In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

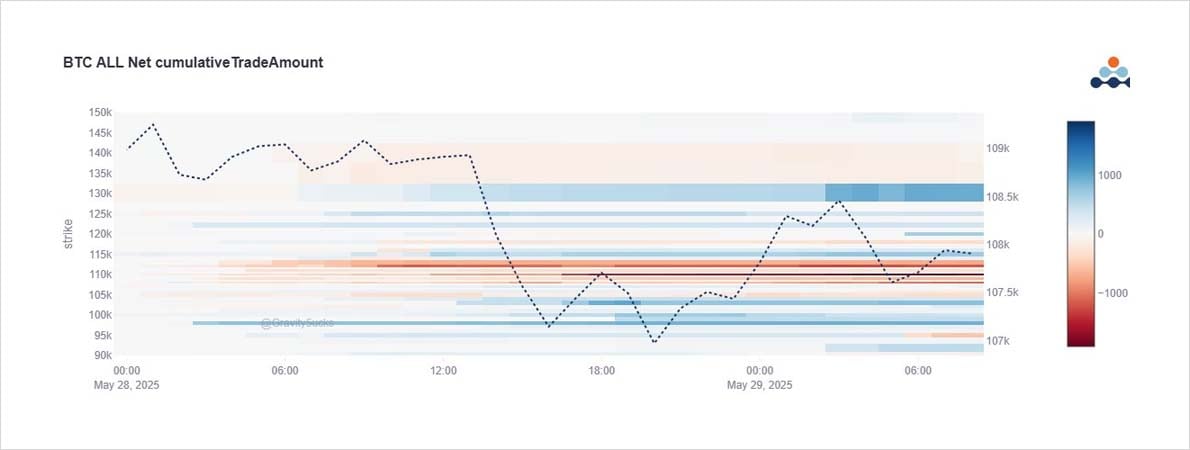

Yesterday started with a dump of Jul 110-118k Calls, Jun6+13 99+100k Puts bought, and a Mar collar bought for the 80k Put; all -ve delta.

IV dropped, Put Skew firmed. Spot <107k. JW liq 106.5k.

Then BTC bounced, some Jul ~115k Calls covered, now Jun 95-120k RR – Calls bought.

2) Within the red selling of Jul 110-118k Calls there is some expiry related May30th 112+113k Call sales.

Likewise, within the blue Jun6+13 99+100k Put buying, there is some expiry related May30th 103k Puts too.

Mid-longer-term 130k Strike Calls still popular, biased long.

3) The onslaught of Jul 110-118k Calls first sold, then partially rebought, can barely be seen on the IV chart despite July round-tripping 4%.

But combined with the Jun Puts at first bought, then today sold, the Skew chart represents the sudden change of Spot-related sentiment.

View X thread.

AUTHOR(S)