Crypto Markets Down Sharply

Crypto markets took a sharp hit on Monday, reigniting concerns around key support levels. Sentiment weakened after a high-profile breach and broader macro pressures, causing altcoins like Solana to plunge. Ethereum, which had shown relative strength, is now struggling below critical thresholds. A suspected Lazarus Group hacker controlling a large ETH stash adds to the uncertainty, though historical patterns suggest limited immediate dumping. Stay alert to potential shifts and opportunities as market conditions evolve, but don’t be surprised if the flush out isn’t over yet.

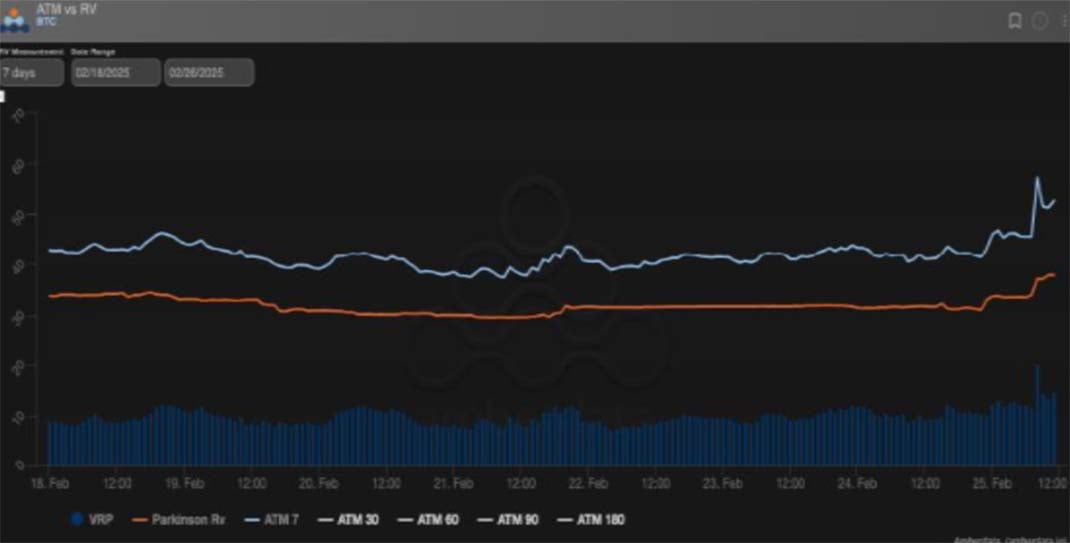

Big Pop In Vol

Volatility remained subdued until Monday, when Ethereum’s swift 15% drop jolted realized and implied vols higher. The move in BTC vol has also been considerable. Short-term implied volatility spiked but is beginning to ease, while BTC’s carry stays positive and ETH’s sits near neutral. Expect more choppiness ahead as markets seek balance following significant liquidations.

