Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

At-the-money implied volatility has continued to trade sideways at its higher, post-rally levels. Futures prices of both BTC and ETH remain above their spot prices, but have shown sings of a small, downwards trend towards spot prices over the last few days. The skew towards OTM calls that we saw in response to January’s strong price action has almost been reversed, with the volatility smiles of both assets showing a slight preference for OTM puts once again.

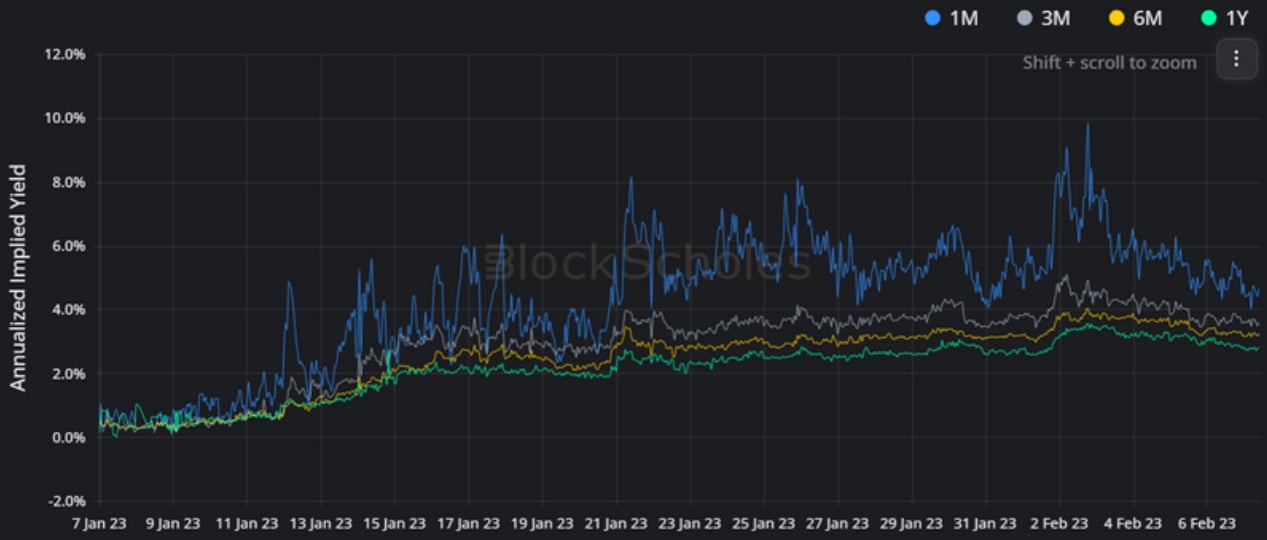

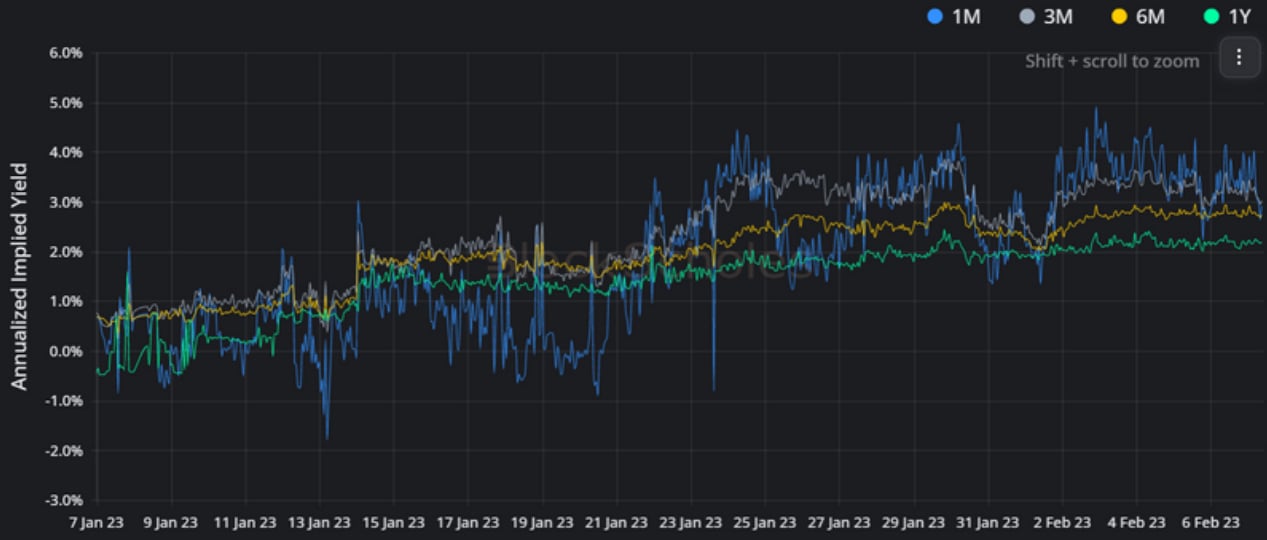

Futures

BTC ANNUALISED YIELDS – trend downwards at all tenors whilst remaining comfortably above 0%.

ETH ANNUALISED YIELDS – continue to move sideways at slightly higher levels above 0% than we saw this time last week.

