Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Derivatives markets show signs that the excitement of the most recent rally in crypto-asset spot prices has faded slightly, as prices stabilise just below key price points for both BTC and ETH. This leaves implied yields back up at their late January rates, whilst ATM volatility has fallen once again. The relative skew towards OTM puts in ETH’s volatility smile is at odds with that of BTC’s, as is the lower level of spikes in it’s perpetual swap’s funding rate.

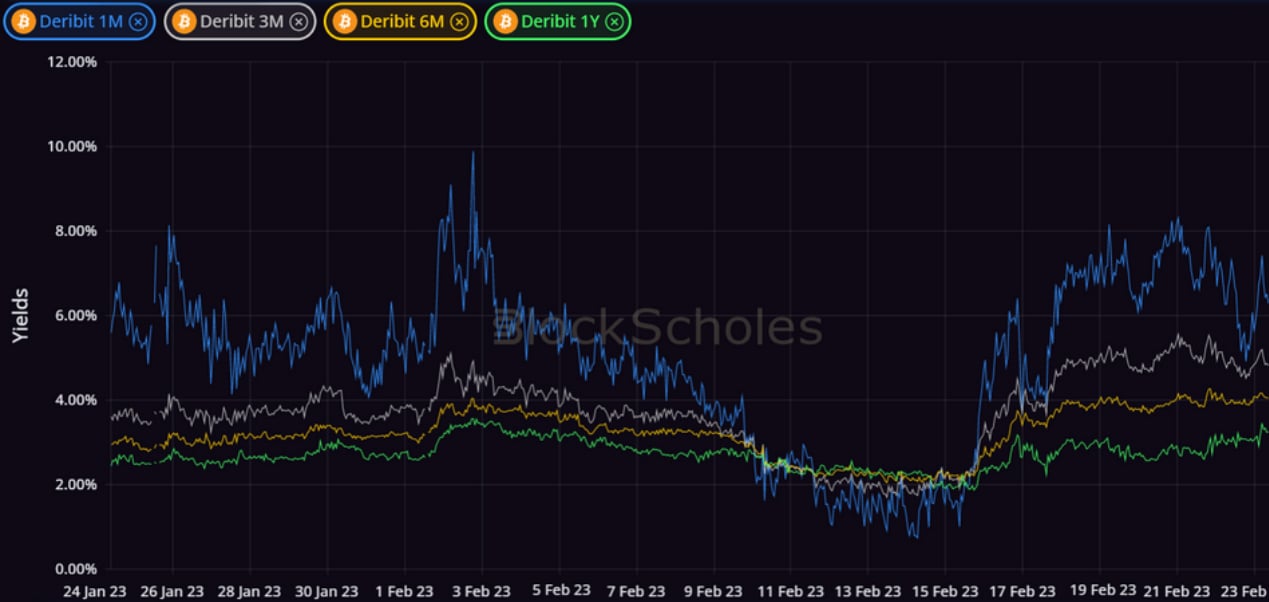

Futures

BTC ANNUALISED YIELDS – this months early rally elevates yields back to the levels they enjoyed in the second half of January.

ETH ANNUALISED YIELDS – enjoy a recovery from their downwards trend this month, although remain just below the levels of BTC’s futures.

