Macro Reset: From Collapse to Consolidation

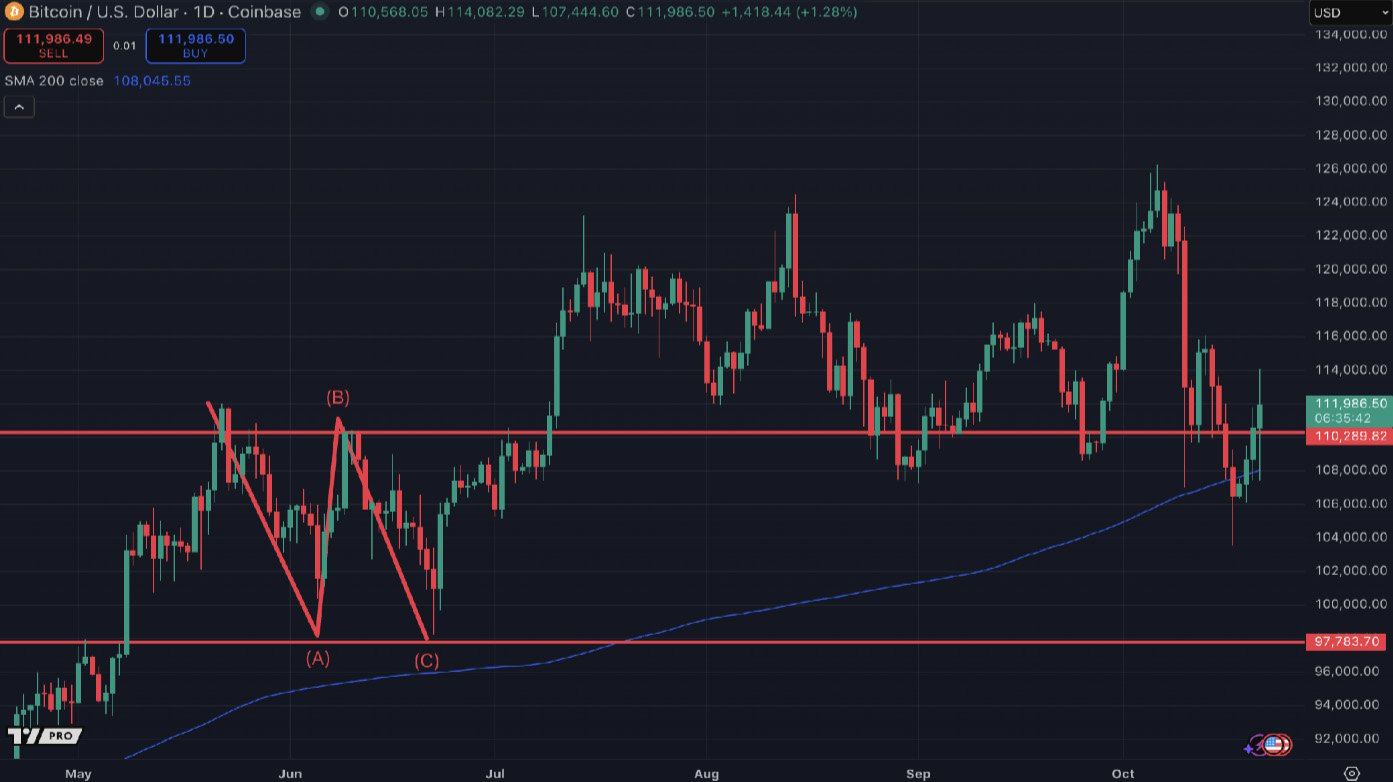

The crypto market appears to be stabilizing after one of the most violent leverage flushes on record, which wiped out over $19 billion in positions. What initially looked like a breakdown has become a structural reset. Bitcoin has recovered to around $110K, volumes and open interest are rebuilding, and liquidity is returning. With systemic leverage purged, the foundation looks stronger and more sustainable. Broader macro signals support the recovery too — easing bank stress, tighter credit spreads, and rising institutional inflows into BTC and ETH ETFs suggest risk appetite is returning.

Crypto has been lagging equities, which are almost back to all-time highs, and seems to be negatively correlated to Gold lately. A year-end rally is still likely with this macro backdrop but choppy price action near term suggests we may need to see a final thrust lower first.

Realized Volatility: Calm After the Storm

BTC’s realized volatility has cooled to around 40, while ETH sits near 60 – a normalization after last week’s panic. Short-dated implieds are roughly flat in BTC but slightly softer in ETH as price swings settle. Carry briefly turned positive before slipping marginally negative again. With CPI data due and the next FOMC meeting approaching, traders should stay alert – macro catalysts could easily reignite vol. Short gamma players beware!

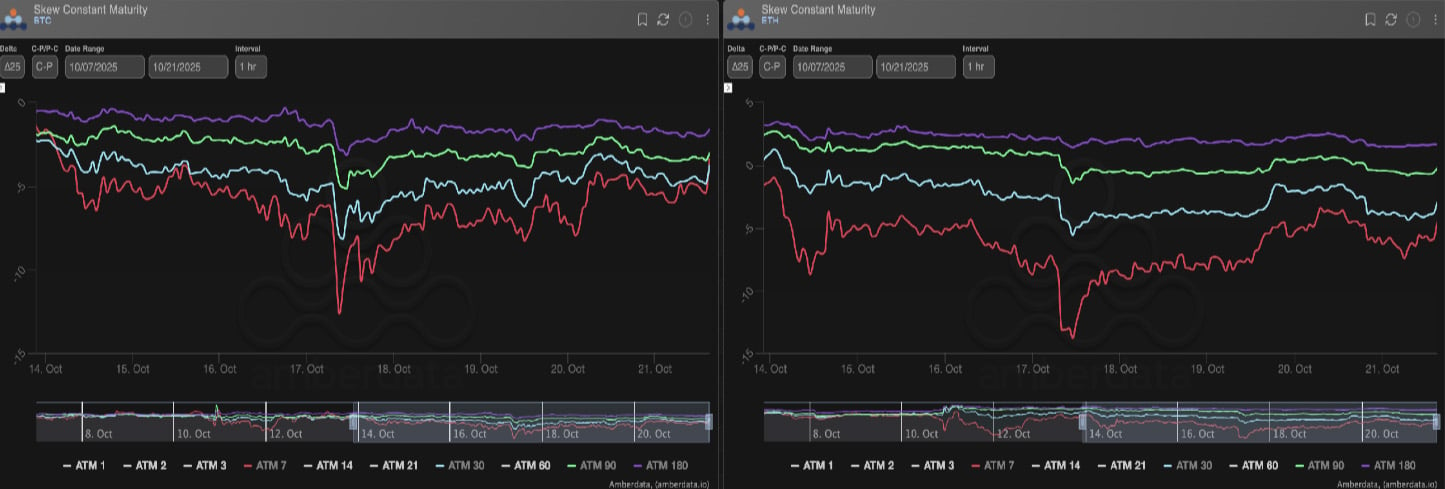

Skew: Hedging Flows Shape the Curve

Option skew term structure steepened sharply mid-week as demand for weekly downside protection surged, with BTC puts trading at a 13-vol premium and ETH near 15. Both have since normalized to modest put skew levels around 3-5 vols. Long-dated BTC options remain tilted toward puts, reflecting persistent institutional hedging rather than bullish conviction. ETH’s back-end structure is more optimistic, with 2026 expiries still showing call premium – a sign the market expects its next big rally to materialize in early 2026.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)