Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

All three measures of directional sentiment in derivatives markets have flashed warning signs after a Thursday selloff which saw BTC plunge below $60K (its largest single-day loss since the collapse of the FTX exchange in 2022). Despite spot prices then whipsawing the following day and BTC recovering back above $70K and ETH above $2,000, risk-sentiment is yet to recover.

Funding rates in BTC fell to their lowest since April 2024, while short-dated futures contracts in BTC and ETH traded at strong discounts to spot prices. ATM implied volatility surged to extremes last seen during the 2022 bear market, as the demand for short-term protection against further declines in spot price rose. 7-day BTC volatility exceeded 100%, while volatility smiles priced in their largest premium for put contracts since November 2022.

Block Scholes BTC Risk Appetite Index

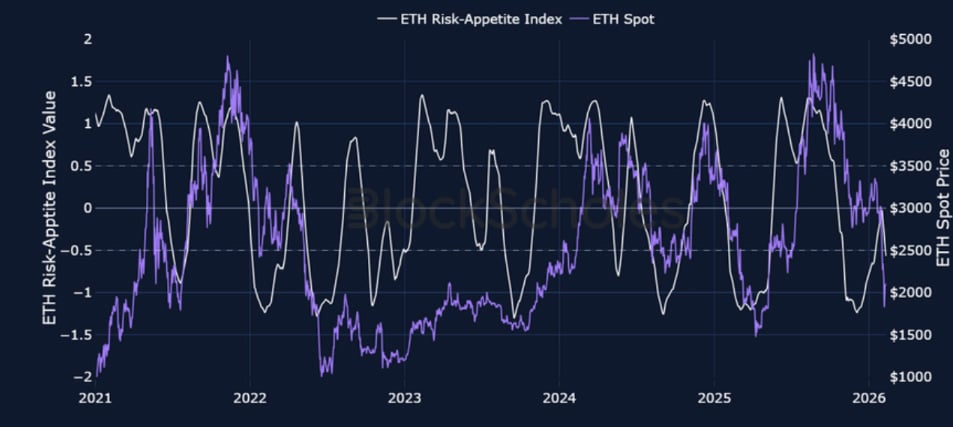

Block Scholes ETH Risk Appetite Index

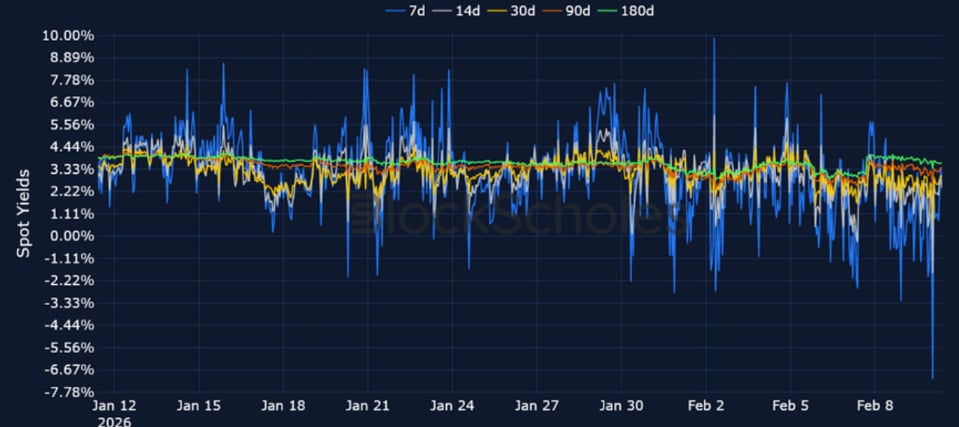

Futures Implied Yields

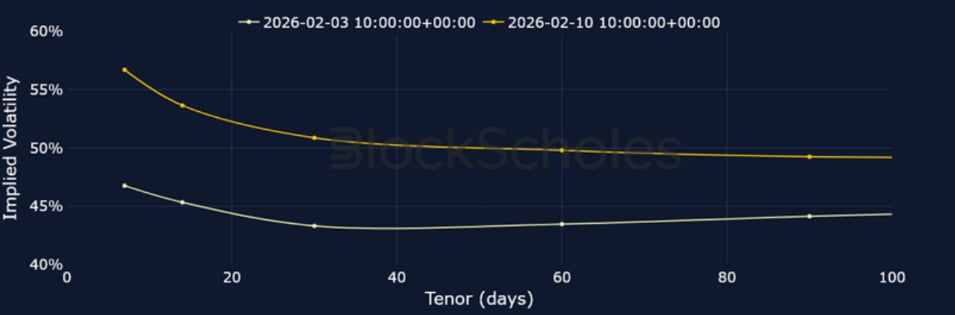

