In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

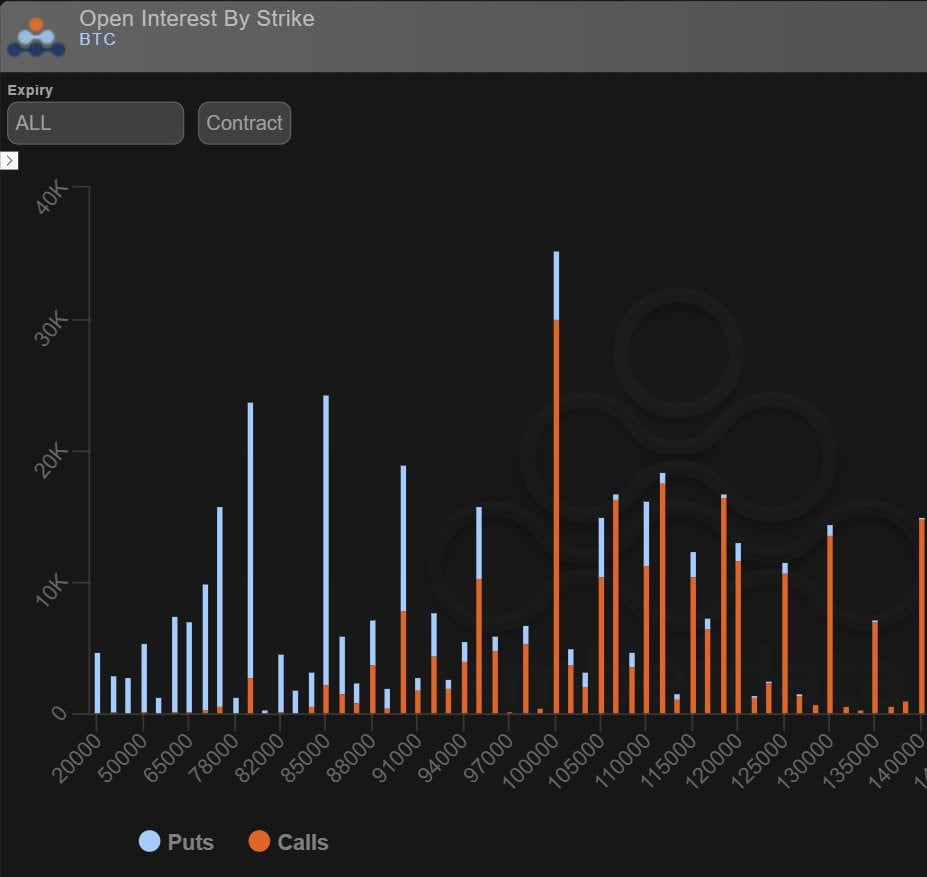

BTC Put Skew remains elevated on account of enduring Dec 85+80k Put caution. But recently, despite sentiment, Xmas 100k+ target has grown in appetite via additional purchases of Dec 100k+ Call spreads, adding to last report’s colossal Dec26 100k+ Call Condor play. FED awaits.

The last couple of days have seen further buying of 100k+ plays adding to the Dec26 100-106-112-118k CC;

- Dec26 100-106-112 ladder.

- Dec26 102-115k Call spread

- Dec26 100-106k Call spread

- Dec12 110k Call

- Dec26 100-115k Call spread

- Dec26 106-120k Call spread

Adding Open Interest.

This places the 100k Calls OI as dominant, towering over the Dec 80+85k Puts that were the main focus as BTC broke 100k and plummeted to test 80k.

On the bounce at the end of Nov, the Condors were bought; and over last weekend the Dec Call spreads were added (a spend of $2m).

Honing in on the Dec26 maturity, where the Size is trading and being positioned, the Put Skew remains positive for the Puts, well above neutral.

ie 50delta 44.5% IV, 20 delta put 51%, 20 delta call 43.5%.

With Calls trading below ATM, this has presented upside opportunities.

