After the Federal Reserve announced the interest rate hike, the risk aversion of the crypto market increased, and confidence was affected by the U.S stock market sell-off wave and other factors.

However, the collapse of UST (the Terra USD) caused the crypto asset price to fall significantly and triggered the biggest shock in the crypto-asset market since May 2021.

Although the series of shocks triggered by Terra has temporarily ended, confidence in the crypto market has already taken a severe blow. Multiple data indicators show that the current fragile confidence may trigger new shocks at any time.

As the crypto market enters a deep bear market, derivatives trading may become one of the few sources of considerable income in a bear market.

Eclipse Harbingers: “Unprecedented” Risk Exposure

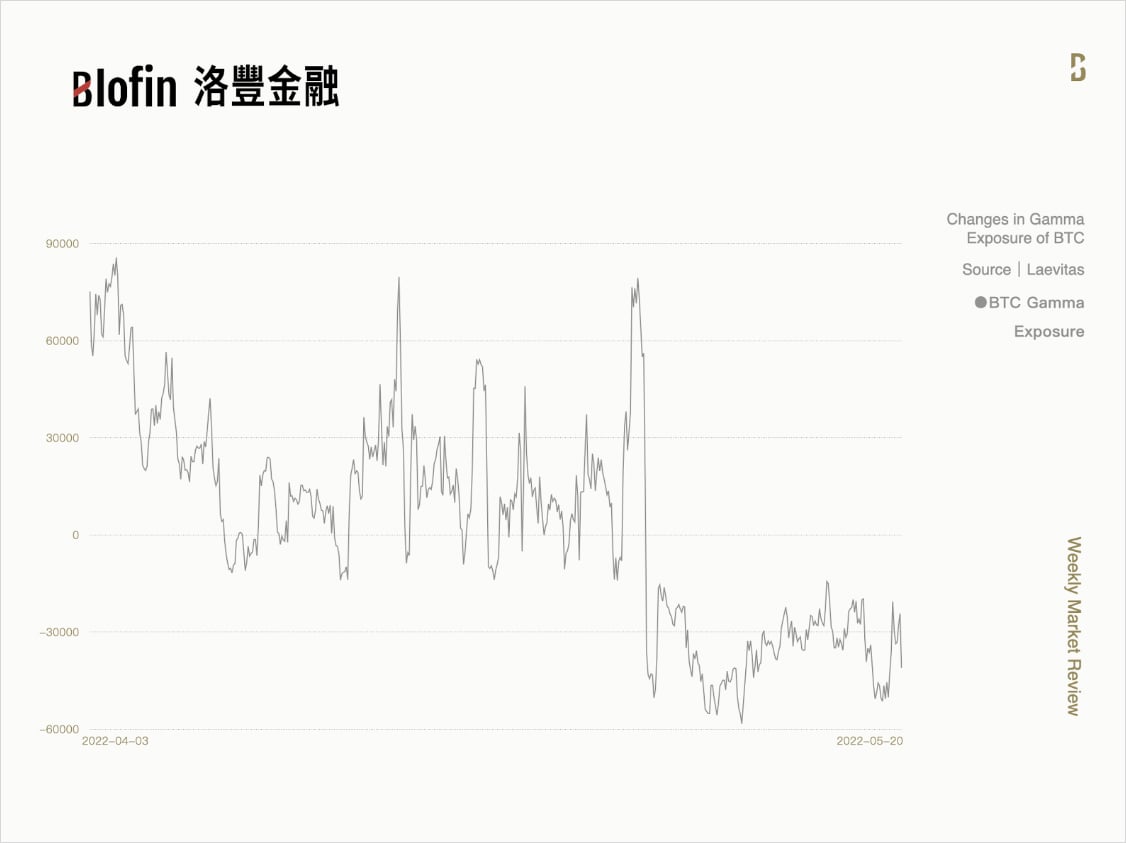

After a lull in April, the Fed’s rate hike in May didn’t cause prices to move much in the short term. However, investors began to take advantage of the short-term release of market sentiment to sell risky assets such as U.S. stocks due to distrusting the Federal Reserve policy and the imminent approach to shrinking the balance sheet in June. The short side also began to short corresponding assets, resulting in considerable risk exposures in the derivatives market. According to Squeezemetrics, on May 5 alone, the U.S. stock market saw more than 1.4 billion negative gamma exposures—one of the most significant exposures in nearly a decade.

