Macro: Liquidity Tailwinds Reassert Themselves

Bitcoin’s violent rebound from 84k to 92k reflects a classic macro-driven reset. Early-week weakness came from Asia – hawkish BOJ signals, soft China data, and regional risk-off – which spilled into crypto and triggered forced liquidations when Strategy hinted at potential BTC sales.

But the macro backdrop has quietly improved: QT is effectively done, odds of a December rate cut are near 90%, US data is cooling, and prediction markets now favour a pro-liquidity Fed Chair. ETFs are back to inflows.

The sharp bounce shows cleaner positioning and renewed sensitivity to liquidity. Sentiment is still fragile, but structurally the setup is supportive – and BTC reacted exactly as a liquidity-sensitive asset should.

Realized & Implied Vol: Calm Before Potential Upside Volatility

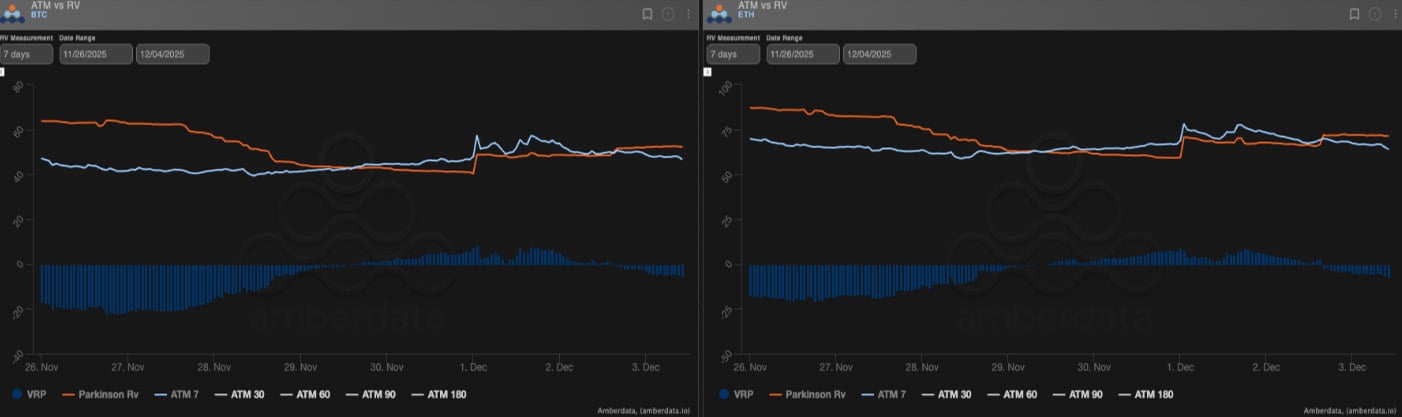

Realized vol eased last week – ~50 for BTC and low-70s for ETH – while implied vol stayed flat in BTC and fell ~7 vols in ETH front-end.

The sharp down-and-up price action briefly breached implied ranges, but markets otherwise stabilized, pulling vols lower and leaving carry slightly negative.

With spot recovering and macro improving, upside volatility is the path of least resistance, unless a fresh negative catalyst hits.

