Macro: Volatility Without Participation

Bitcoin’s sharp weekend swings were a reminder of how easily price moves when liquidity thins out. Despite $4k intraday ranges and ETH surging just as fast, leverage barely moved – liquidations were small, open interest keeps leaking lower, and retail activity is flat.

With fewer active participants, smaller flows move the market more aggressively. At the same time, supply continues tightening: ~25,000 BTC left exchanges in two weeks, pushing balances toward multi-year lows while ETFs and corporates now hold more BTC than spot venues. ETH is showing similar structural supply compression.

The near-term catalyst is Wednesday’s Fed meeting. A rate cut is expected, but balance-sheet guidance is what matters: any hint of renewed liquidity injections could propel risk assets sharply higher. Until then, BTC sits inside a psychological cage ($84k–$100k), with options positioning already anticipating a move beyond either boundary.

Thin liquidity + shrinking float = asymmetric reaction to any macro shock. A fast break – up or down – is increasingly likely.

Realized vs Implied Vol: Calm Before the Event

Realized vol has faded – BTC is back in the low 40s, ETH in the 60s – pulling carry back into slightly positive territory.

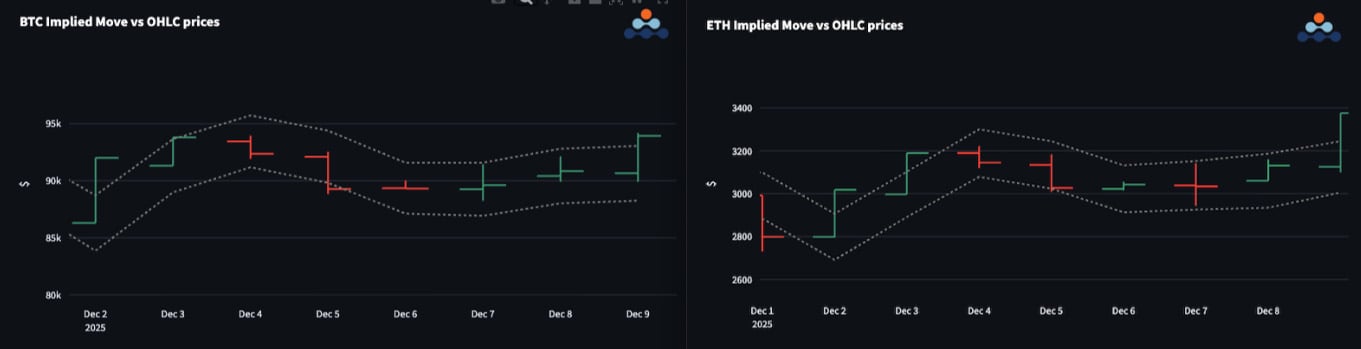

Front-end implied vol firmed ahead of the FOMC but otherwise continues to drift lower. Implied ranges held last week, with today’s ETH spike the first meaningful break above the upper bound.

With an FOMC catalyst approaching, being short gamma into the event looks unattractive. Expect noisy price action around the announcement.