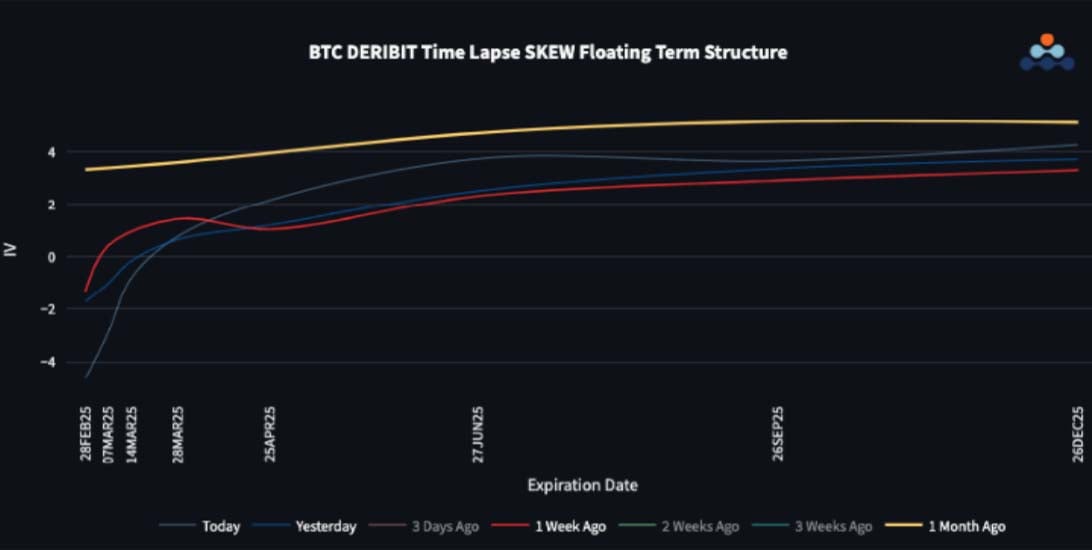

Skew Term Structure Into Deeper Contango

Short-dated puts are driving a steeper contango, pushing front-end put skew higher—especially in ETH compared to BTC. Despite recent selling pressure, long-end call skew remains firmly bullish, hinting at confidence for later in 2025. We see an opportunity to use April call skew for risk reversal hedging strategies, offering near-term protection while maintaining core positioning for potential upside.

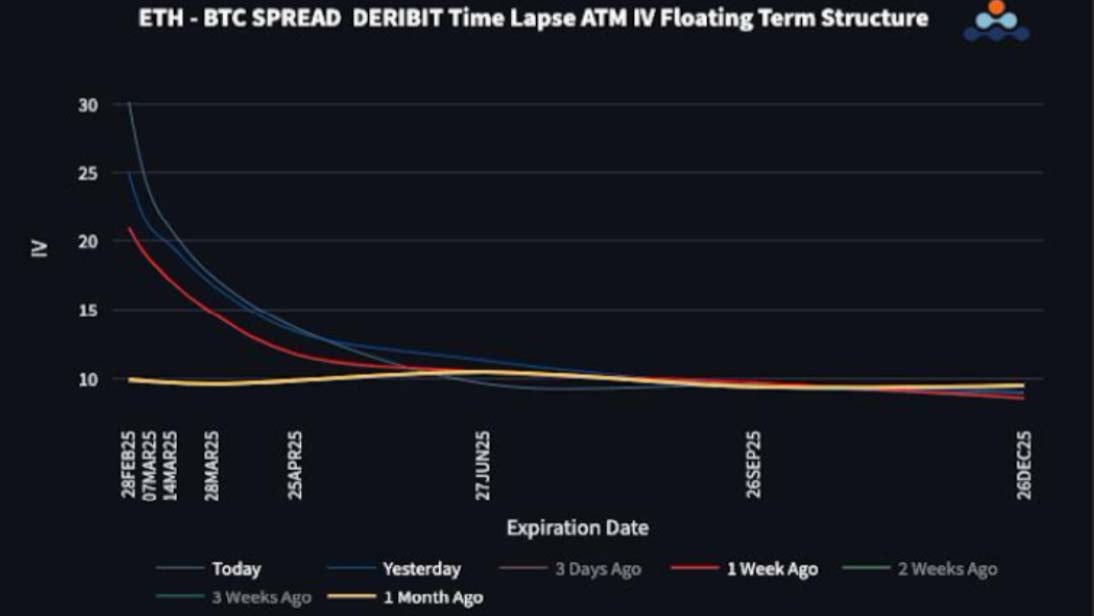

ETH/BTC Remains In A Downtrend

ETH/BTC continues to slide, while ETH’s front-end volatility commands a historically high premium 30 points over BTC—currently supported by realized moves. The back-end spread is holding near 10 vols, indicating a potential floor. Skew is shifting, with ETH puts priced at a premium in the near term and calls still favored further out, though that gap is narrowing. We’re monitoring these flows for tactical entries.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)