In this week’s edition of Option Flows, Tony Stewart is commenting on how the majority of the traders react up the coming deadline for BTC ETF approval.

Increased Jan 10th deadline approval odds have not surprisingly pushed BTC+ETH to challenge year highs.

Option market ‘Call’ed this for some time, but resistance at 38.5k/2.1k frustrating what has been an obvious long upside trade.

IV drift. Call spreads favored + employed.

2) Persistent failures to breach 38.5k have forestalled pure Long Calls, as IV has drifted and Theta both taking chunks out of profits.

Greater moves to more mitigating structures – upside exposure, reduced Vega+Theta:

BTC Dec 39-45k Call Sprd.

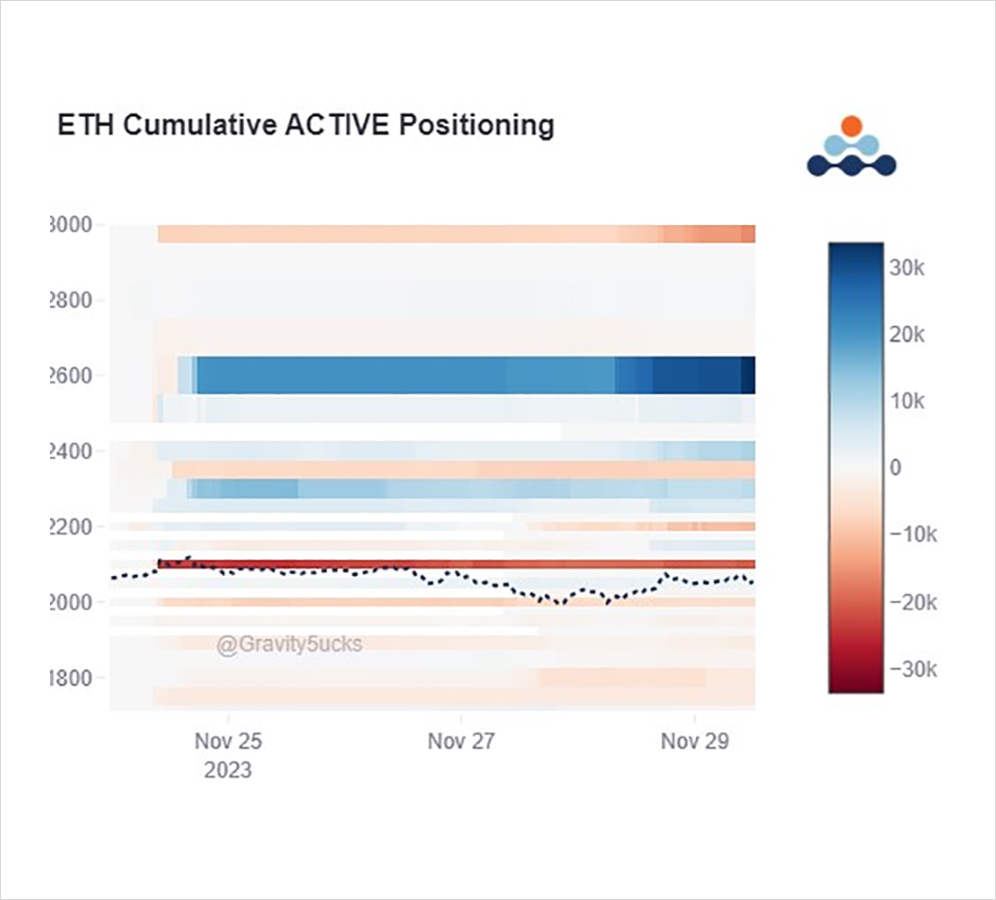

ETH 2.6-3.2k + 2.4-3k Call Sprds.

3) BTC Dvol ~50% is current support, drifting back from 60% on the first attempted summit of Spot year highs.

