Although the US had celebrated a long weekend, price action has still shown signs of uncertainty. A wick to $23.8K was quickly met with a reversal in price and a sanguine test of $25K followed quickly after the Asia trading session started Monday. Topside demand last week had been concentrated in the $26K strike for BTC, and after an exhaustion of bullish spot buying and multiple rejections of $25K, the open interest in this strike has started to decline.

From a volatility perspective, the ratio of ETH/BTC ATM IVs has come in sharply over the weekend and now shows the spread between ETH/BTC at relative lows. The rally has been predominantly focused on BTC as expressed through the demand and interest in the options markets, even as the ETH-specific Shanghai narrative has started to pop up on the occasional Twitter thread.

ETH/BTC ATM Ratio (BlockScholes)

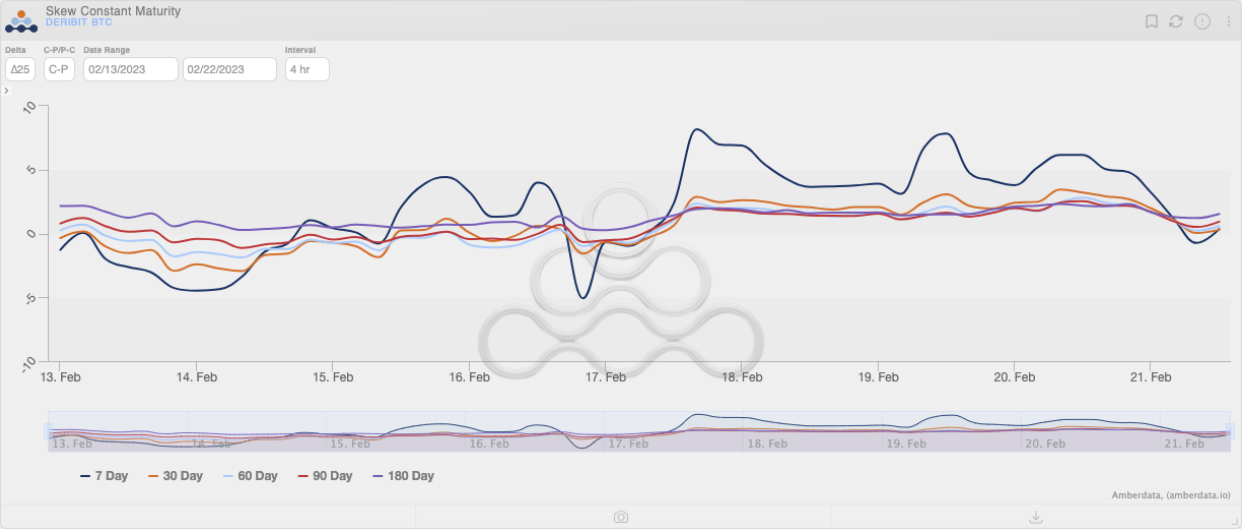

Skew, BTC

Thursday last week saw a massive shift in sentiment implied by the options market, as weekly skew saw a sudden shift ending with weekly calls trading at a premium. This shift is most likely driven by short-dated topside flows coming in toward the end of the week. The premium in weekly call skew has since then reversed, driven by the closing out of some of these positions as the upside rally some had expected failed to materialize.

