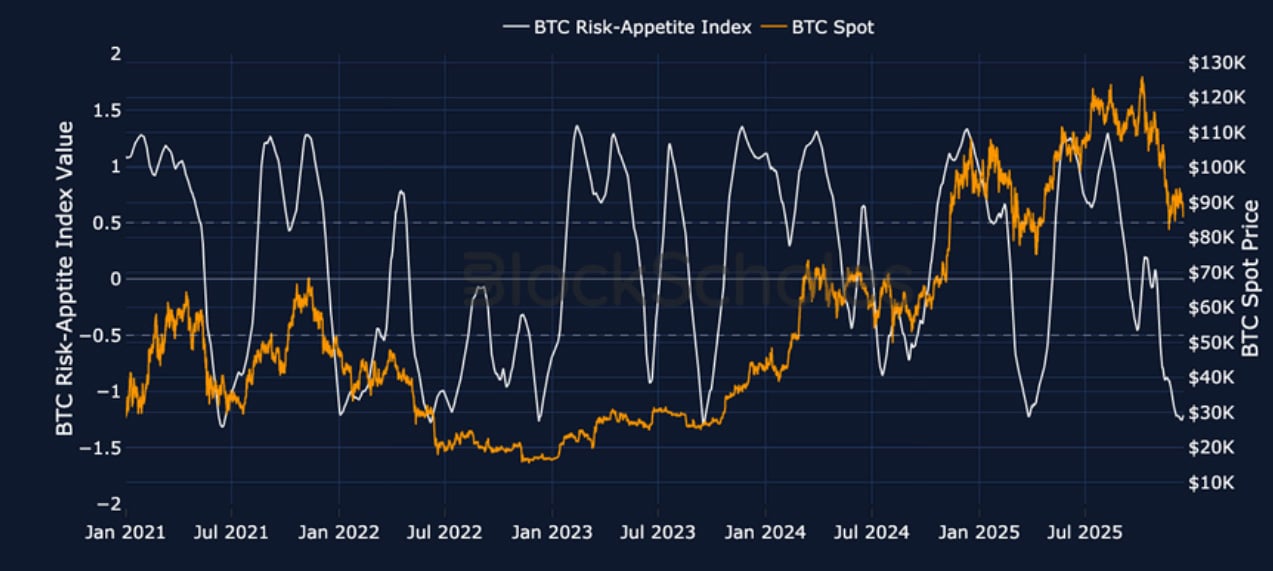

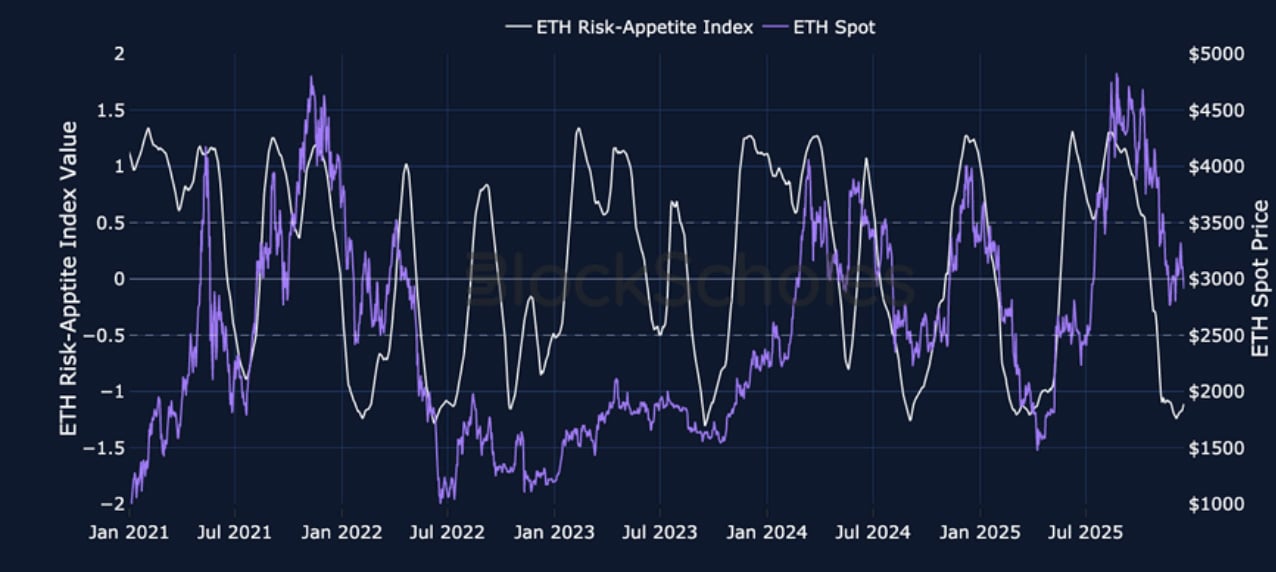

While key indicators in derivatives markets suggest slightly different sentiment for BTC and ETH, neither indicate a full recovery in sentiment. BTC holds the edge in futures and perps markets, with a higher pricing of futures contracts and a consistently positive funding rate, but options markets in BTC also hold a stronger put-skew relative to ETH’s. Volatility expectations are, as ever, higher for ETH, but are lower than their late November highs when traders rushed to put options. Our in-house risk appetite index has continued to linger near its historical lows for both assets – indicating that we are near to the most extreme levels of crypto sentiment.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