1-Month Tenor ATM Implied Volatility

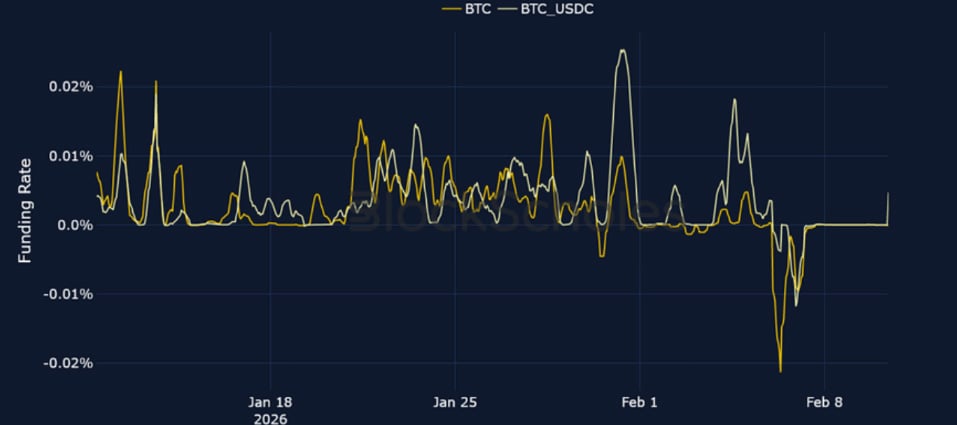

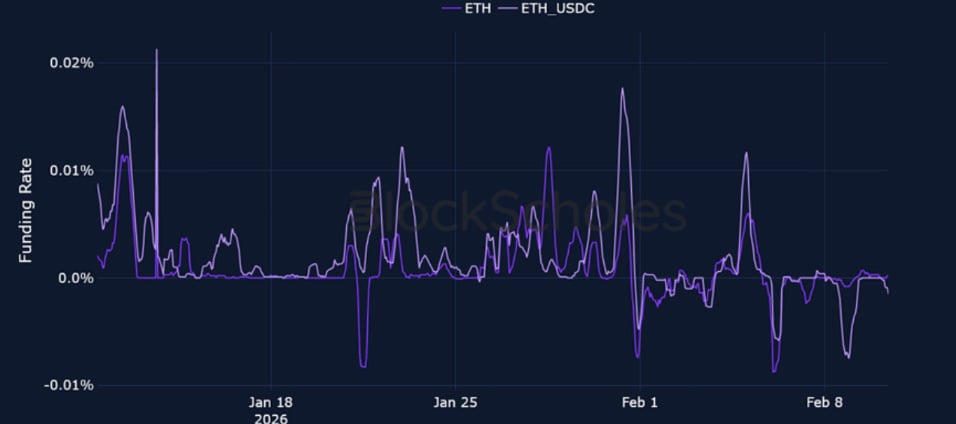

Perpetual Swap Funding Rate

BTC FUNDING RATE – The aftermath of Thursday’s selloff to below $60K pushed funding rates to their most negative since April 2024 – a sign of traders positioning for continued downside pressure.

ETH FUNDING RATE – ETH funding rates have traded neutral-to-negative over the past week, as spot price is trading 60% below its August 2025 high.

Futures Implied Yields

BTC Futures Implied Yields – Perhaps unsurprisingly, the largest single-day price drop since the collapse of the FTX exchange saw short-dated futures trade at a strong discount to spot – another bearish derivatives signal.

ETH Futures Implied Yields – Like BTC, near-term ETH futures contracts traded below spot prices as traders showed a willingness to accept a lower price when shorting compared to the spot price.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Forward looking volatility expectations briefly surged to their most extreme since November 2022, exceeding 100%.