Term Structure and Skew: Hedging Flows Dominate

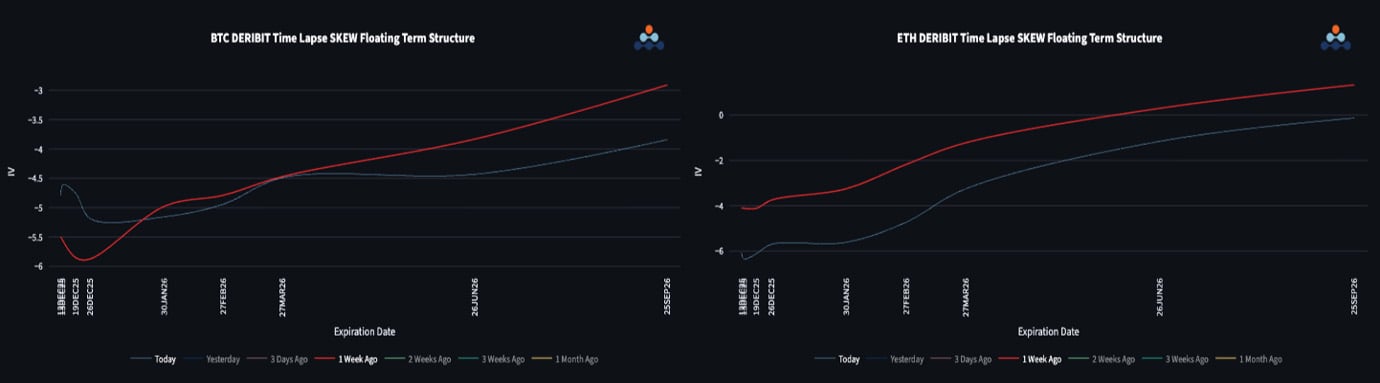

Skew remains in contango: near-dated puts are bid relative to calls. The long-end BTC put skew keeps grinding higher, likely reflecting institutional hedging demand.

ETH skew is shifting lower in a more uniform way across the curve, with even the back end flipping into minor put premium. The lack of call demand – even on an +8% day – suggests traders distrust the rally and are lightening risk ahead of the FOMC.

BTC hedging flows persist, ETH enthusiasm is muted, and positioning remains cautious.

ETH/BTC Dynamics: Breakout in Spot, Skepticism in Options

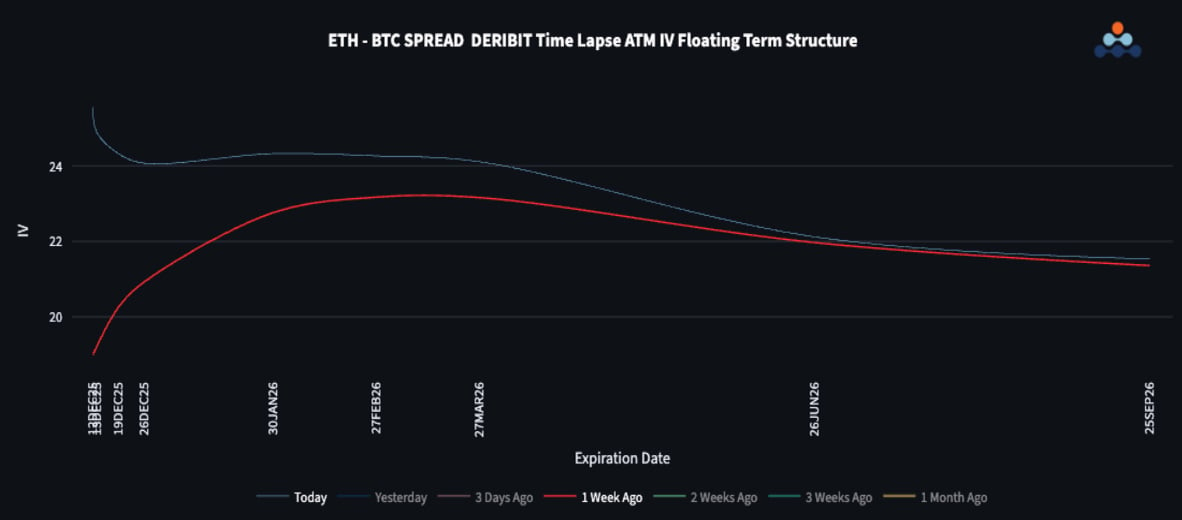

The ETH/BTC cross finally broke out of its compression pattern, jumping more than 10% to ~0.036. ETH front-end vol bounced taking the vol spread back to around 25 as gamma performed well.

But the options market isn’t buying the breakout: front-end skew flipped bearish for ETH relative to BTC, showing demand for downside protection despite the rally. Longer-dated skew (2026+) still favours ETH upside, but near-term sentiment remains defensive.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)