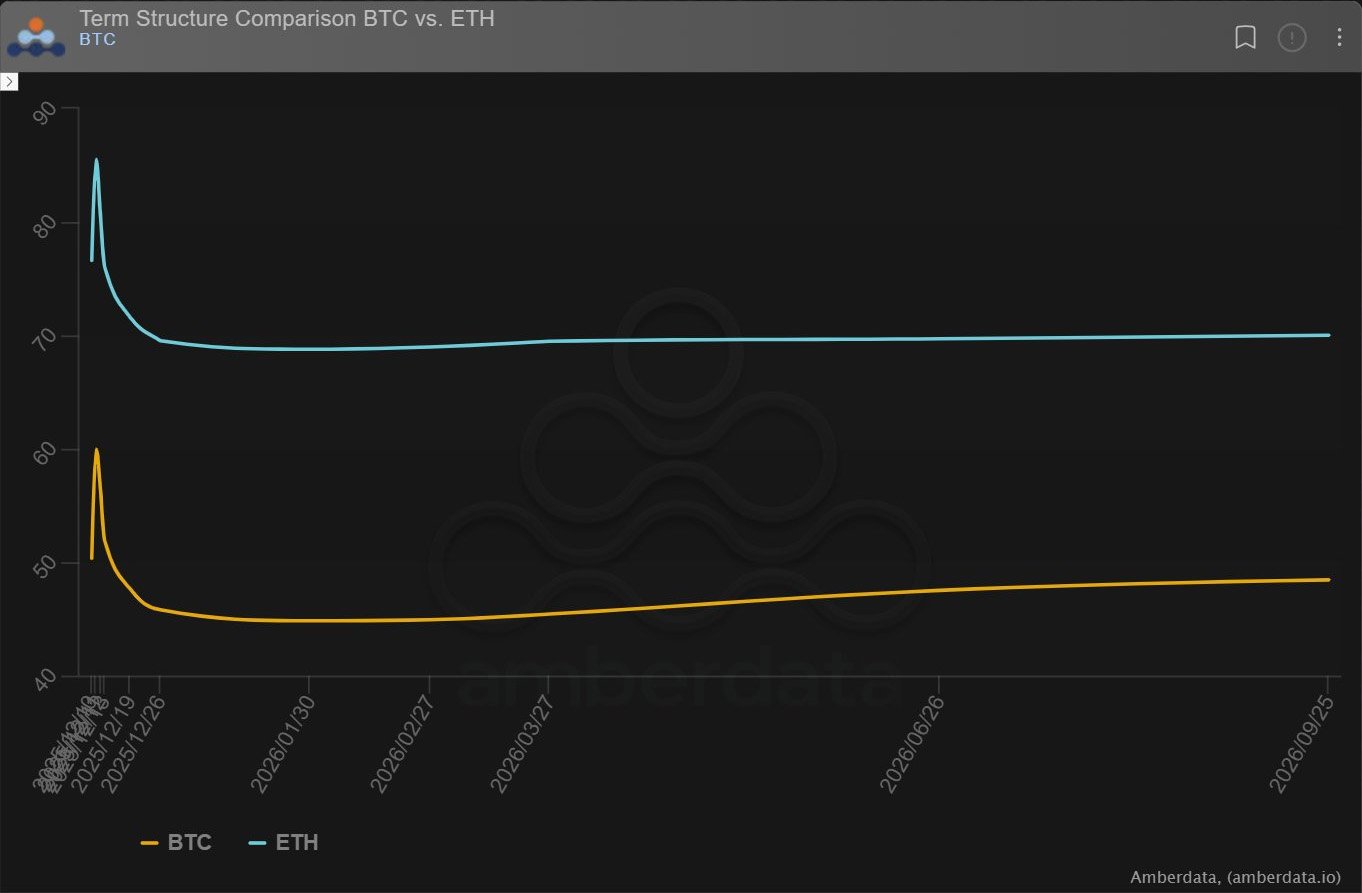

Term-structure shows demand for front-end Gamma ahead of the FED, JPows last meeting and FED AMA.

The blip on the far left is the Dec12 Friday weekly expiry on ETH+BTC, indicating this is FED/week specific across both assets.