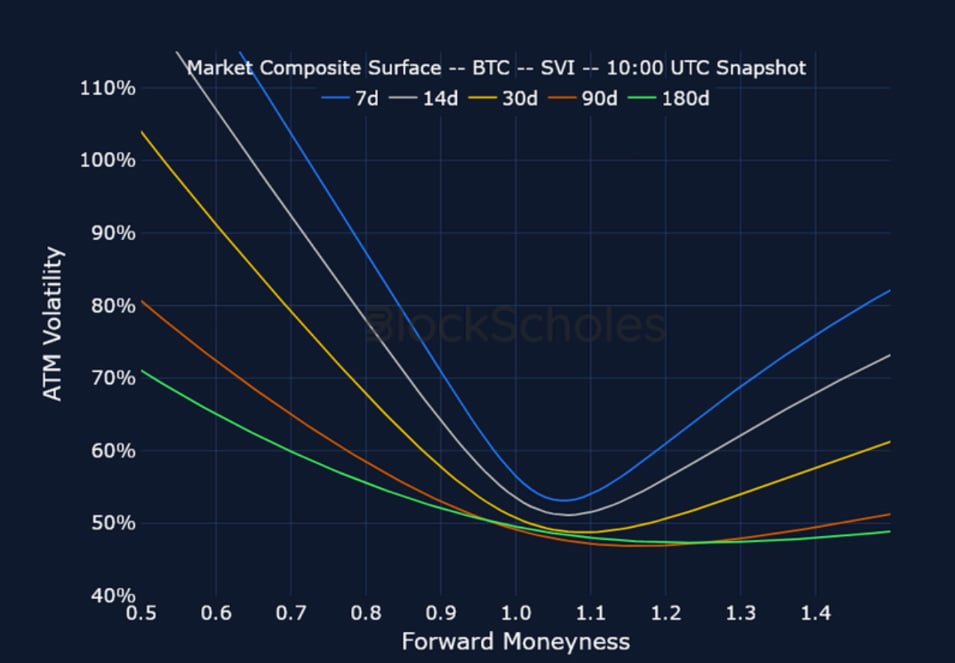

BTC 25-Delta Risk Reversal – Similar to ATM IV reaching its highest since the 2022 bear market, put-call skew traded at its most negative since November 2022, though did not fall to the same extremes (back then, skew fell as negative as -60%).

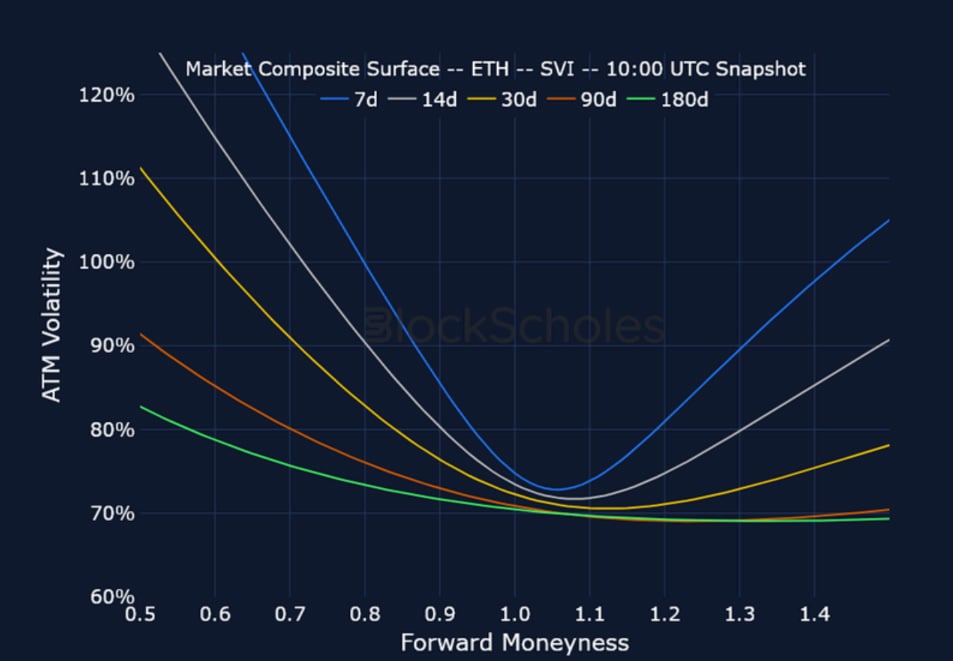

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – The term structure is still inverted for ETH, though not as extreme as last week.

