In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movement while we come to an end of 2023.

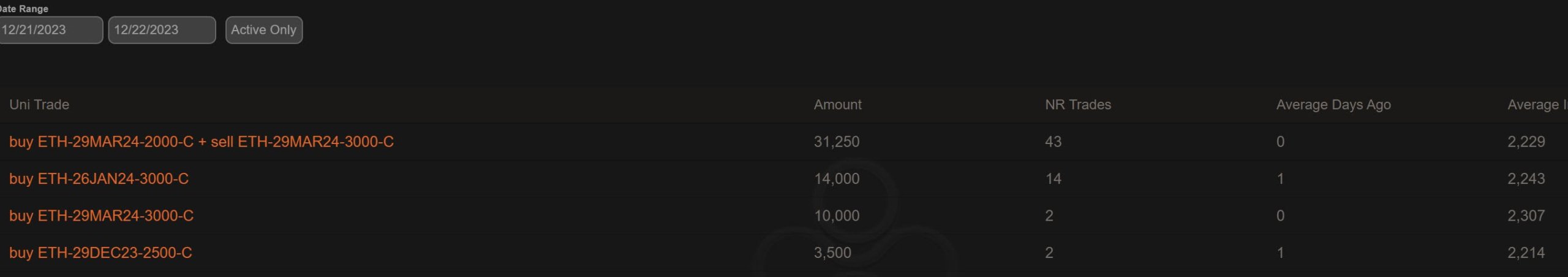

ETH Mar 2k-3k Call spread bought x30k. Hated ETH rotation as BTC+loved Alts Pull-back.

ETH Dec ATM bought, and Jan+Mar 3k Calls bought x25k, pushing ETH Dvol >60%, while BTC Dec ATM sold and DVol drifts <57% as anticipation of an imminent pre-holiday BTC Spot ETF diminishes.

2) Uncommon to see an ITM-OTM Call spread bought, furthermore on ETH.

OI shows this as opening.

But this style of Call spread (rather than an ATM/OTM-OTM spread) is often employed as ETH Delta replacement but with a fixed invalidation, <2k.

Remains bullish exposure, long basis.

3) With ETH pushing >3k and back in vogue (temporarily?), some seeing the value in a post-BTC-Spot-ETF-approval world where ETH may become the focus.

ETH 3k Calls bought 25k for end Jan+Mar expiries.

Small clip of buying ETH Gamma to sell BTC Gamma executed.

Combined Dvol >60%.

View Twitter thread.

AUTHOR(S)