Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

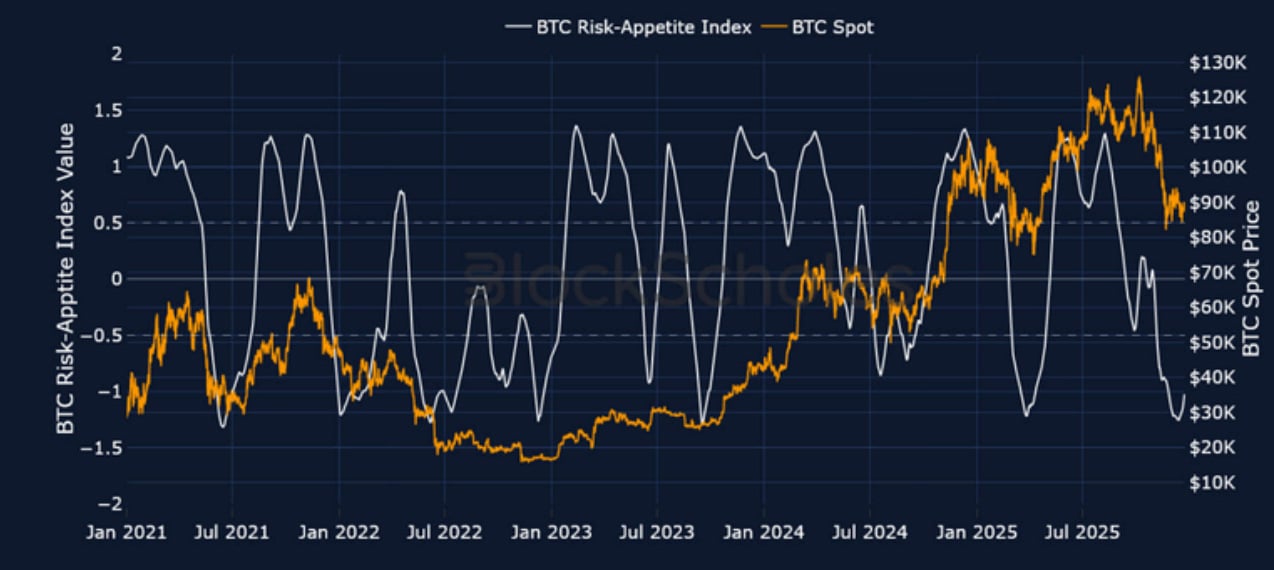

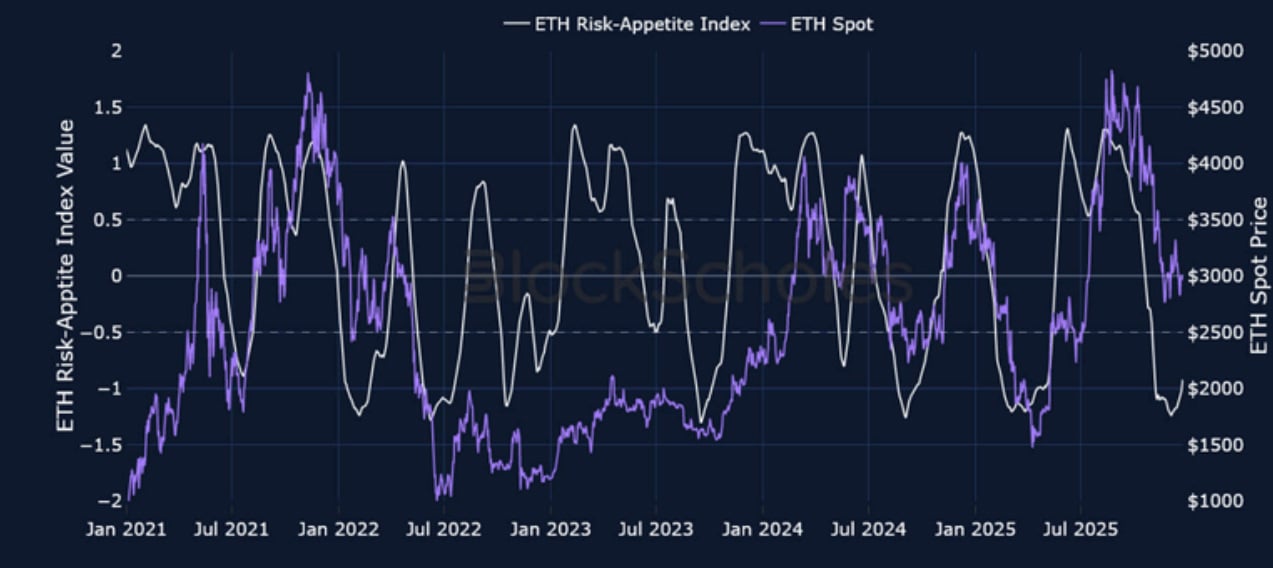

Similar to last week, derivatives markets point towards slightly differing levels of sentiment in the two majors. ETH funding rates shot up to their highest level since late November on Monday Dec 22, 2025 after reclaiming $3,000, though collapsed back to neutral levels just as quickly. However, futures markets point to a slightly higher pricing of BTC futures compared to ETH. On the other hand, despite option’s markets being bearish for both tokens heading into the new year and beyond, ETH volatility smiles assign a slightly less negative put-call skew premium at all tenors on the volatility smile. Expectations for volatility in options markets have also dropped – mirroring a similar decline in TradFi markets, with both the VIX index and the MOVE index close to their year-to-date lows. Finally, despite a relatively flat spot price over the past seven days for both BTC and ETH, our in-house Risk Appetite Index is increasingly showing signs of a bottom being reached, with risk-appetite now having bounced from historically low levels.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