ETH 25-Delta Risk Reversal – 7-day ETH puts briefly traded at a 30 volatility point premium to OTM calls as the demand for downside protection surged. Similar to BTC, that was the largest put premium since 2022.

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

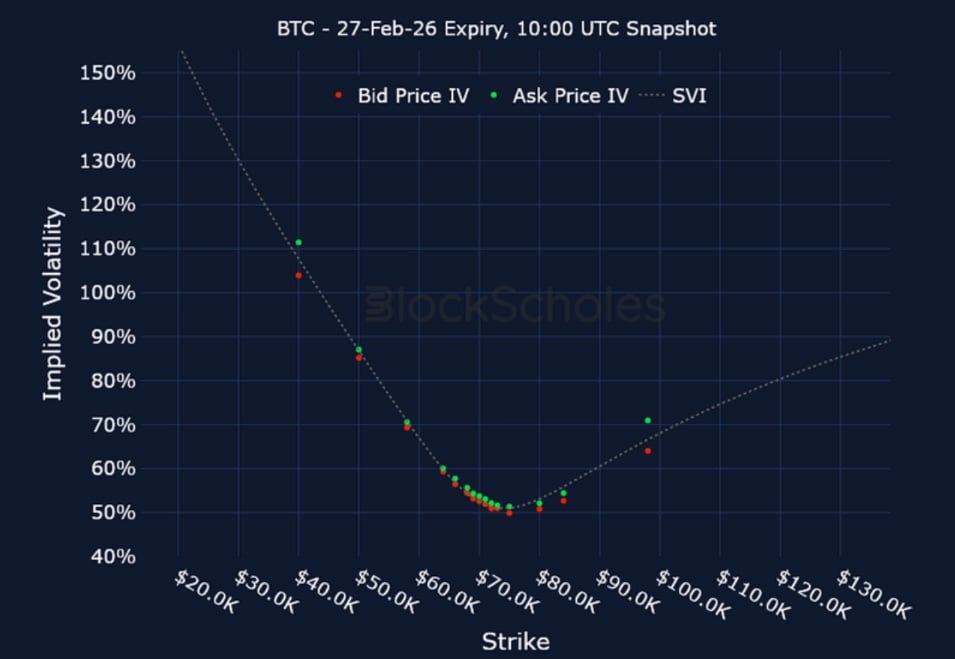

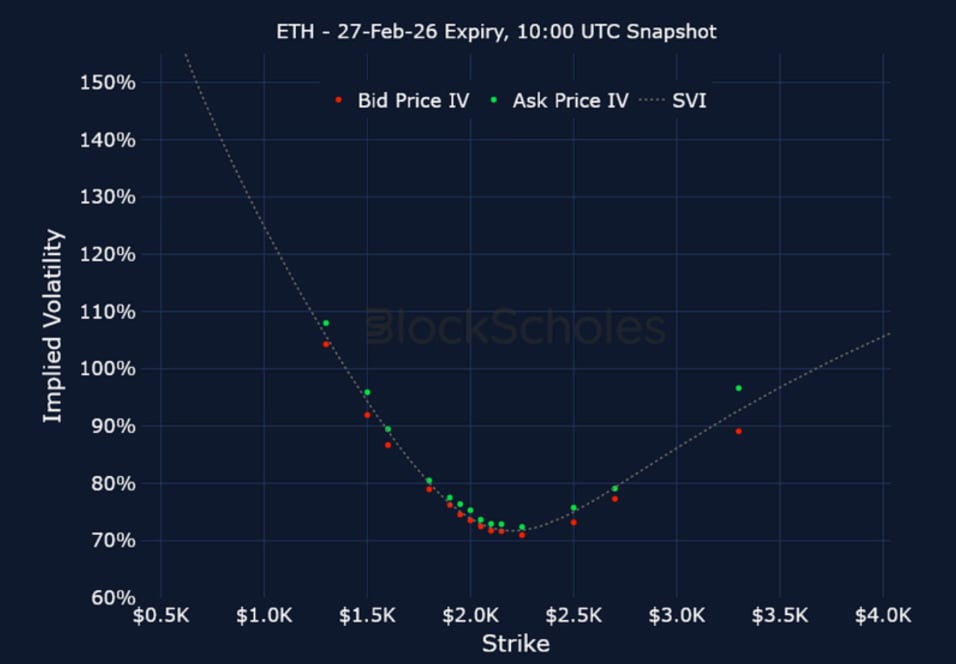

Listed Expiry Volatility Smiles

BTC 27-FEB EXPIRY – 9:00 UTC Snapshot.