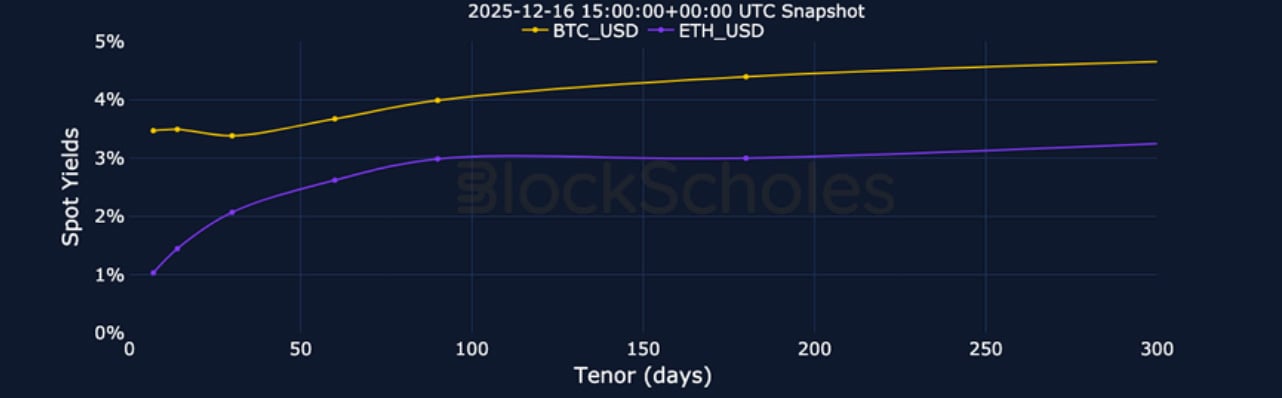

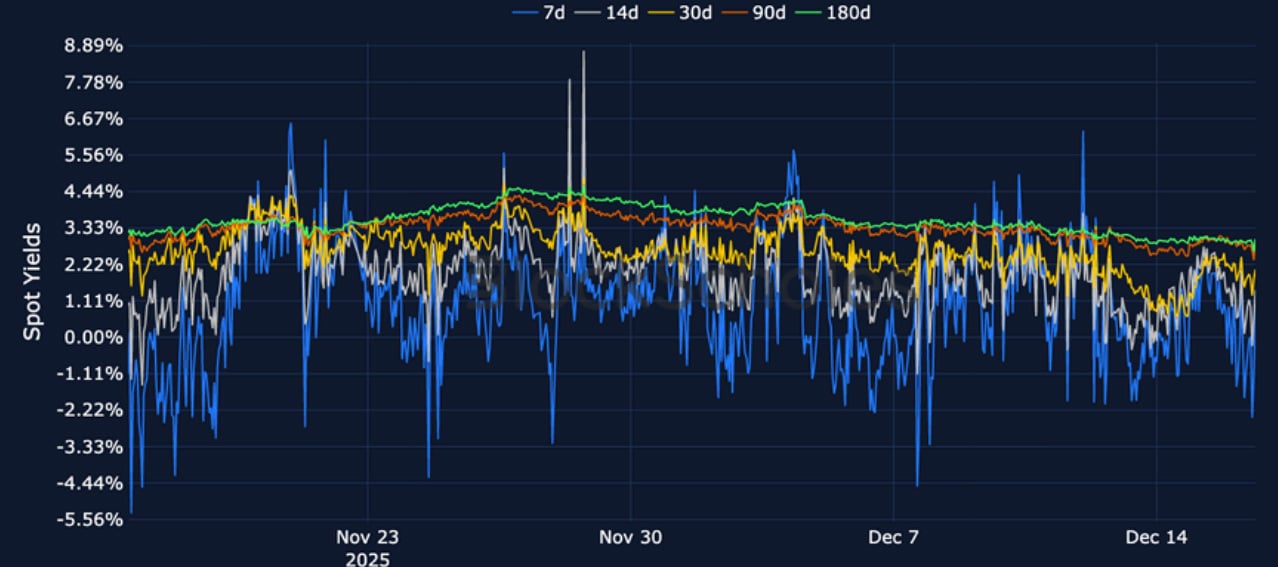

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

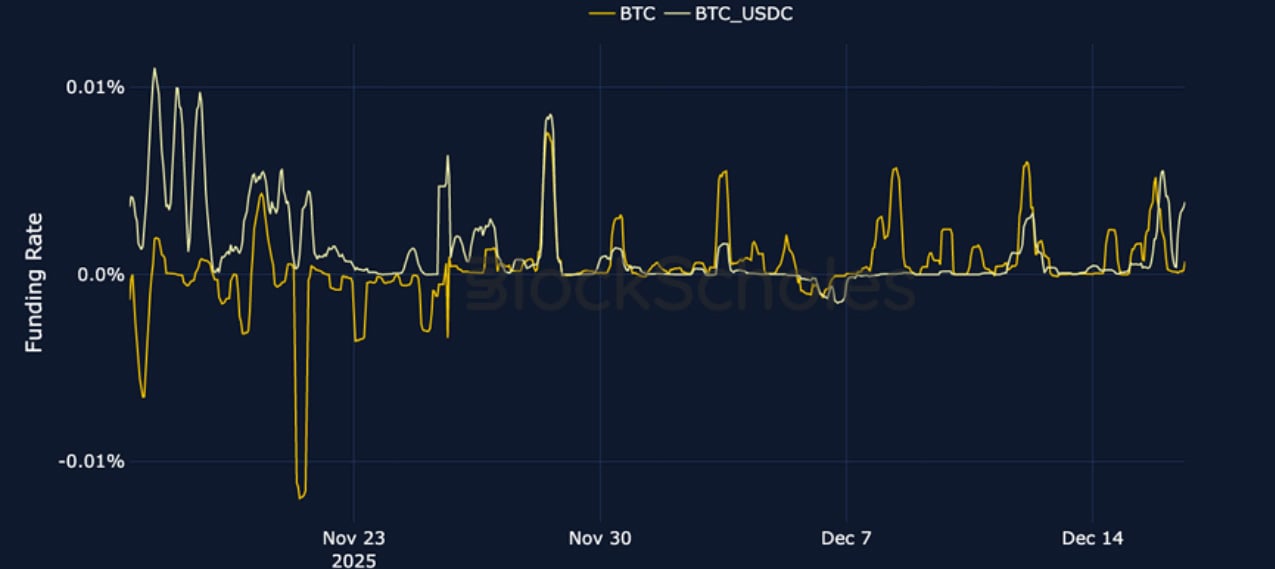

Perpetual Swap Funding Rate

BTC FUNDING RATE – As in futures markets, BTC shows a slightly more bullish sentiment than ETH as funding rates have not slipped negative for a significant period since mid November.

ETH FUNDING RATE – Funding rates have slipped negative on several occasions over the last week, and have failed to trade consistently positive.

Futures Implied Yields

BTC Futures Implied Yields – BTC’s future prices contrast the bearish sentiment in ETH’s, as they trade consistently above spot.

ETH Futures Implied Yields – Sentiment in futures markets remains bearish at short tenors, with 7-day futures frequently trading at prices below spot.