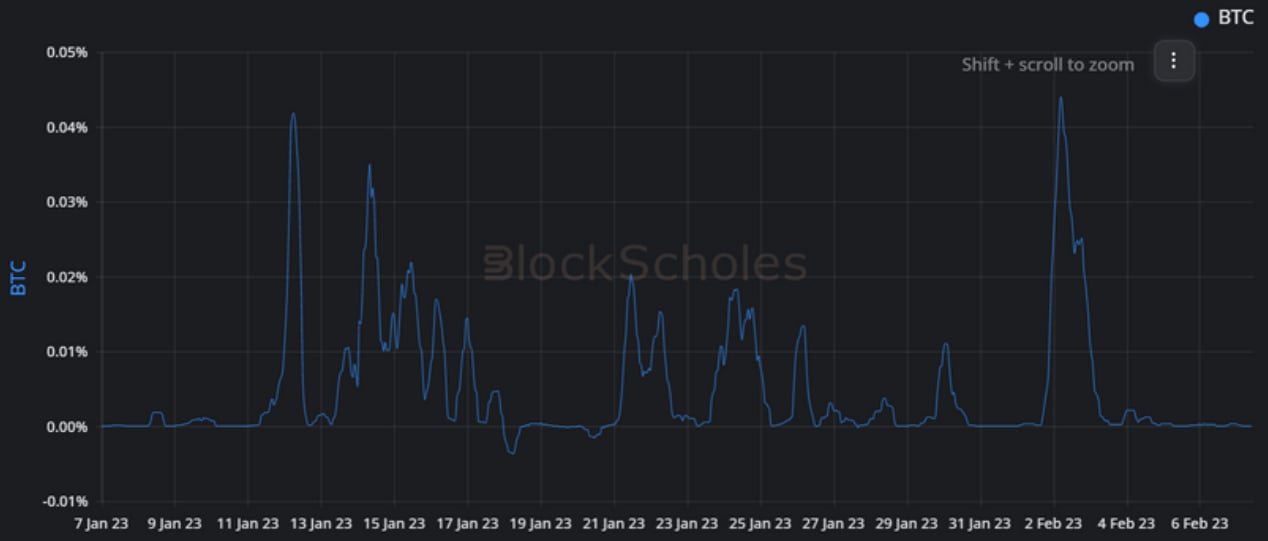

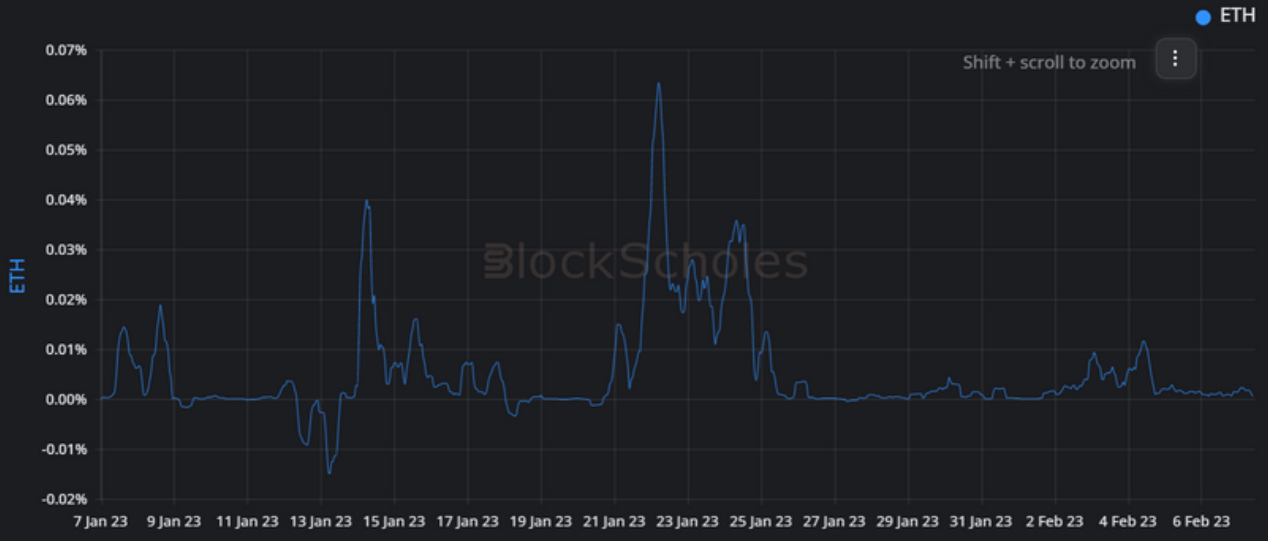

Perpetual Swap Funding Rate

BTC FUNDING RATE – spiked positively late last week in response to the demand for long exposure on Thursday.

ETH FUNDING RATE – did not spike to the same heights as BTC’s on Thursday, despite its spot price enjoying a comparable rally.

Options

BTC SABR ATM IMPLIED VOLATILITY – remains depressed with a small downwards trend noted in the last few days.

ETH SABR ATM IMPLIED VOLATILITY – trades sideways, nearly 15 vol points higher than BTC’s at the same tenors.

Volatility Surface

BTC IMPLIED VOL SURFACE – experiences surface-wide cooling, in OTM puts and calls, as well as ATM.

ETH IMPLIED VOL SURFACE – sees a rise in the implied volatility of 10- delta puts, particularly at a 1M tenor.