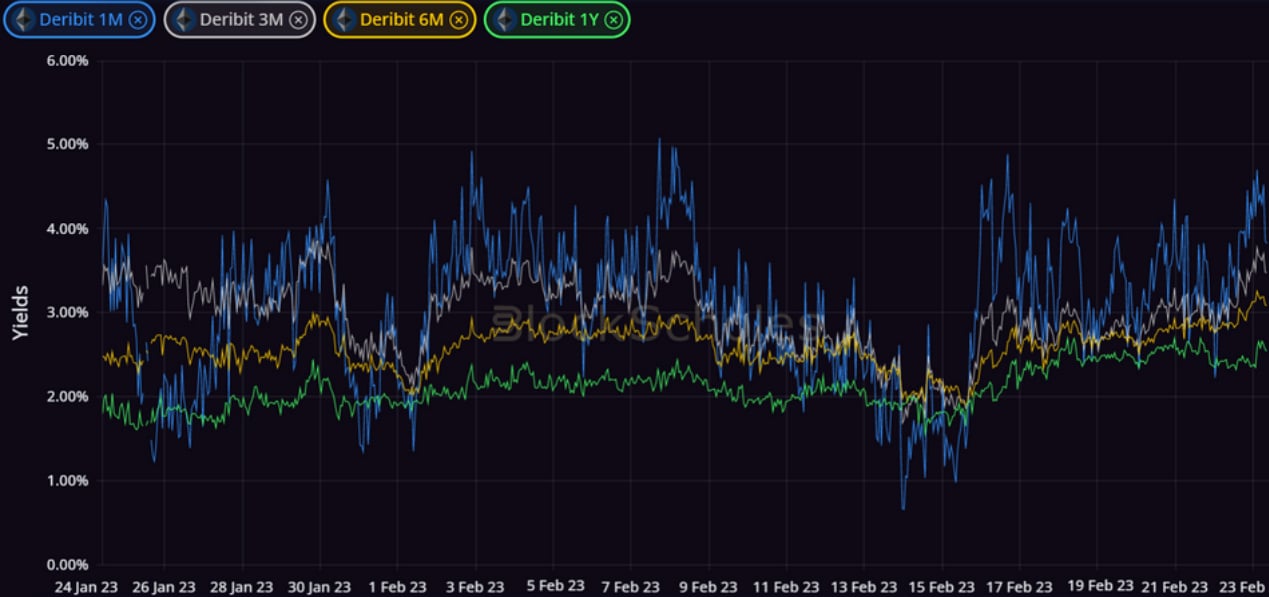

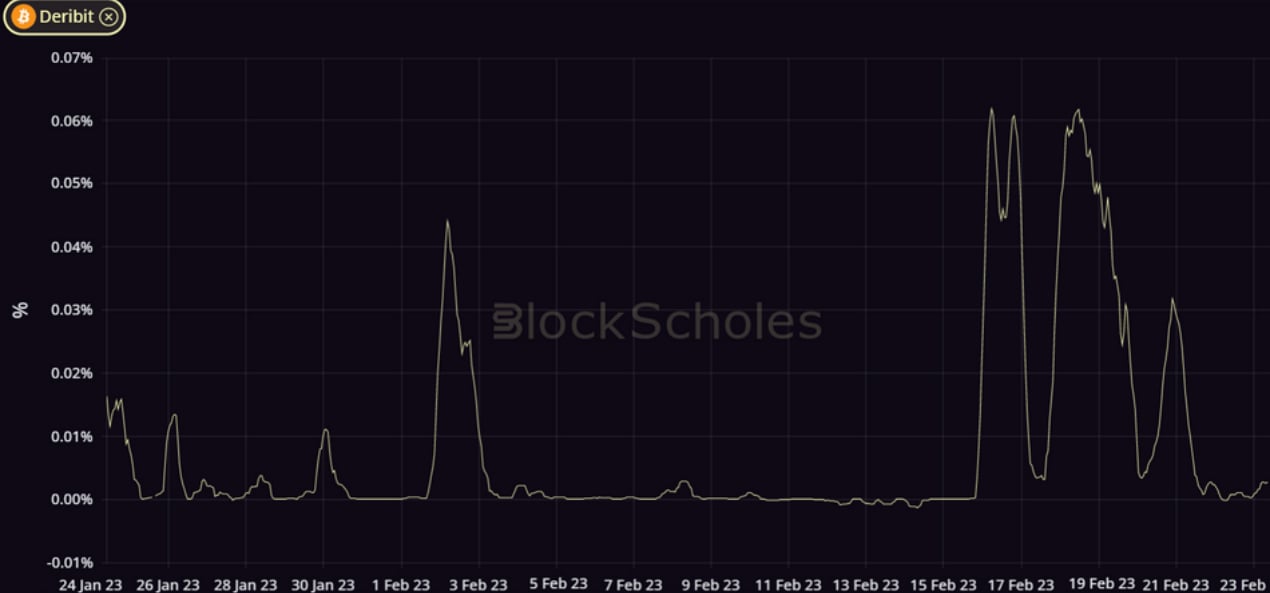

Perpetual Swap Funding Rate

BTC FUNDING RATE – spiked positively several times early this month, with short positions collecting a significant amount of fees.

ETH FUNDING RATE – does not see the same high rate as BTC’s, repeating its response to previous moves upward this year.