In a situation where derivatives, especially options, are occupying an essential position in the overall market, the impact of gamma exposure on the market is considerable. When market makers, institutions, and retail traders all hold too much negative gamma exposure, in order to hedge risks, investors usually sell spot and short futures when prices fall and buy back when prices rise. Negative gamma exposure usually occurs during bear market periods when prices decline, and large-scale spot selling and short futures/contracts will further impact prices, creating a downward cycle until prices have no downside space or the contract is delivered.

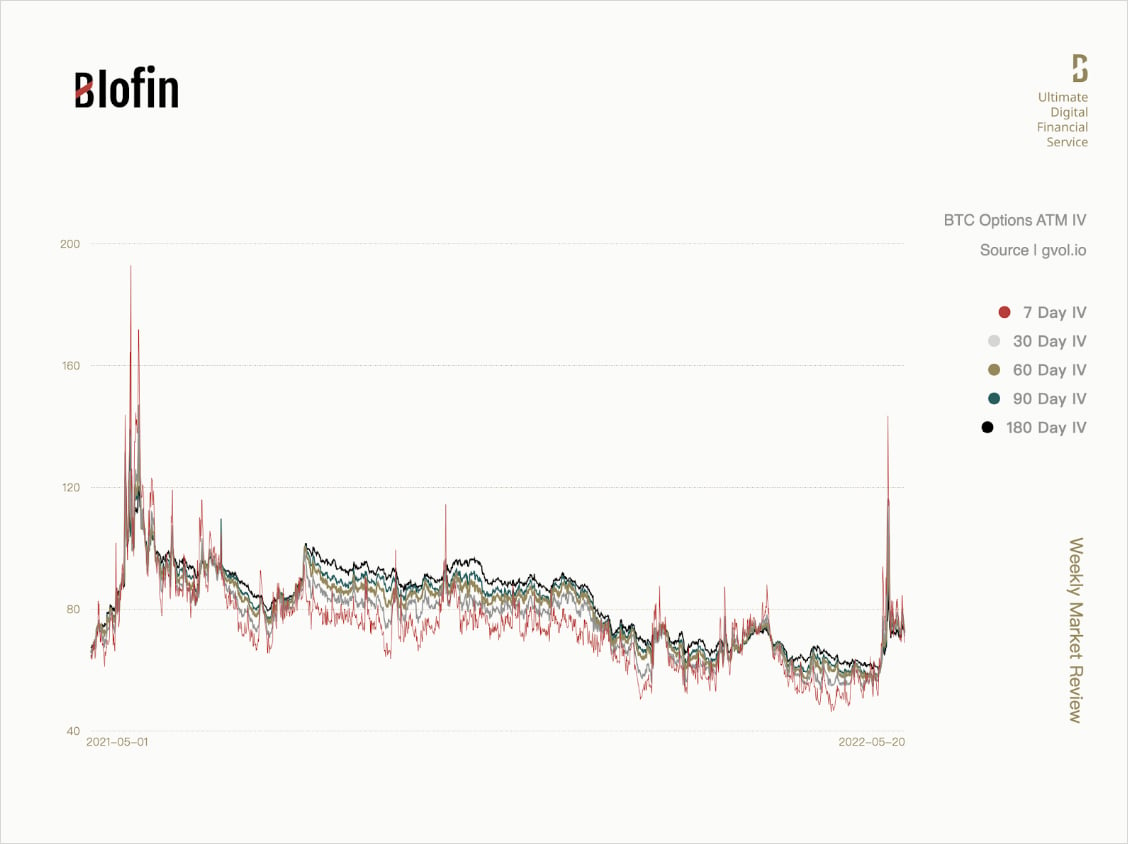

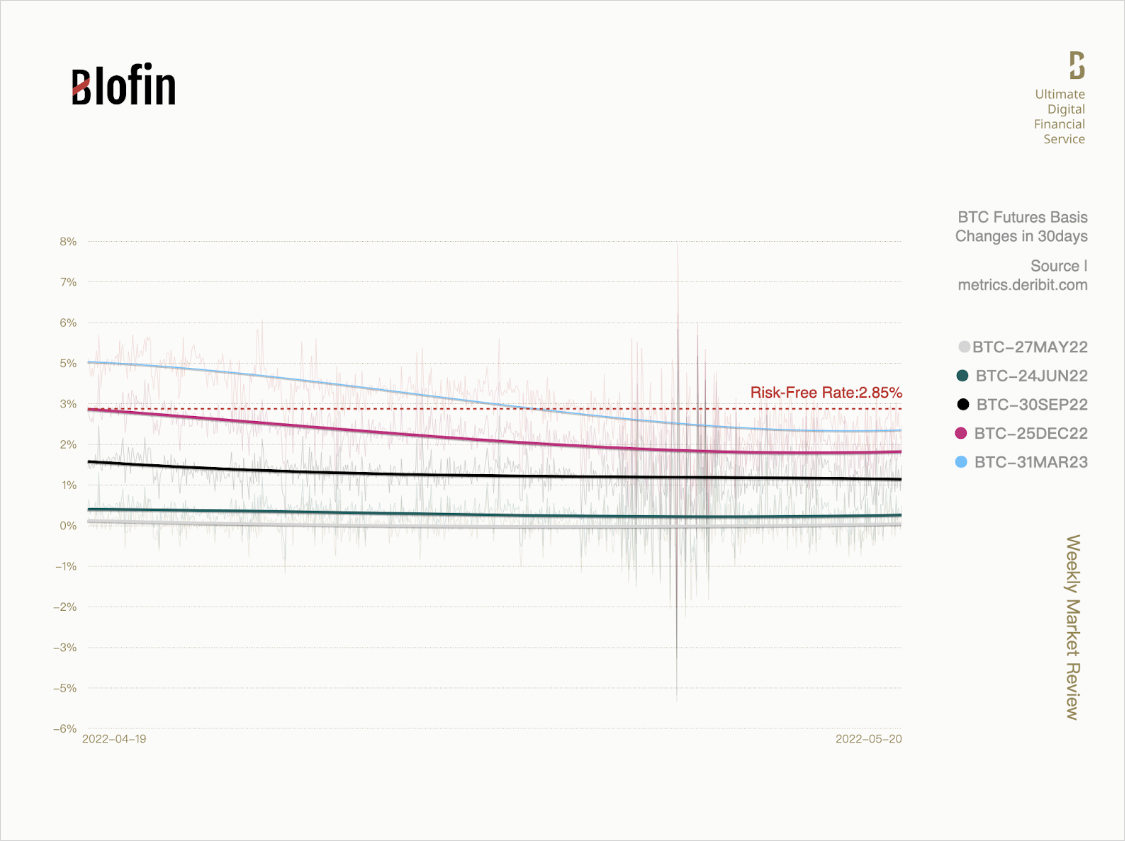

As a type of risky asset, it is also difficult for crypto assets to be “isolated” from the downtrend in the whole market. Starting from May 5, mainstream crypto assets represented by BTC fell rapidly after a brief rebound, and the premium in the futures market also decreased. Despite this, the crypto market remains relatively stable: volatility has not changed much, and the volatility surface has not changed significantly, Gamma exposure is still within a controllable range, and the far-month futures premium is also higher than the risk-free rate. All the above means that passive investing in crypto assets is still profitable to some extent.