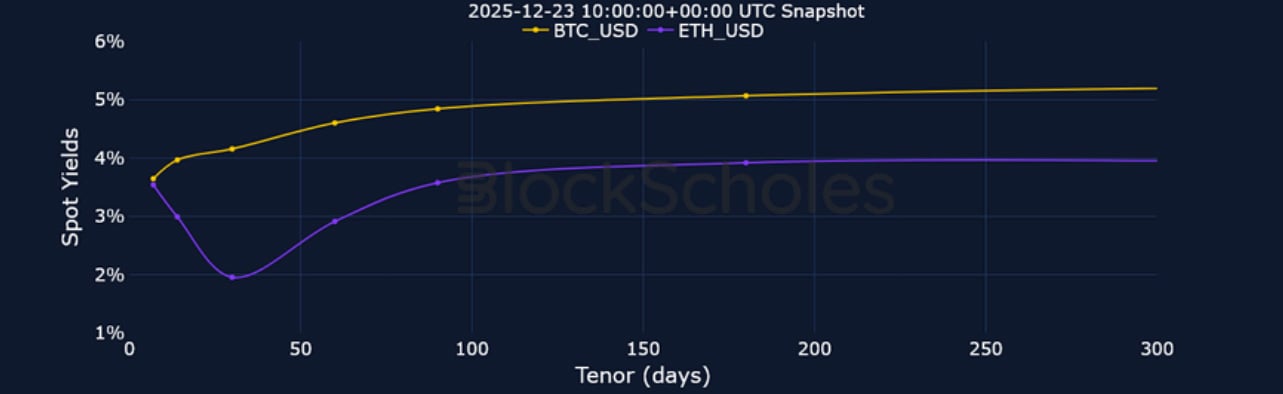

Futures Implied Yields

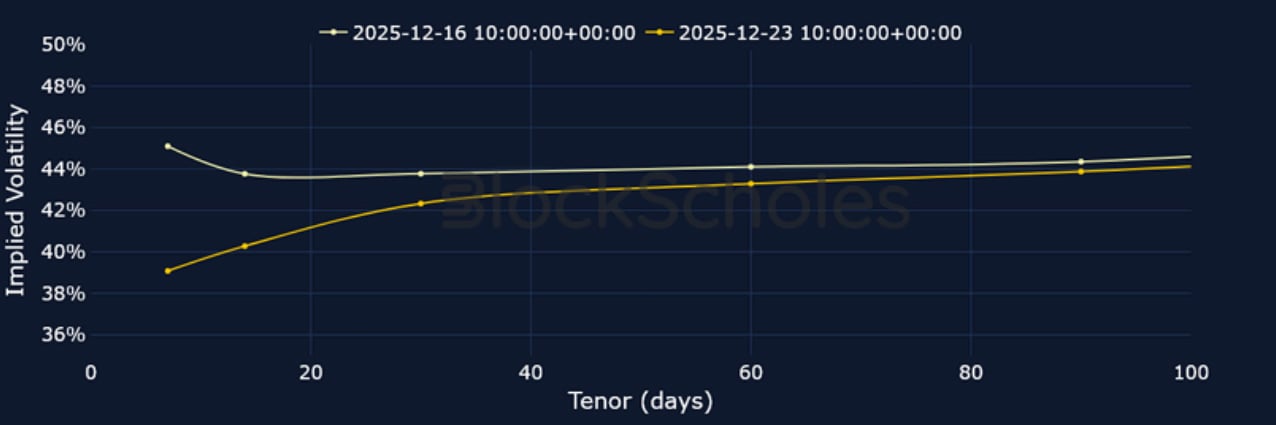

1-Month Tenor ATM Implied Volatility

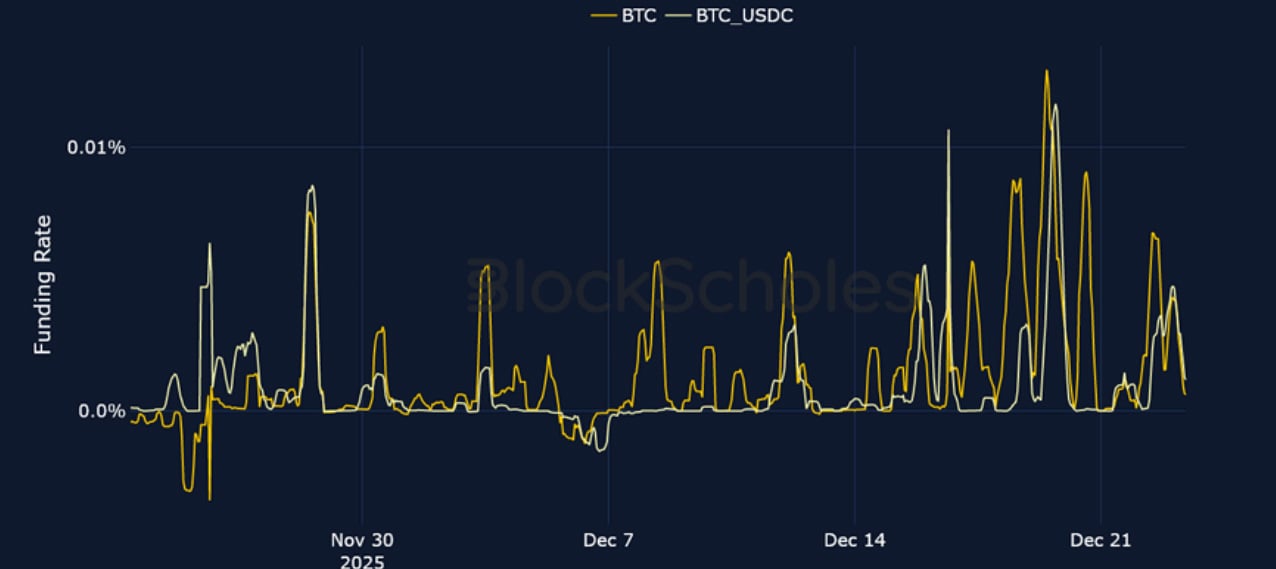

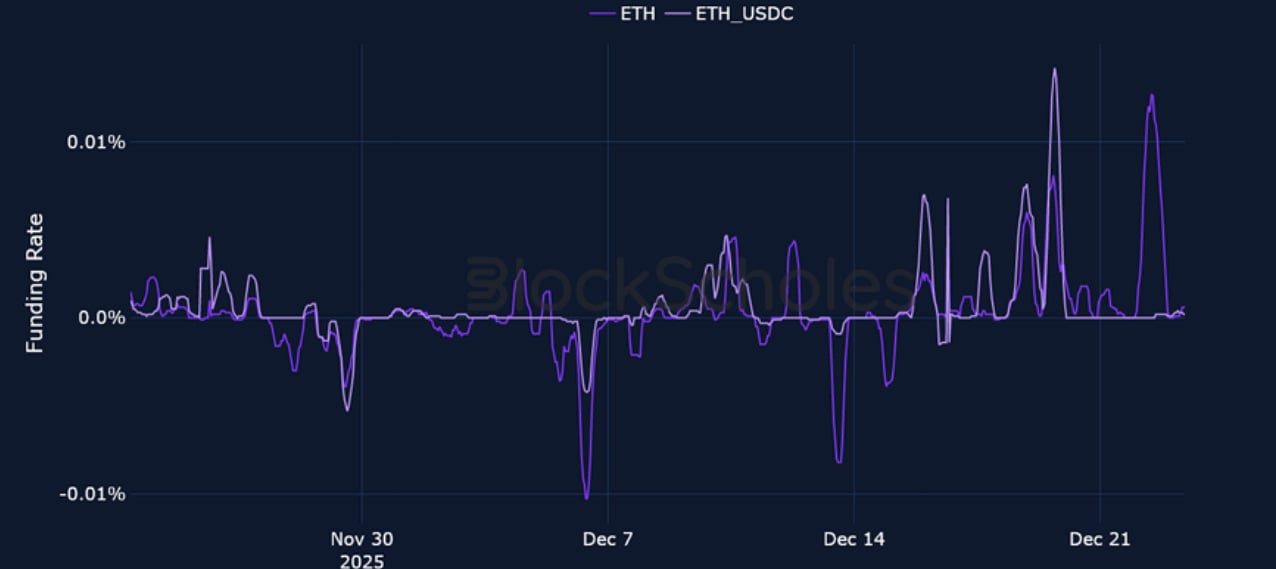

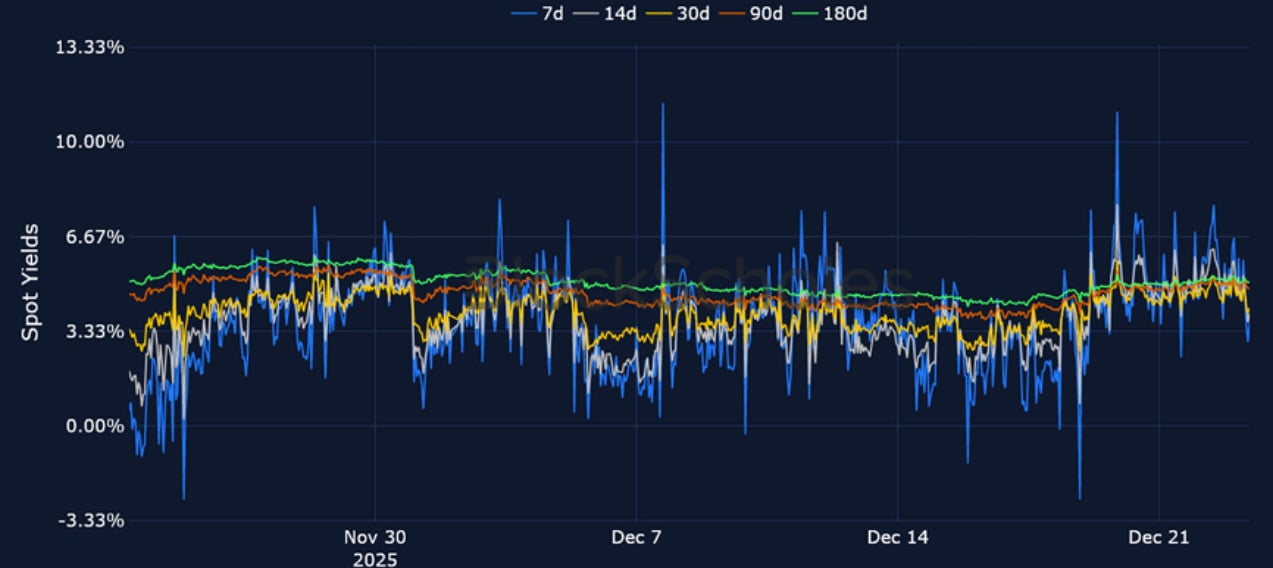

Perpetual Swap Funding Rate

BTC FUNDING RATE – Despite several caveats, a cooler-than-expected CPI report in the US helped push BTC past $89K on Dec 19, 2025 and coincided with the highest positive funding rate so far this month.

ETH FUNDING RATE – ETH funding rates shot up to their highest levels since late November on Monday 22 Dec, 2025 as Ether reclaimed $3,000.

