Although Powell’s statement indicates that there may be no more interest hikes, continued high interest rates will become a “liquidity ceiling” that is temporarily difficult to penetrate in the crypto market, and the hedging behaviors from market makers and traders further suppresses market volatility, making the “ceiling” thicker and thicker. Considering that Aug is the “summer vacation” of the Fed, the low volatility of BTC and ETH prices may continue throughout the summer. However, the current market environment is undoubtedly “happy hour” for passive income strategies, especially those based on selling volatility.

It Won’t Get Worse, but It’s Even Less Likely to Get Better

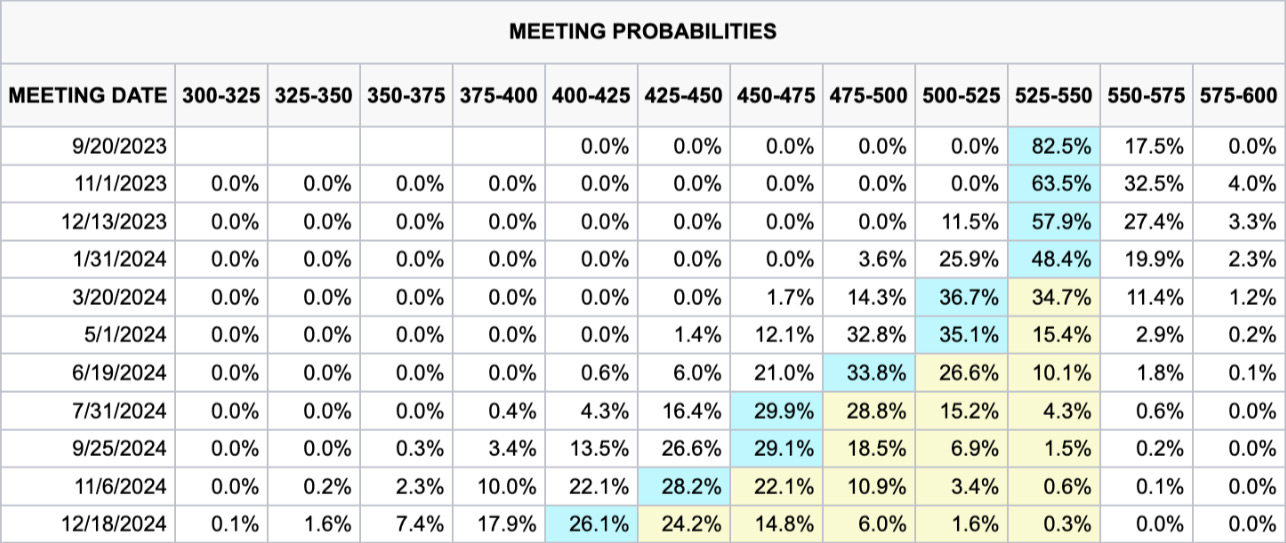

July’s Fed rate decision may be the least suspenseful of all Fed rate decisions. The 25 bps rate hike did not exceed anyone’s expectations, and Powell’s usual hawkish speech did not bring more new ideas. “Further rate hikes” will only happen if the economic data is significantly overheated, and “maintaining high rates” is the more likely solution until data supporting the “significantly overheated” is fully supported. Interest rates above 5.25% will continue until at least March 2024, and a rate cut is not possible until after May.

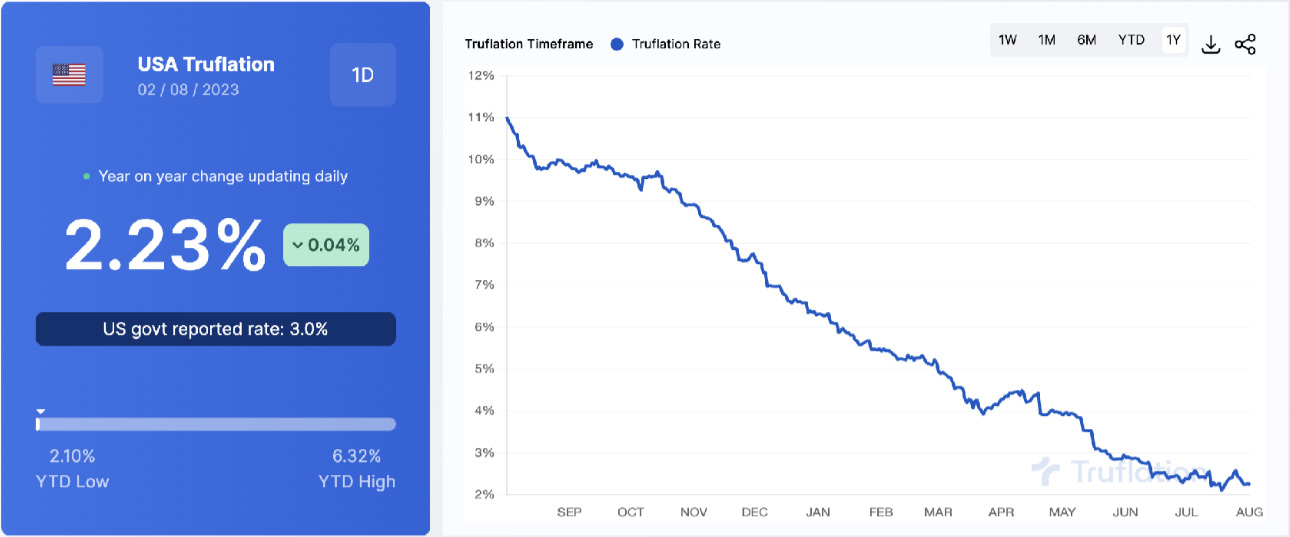

Of course, the possibility of further interest rate hikes is somewhat priced in. Interest rate market data show that traders expect the possibility of one more 25bps is about 30%. Traders’ concern is not unreasonable: real-time inflation data show that after a year of falling inflation, in mid-July, on the back of a rebound in the prices of necessities such as food, housing, and transportation, the headline inflation level began to bottom out and rebound, which means that the probability of reflation is not zero, and the possible policy easing may cause the failure of inflation control like the 1970s. Therefore, for whatever reason, Powell will not easily consider cutting interest rates.