However, risk exposure to the entire crypto market is not limited to what the derivatives market can reflect and hedge against. Many public chain tokens lack derivatives. Altcoins, subordinate risk asset bonds, algorithm stablecoins, and leveraged wealth management products hide huge risks. Similar risks can be seen everywhere in the Defi market. During bull market periods, these risks do not erupt on a large scale due to sufficient liquidity, while during bear market periods, liquidity tends to leave the crypto market, so once there is insufficient liquidity, it may cause a chain effect and trigger a market crisis.

But after the end of the recent rate hike, institutional investors looked around the market, and they did not find similar exposure: at a time when the market downturn had lasted for about half a year, investors who were planning to leave seemed to have left. It seems that the crypto market has escaped from the Fed and Powell successfully. Even the determined long side of the volatility began to hesitate before and after delivery on May 6.

The Day of the Luna Eclipse: Depegging, Panic, and Runs

On May 8, when UST was undergoing liquidity transfer and reorganization, some block traders sold UST suddenly and simultaneously, causing the 1:1 fixed exchange rate between UST and the U.S. dollar to depeg. At this point, the situation seemed to be still under control: LFG, the issuer of UST, announced that it would use reserve funds to stabilize the market. However, LFG underestimated the impact of market sentiment. The fragile confidence in the crypto market was beginning to crumble after the bearish sentiment in the crypto market had persisted for more than a month. Panic spread, and a run on the UST happened.