Options

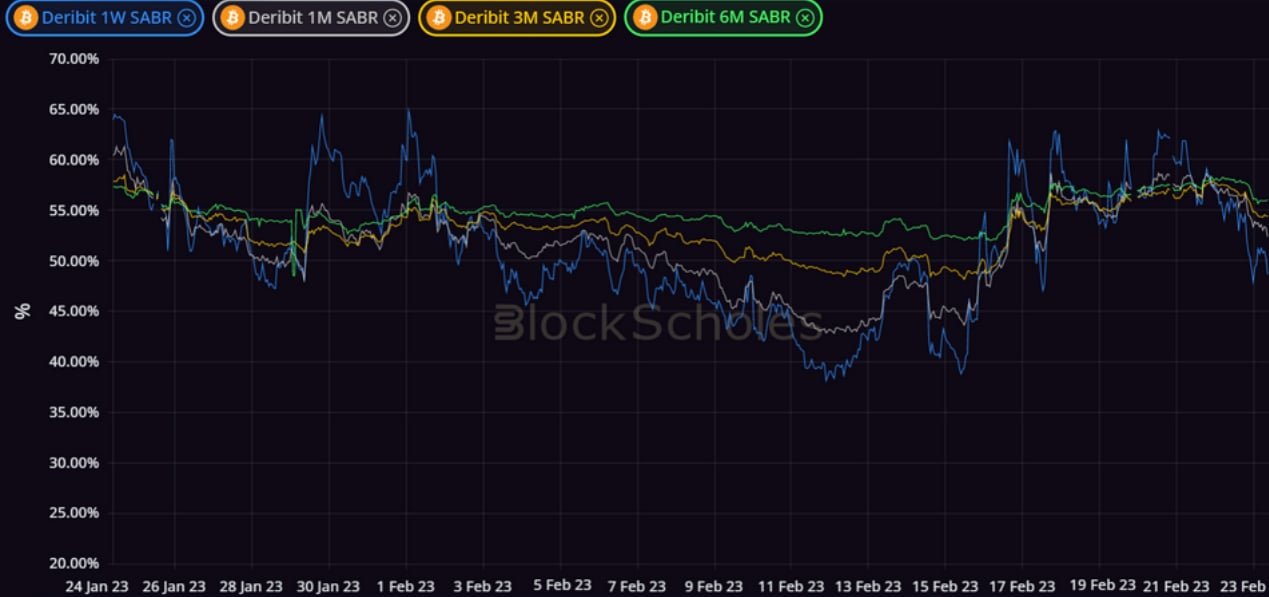

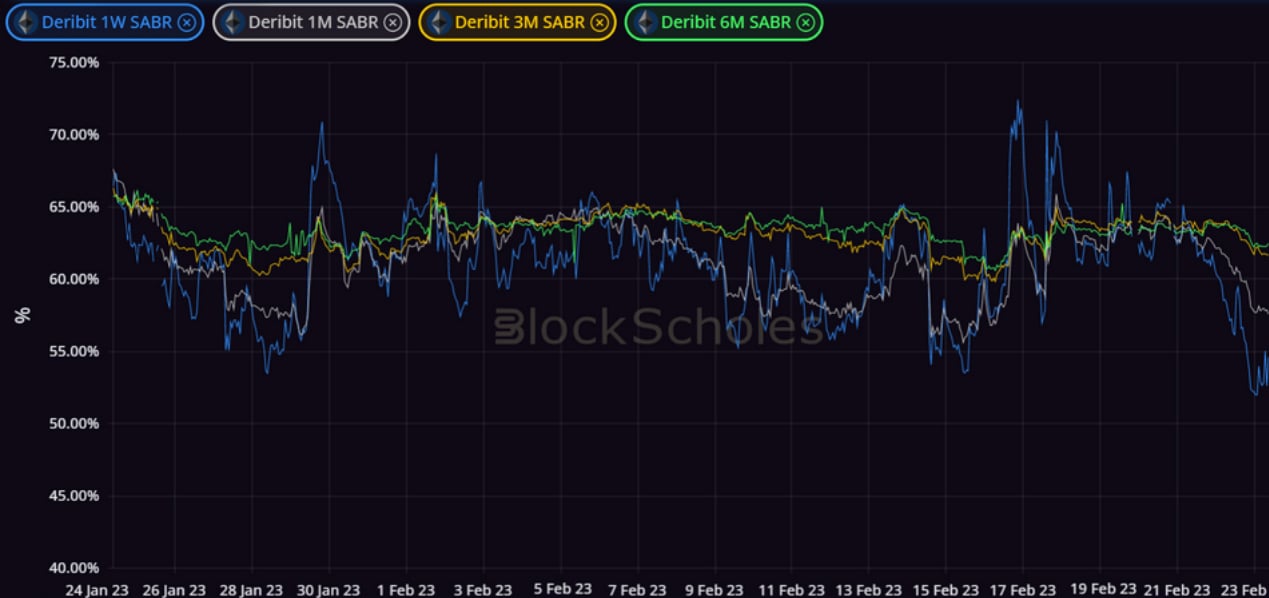

BTC SABR ATM IMPLIED VOLATILITY – has begun to fall lower once again, despite rising in response to the rally earlier this month.

