Crypto Breakdown Forces a Defensive Reset

Crypto has decisively shifted regime. Key technical levels in both BTC and ETH have failed, triggering forced deleveraging and accelerating downside momentum. This is no longer a slow grind lower but a disorderly repricing, with market psychology turning from dip-buying to capital preservation.

From an options perspective, the important signal is not direction but speed. The market is no longer absorbing shocks smoothly. Structural weakness and persistent selling pressure have pushed traders to prioritize protection, hedge gamma exposure, and reduce convexity risk.

Realized Volatility: Shock Levels Redefine the Playing Field

Realized volatility has surged aggressively—BTC moving above 80 and ETH exceeding 100. These are stress-level prints, reflecting both the magnitude and persistence of the sell-off.

Implied volatility has struggled to keep up. Even with large increases across the curve, implied ranges have been repeatedly breached to the downside, keeping carry firmly negative. This is a textbook environment where realized vol performs and owning “expensive” gamma works, rewarding those positioned for movement rather than stability.

Term Structure & Skew: Inversion, Fear, and Vol Compression Risk

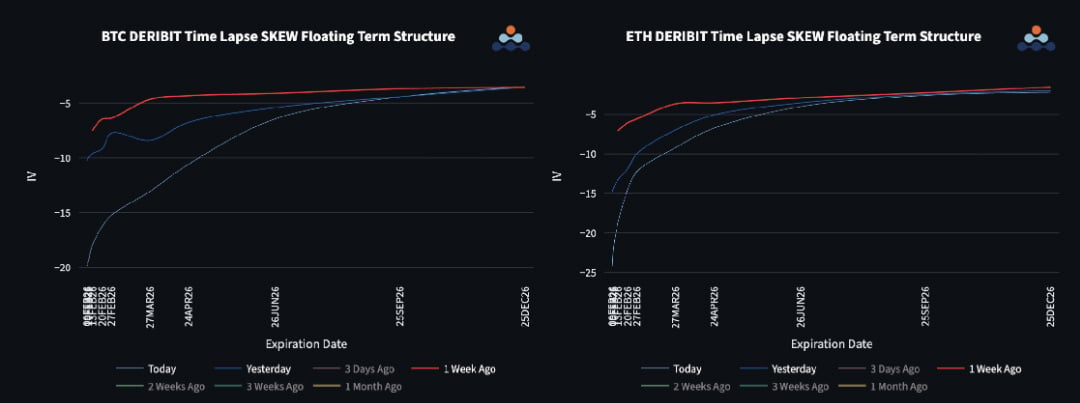

The volatility term structure has flipped into a sharp inversion. Front-end daily vol has spiked to extreme levels, while one-month volatility has repriced higher by tens of points in days.

Put skew is stretched to extremes. Front expiries show the steepest downside skew in over a year, and that pressure is bleeding into mid-curve maturities. This structure signals acute near-term fear but also sets the conditions for violent implied vol compression if spot stabilizes or rebounds. In this regime, vanna effects get amplified due to high vol of vol: rallies are likely to crush implied volatility faster than traders expect.

ETH/BTC Dynamics: Volatility, Not Direction, Is the Edge

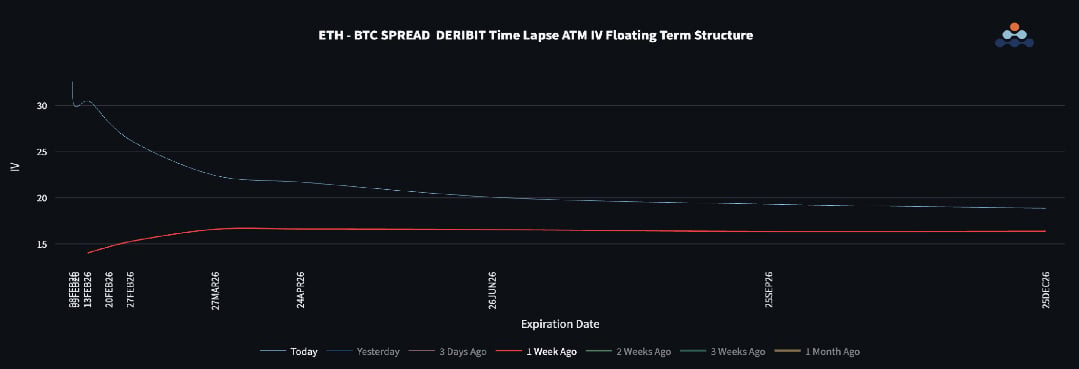

The ETH/BTC spot cross has broken key support and weakened further, confirming ETH’s higher downside sensitivity.

ETH volatility has exploded relative to BTC, with the front-end vol spread widening sharply. Despite looking expensive on paper, this spread reflects genuine uncertainty rather than mispricing. ETH remains structurally unstable, making its gamma valuable. We flagged last week that ETH looks decent value at 15 over BTC. Now at 30, it’s probably fair, but not a sell. We are in a different vol regime so old ranges don’t matter as much. Take size down and calibrate to the new world where short-term vol is 3x what it used to be. Stay safe.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)