LFG tried to bail out the market, but due to a significant number of runs by investors and intense market selling pressure, LFG finally gave up the bailout around May 10. As the liquidity gradually dried up, the exchange rate of UST changed from a fixed rate to a floating rate, which eventually triggered a total collapse of all assets related to UST and Luna: Until May 20, the total market capitalization of LUNA and UST was less than $2 billion. Terra, one of the once “giants” of the crypto world, left only a husk on the blockchain.

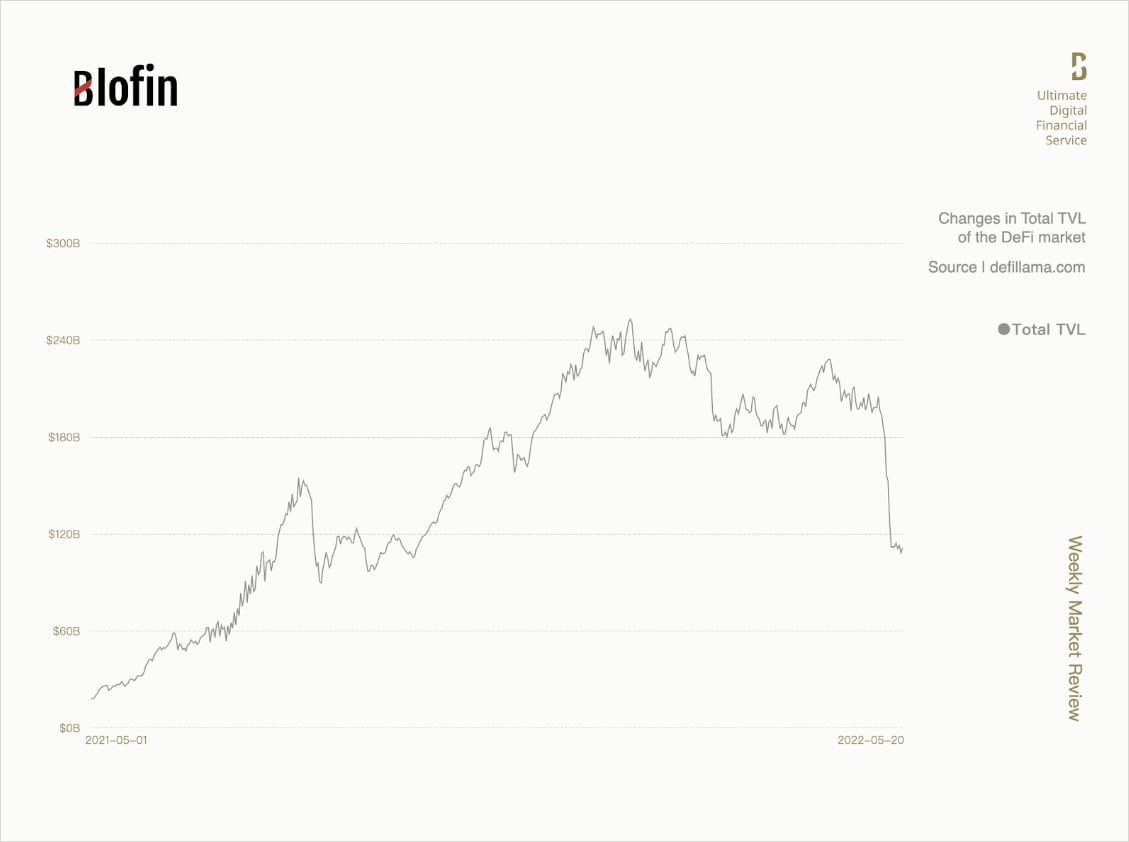

According to Defillama, the collapse of LUNA and UST caused a series of “secondary disasters” in the Defi market. As a result, the TVL of the Defi market evaporated by more than $100 billion in less than two weeks, about half of the total Defi market lock-up volume, and the blow to market confidence is hard to estimate.

The Reasons for the Luna Eclipse: Grossly Underestimated Risks

At the moment, the UST incident has entered the legal stage, and the immediate impact of UST and LUNA on the crypto market appears to be over. However, the collapse of UST has exposed the most vulnerable side of the crypto market and further exposed the world to the multiple risks that exist in this market and need to be concerned.