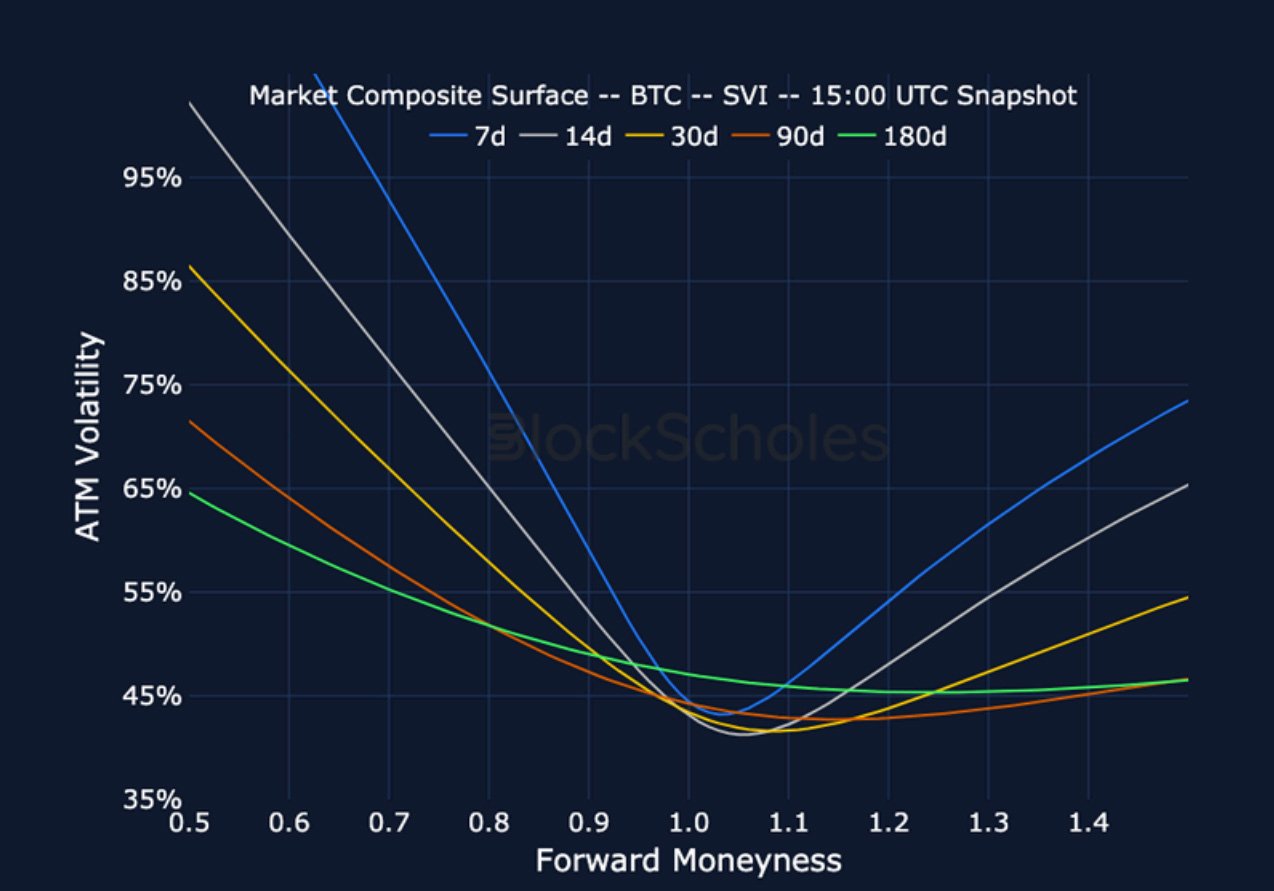

BTC Options

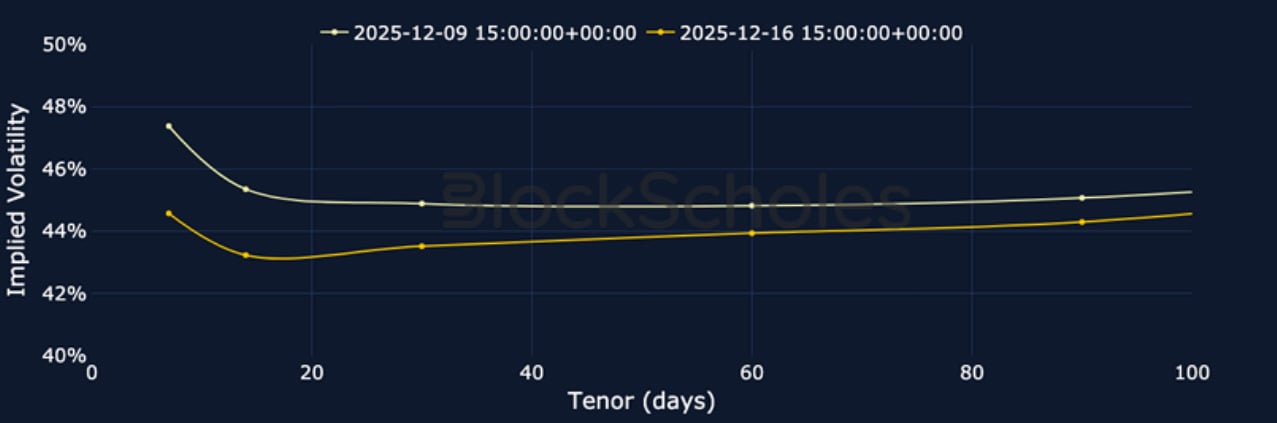

BTC SVI ATM IMPLIED VOLATILITY – Volatility expectations remain elevated, despite short-tenor implied vols falling from their late November highs.

BTC 25-Delta Risk Reversal – Short-tenor BTC smiles have extended their extra bearish put-premium over still-bearish longer tenor smiles.