Futures Implied Yields

BTC Futures Implied Yields – Similar to last week’s edition, BTC futures and perp markets show a slightly more bullish sentiment relative to ETH.

ETH Futures Implied Yields – Sentiment in futures markets has rebounded from last week when 7-day futures frequently traded at prices below spot. That’s despite an almost unchanged spot price over the last seven days.

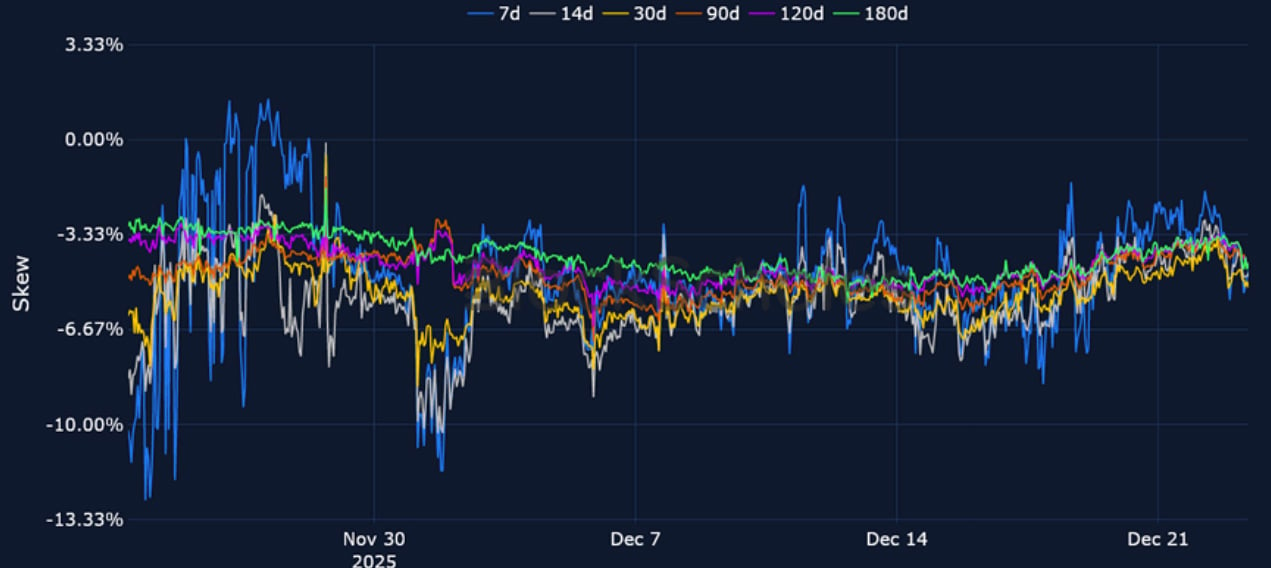

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor IV has continued to fall lower as we head into the new year and is now 20 points below late November levels.

BTC 25-Delta Risk Reversal – While a Santa rally may be on the cards for US equities, BTC options markets maintain a bearish put premium at all tenors.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – After a number of term structure inversions earlier in the month, short-dated ATM vol now trades at 60%.

ETH 25-Delta Risk Reversal – ETH options markets also continue to price in a premium for downside protection at all tenors; however, the put-call skew ratio is slightly less bearish than that of BTC across the vol surface.