ETH 27-FEB EXPIRY – 9:00 UTC Snapshot.

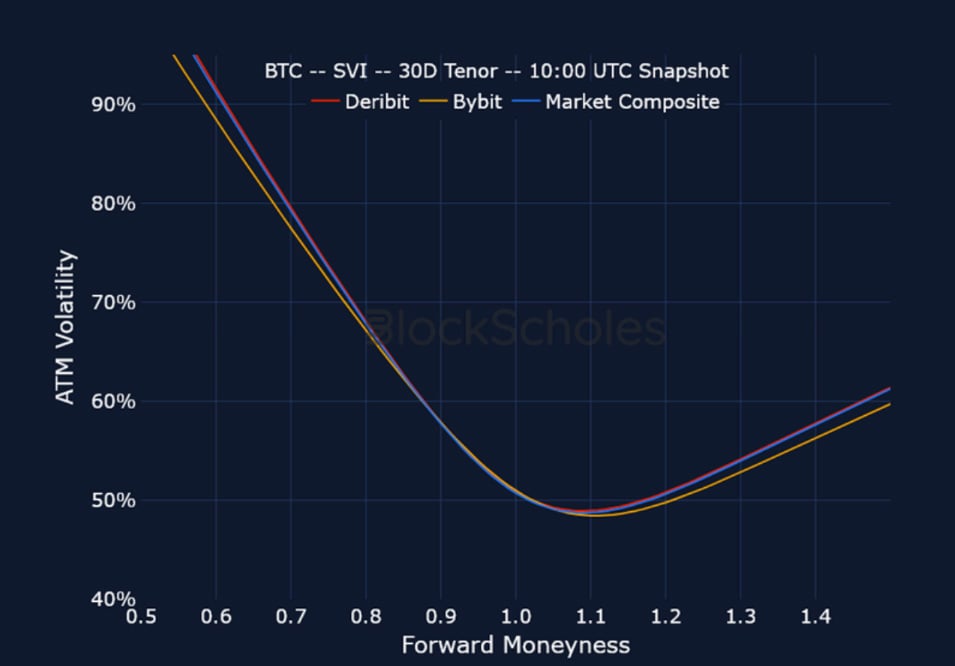

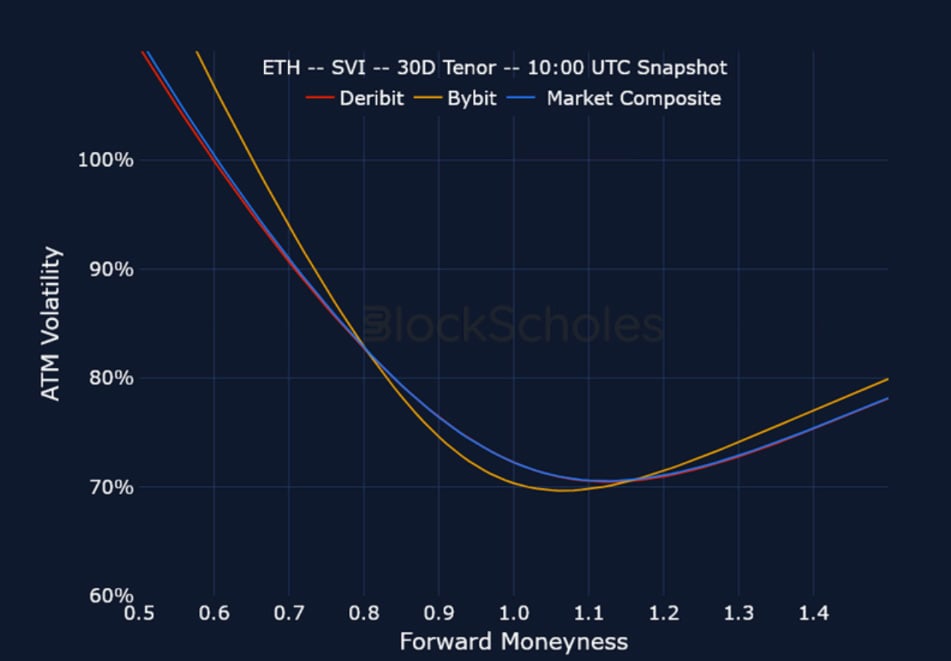

Cross-Exchange Volatility Smiles