UST is an algorithmic stablecoin with the highest market value share in the crypto market history. It maintains a 1:1 anchor with the US dollar through a complex algorithm with Terra’s public chain token LUNA. Let’s ignore the complicated algorithms; in fact, LFG applied a solution that has been used in traditional markets for decades – it’s known as the linked exchange rate system. Under this system, Hong Kong has become a global financial center, and the Hong Kong dollar has become one of the “hard currencies” trusted by global investors.

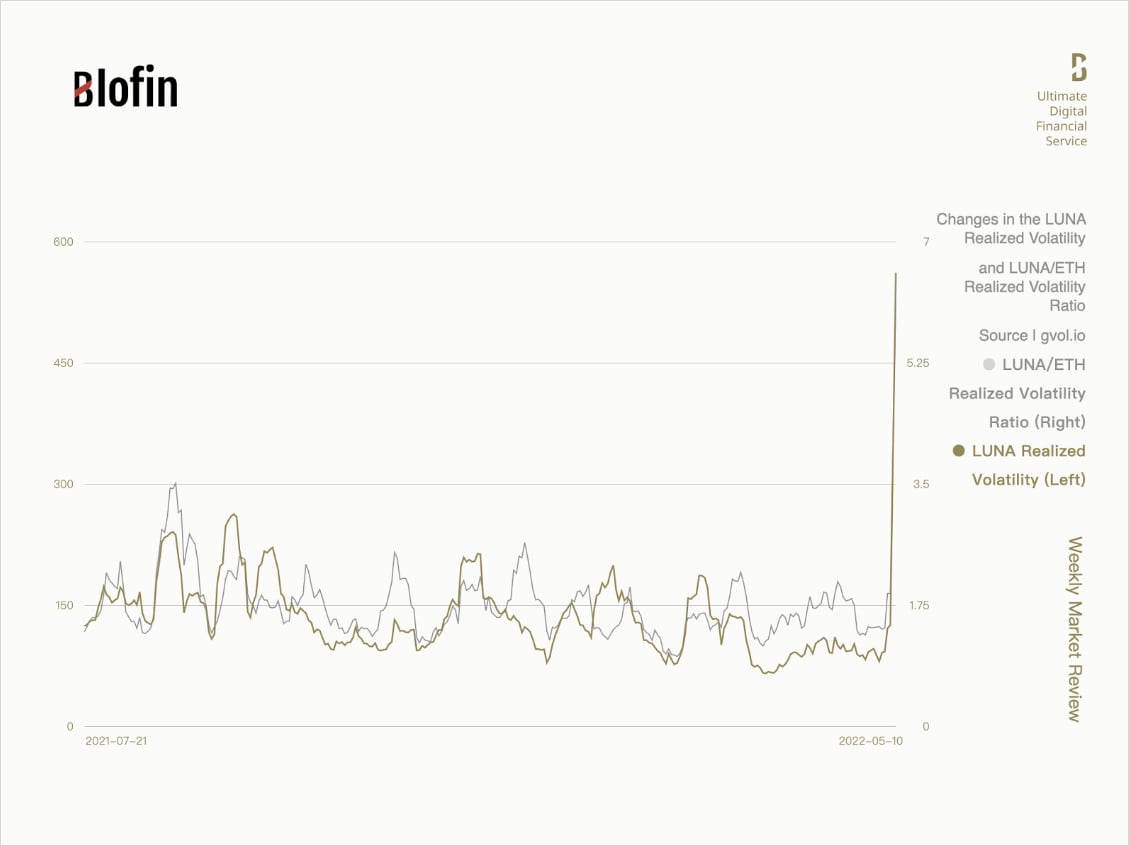

However, the linked exchange rate system has “ballast stones”. The Hong Kong government has a significant amount of high-quality financial assets, which can fully support the stable operation of the Hong Kong dollar. But for LFG and UST, the “ballast stones” are mainly composed of LUNA, which is the source of the risk of UST collapse. Unlike gold, silver, U.S. dollar bills, U.S. bonds, and other “high-quality assets” with low volatility, LUNA is a stock-like asset, and its volatility is maintained in the range of 1.2 times to 2 times that of ETH. There is no doubt that LUNA can be defined as a “high-risk asset”, and no matter how sophisticated the algorithm is designed, high-risk assets cannot be regarded as the “ballast stone”.

