Summary: Traders must remember that the rally from 25,000 to 38,000 is primarily built upon the assumption that the SEC will approve a Bitcoin Spot ETF. The SEC is still in an open lawsuit with Coinbase, which is expected to be the primary counterparty (prime broker and custodian) for various Bitcoin Spot ETF applicants, and the SEC sued Coinbase in June. Each of the four crypto bull markets (2011, 2013, 2017, and 2021) was associated with a novel way to acquire Bitcoins. With the approval of a Bitcoin Spot ETF, moving fiat from any bank into Bitcoin would then become possible.

Analysis

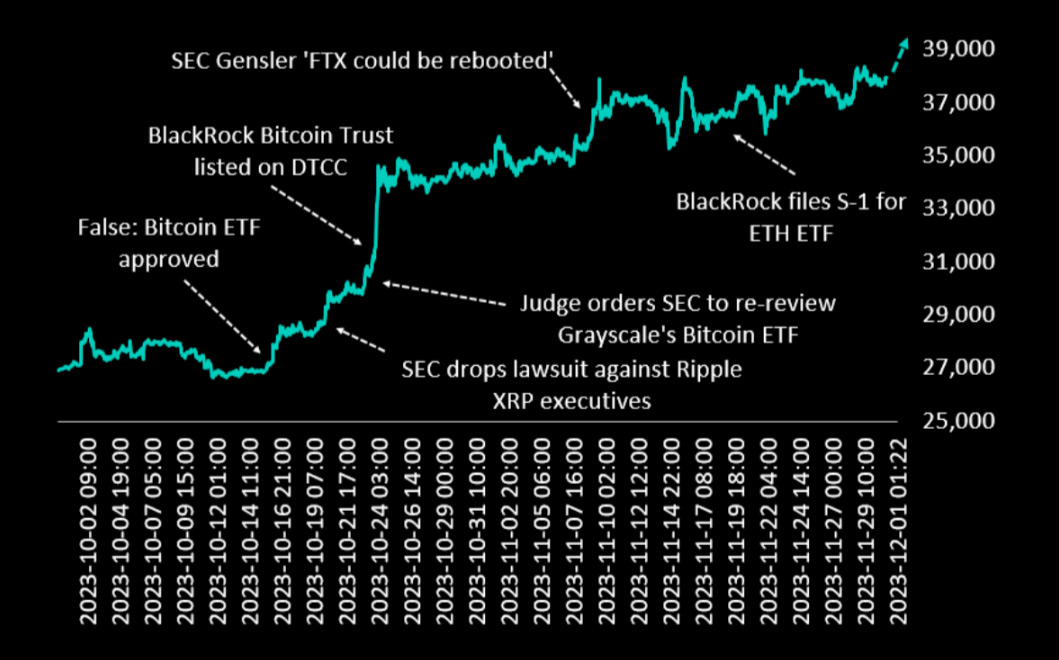

Another month, another rally attempt? 38,000 appears to be a tough nut to crack, but we would still expect another break higher attempt. Traders must remember that the rally from 25,000 to 38,000 is primarily built upon the assumption that the SEC will approve a Bitcoin Spot ETF – eventually – or even immediately. We would use any break higher to position ourselves for a sideways to mildly downside surprise afterward.

I don’t expect a Bitcoin Spot ETF to be approved in Q1 2024, as there is no surveillance-sharing agreement yet. The SEC is still in an open lawsuit with Coinbase, which is expected to be the primary counterparty (prime broker and custodian) for various Bitcoin Spot ETF applicants, and the SEC sued Coinbase in June, accusing it of operating illegally as a national securities exchange, broker, and clearing agency without registering with the regulator. The SEC may approve a Bitcoin Spot ETF in April 2024 or later.

Each of the four crypto bull markets (2011, 2013, 2017, and 2021) was associated with a novel way to acquire Bitcoins. From 2011 onwards, we had spot exchanges, 2013 leveraged spot exchanges, 2017 perpetual futures exchanges, and 2021 saw the institutional borrowing and lending market effectively with uncollateralized borrowing from crypto hedge funds and trading desks – I wrote about it in my book ‘Crypto Titans’. In this fifth bull market and with the eventual approval of Bitcoin Spot ETFs, Bitcoin could become part of institutional portfolios and be used to collateralize assets. This could create leverage or other ways of portfolio optimization. Importantly, moving fiat from any bank into Bitcoin would then become possible.

Three US banks were dismantled in March 2023 that were instrumental in facilitating the seamless onramp from fiat into crypto, and there has yet to be a replacement. This is why the onramp we have been seeing this year has been predominantly institutional, as this avenue is still available through Tether, which does not deal with retail. A Bitcoin Spot ETF would solve this onramp with regulated, trusted entities, and investors still demand crypto allocation.

Futures-based Bitcoin ETFs lose money for investors due to the high operating costs and the near permanently high monthly roll costs, which are elevated in times of high interest rates and bullish market environments. On average, a Bitcoin Futures ETF holder will lose 6-8% annually and underperform Bitcoin Spot. It is remarkable that even those Bitcoin Futures ETFs have attracted $1.1bn in assets – imagine the amount a low fee with near zero tracking risk Bitcoin Spot ETF could attract. This compares to the expectations that a Bitcoin Spot ETF would cost 1% or less for investors per year, including custody fees.

The performance of listed Bitcoin-proxies, such as Bitcoin mining or other crypto service providers (Coinbase, Galaxy, MicroStrategy), shows that there is pent-up demand from investors. The market capitalization of precious metals ETFs in the US is $120bn, and 77% of respondents under 40 prefer Bitcoin over Gold as a safe haven asset. If 20% of those previous metals holdings were moved into a Bitcoin ETF, this would result in $24bn of inflows. In comparison, Registered Investment Advisors (RIA), which manage around $5trn (or more by other estimates), could move 1% into Bitcoin – for example, for portfolio diversification reasons, that would result in $50bn of inflows. Through our work with BlackLitterman Asset Allocation portfolio analysis, we can make the case that Bitcoin could become 0.5% to 10% of institutional portfolios.

While there are Bitcoin Spot ETFs in other countries, the US market is dominated by institutions (78% of trading volume) that actively use ETFs as the market is large enough to use sector strategies for asset allocations. This is not the case in other jurisdictions. As mentioned above, the RIA community is $5trn strong and prefers using ETFs for asset allocation strategies. This is why the Bitcoin Spot ETF can be a big deal in the US.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)