The possible path of Fed rate changes, as of Aug 2, 2023. Source: CME Group

US real-time inflation data, as of Aug 2, 2023. Source: Truflation.com

US real-time food inflation data, as of Aug 2, 2023. Source: Truflation.com

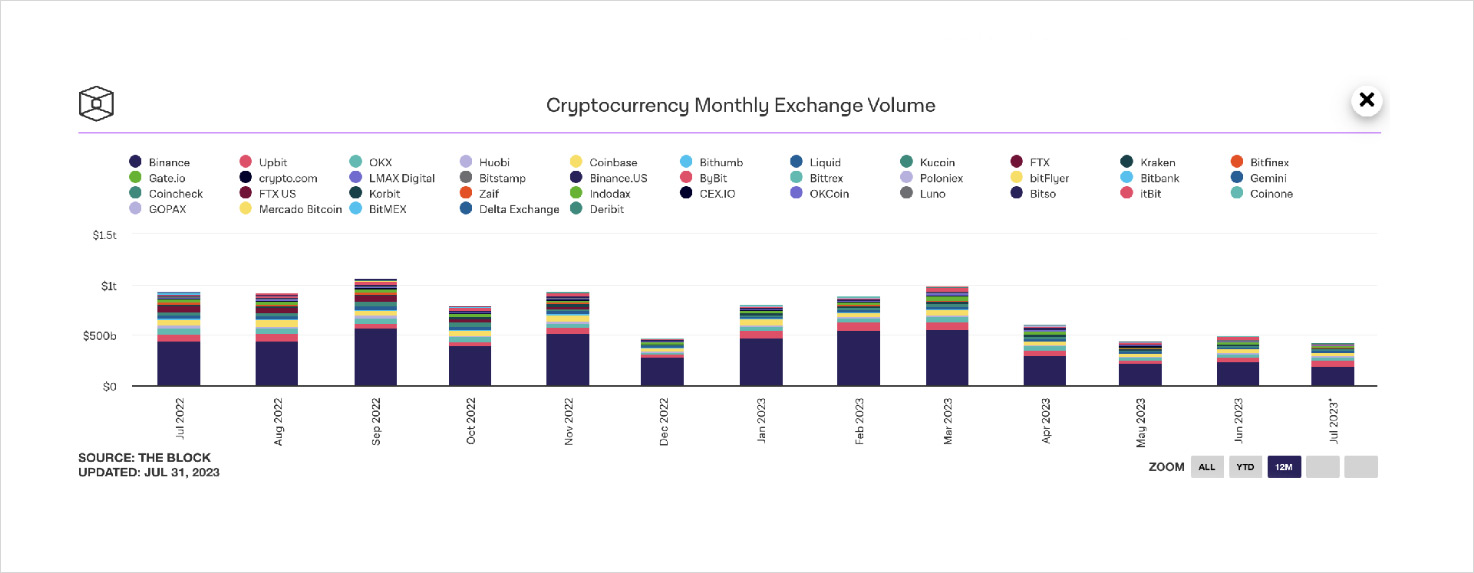

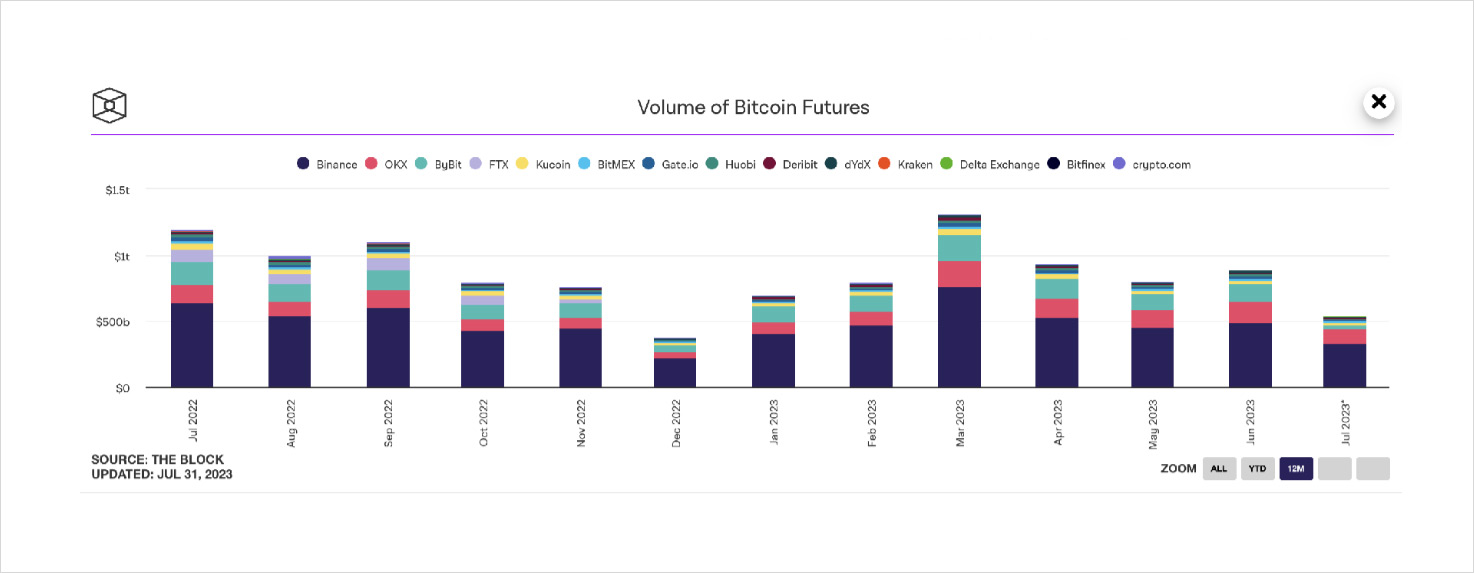

For the crypto market, investors seem to have become accustomed to daily life at high interest rates. The lack of liquidity has left investors with little interest in “trading”. Most investors are sitting on the sidelines. As a result, the monthly spot trading volume was even lower than Christmas in Jul, while the trading volume of BTC Delta 1 contracts was only slightly better than Christmas and New Year. It looks like the crypto market has a “summer vacation”.