ETH SABR ATM IMPLIED VOLATILITY – falls much sharper than BTC’s, with shorter tenors falling near to the outright levels of BTC options.

Volatility Surface

BTC IMPLIED VOL SURFACE – shorter dated tenors feel the bulk of the cooling in implied volatility, with OTM puts at a 1 month tenor cooling fastest on the surface.

ETH IMPLIED VOL SURFACE – the 1W tenor volatility smile flattens, with the implied vol in the wings cooling whilst its ATM rises.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

Put-Call Skew

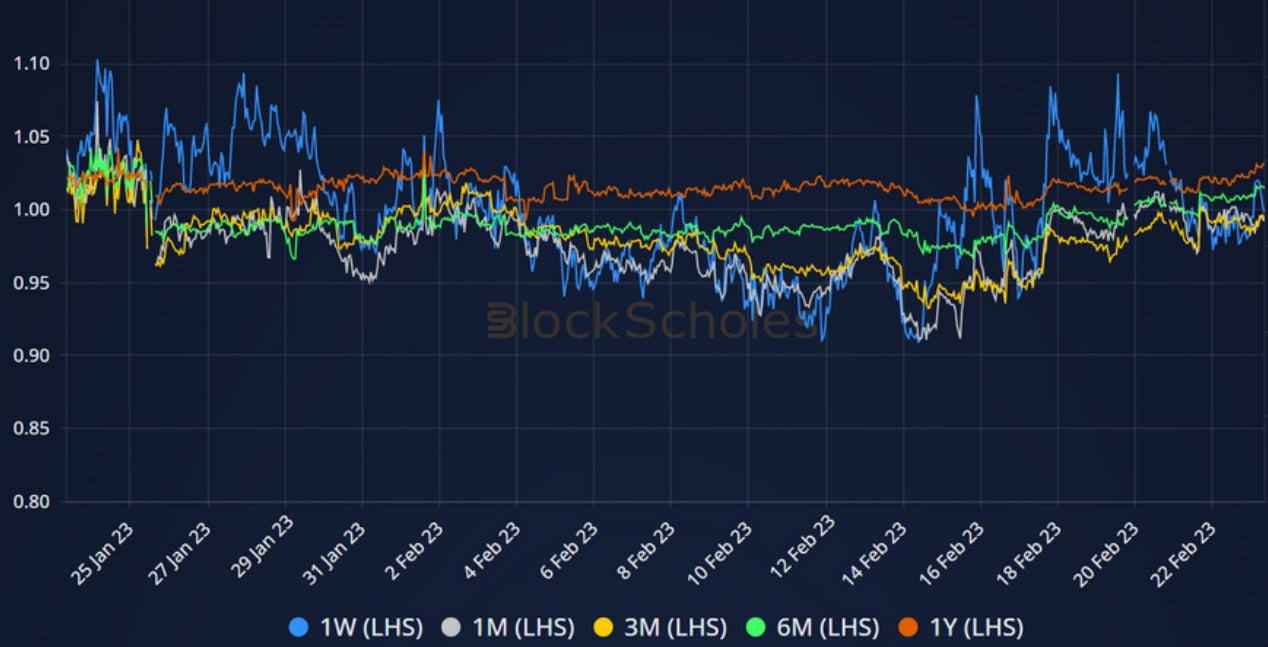

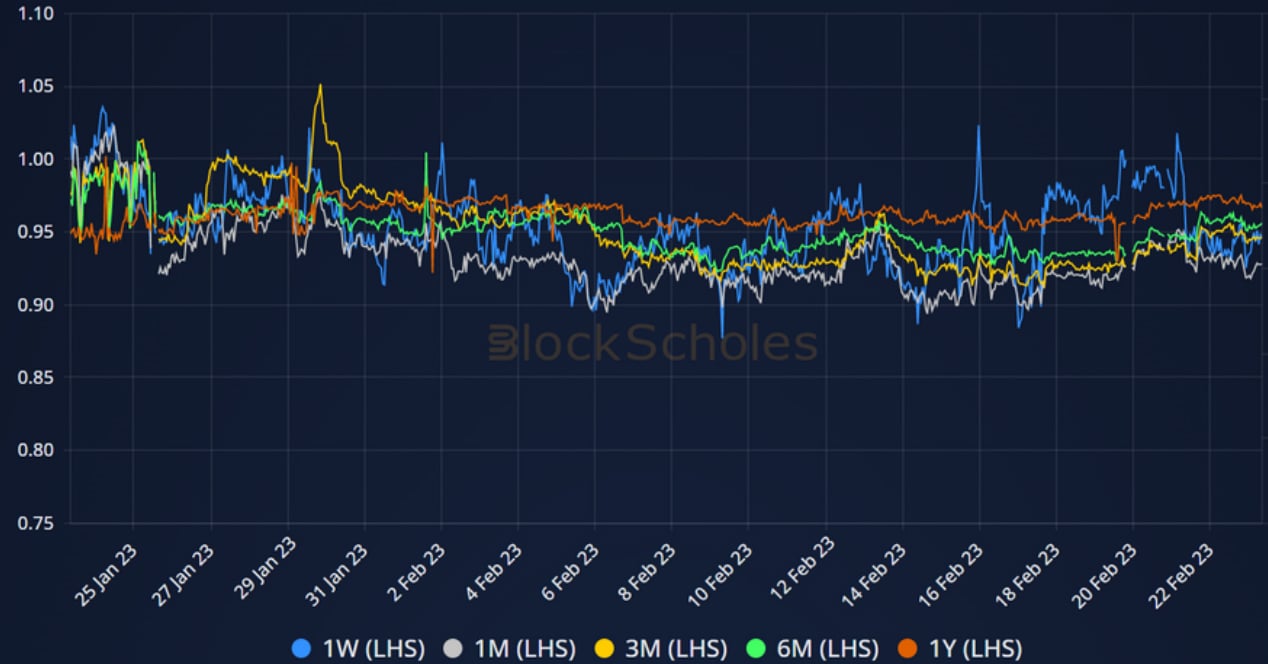

BTC 25 DELTA PC SKEW – OTM puts and calls continue to trade close to par, with the skew at all tenors in a tight band near to 1.

ETH 25 DELTA PC SKEW – trades in a similar tight band across the term structure but at a distinctly lower level, skewing slightly towards OTM puts.