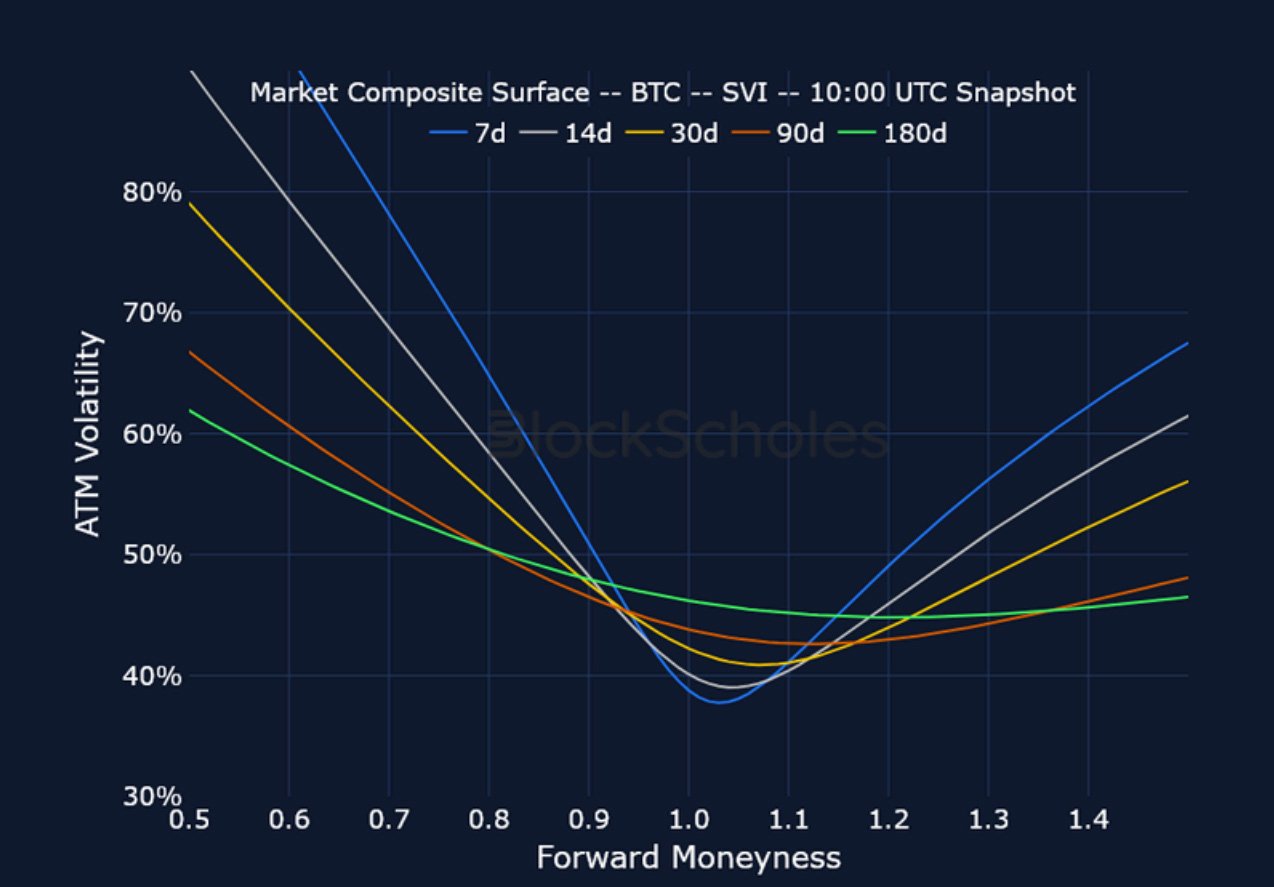

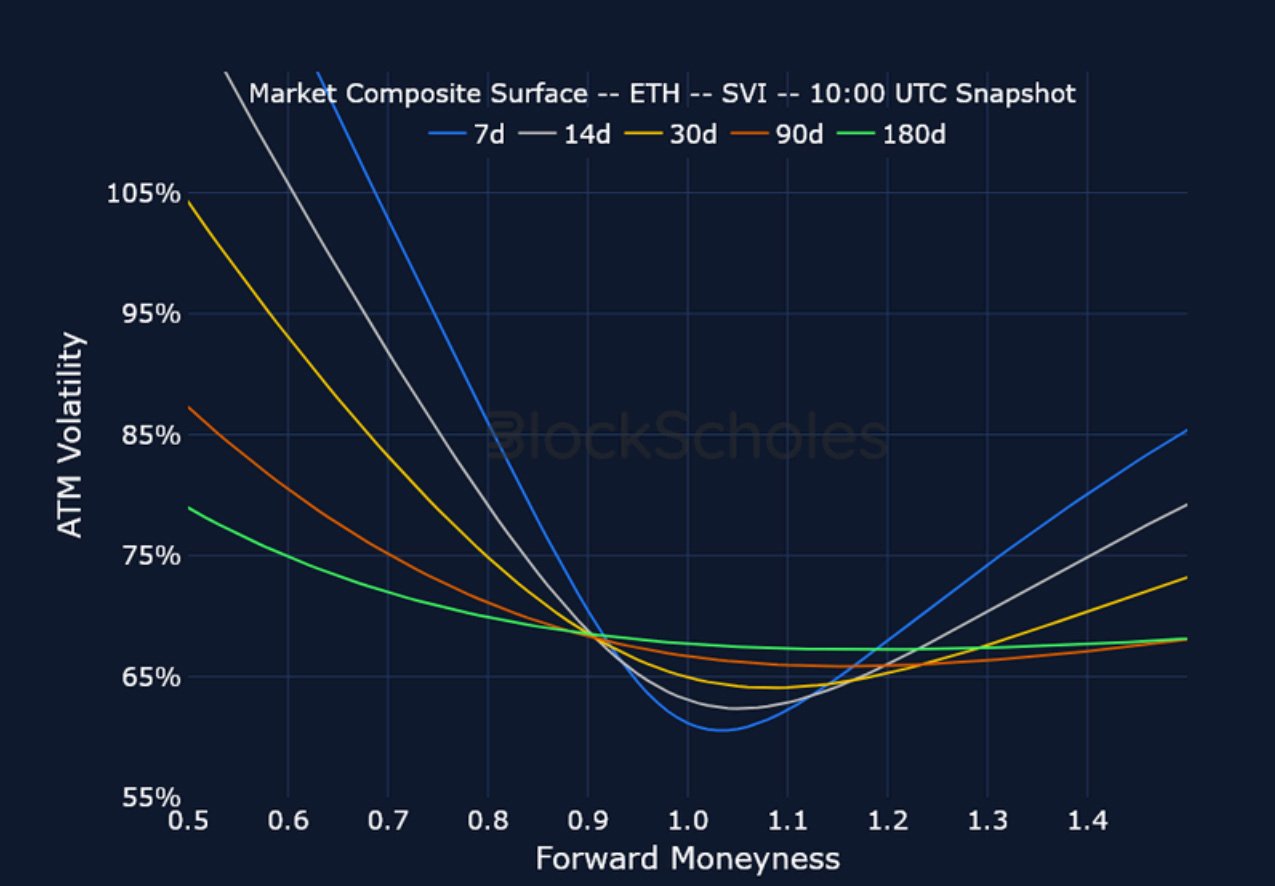

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