Monthly spot volume changes in the crypto market. Source: The Block

Monthly trading volume change of Bitcoin Delta 1 contract. Source: The Block

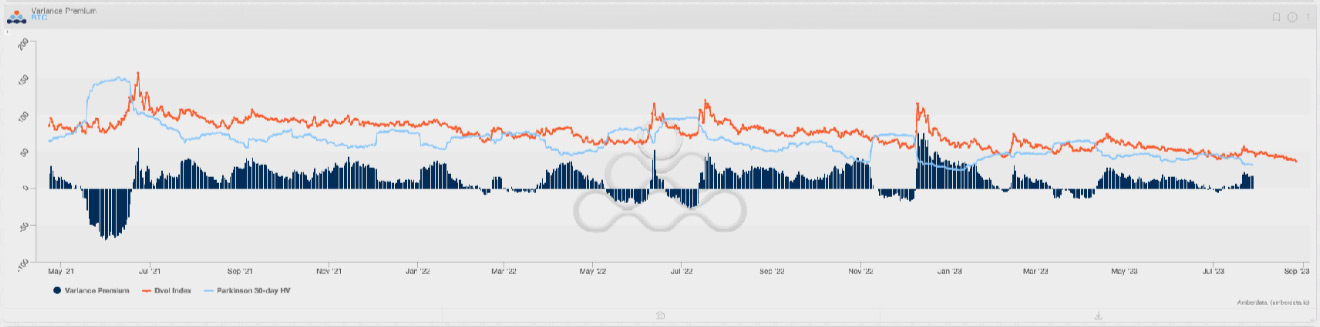

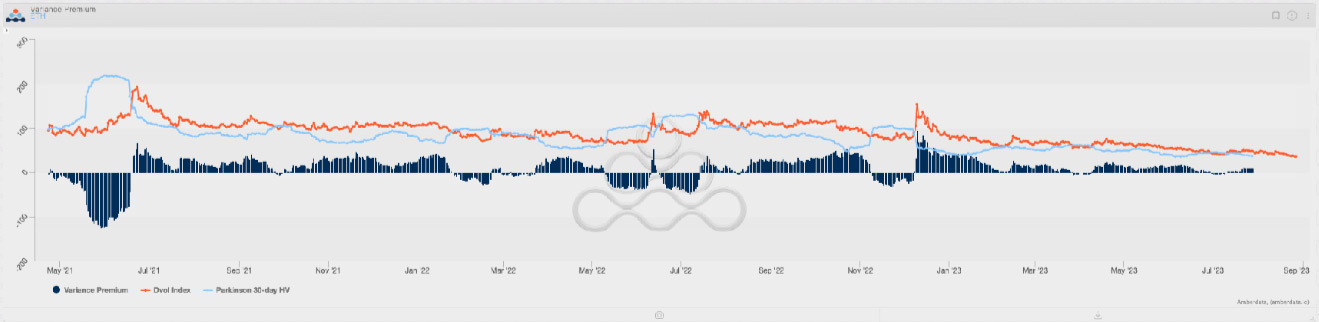

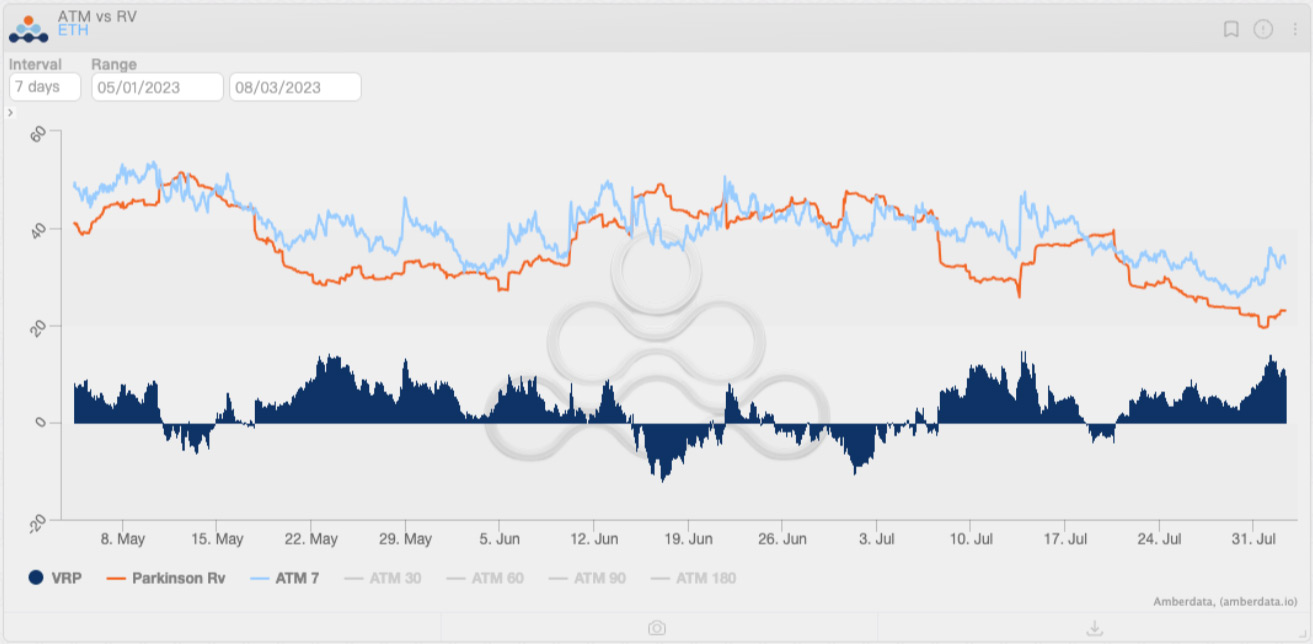

“Summer vacation” means low volatility. BTC and ETH’s Volatility Index (DVOL) broke a new 2-year low, and even with this record-low volatility expectation, option sellers can still get profits, which means that the realized volatility in the market is still significantly lower than expected. In 2021, few would consider a scenario in which the intra-day price movement of BTC was less than 1%. In contrast, in mid-2023, the 0.1% daily price movement has become normal in the crypto market.

BTC and ETH volatility index (DVOL) changes. Source: Deribit