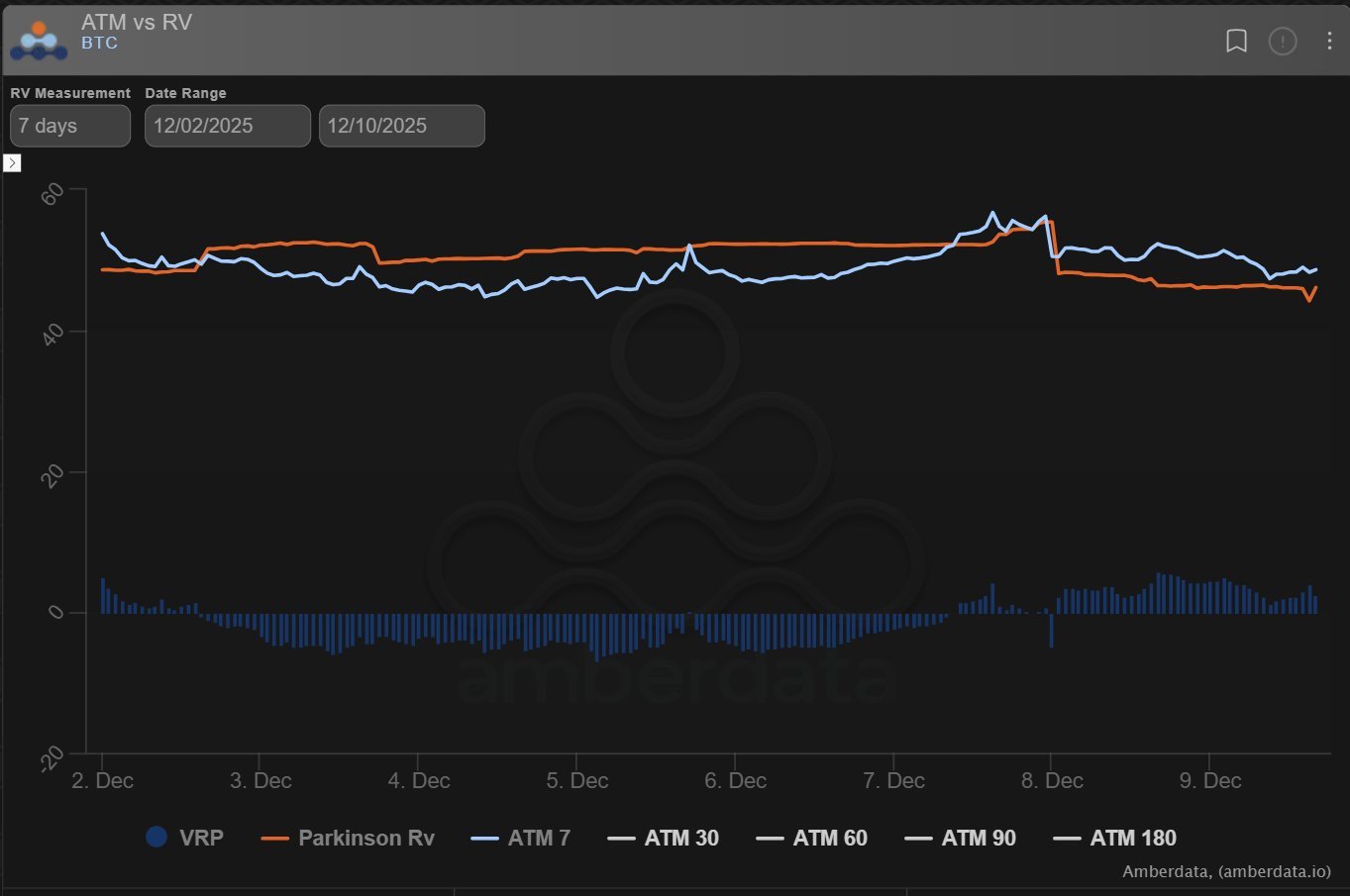

Today’s sharp Spot move higher in BTC+ETH probably caught a few napping, many having flattened up positions pre-Fed.

IV had just started to soften, as long optionality looked to offload on an expected quiet day (7d RV falling below IV) and possible sell-vol news after the Fed.

One fund took the opportunity to hedge/play a retrace by buying the Dec13 90-98k RR (buying the Put) just as Spot hit 94k.

Despite Spot mid-point of the strategy, this cost 200k premium for the 1k options traded due to the existing elevated Put Skew forcing a premium.

Another took advantage of the elevated Dec12 maturity and rolled to Dec19, still of course benefiting from FED volatility, but extending the capture period out a week to a cheaper IV cost.

This is a common strategy to exploit targeted limited-day plays that distort curves.

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)