BTC Finds Bottom Sub $90k?

BTC and other cryptos initially sank this week but rallied once U.S. trading began, hinting that the $90k mark could hold firm. Inflation worries, strong jobs data, and tariff concerns rattled markets, while the DOJ’s plan to sell a large Silk Road Bitcoin stash adds more uncertainty. Upcoming CPI and Unemployment releases may test crypto’s inflation-hedge narrative. With bond yields climbing and a hawkish Fed stance, expect BTC’s sideways action to persist a bit longer.

Realized Vol Picking Up Significantly

Market volatility spiked as BTC briefly broke key support, sending realized vol up to 50% and ETH to 68%. Implied vols rose on the wild swings, keeping carry positive. Most of the turbulence happened in a single session, while other days stayed calmer. Inflation data passing could drive implied vols lower from here, depending on whether the recent sell-off truly ends.

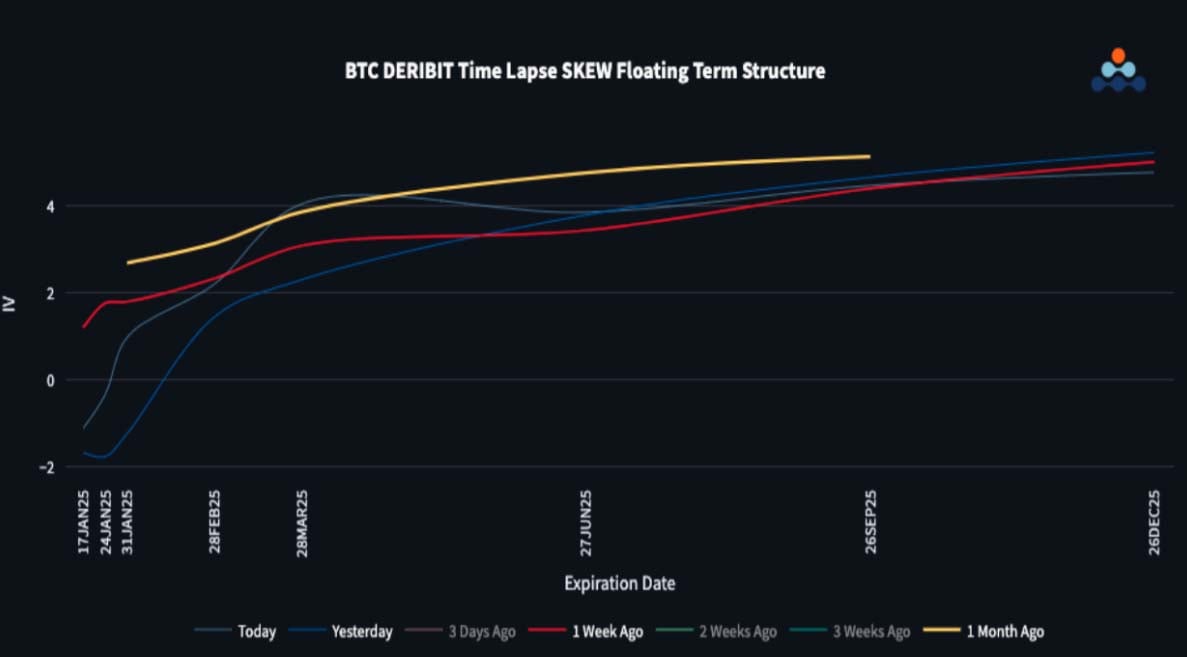

Skew Term Structure Still In Contango

Skew term structures remain in contango but flattened slightly after the market’s rebound. A brief breakdown pushed short-dated puts to a 4 vol premium, which quickly disappeared when prices reversed. The long end still features a healthy 5-6 vol call premium as corrections are expected to be short-lived.

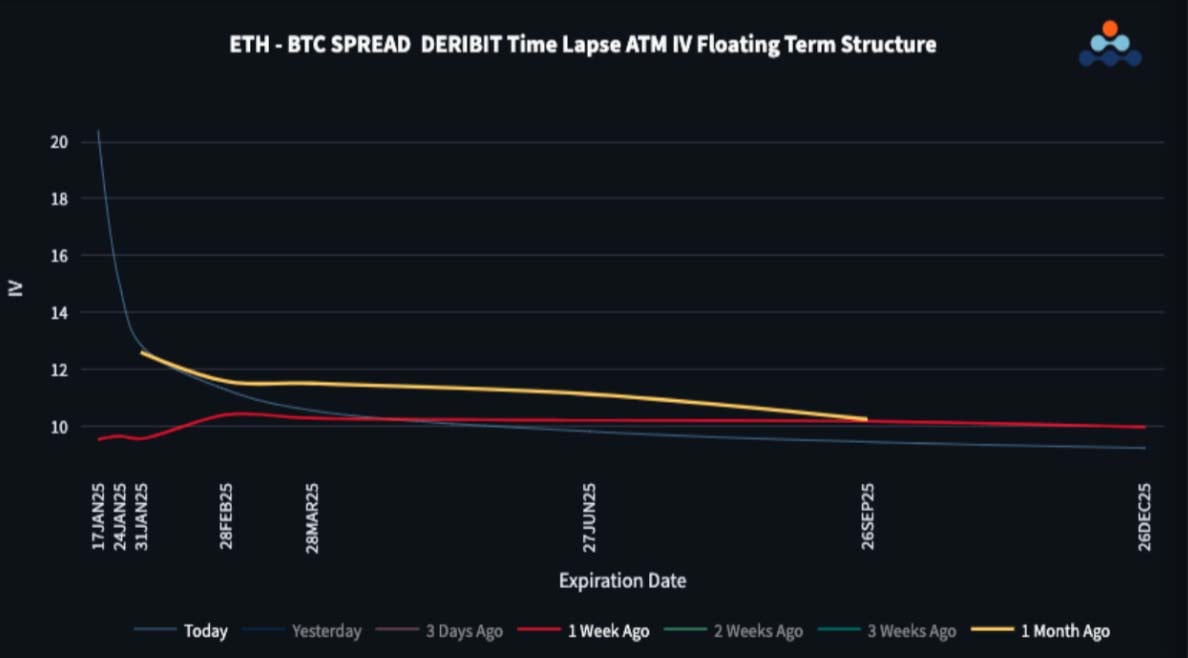

ETH/BTC Shows No Signs Of Reversal

ETH/BTC continues trending lower with no clear reversal in sight. ETH volatility surged on a rapid drop and rebound, pushing front-end vol spreads to 20 vols. This elevated volatility could create yield opportunities for short-dated strategies, especially if the market remains choppy without a strong directional trend.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)