BTC and ETH variance premium changes. Source: Amberdata Derivatives

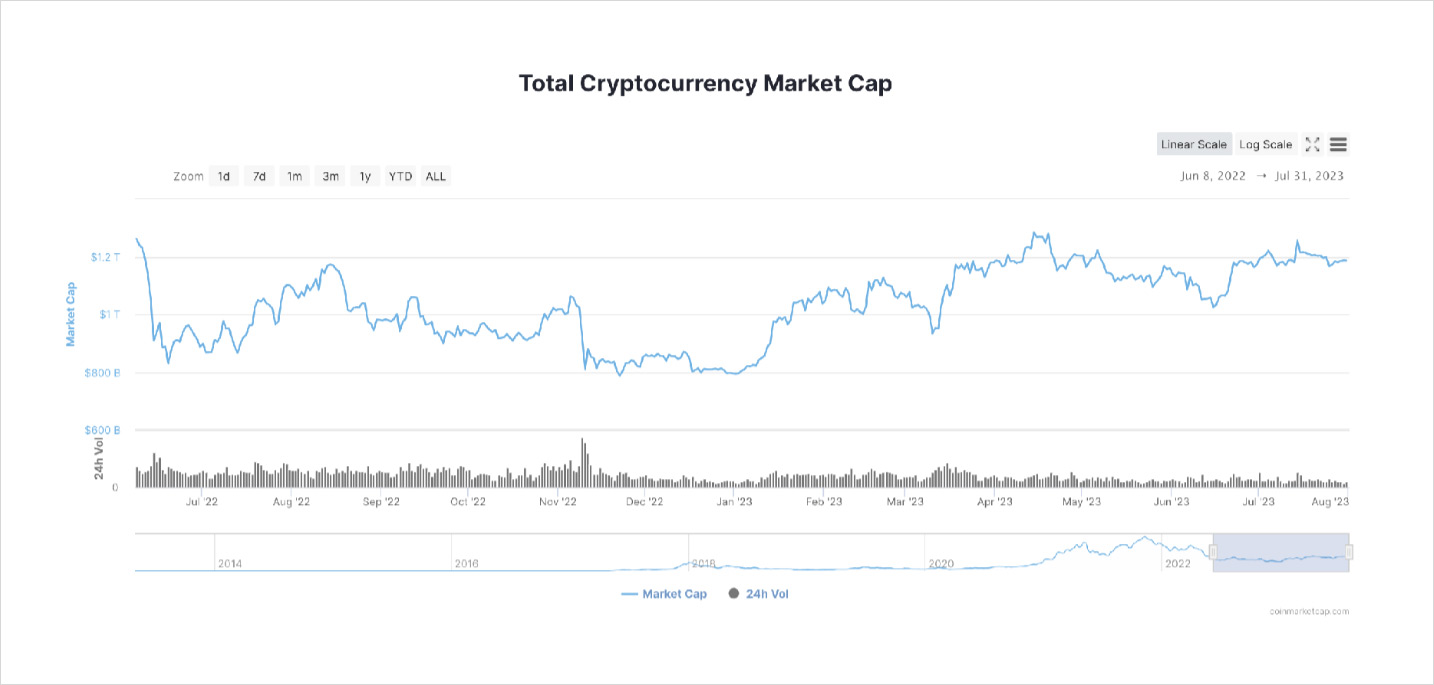

Similarly, crypto investors have become less sensitive to interest rates due to the pervasive wait-and-see sentiment and low volatility. Even if Powell and Lagarde raise interest rates 1-2 times, it will only be “one step further on Mount Everest” – the liquidity situation will not worsen. Many “smart money” have already left, but the sinking liquidity will not leave the crypto market quickly, providing the necessary price support for cryptos. However, sinking liquidity is usually inactive: Judging from the crypto market cap changes, the total market cap has hovered around $1.2T for over four and a half months since mid-March.

Changes in the total market capitalization of the crypto market. Source: CoinMarketCap