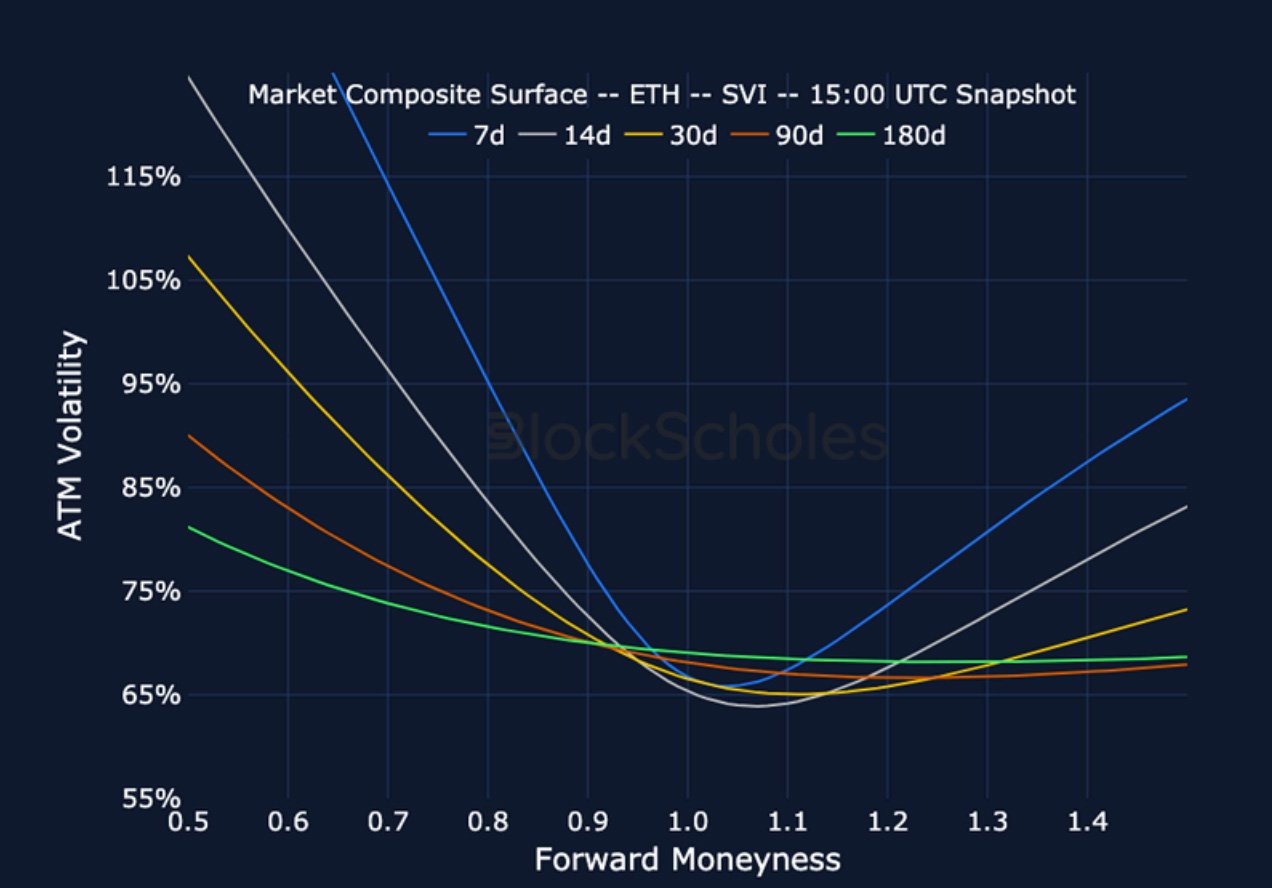

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – While not inverted, volatility trades in a tight range between 65% and 68% across the term structure.

ETH 25-Delta Risk Reversal – Volatility smile skews have slipped lower, with little reaction to the FOMC’s Dec 10 interest rate cut.