Term Structure & Skew: Early Signs of Bullish Re-Positioning

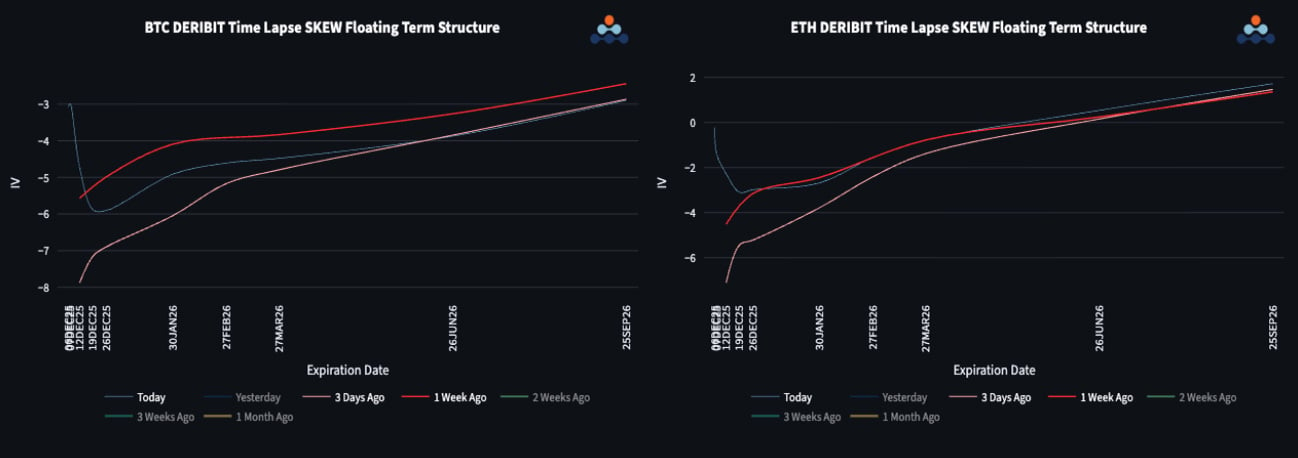

Front-end put skew spiked during the sell-off (back to ~10 vols) but faded again after the BTC bounce – leaving skew mostly unchanged on the week.

Long-end BTC put skew continues grinding higher on hedging flows. ETH’s front-end skew flipped back to neutral after the latest uptick – often a leading signal for upside acceleration.

The next few sessions will determine whether this shift develops into a broader crypto rally and builds momentum for a year-end recovery.

ETH/BTC Dynamics: Quiet Coil With a Bullish Lean

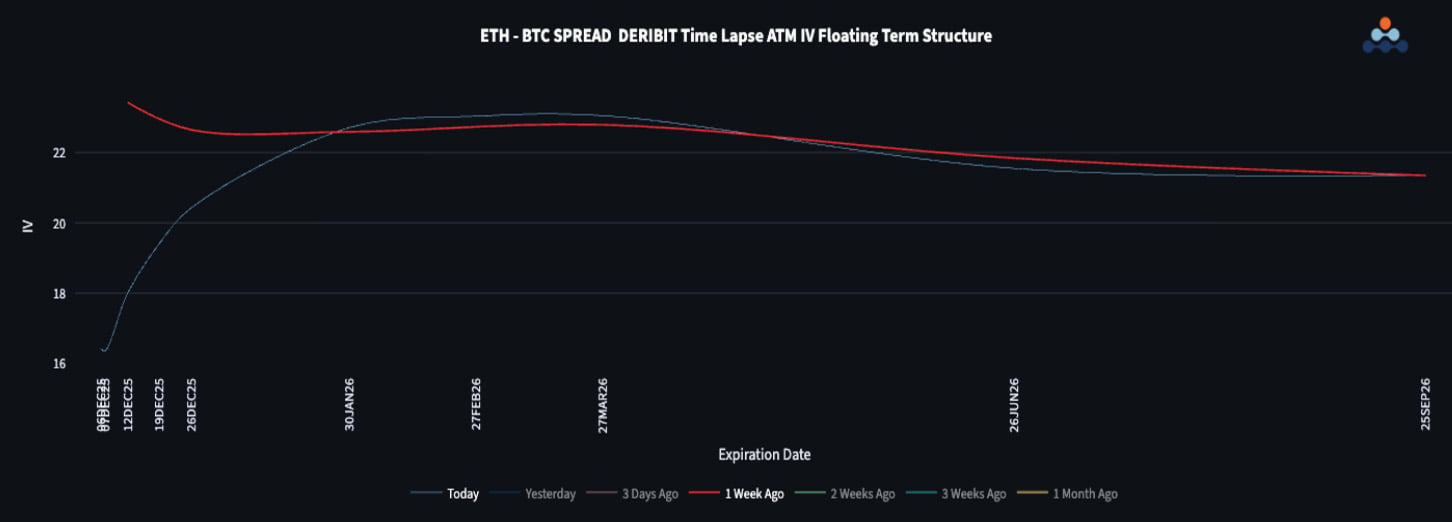

ETH/BTC continues to coil tightly and is holding up strongly even during broad crypto dips – a constructive sign.

ETH vol compressed sharply versus BTC in the front expiry, bringing the vol spread into the mid- teens (while longer maturities still trade above 20 vols).

Relative skew shows consistent bullish preference for ETH, especially further out the curve – hinting at growing confidence in Ethereum’s medium-term outperformance.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)