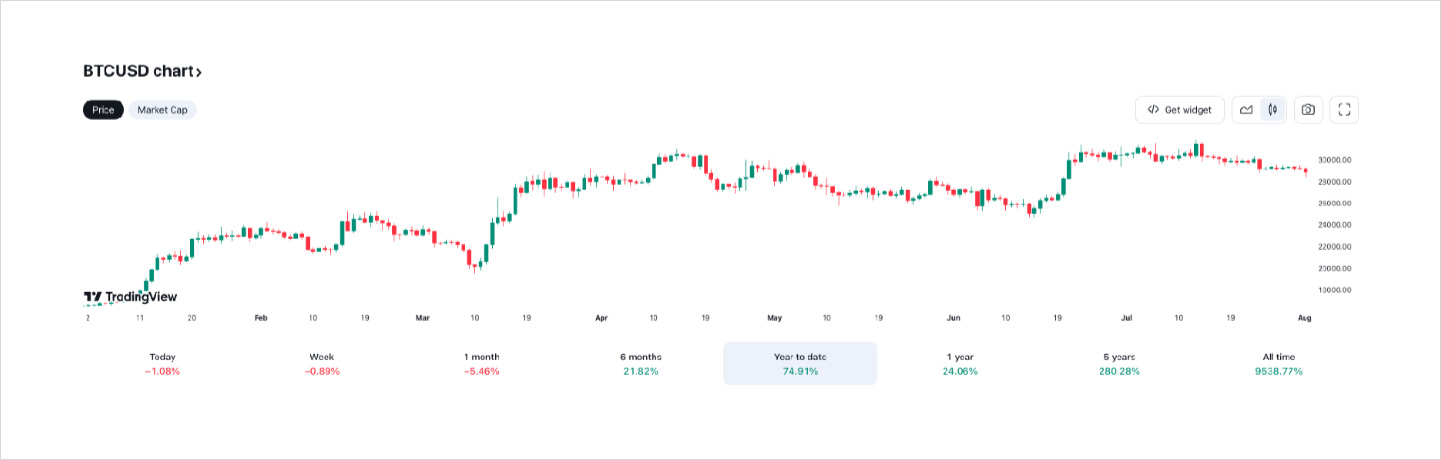

If we compare the price data of recent months, it is not difficult to find that when the price of BTC is around $30,000, and the price of ETH is around $2,000, both will lose further upward momentum here, hovering for a while, and then fall. The time to hit both levels was short or long, but further price breakouts did not occur. There seems to be an invisible ceiling around these two levels, blocking the upward pace of crypto assets.

BTC and ETH price changes since the beginning of 2023. Source: blofin.com

Ceiling

Liquidity level changes are essential for forming the “crypto ceiling”. With high interest rates, money market funds have shown relatively higher attractiveness. At the same time, US stocks (especially technology stocks included in the Nasdaq index) have also become strong competitors of the crypto. Excess returns from BTC’s rise appear to have been concentrated only at the beginning of this year, and in the following six months, BTC has significantly underperformed the Nasdaq index.

In this case, for retail investors, the wealth-creating effect brought by crypto has been partially inferior to that of US stocks, which means that most retail investors are more inclined to “remain silent” in the crypto market. Since retail investors usually tend to go long, the absence of retail investors makes the crypto market have lost an important source of upward momentum.

The YTD changes of Nasdaq index and BTC price, source: Tradingview

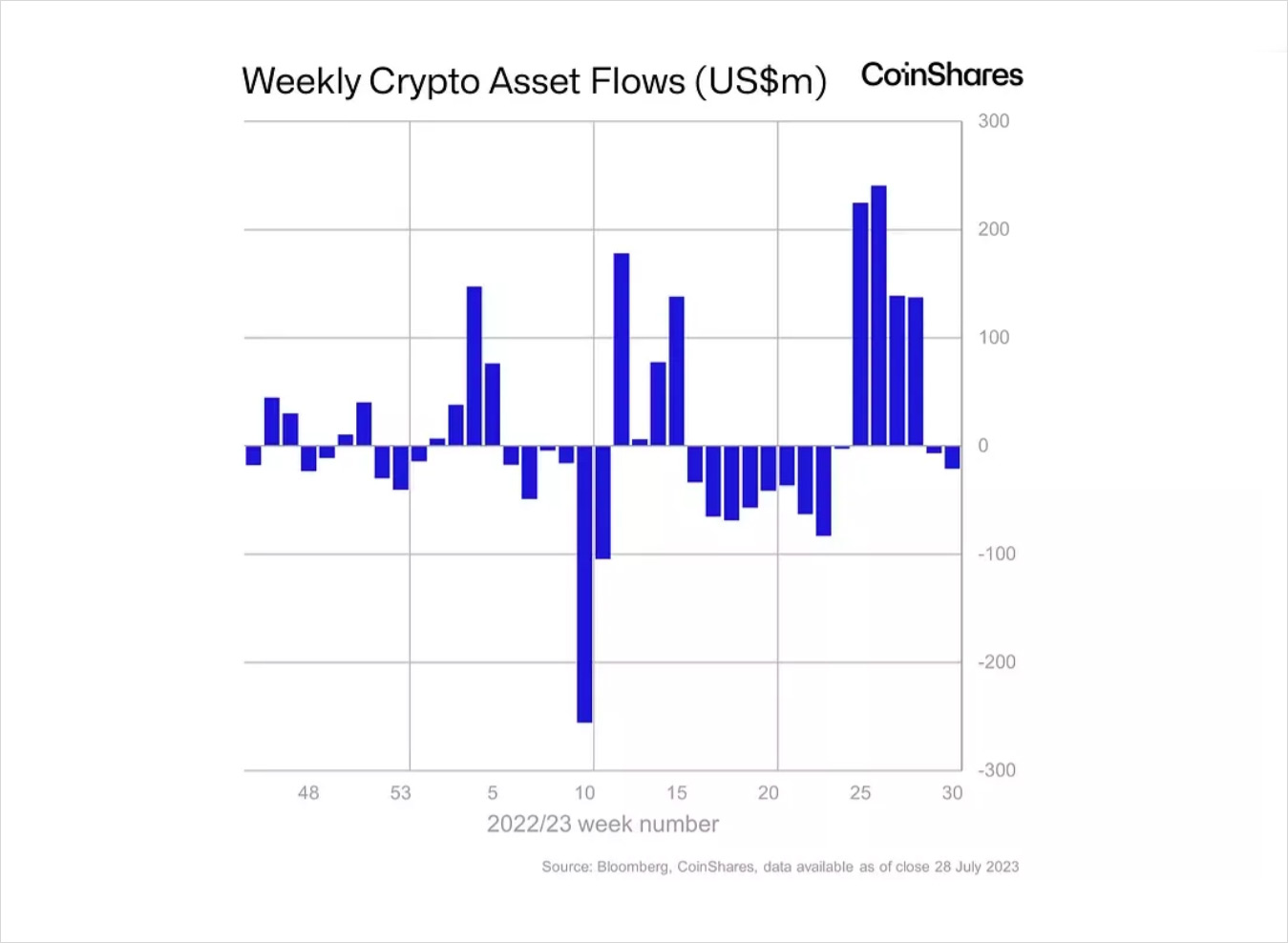

The behavior of institutional investors is even more intriguing. Looking back at the weekly crypto asset flow from the beginning of 2023 to the present, it is not difficult to find that the behavior of institutional investors has a significant “tidal” feature: when the crypto market has a sharp rise, institutional funds pour in, and when the market tends to be calm, institutional funds begin to flow out.