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

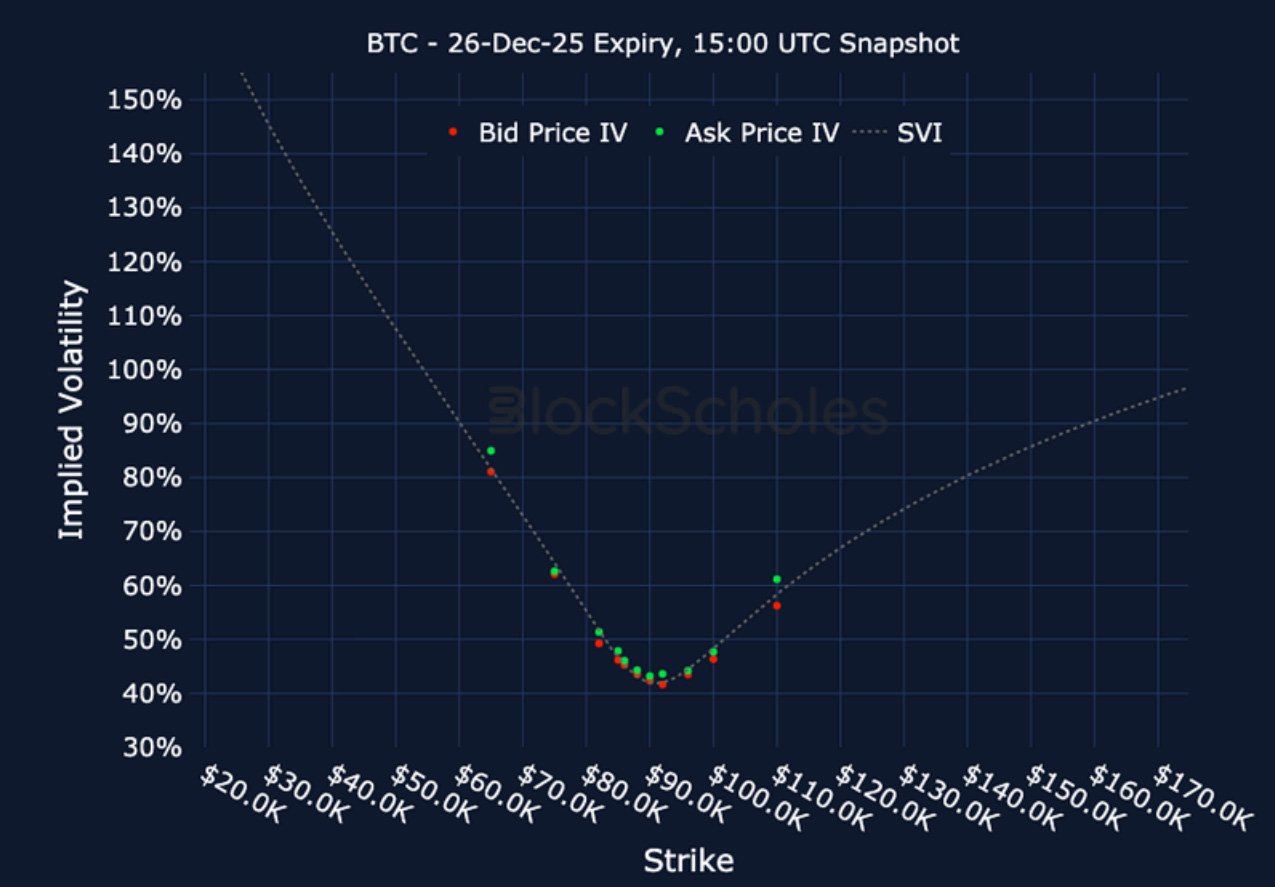

Listed Expiry Volatility Smiles

BTC 26-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 26-DEC EXPIRY – 9:00 UTC Snapshot.

