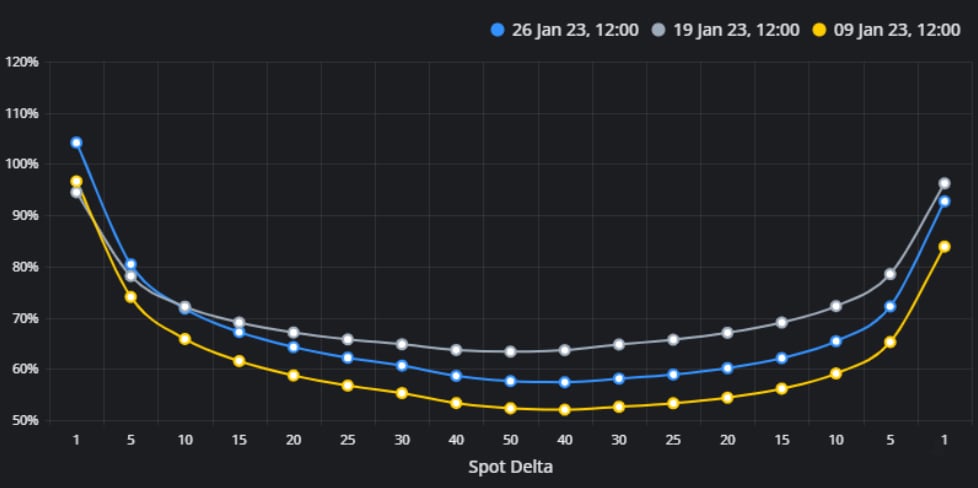

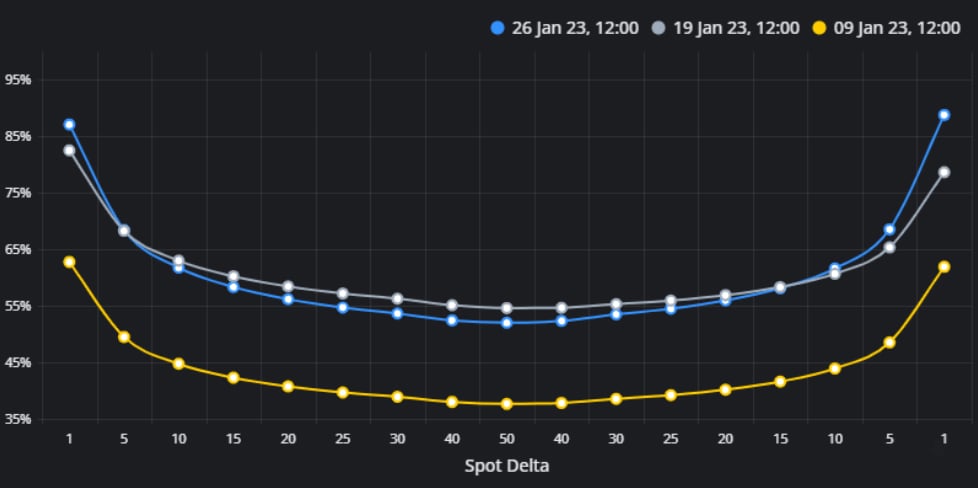

BTC’s volatility smile remains near to the levels seen following the first of the two weekend rallies that kick-started 2023, whilst ETH’s volatility smile has fallen closer to the levels seen on the 9th of January. In addition, ETH’s volatility smile has returned to its skew towards OTM puts at a much faster pace at short-dated tenors, whereas BTC is pricing OTM calls and OTM puts at similar levels to each other.

ETH Skewed Further towards OTM Puts

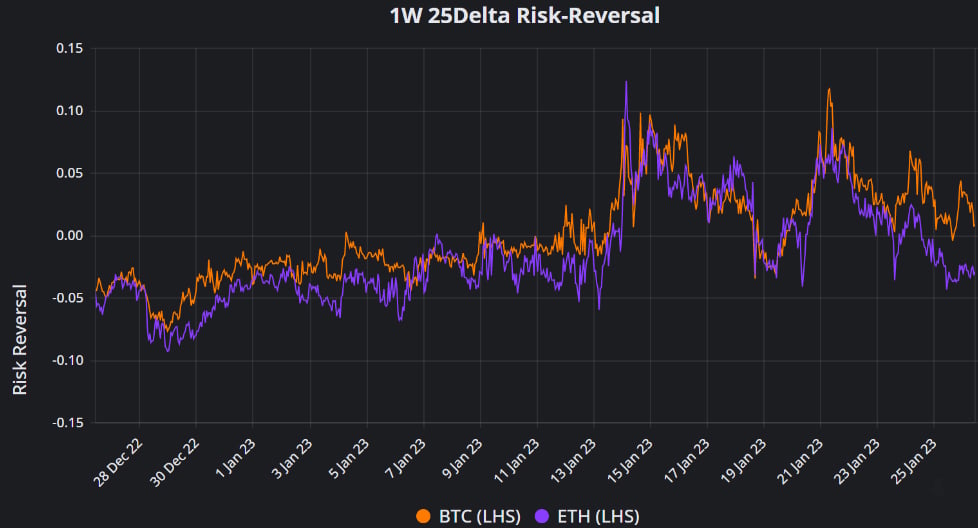

Figure 1 Hourly 1-week, 25-delta put-call skew of BTC (orange), ETH (purple). Source: Block Scholes

- BTC’s volatility smile is currently pricing for a neutral skew at short dated tenors, after assigning a premium to OTM calls for the first time since 2021 over the last two weeks.

- In contrast, ETH’s vol smile has returned to its skew towards OTM puts at short tenors despite participating in both of the last two weekend rallies.

- ETH’s return to a negative skew is the result of an outsize fall in its OTM calls in the days after the most recent weekend rally when compared to its OTM puts.

- At the same time, the implied volatility of its OTM puts has remained relatively elevated throughout that period.

ETH’s 1M Volatility Smile

Figure 2 ETH’s 14-day SABR volatility smile generated on 26th Dec (blue, today), 19th Jan (grey, following the first weekend rally), and 9th Jan (yellow, before the first weekend rally). Source: Block Scholes

BTC’s 1M Volatility Smile

Figure 3 BTC’s 14-day SABR volatility smile generated on 26th Dec (blue, today), 19th Jan (grey, following the first weekend rally), and 9th Jan (yellow, before the first weekend rally). Source: Block Scholes

- In contrast, BTC’s OTM calls have remained much closer to the high levels they traced out during the height of bullish sentiment following the first weekend rally.

- The evolution of the smile over those dates leaves BTC’s smile elevated across the strike domain at shorter tenors, with volatility up around 15% from its pre-rally lows.

AUTHOR(S)