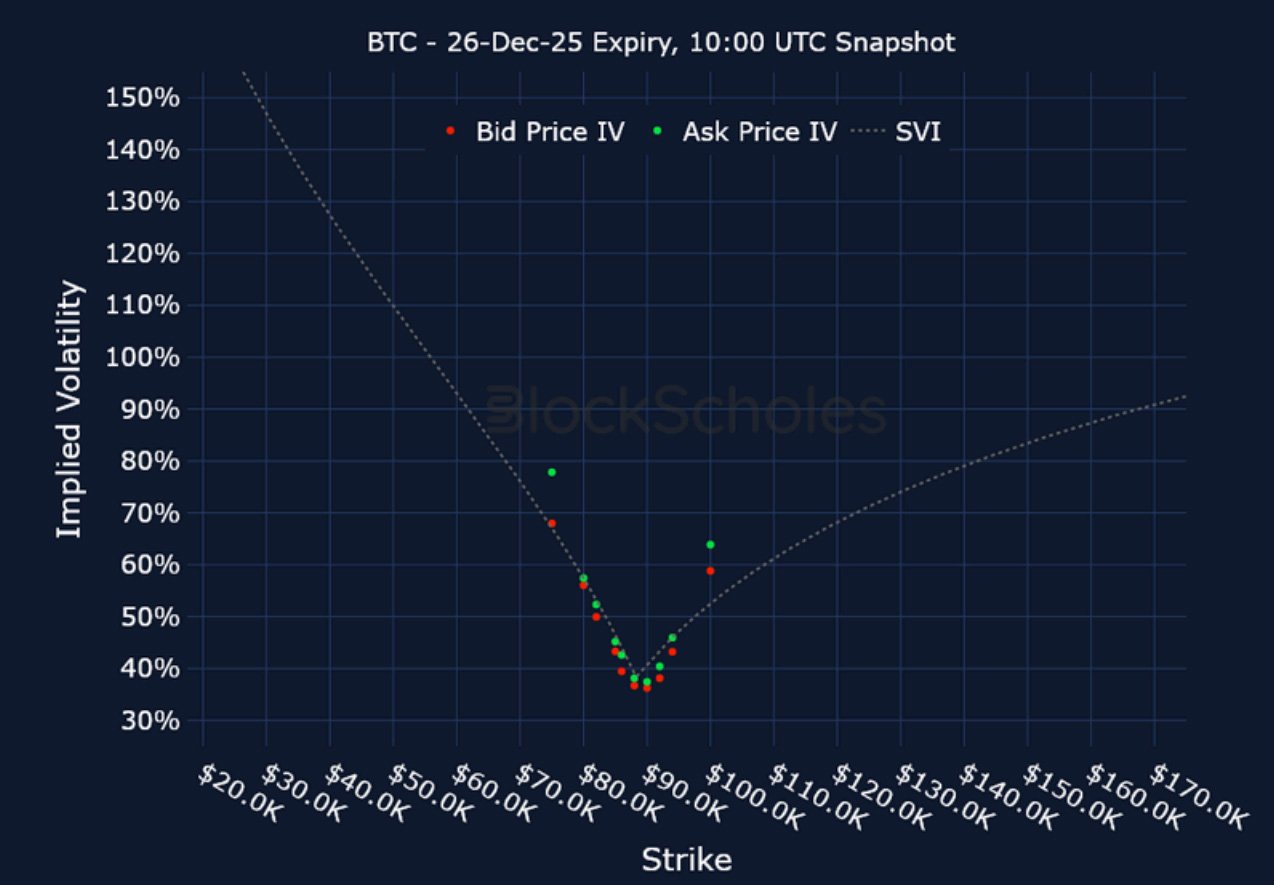

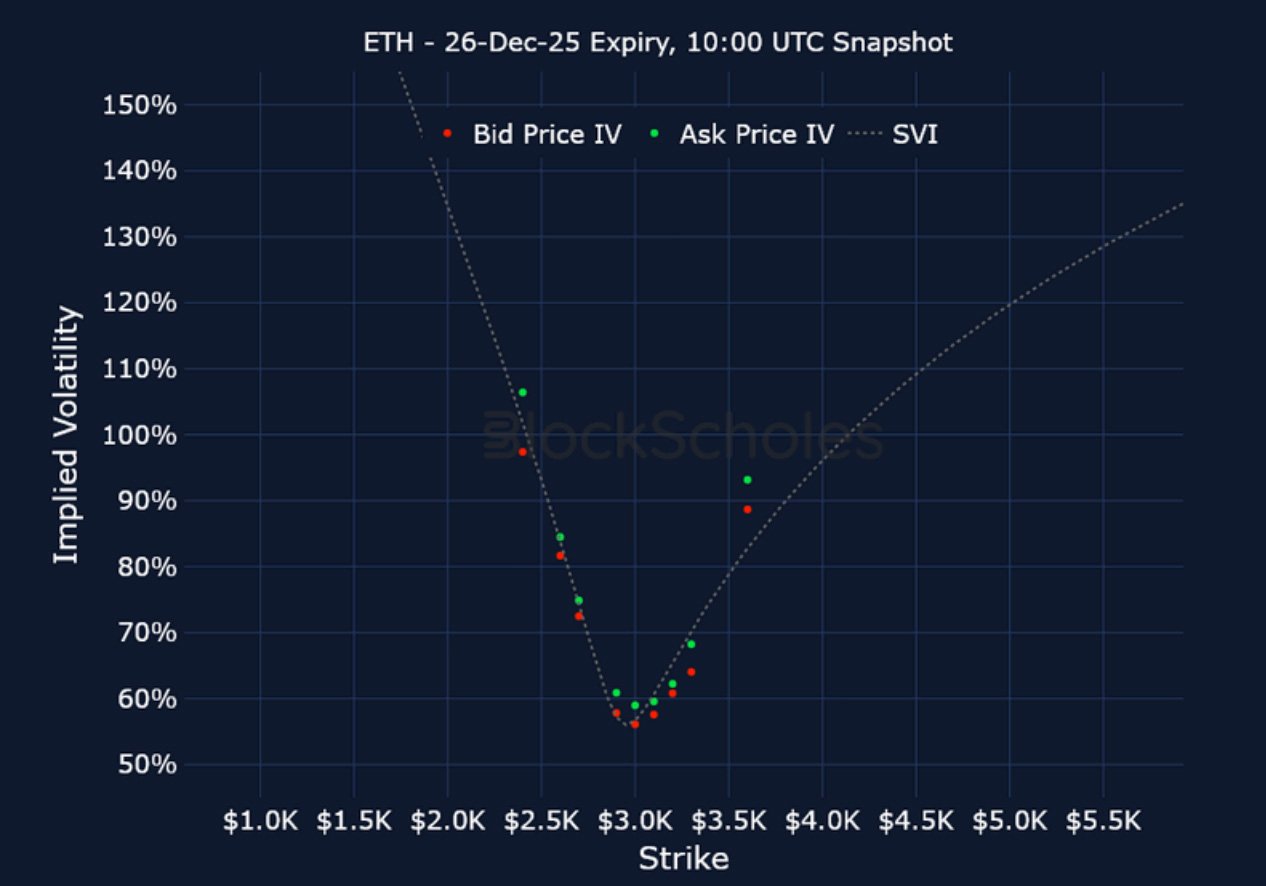

Listed Expiry Volatility Smiles

BTC 26-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 26-DEC EXPIRY – 9:00 UTC Snapshot.