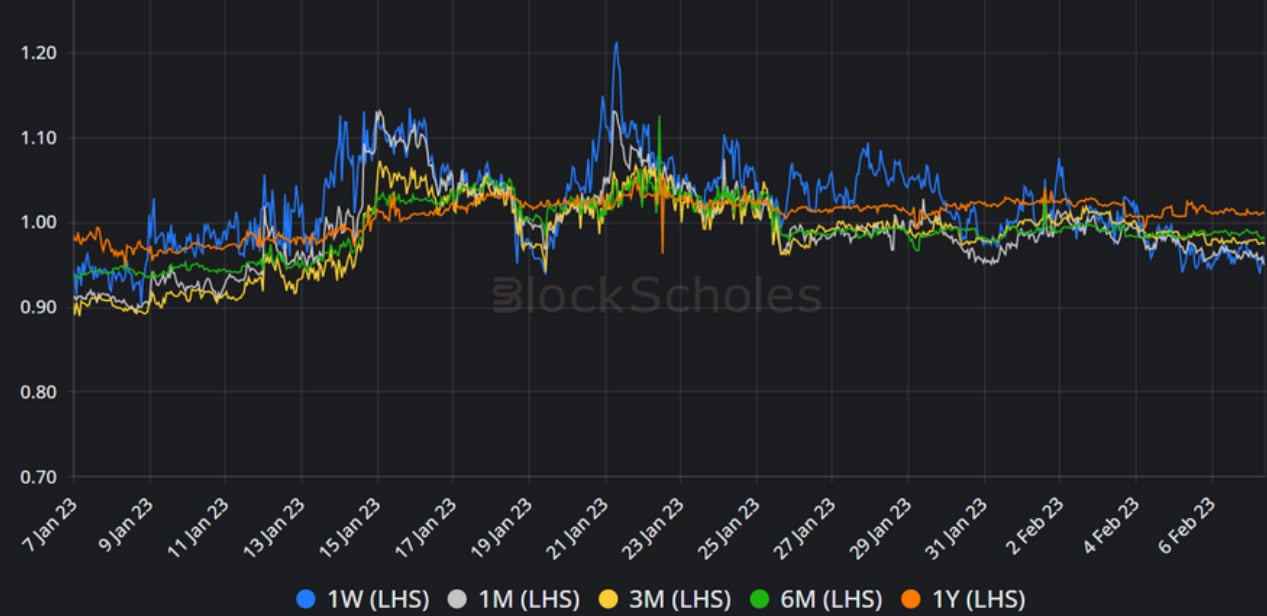

Put Call Skew

BTC 25 DELTA PC SKEW – drifts towards OTM puts over the last week, with only 1Y tenor options expressing a small preference for OTM calls.

ETH 25 DELTA PC SKEW – is much more skewed towards OTM puts than BTC’s, with