25D BTC Skew Call-Put

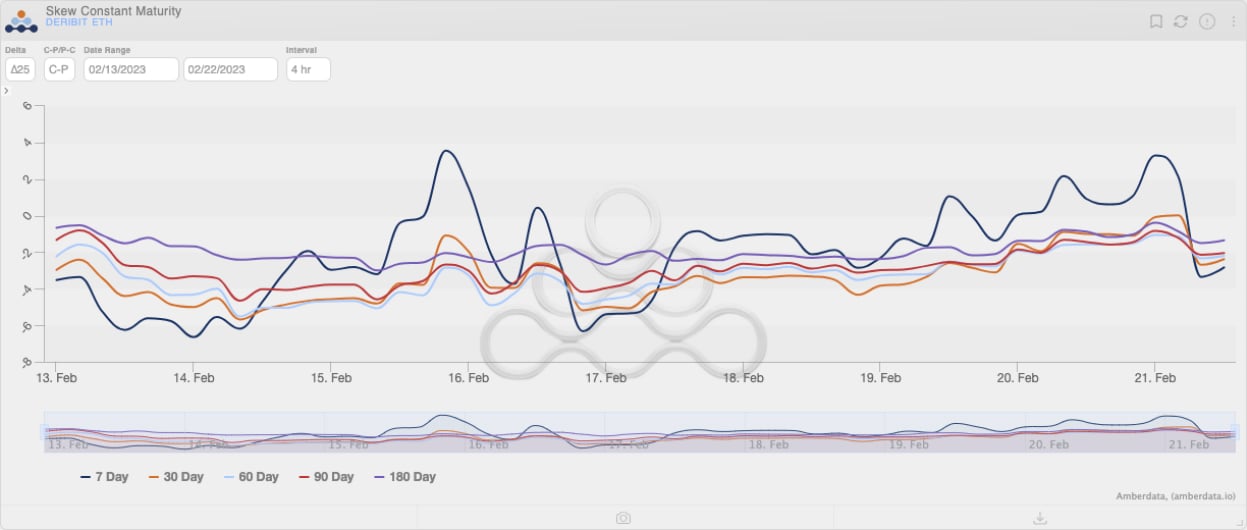

Skew, ETH

ETH saw a similar spike and eventual reversion in skew as well, although in much lesser magnitude. Skew still remained slightly negative throughout the weekend until a gradual but slight break into the positive ranges occurred toward the end of Monday. This has since then been met by a sharp decline of 7 day and 30 day skews back into the negative region as demand for ETH downside has become a relevant flow, and the exuberant chase for topside evanesces.

25D ETH Skew Call-Put

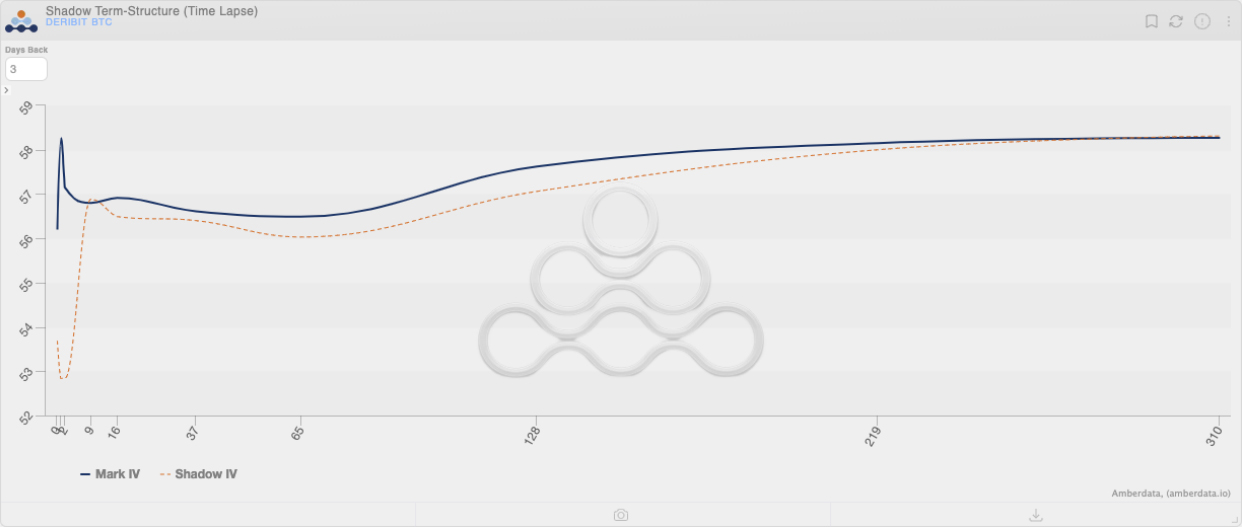

Term Structure, BTC

Looking back three days, term structure in BTC is relatively unchanged – as most of the interesting changes in the volatility surface over this time have been seen in skew – as indicated by the 25D RR. The recent decline in implieds was noted over the past day rather than throughout the weekend. Longer dated term-structure has firmed while the front end has stayed flexible into this ever-changing market sentiment.