Weekly net inflows/outflows from crypto funds in the past year, source: CoinShares

To some extent, institutions behave similarly to 0DTE traders: they tend to profit from short-term price movements rather than market cycles, called the “gamma effect”. Under the influence of the “gamma effect”, institutions tend to sell after the price rises to a certain level and turn to buy after the price falls to a certain level. Although the above actions strongly support crypto asset prices (especially when considering the position of institutions in liquidity providers), the trigger selling behavior undoubtedly makes the “crypto ceiling” thicker.

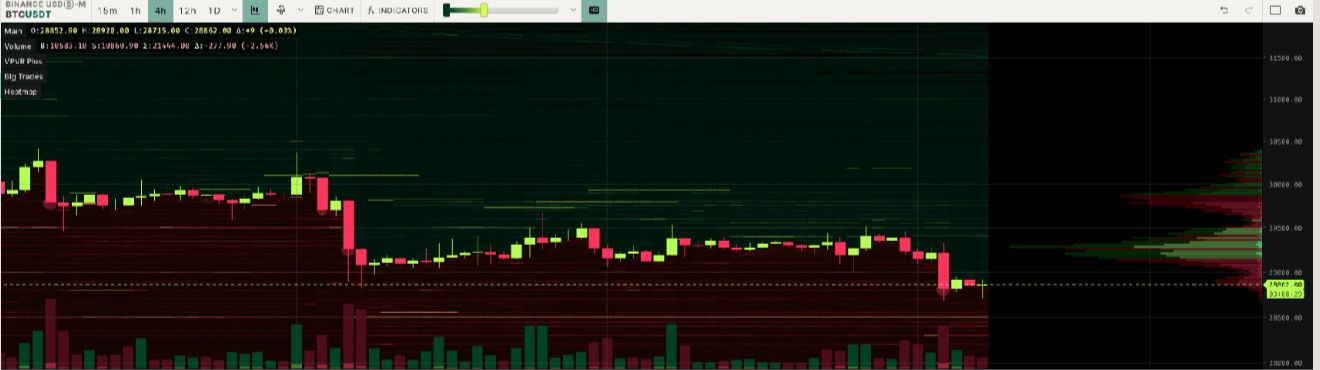

More evidence from VPVR (Volume Profile Visible Range) data supports the “gamma effect”. Taking BTC as an example, near $30,000, sell orders dominate, shown in red, while near $29,000, the part showing a clear green color dominates buy orders. On ETH, there is a similar distribution of buy and sell orders.