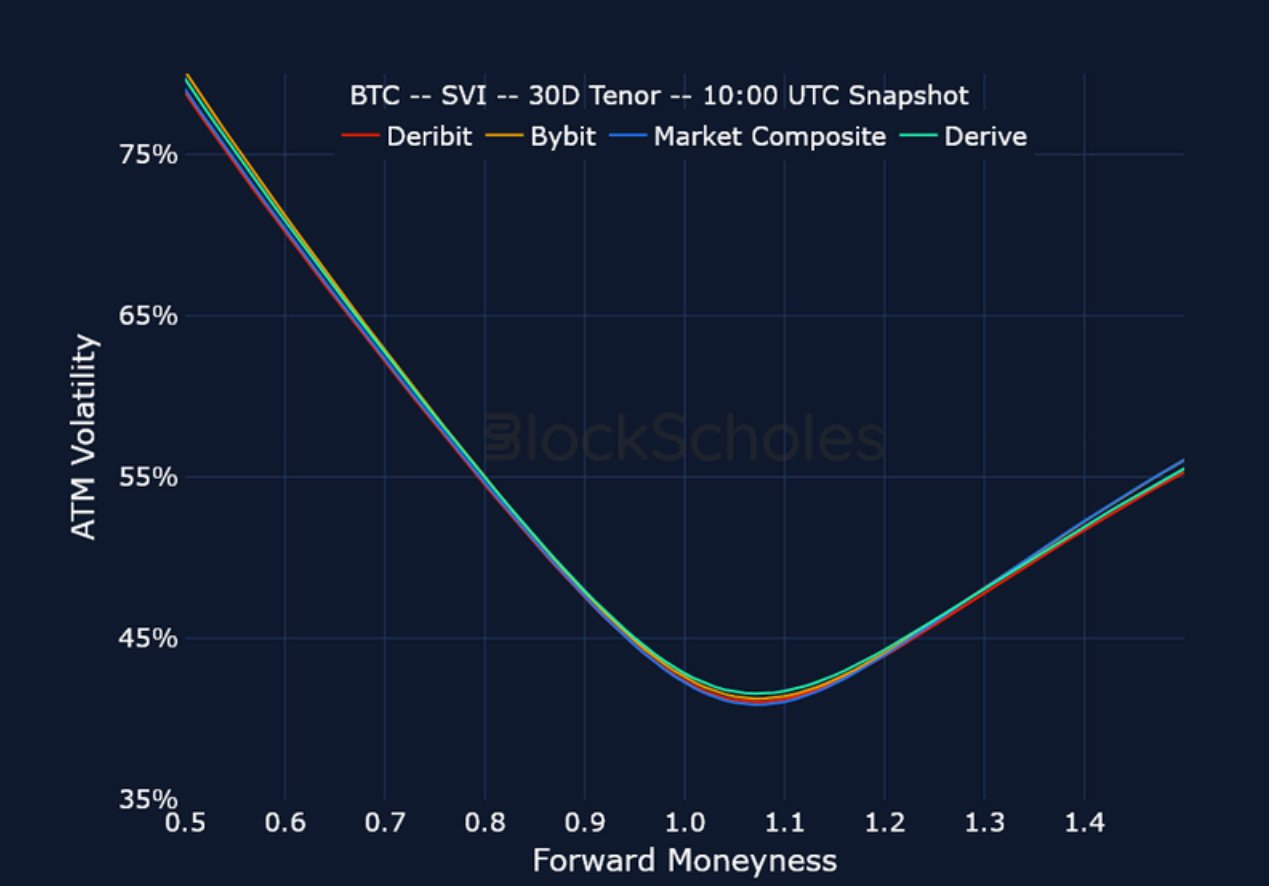

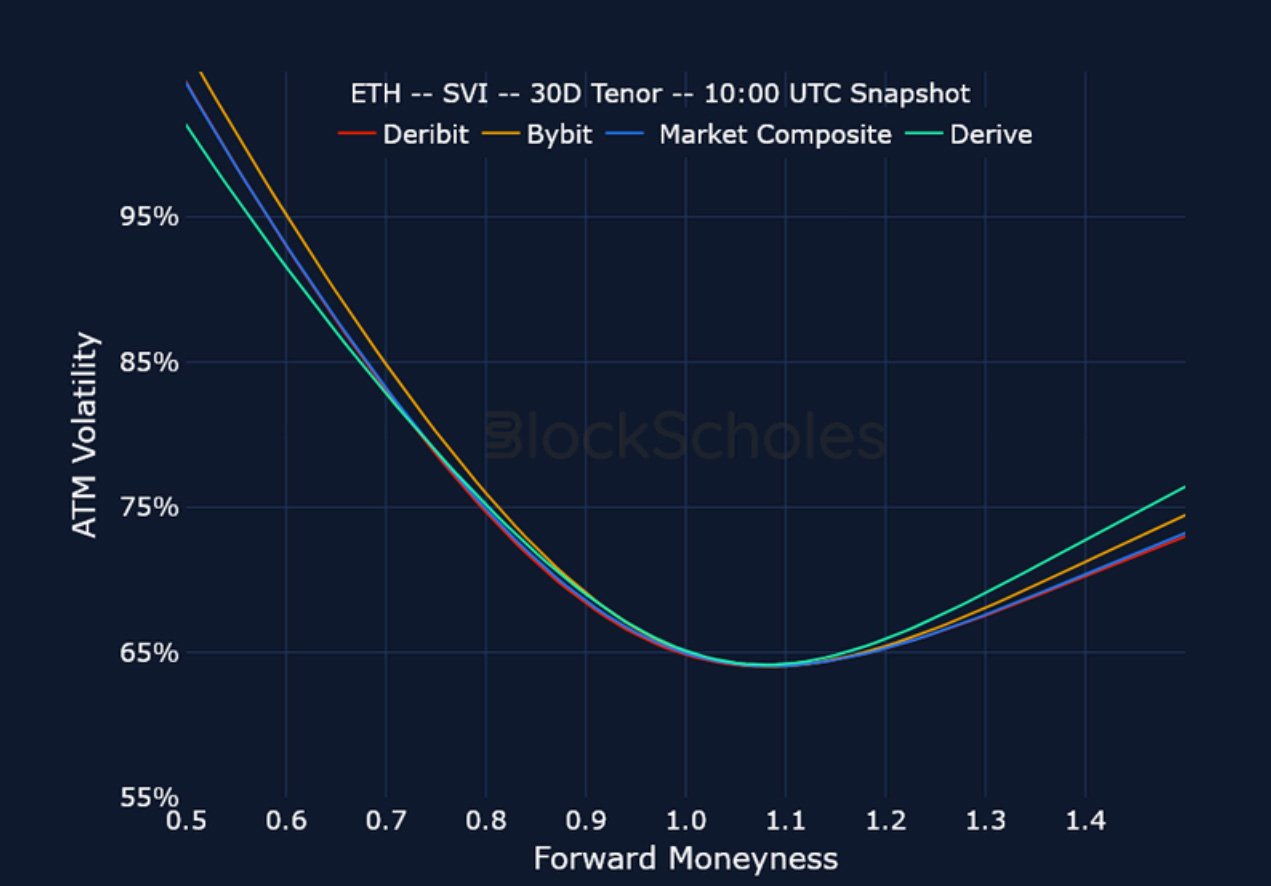

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)