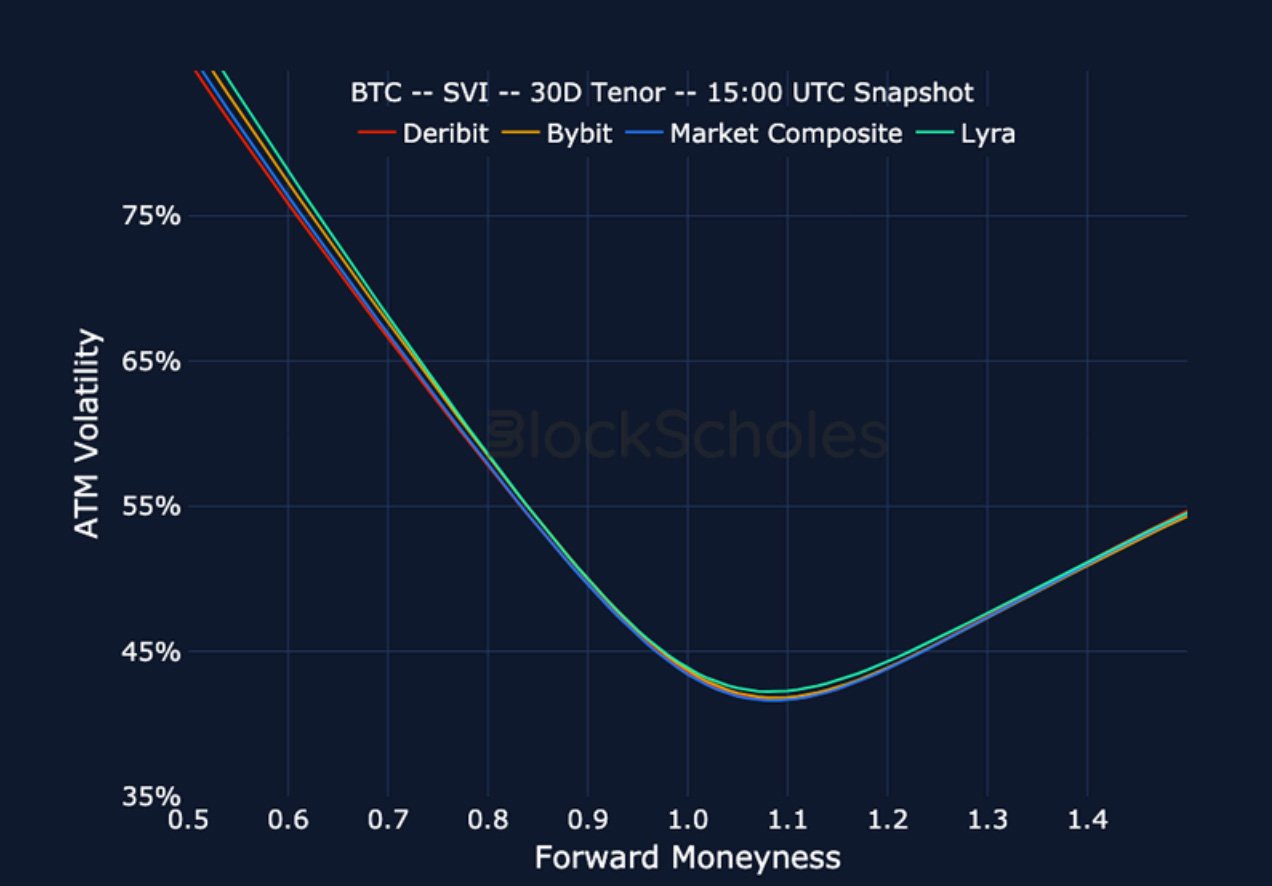

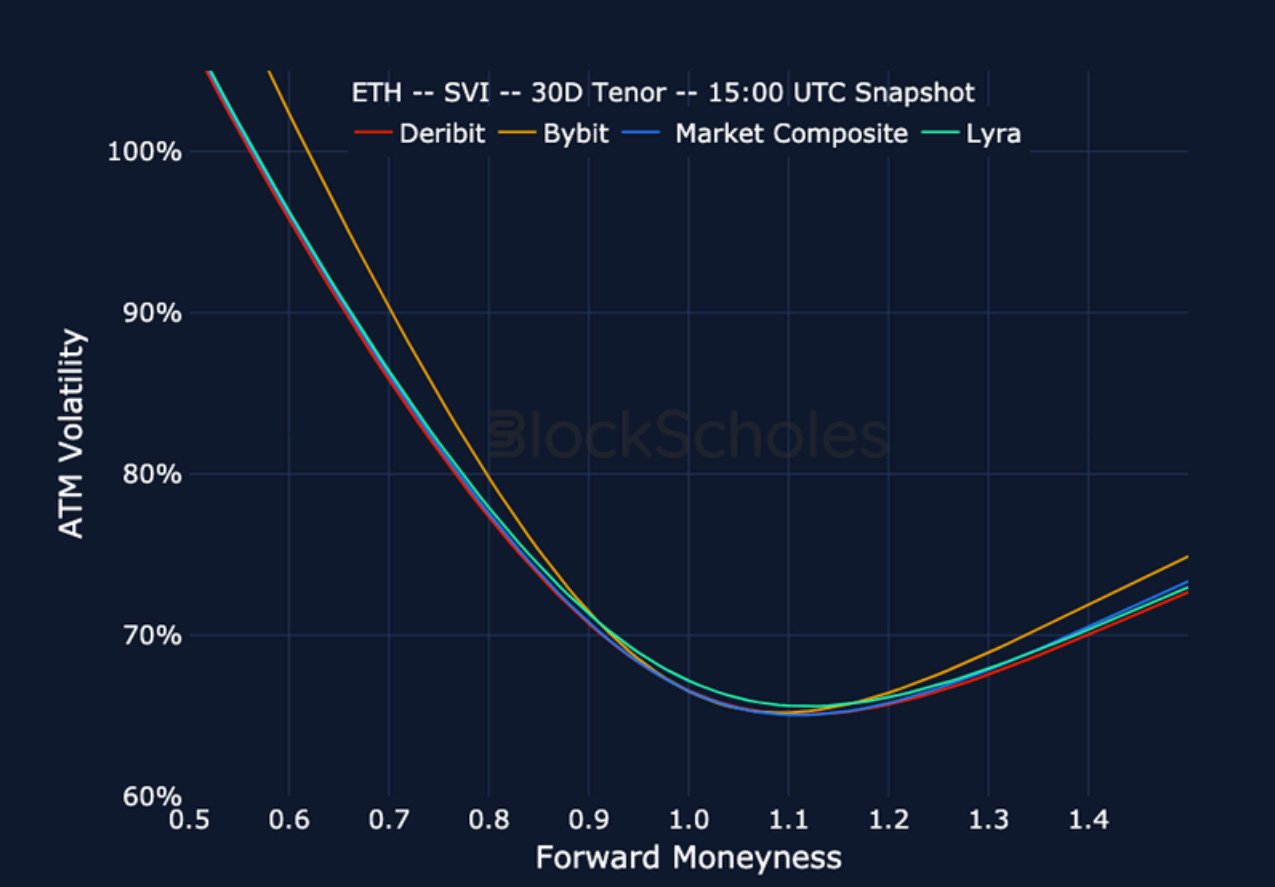

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