BTC and ETH perpetual contract VPVR data changes. Source: Tradinglite

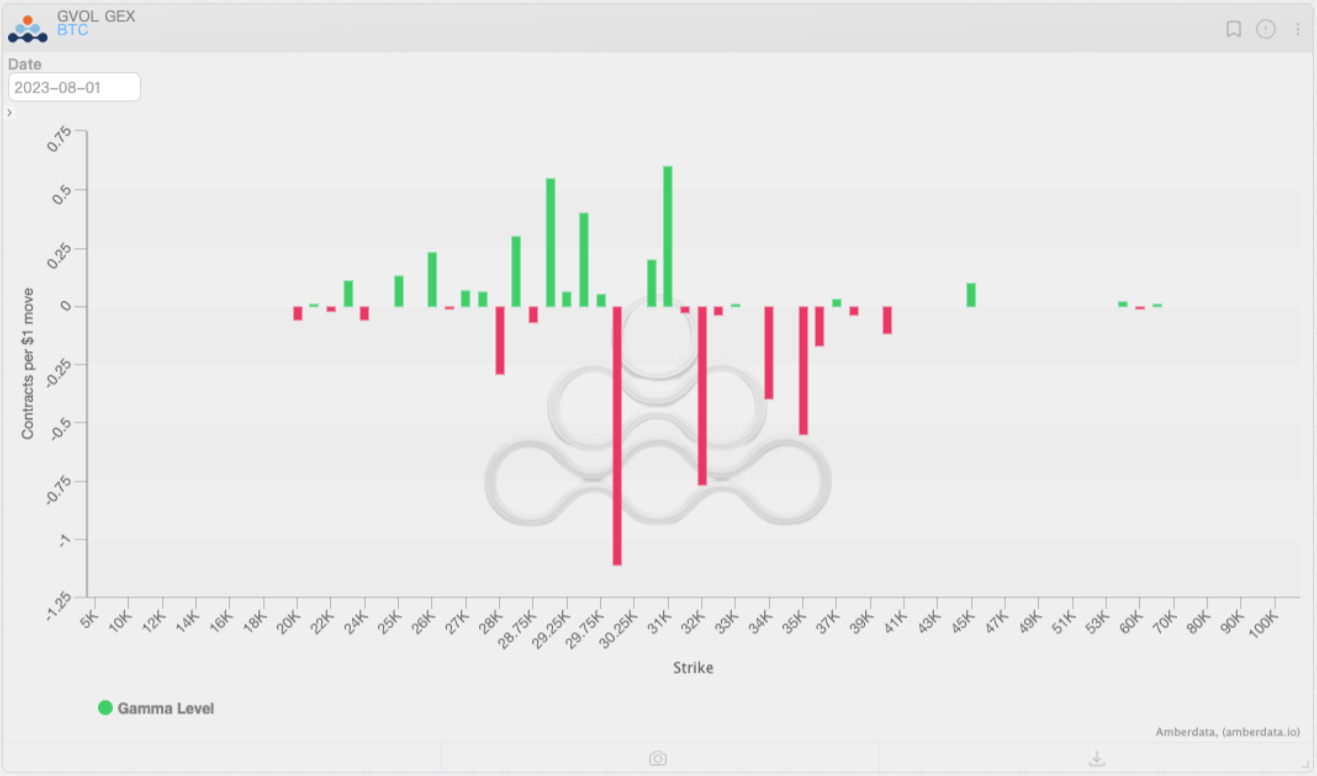

The hedging behavior of market makers is another factor supporting the “crypto ceiling”. For options market makers, to maintain delta neutrality near the strike prices with positive gamma, market makers usually adopt a strategy of “selling high and buying low”. In contrast, the opposite is true near the strike price with negative gamma. In a positive gamma- dominated market, market makers tend to dump their delta inventory when prices rise, suppressing prices – precisely what has been happening these weeks.

Considering that market makers are one of the few active groups when investors are not very enthusiastic about trading, the hedging behavior of market makers to balance risk exposure makes the upward path of prices even more “difficult”.

Distribution of BTC and ETH gamma exposure, Source: Amberdata Derivatives

Another consequence of hedging is the suppression of market volatility. Due to the lack of trending market and directional trading opportunities, investors are not enthusiastic about trading, tend to make profits through passive income strategies (such as selling options), and even embrace risk-free income. The market was further stabilized with the hedging behavior of market makers. Volatility is an indispensable element in breaking through the “crypto ceiling”. However, in the absence of volatility, “narrow shocks” may have become the theme of the crypto market in the whole Aug.

Aug Outlook: Potential Tail Risk and “Happy Hour”

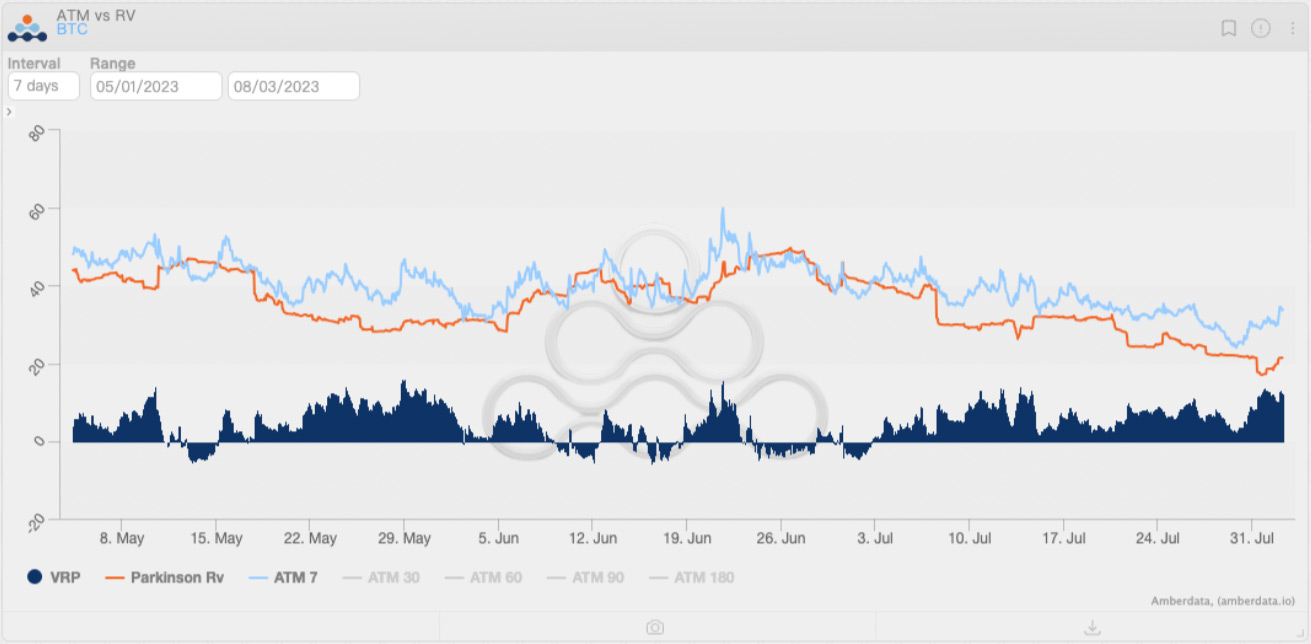

Volatility sellers appear to be the few winners in the market in August. Although the implied volatility of BTC and ETH has hit a record low since 2021, compared with the realized volatility, the selling volatility strategy is still profitable, and the current volatility premium is even the highest since May—one of the good moments. Investors’ tail risk management and speculative demand persisted regardless of the market environment, resulting in continued positive cash flow for options sellers, especially during quiet times like August.

In addition, low volatility means that the uncertainty of the price direction has increased, and there is a lack of income expectations brought about by the trending market. Considering that sell volatility strategies are less correlated with the direction of price movement, sell volatility strategies have better-earning potential in moments of low volatility than strategies based on Delta 1.

VRP changes of BTC and ETH, source: Amberdata Derivatives

However, continued low volatility does not mean that tail risks will not occur. For the crypto market, the potential risks from the macro still cannot be ignored.