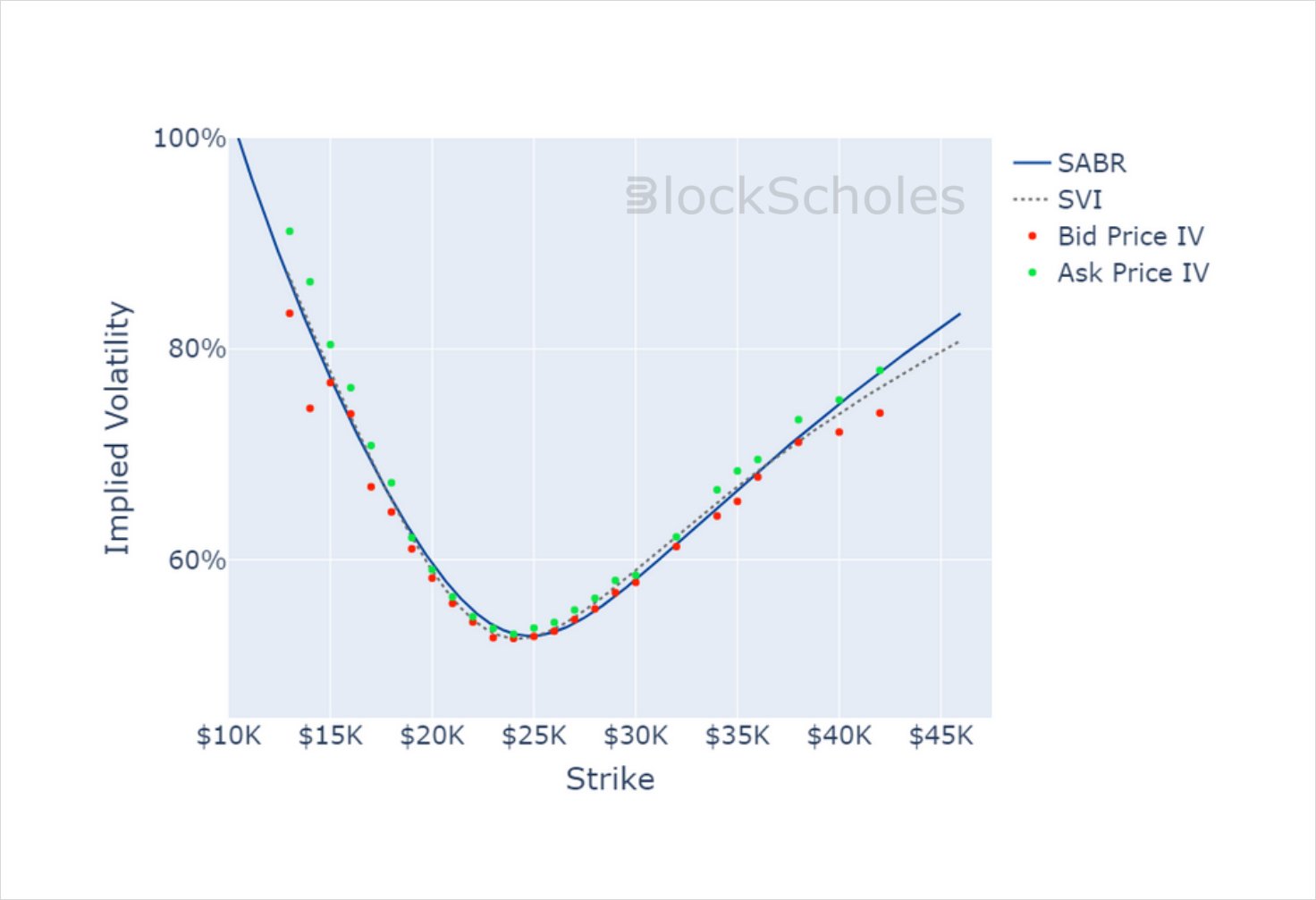

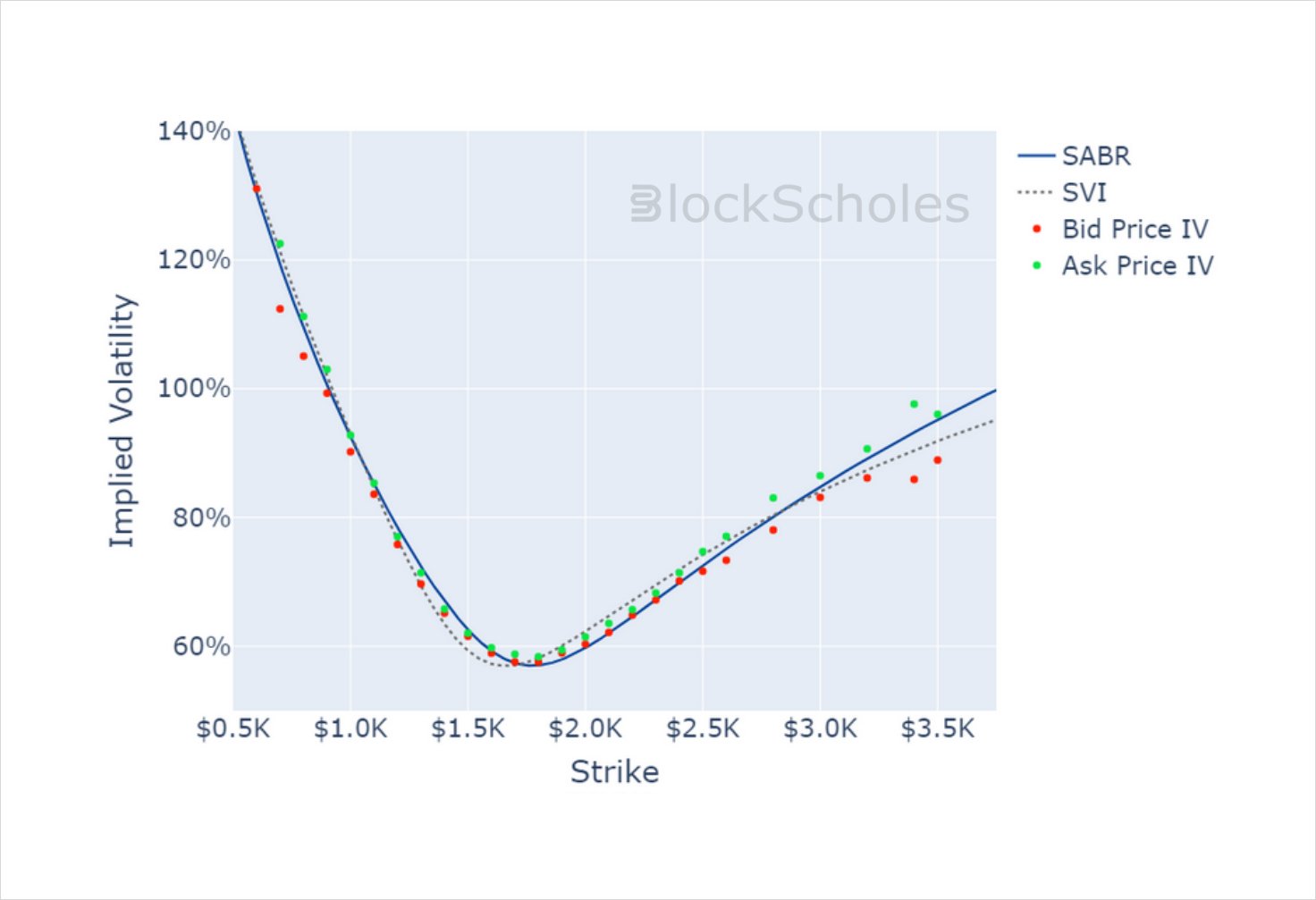

Volatility Smiles

BTC SMILE CALIBRATIONS – 31-Mar-2023 Expiry, 10:00 UTC Snapshot.

ETH SMILE CALIBRATIONS – 31-Mar-2023 Expiry, 10:00 UTC Snapshot.