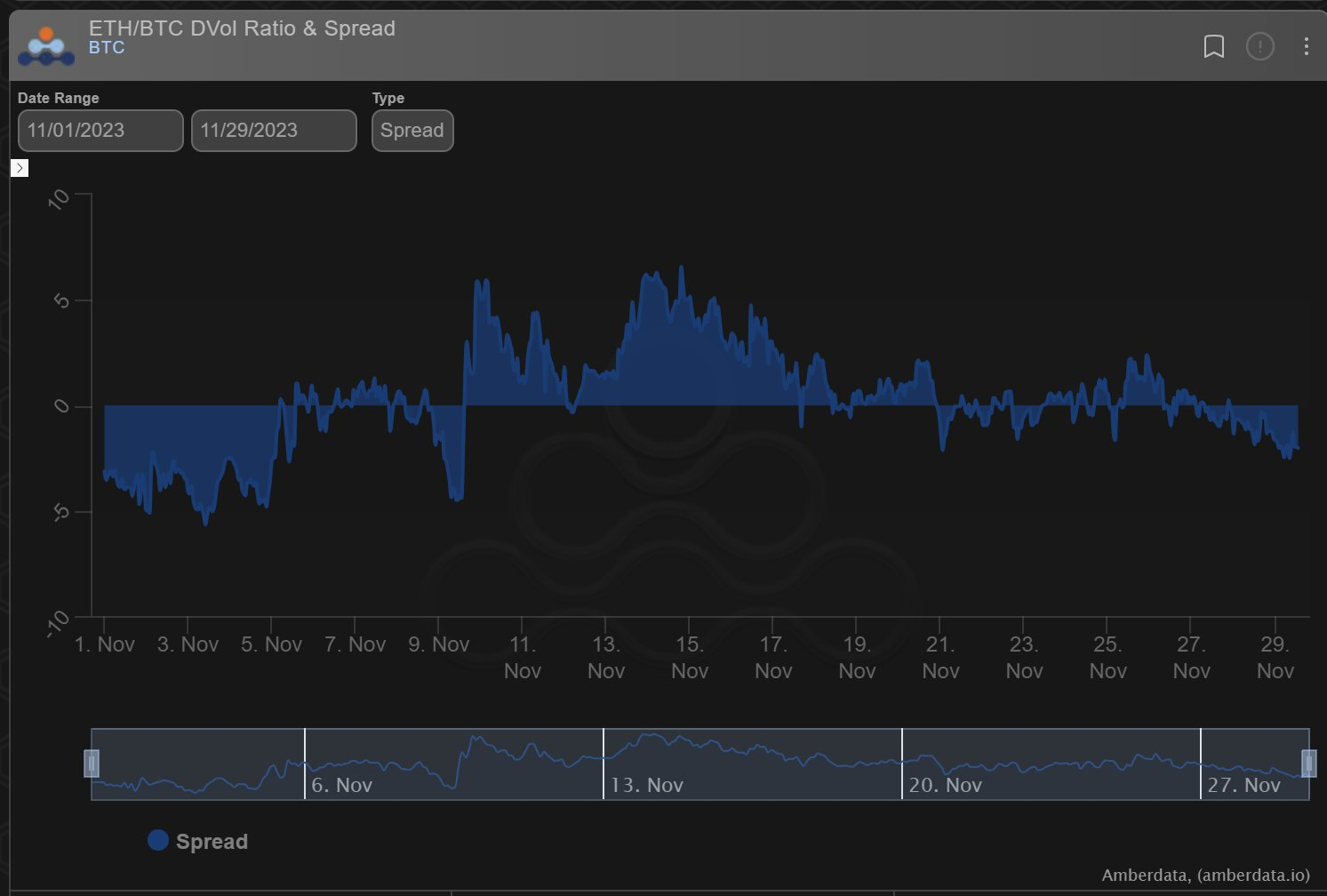

ETH relative rise above the horizon short-lived, as the ETH Overwriter applied IV pressure, and BTC ETF narrative approaches first.

But ETH upside interest perceptible.

View Twitter thread.

AUTHOR(S)