BTC Term Structure (3 Day Lookback)

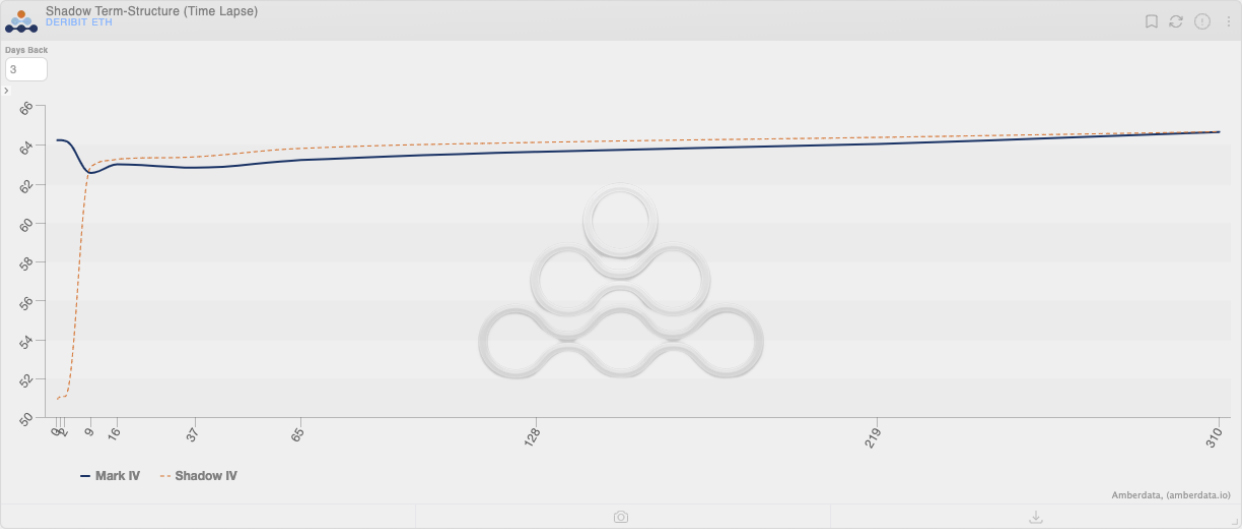

Term Structure, ETH

ETH’s flat term structure has persisted over time in both the mid-long term tenors. The front end has seen a similar rise in IV as volatility picked up over the weekend, with market participants shifting demand to outright short-dated options as this breakout continues to be at the forefront of speculation with downside put buying starting to pop up.

ETH Term Structure (3 Day Lookback)

