Macro Backdrop: Risk-Off Dominance Overrides Crypto Narratives

Crypto markets are being driven less by internal developments and more by global macro stress. Renewed U.S. fiscal uncertainty, rising shutdown risk, trade tensions, and FX intervention concerns have tightened overall risk appetite. This has triggered deleveraging across crypto, with forced liquidations accelerating downside moves.

Capital flows tell the same story: traditional defensive assets such as gold and silver are attracting inflows, while crypto underperforms broader risk markets. In options, this macro sensitivity is expressed less in absolute implied vol levels, which remain low, but instead a relative demand for downside protection. Near-term price action remains headline-driven, with limited room for bullish conviction until macro clarity improves.

Realized Volatility: Elevated but Stabilizing After the Shock

Realized volatility remains high, reflecting the sharp downside move seen recently—roughly in the low-40s for BTC and around 60 for ETH. These levels are backward-looking but still influential, keeping vol metrics elevated even as spot price action begins to stabilize.

Implied volatility has eased slightly, drifting lower by a couple of points, though short-lived spikes continue to appear during spot sell-offs. The negative spot/vol correlation remains intact. Carry is still negative, signaling that the market expects realized volatility to compress over time, even if near-term uncertainty persists. For now, implied ranges have largely contained price action, reinforcing a heavy but controlled market.

Term Structure & Skew: Cautious Positioning, Defensive Bias

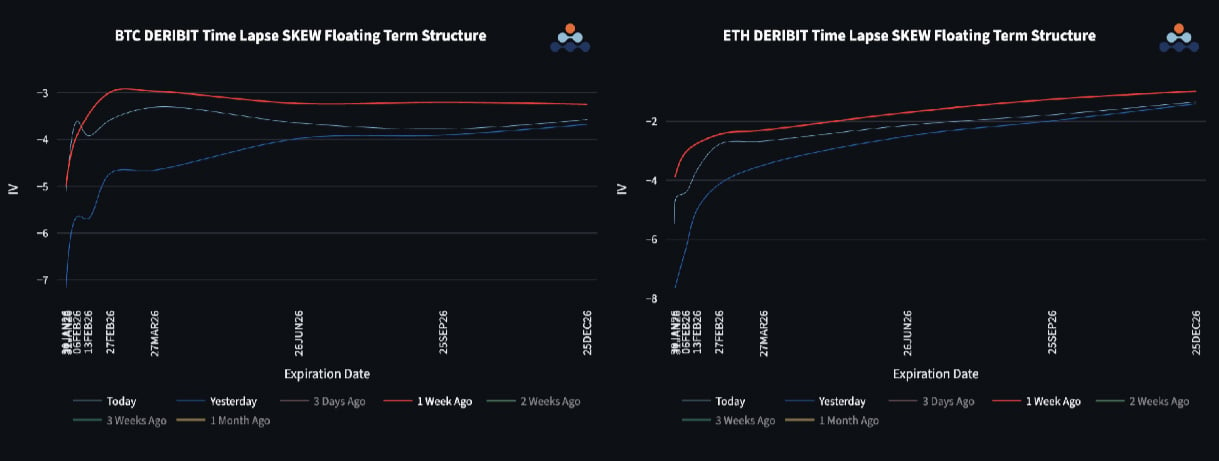

The volatility term structure reflects near-term caution rather than outright panic. Skew deepened into contango during the sell-off, with front-end put skew becoming meaningfully bid as spot weakened. Although the subsequent bounce reduced some of this stress, downside skew remains elevated relative to the start of the week.

Flow-wise, BTC continues to see consistent call selling in front expiries, highlighting supply overhead and limited upside conviction. ETH flows are more mixed, but its higher downside beta makes its skew reactive to sell-offs even if the protection buying is less apparent. Overall, options markets are pricing asymmetry to the downside while avoiding aggressive tail-risk pricing.

ETH/BTC Dynamics: Volatility Still the Cleaner Trade

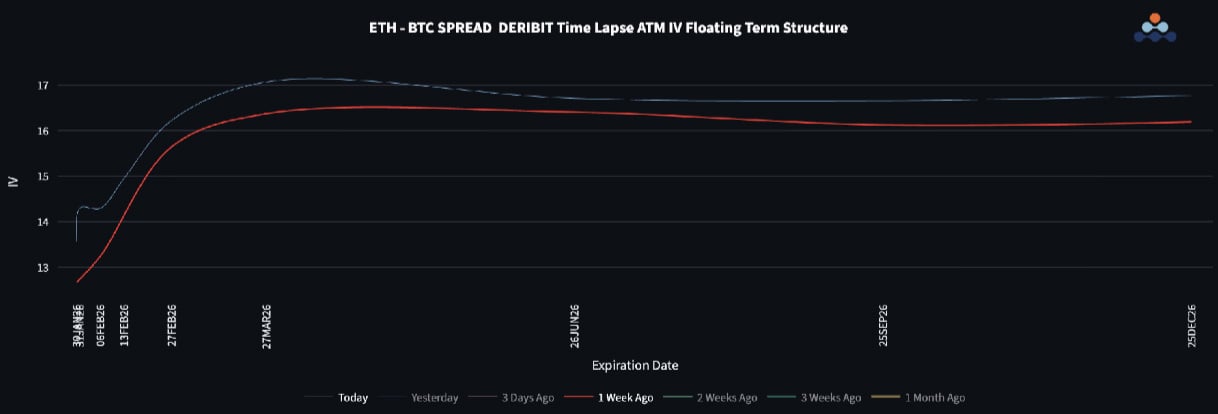

From a relative value perspective, ETH/BTC remains structurally weak. The cross has held near-term support but continues to trade below its long-term moving average, limiting bullish directional signals.

Volatility tells a more constructive story. ETH implied and realized volatility have held up better than BTC, keeping the vol spread elevated. With realized vol differentials still wide, long ETH gamma versus BTC gamma remains attractive for active hedgers. In the absence of a strong directional catalyst, relative vol continues to offer cleaner risk-adjusted opportunities than outright spot exposure.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)