In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

With JW liquidated, the market refocused.

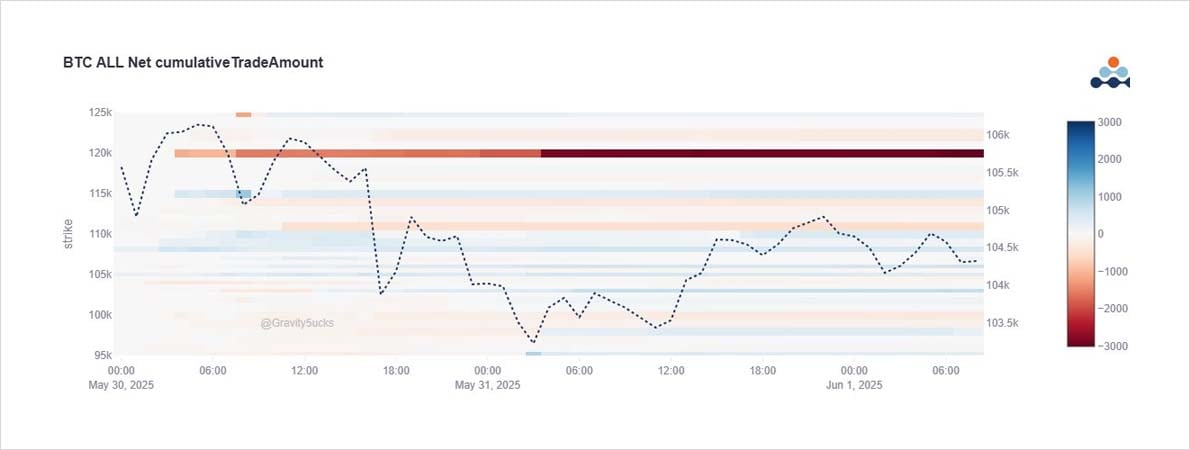

The pull-back led to far upside sold: Jun20+Jul 120k Calls, Jun6 115-125k Call spreads.

Some trend continuation Jun 1week 100-103k Puts bought.

But bias flipped during expiry: large buy flow of Jun27 105-115k Calls x3.5k, $12m fresh.

2) The Jun20+Jul120k Calls appear to dominate in strong ‘red sales’, and a decent notional was indeed sold – $250m+, mainly on blocks. But the distributed ‘blue buys’ of Jun27 105+108+110+115k Calls, mainly on DSOB totaled $400m+, and 3x as much upside delta.

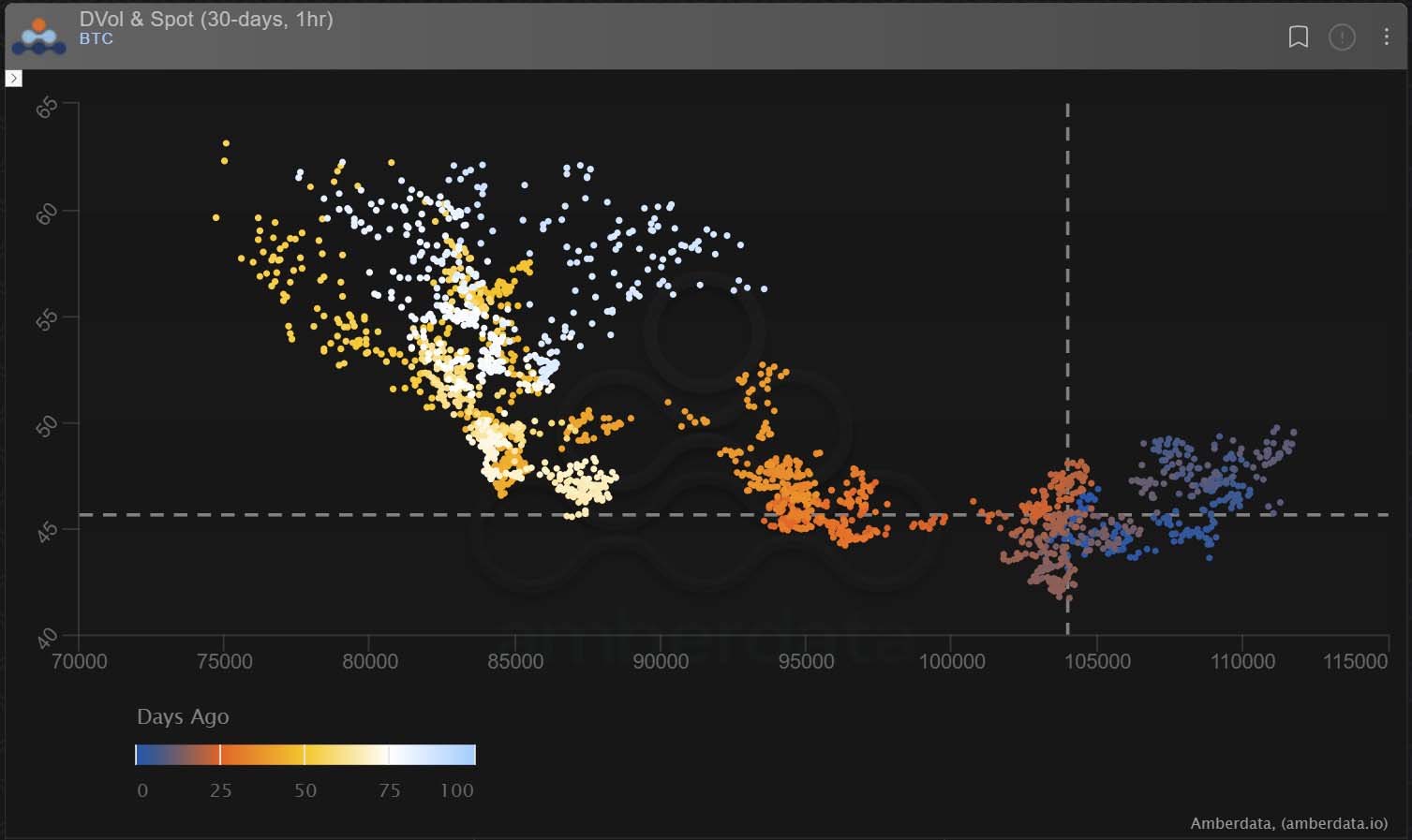

3) That said, while the Jun27 Call buying during the May30th expiry window (NB fresh money, but possibly replacing deltas) held the market at 105k, and pumped Jun27 IV 5% over a short period, BTC Spot and IV have once again failed to hold into positive institutional news flow.

View X thread.

AUTHOR(S)