In this case, UST becomes similar to corporate credit bonds, and the valuation of Terra ecology supports its value. Once the business goes bankrupt, the credit bond becomes worthless—the same thing happened to UST. In fact, UST is a short-term credit bond backed by corporate equity and pegged to the U.S. dollar. For bonds backed by unstable assets, especially corporate bonds, the default risk is usually much higher than high-quality assets such as treasury bonds. Unfortunately, the investors have no understanding of the actual risk level of UST.

Another risk arose from severe over-issued of the UST. In fact, this risk had been discovered by many researchers and warned accordingly. However, it cannot be ignored that before the UST incident, the liquidity of the crypto market had fallen to a one-year lowest point due to the advent of the bear market in the risk asset market. Both individual and institutional investors were mainly wait-and-see in the crypto market, and trading was relatively inactive.

In addition, even if UST had been seriously over-issued, as long as LFG could meet the exchange demand under the existing liquidity and formulated a plan to recover excess liquidity in time (that is, the so-called ” balance sheet reduction”), UST may collapse, but it will not happen in the short term. As of the beginning of May, the exchange of UST under low liquidity is still stable, and LFG is constantly buying the relatively high-quality assets in the crypto market, such as BTC, as “ballast stones” to stabilize the market confidence. Therefore, as long as there is no large-scale withdrawal of liquidity or a large-scale panic in the market, the story of UST would continue. However, two things happened simultaneously; the story came to an end when UST’s weakness was discovered and seized.

Last but not least, both institutional and individual investors had seriously underestimated the risks of UST and the crypto market to some extent. Market confidence was fragile, and a large-scale withdrawal of liquidity was possible. However, most people in the crypto market maintained a fluke and gambler mentality: everyone who should have left had already left, and the worst situation will not happen. The misjudgment of risks and the blind pursuit of high returns eventually led to considerable exposure to LUNA and UST, from institutional managers to retail investors. They even treated UST as a stable asset and held it.

Under the bear market, to maintain asset management scale, many institutional investors began to look for stable and high-yield income sources, and Anchor’s 20% “steady” annualized rate of return made by LFG’s subsidies has successfully attracted many institutions holding heavy positions here. Objectively speaking, Anchor successfully locked the liquidity before UST de-pegging and slowed down the consumption of subsidies from LFG by slowly reducing the return, waiting for the return of the bull market. However, with UST de-pegging, market confidence instantly turned into panic, and the liquidity that had been stored flooded into the market, immediately draining the liquidity of UST’s underlying assets. With the influx of arbitragers and short positions, what happened next is already well known.

To sum up, the neglected high-risk attribute of UST itself was the root of this incident. At the same time, the underestimation of market risk and overestimation of market confidence and the widespread fluke and gambler mentality made the risk exposure from UST continue to expand and deepen on the market. In the end, the crypto whales snapped their fingers, and the most severe crisis in the crypto-asset market since 2020 broke out.