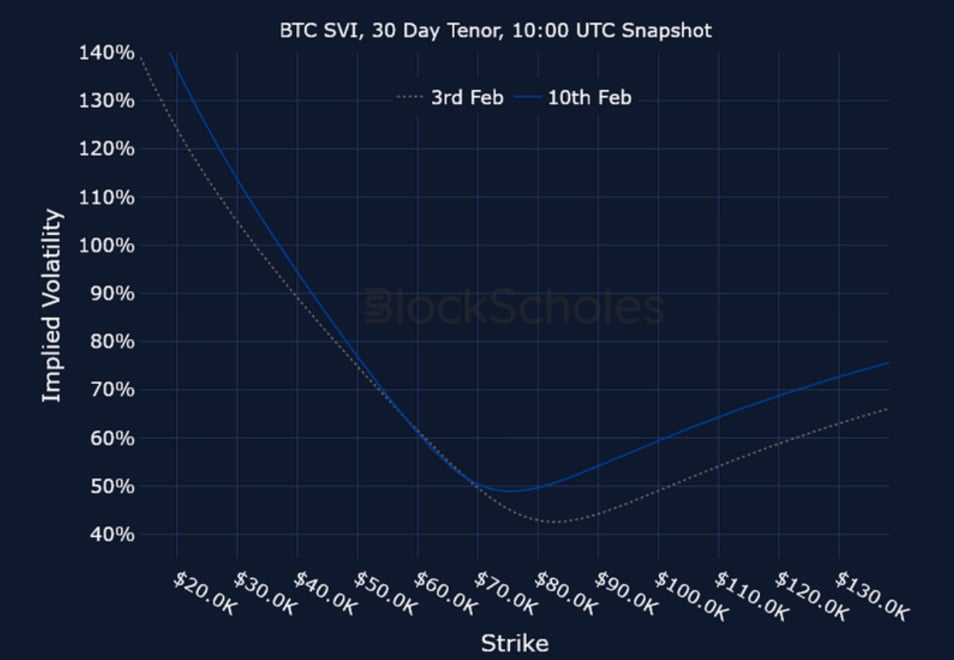

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

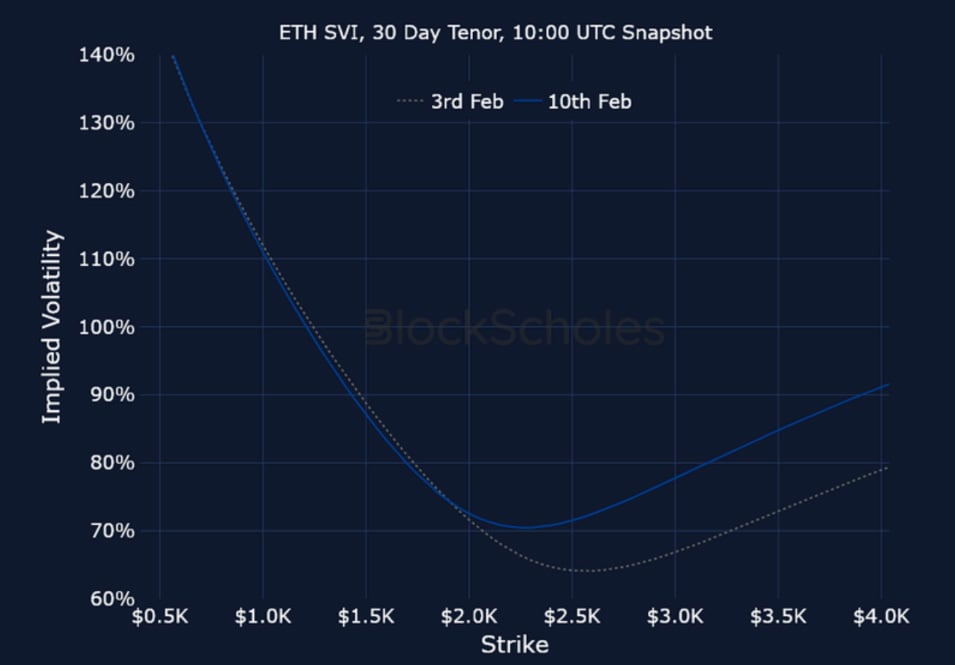

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)