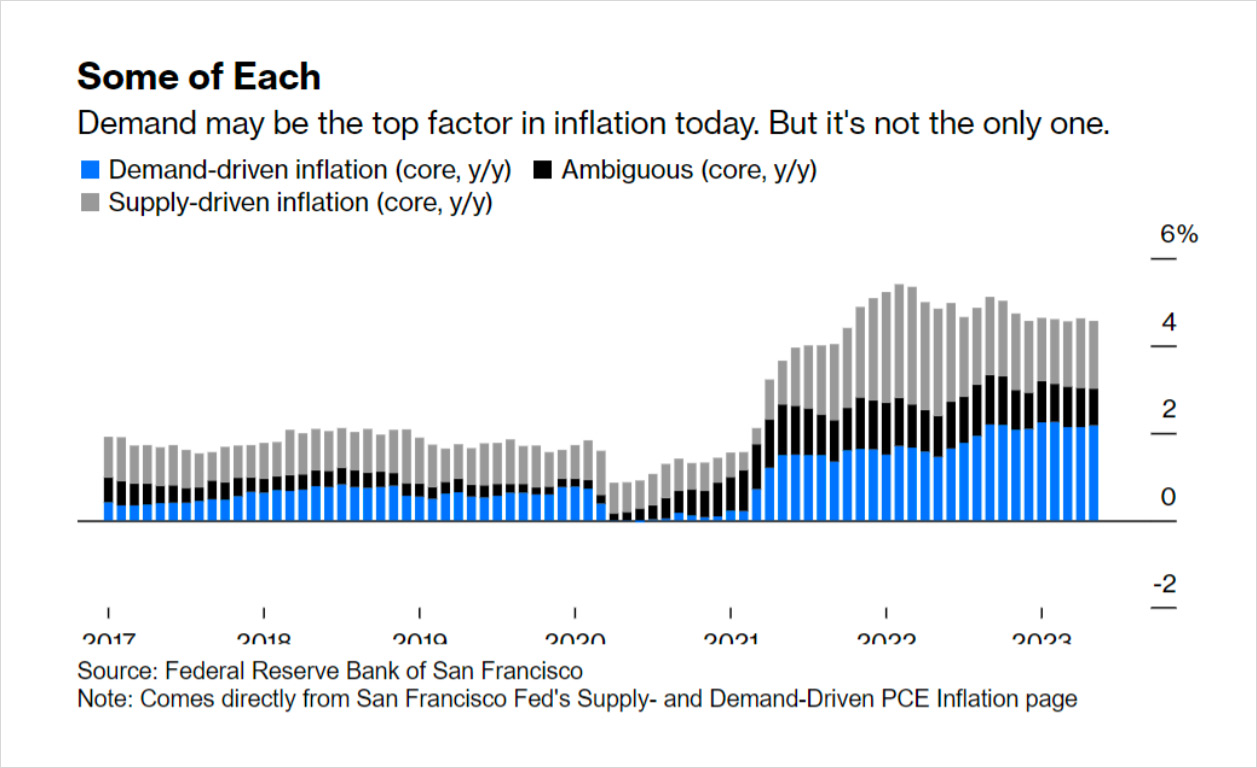

From the economic data perspective, the US macro data and employment performance were stronger than expected. With the complete ease of the supply chain, “relatively overheated” demand may have become the main factor leading to inflation. The above situation means that the Fed may further manage the demand side to suppress inflation completely. Economists at the Fed believe in the theory of “limited economic growth”; they think the economy will overheat and possibly lead to inflation when the growth is too fast.

Therefore, for the Fed, it is not an unacceptable option to take more than expected behavior (such as raising interest rates again or extending the peak period of interest rates) or even trigger a short-term recession to achieve the inflation target. Still, for the crypto market, this means further liquidity pressure.

Changes in the proportion of leading factors in inflation since 2017. Source: Federal Reserve of San Francisco

In addition, the action on the west coast of the Pacific cannot be ignored. As one of the main liquidity providers in the financial market, the Bank of Japan has long provided the “Mrs. Watanabes” with a steady stream of funds through the magic of “Yield Curve Control” (YCC). However, the BOJ has become reluctant to be so generous as inflationary pressures build within Japan; they have loosened their grip on the YCC, which is the beginning of a shift in liquidity policy. We must know that the liquidity released by the Bank of Japan is not only distributed in traditional markets; BTC and ETH are facing additional risks.

Of course, some unexpected events in the crypto market can also be a source of tail risk. The Curve event has caused some investors to worry; similar events are usually hard to be priced in time. At the same time, the regulatory authorities have not stopped because of the failure of the XRP lawsuit; the SEC is still trying to bring other tokens besides BTC into the scope of supervision. Those above “extra events” are precisely what we need to guard against; buying some tail protection while collecting theta is still necessary.

To sum up, we still need to be vigilant to a certain extent while spending the summer vacation. Fortunately: the probability of the events mentioned above is not too great, and even if it happens, the likelihood of unexpected events in August is even smaller. August is a good vacation season; while selling volatility, pay some necessary costs and do an excellent job of tail protection. Let’s enjoy “happy hours” with theta.

Disclaimer

This report is based on public sources considered to be reliable, but Blofin does not guarantee the accuracy or completeness of any information contained herein. The report had been prepared for informative proposes only and does not constitute an offer or a recommendation to purchase, hold, or sell cryptocurrencies (tokens) or to engage in any investment activities. Any opinions or expressions herein reflect a judgment made as of the date of publication, and Blofin reserves the right to withdraw or amend its acknowledgement at any time in its sole discretion. Blofin will periodically pr irregularly track the subjects of the reports to determine whether to adjust the acknowledgement and will publish them in a timely manner.

Blofin takes its due diligence to ensure the report provides a true and fair view without potential influences of any third parties. There is no association between Blofin and the subject referred in the report which would harm the objectivity, independence, and impartiality of the report.

Trading and investing in cryptocurrencies (tokens) may involve significant risks including price volatility and illiquidity. Investors should fully aware the potential risks and are not to construe the content of the report as the only information for investment activities. None of the products or Blofin Inc, nor any of its authors or employees shall be liable to any party for its direct or indirect losses alleged to have been suffer on account thereof.

All rights reserved to Blofin.

AUTHOR(S)