After the Luna Eclipse: Fragile Markets With Low Liquidity and Low Confidence

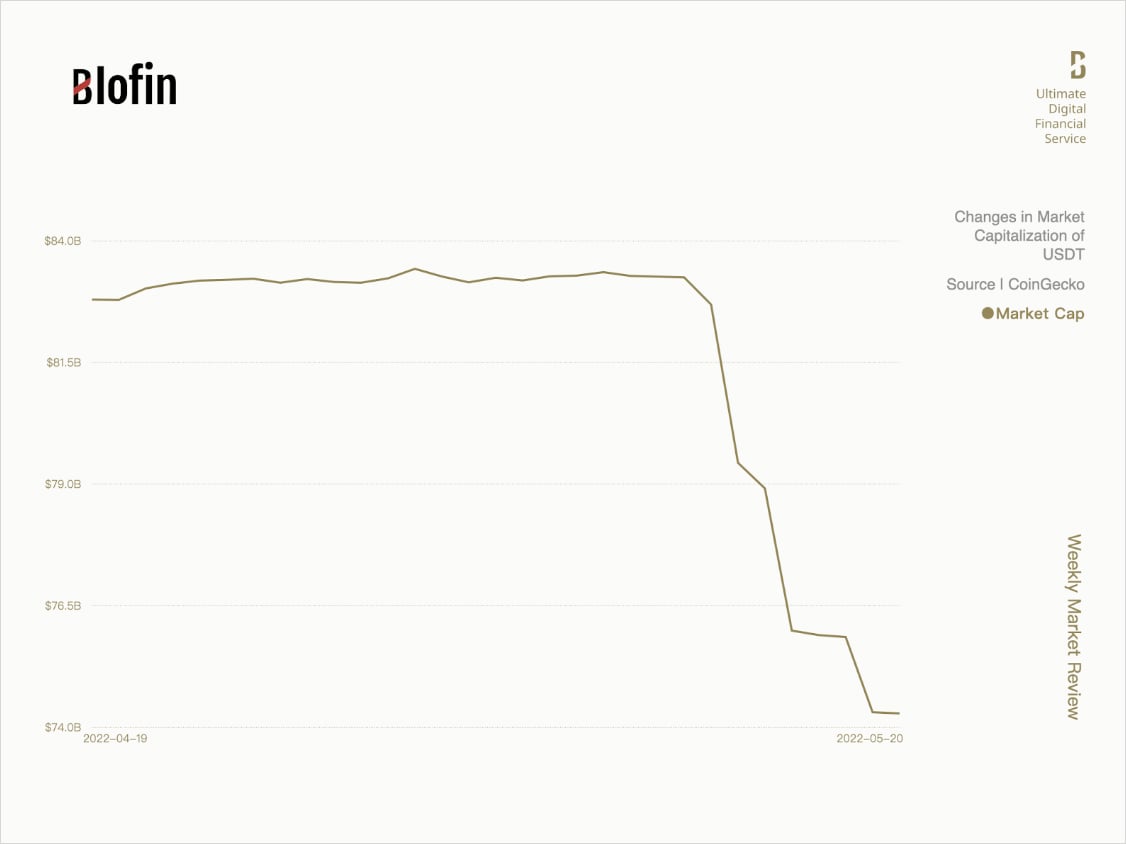

The impact of the UST de-pegging event on the crypto market is actually far from ended. Due to the collapse of Terra’s ecology, investors even began to worry about the risks of the underlying assets in the crypto market, such as BTC, ETH, USDT, USDC, and BUSD. USDT was once close to de-peg, while BTC, ETH, and other assets were sold off a lot. More signals from the derivatives market suggest that a series of shocks from UST is continuing, raising the risk of further liquidity outflows.

Based on the performance of the futures market, the premium of mainstream crypto-asset far-month futures is significantly lower than the risk-free yield. In this case, the expected return of crypto-asset investors is already lower than the risk-free return, and more investors may further turn to risk-free assets. As a result, the liquidity outflow of crypto assets will be difficult to improve in the short term. The change in the market value of USDT also reflects the above point of view: considering benefits and risks, investors are exchanging USDT for USD and leaving the market. Within two weeks, the outflow of funds has exceeded $9 billion.

From the options data, although the most significant negative gamma exposure in the crypto market has initially been under control, negative gamma exposure still persists. To hedge the negative gamma brought by the decline, market makers have to choose to go short further, which means that any trouble will trigger a new round of selling and promote the continuation of high volatility in the crypto market.

Increasing macro risks also puts increasing pressure on the recovery of the crypto market. Inflation in main capital markets is still ongoing, and the previous liquidity contraction actions are ineffective so far. Therefore, central banks have to choose between suppressing inflation and short-term recession, and both the Federal Reserve and the European Central Bank have already chosen the former.

For the crypto market, the aggressive liquidity contraction policy for the crypto market means a further increase in liquidity outflow pressure. On the other hand, the Terra USD incident has successfully attracted the attention of regulators, and regulatory pressure has once again become prominent in the crypto market. For now, at least in 2022, the crypto market still has to face a series of shocks caused by the Terra USD crisis. The few chances of profit in a bear market can only be found in derivative markets as before.

The crypto market has entered a severe winter. Terra USD ends an era. As risk management and compliance are further brought to the schedule, the crypto market is heading down a different path than its previous “Wild West” era. There is no doubt that this will bring countless new opportunities, but for now, how to spend at least six months of the long winter is the primary issue we need to consider first.

Although the future is uncertain, it is worth mentioning that there are still potential income opportunities in the current crypto asset market. “For everyone who asks receives; the one who seeks finds.”

AUTHOR(S)