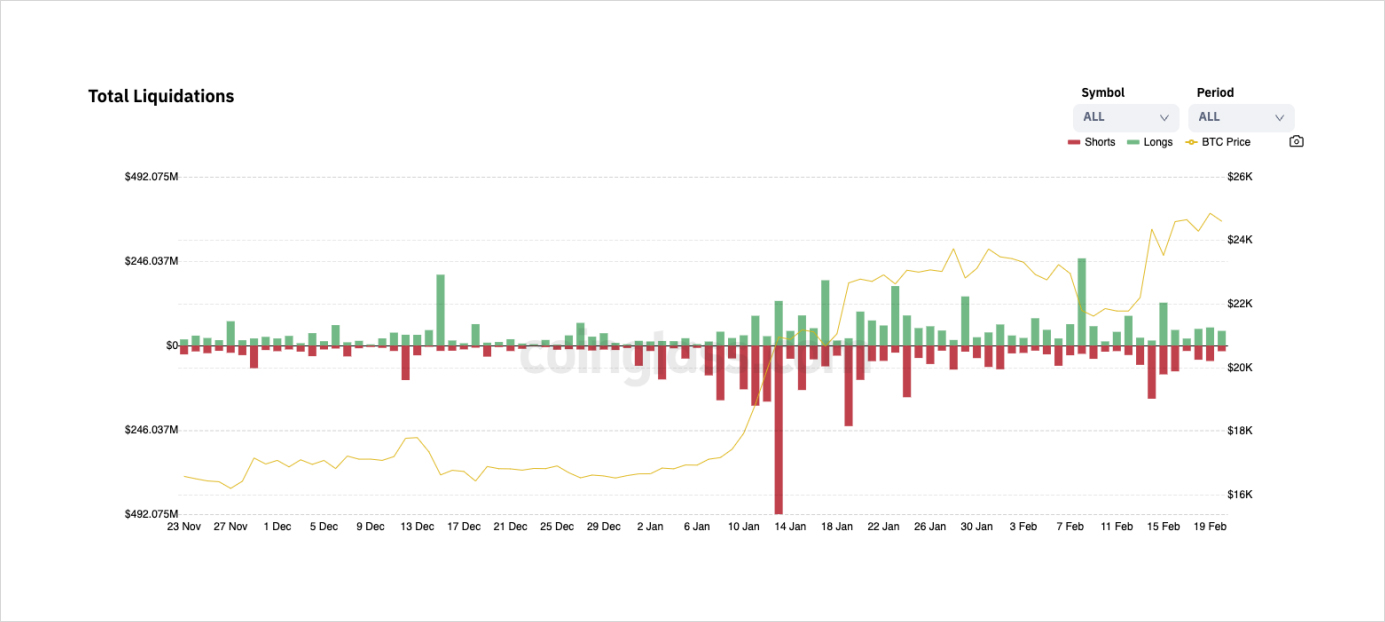

Liquidations

As price action in both the majors has been quiet compared to some of the post-CPI price volatility, there have been relatively few notable liquidations. Saturday and Sunday saw relatively equal amounts of both longs and shorts liquidated, and price action in the spot markets persisted quite evenly throughout bids and offers.

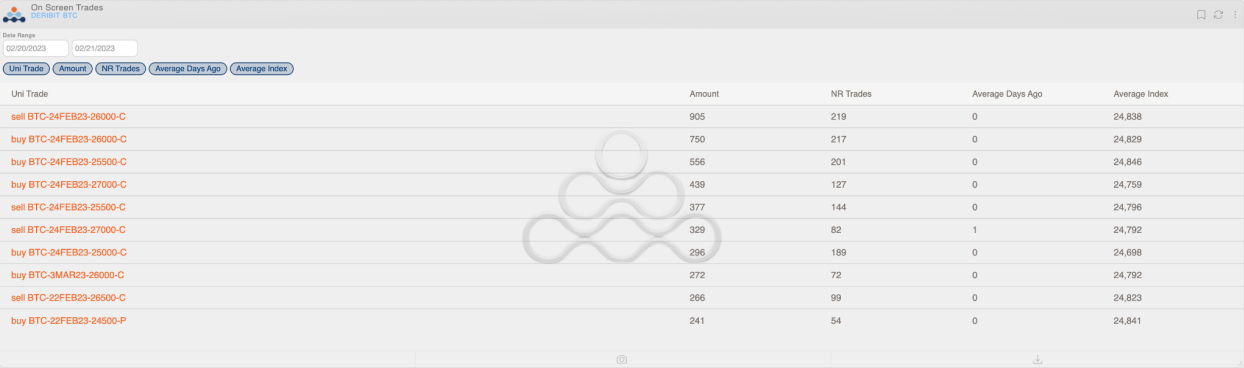

Noticeable Flows

Some of the most interesting flows seen over the past week was certainly some of the outright demand in BTC topside as expressed through the $26K 24FEB23 purchases that have recently been closing out as sales of this strike have led to a decline in open interest. Yesterday we saw longer dated put flow entering the market, and another failed breakout of the $25K region as we approach this punchy gamma expiry of 24FEB23.

Friday primarily saw upside demand in both the majors. Outright call spreads in ETH were purchased for longer dated expiries, and short-dated demand for puts had been expressed as well. Screen trades popular today and yesterday show a mix of buying and selling across the call strike range, with a mix of old positions closing out and newer positions popping up.

A Look Ahead

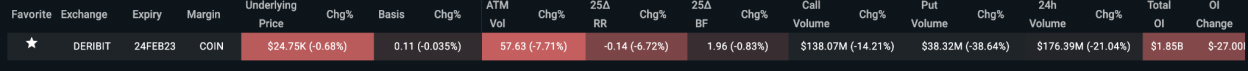

Post-CPI led to a large interest in EoM optionality as open interest for this Friday now encroaches upon almost $2B of notional expiring. A large amount of interest and trading of this EoM tenor popped up throughout last week as the volatile price-action saw rapid changes in price and multiple tests of the upper bounds of the current price-range.

BTC has led this rally even with the Shanghai narrative popping up on a few Twitter threads, and the options market has replicated this euphoric demand for upside as BTC implied vols saw a large spike recently – narrowing the typical spread between ETH/BTC. This week, eyes should be on the expiry coming up and cognizant of the repositioning and shift of speculated dealer gamma positions and subsequent hedging.

AUTHOR(S)