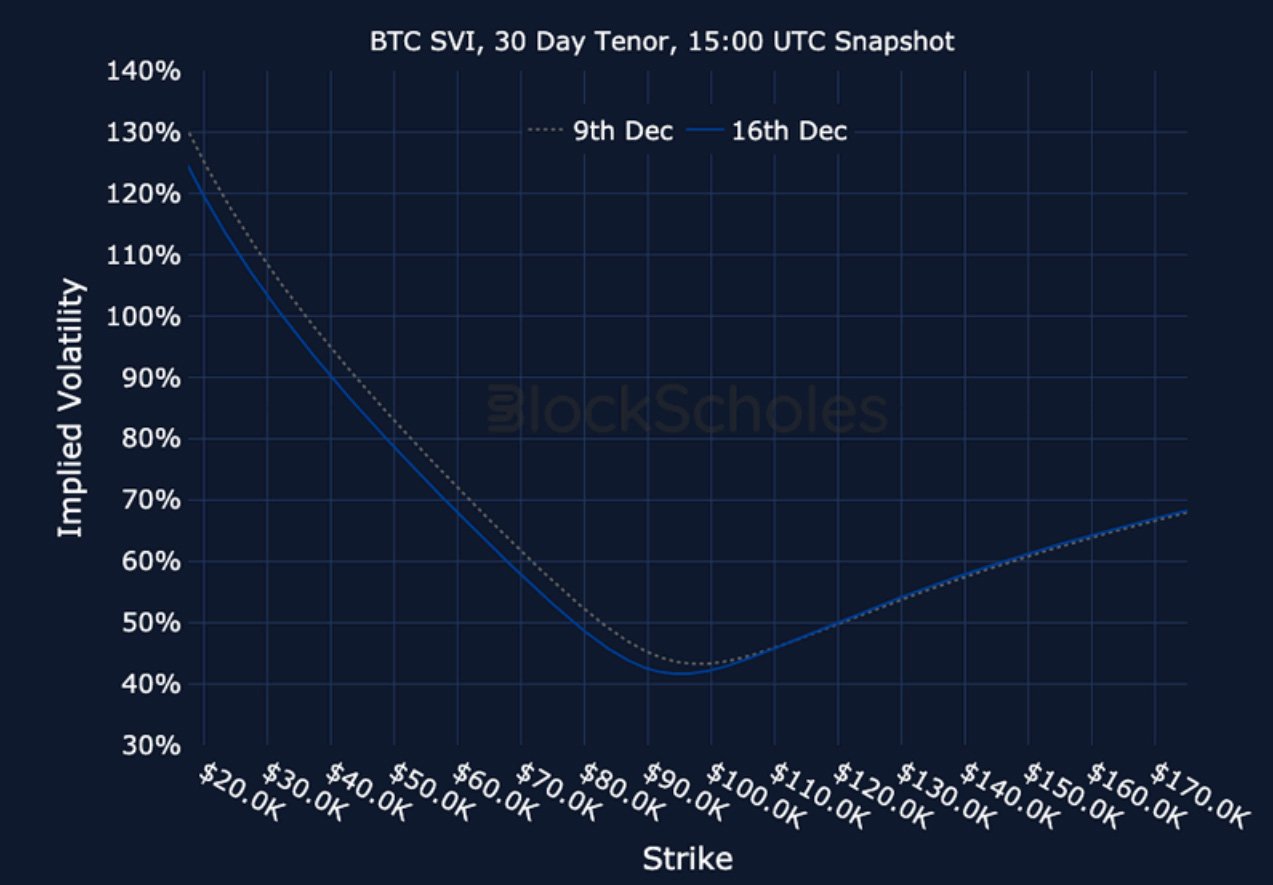

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)