In this week’s edition of Option Flows, Tony Stewart is commenting on the market prior to Powell speaking followed by CPI.

January 10

A couple things abreast.

GBTC discount narrowed from 50% to 40%.

Powell speaking today, with CPI ahead.

A large buyer of BTC Jan27 18+19k Calls (x3k so far) dominating Option flows in an otherwise quiet market.

With current RV deathly low, it’s difficult not to connect dots.

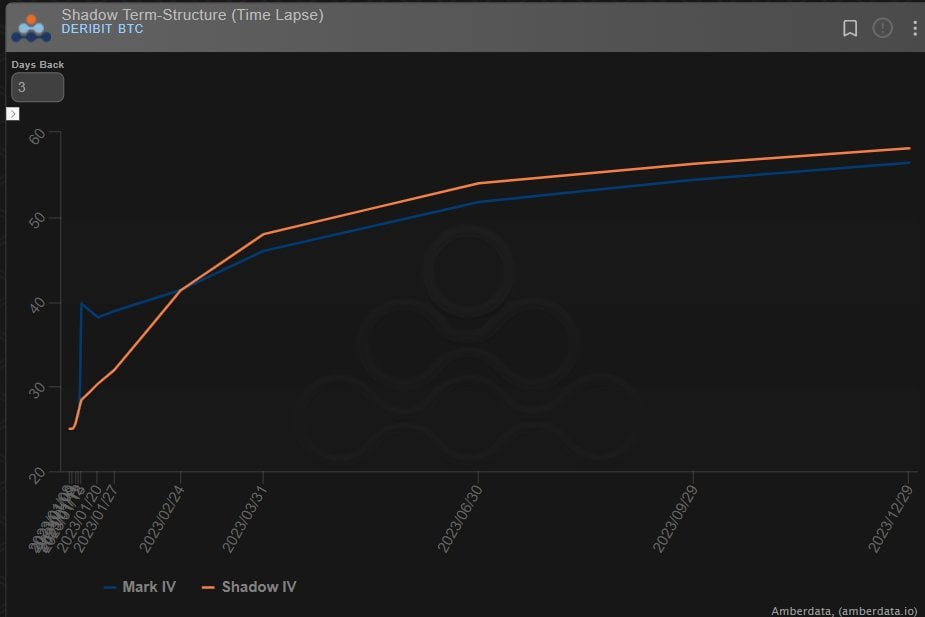

2) The Term Structure has been in steep contango for some time, with significant pressure at the front end as Theta is the enemy of any Long Option holders with little Realized to offset.

This buyer has corrected the steepness to a fairly normal-looking Term in normal markets.

3) Interesting to note the Jan27 maturity chosen.

Lower outlay premiums are available in Jan13+Jan20, particularly if the only focus is this week’s events, so liquidity is no doubt a factor.

Also with RV environment at such a discount, this is a big commitment against the flow.

View Twitter thread.

AUTHOR(S)