all tenors displaying a significant tilt towards OTM puts.

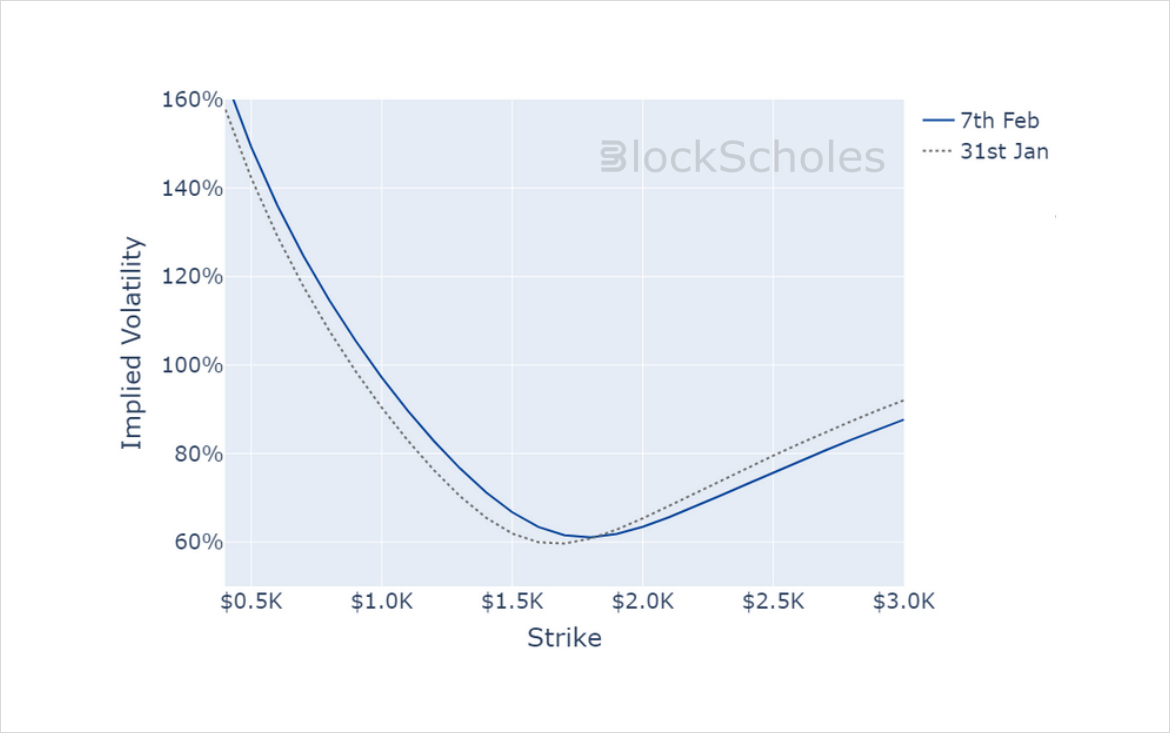

Volatility Smiles

BTC SMILE CALIBRATIONS – 24-Feb-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 24-Feb-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)