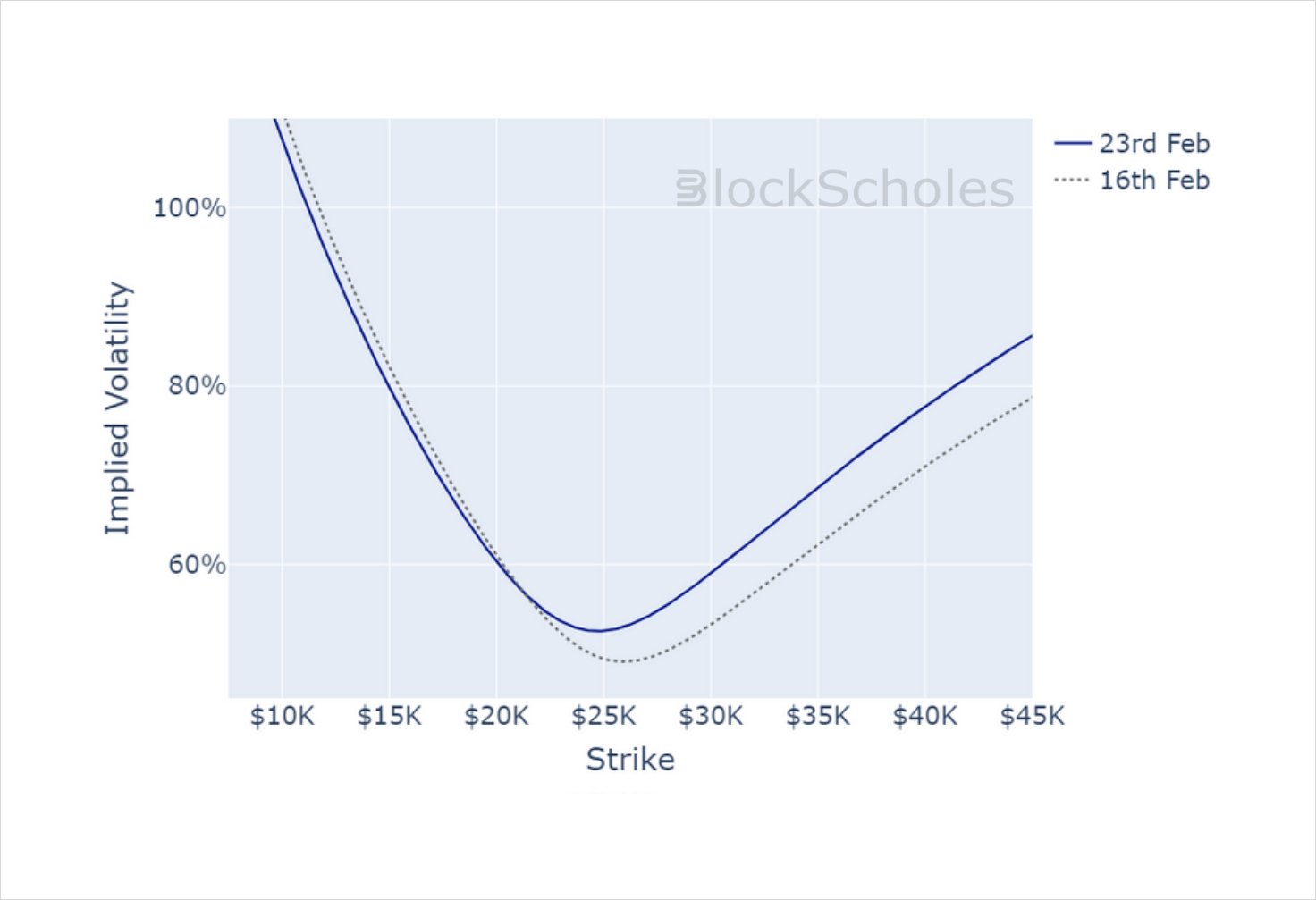

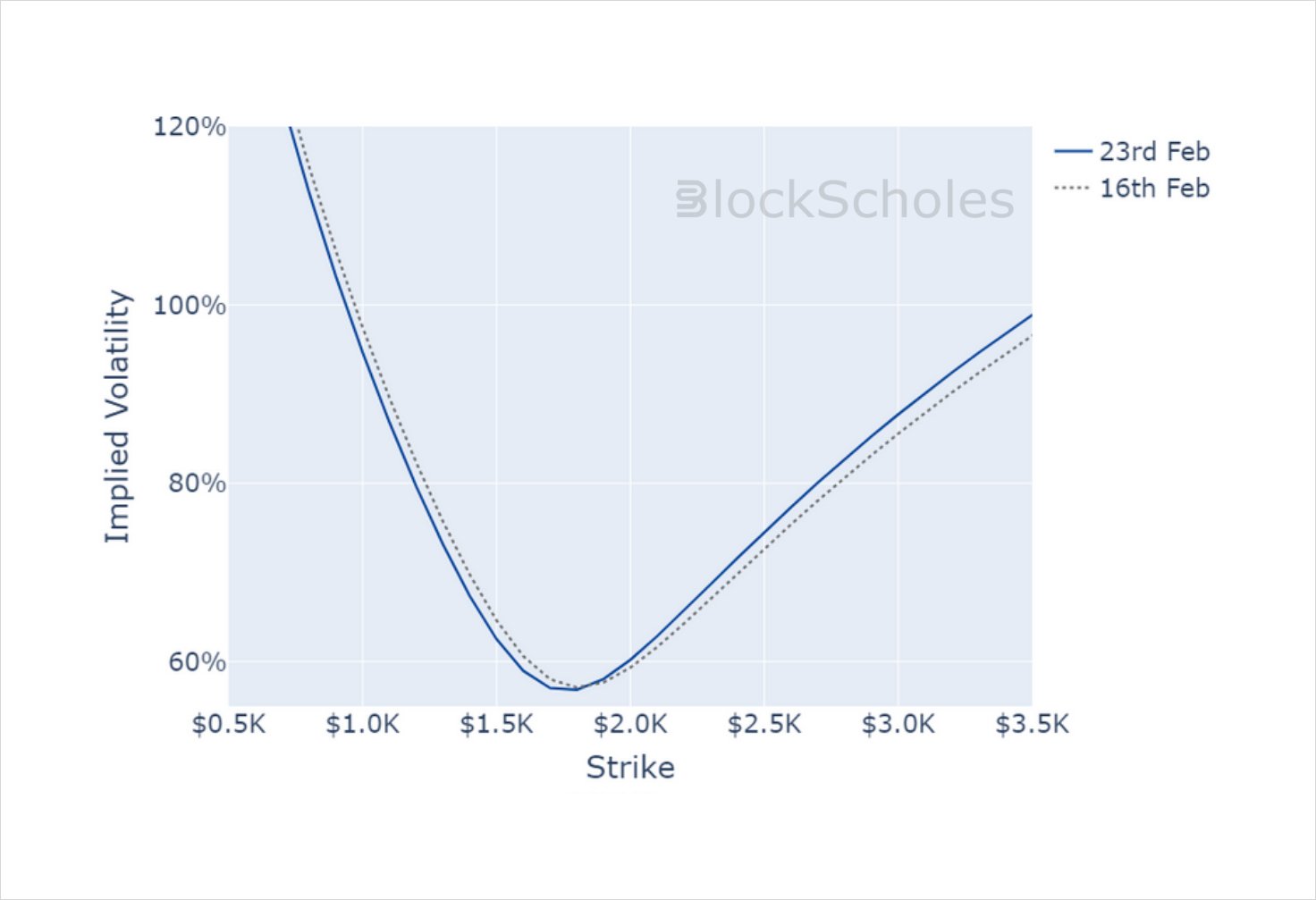

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)