In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

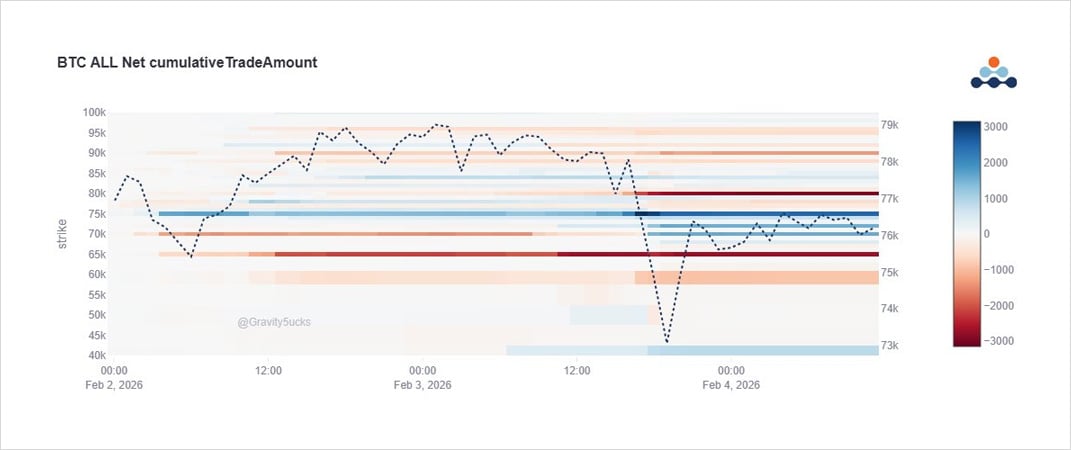

BTC Option flows suggesting downside plays not over. Now In-The-Money Puts rolled down to lower (predominantly 70k Strike) to TP but keep notional exposure. New Put spreads bought. New OTM Puts bought.

Similar behaviour on IBIT as well as Deribit.

Skew+Implied Vol firm.

Within the picture:

Mar 80k Puts rolled lower to Mar 75k Puts

Feb 80k+76k Puts rolled lower to Mar 70k Puts

Feb 70k Put +72-65k Put spread bought.

Jun 40k Puts bought

IBIT TP on Mar Put spreads, rolled to equiv Mar 70k Put. (h/t @Amberdataio ).

Vol sale Apr 65-90k Strangle.

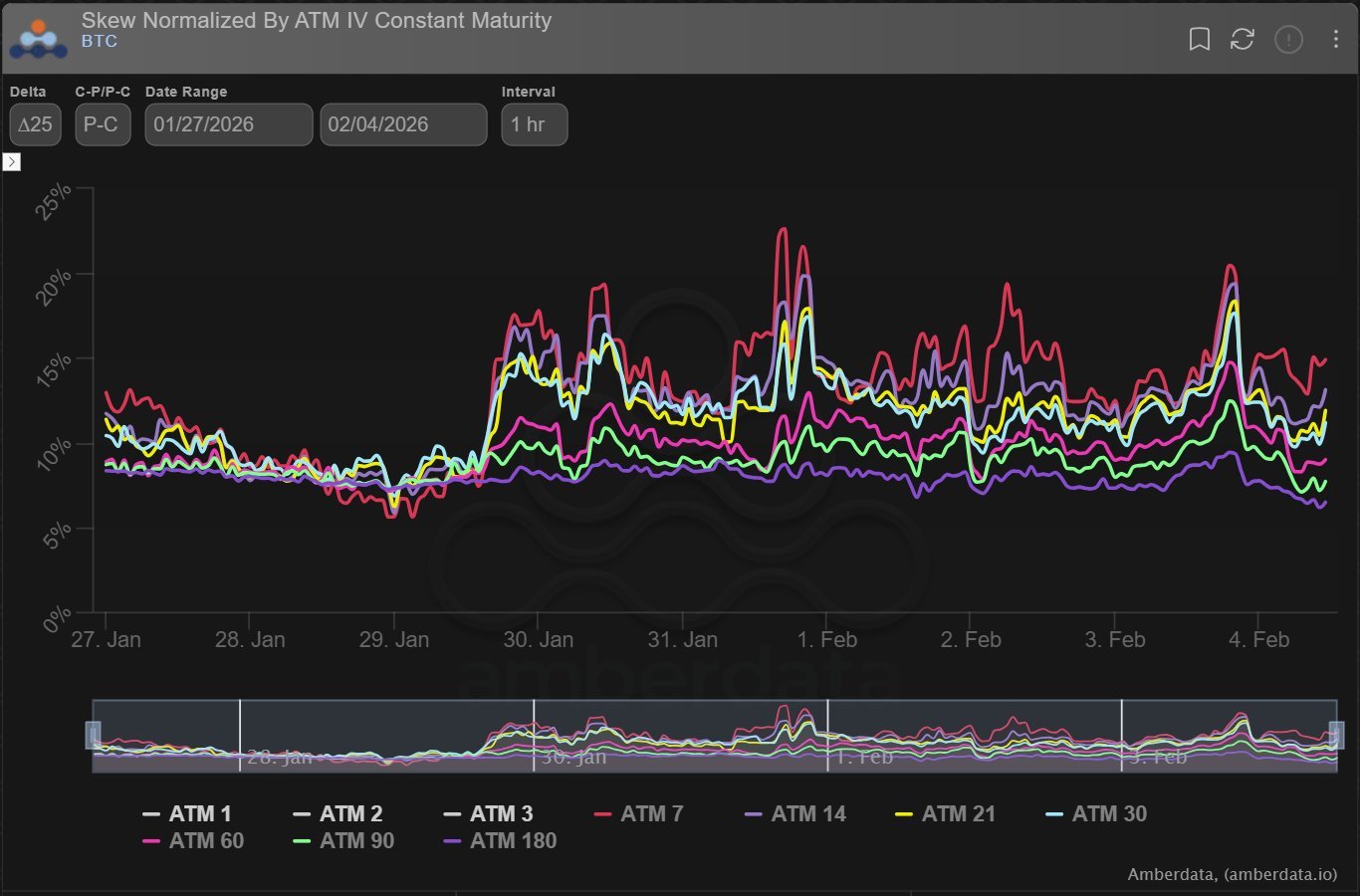

Put Skew, already elevated, remains firm.

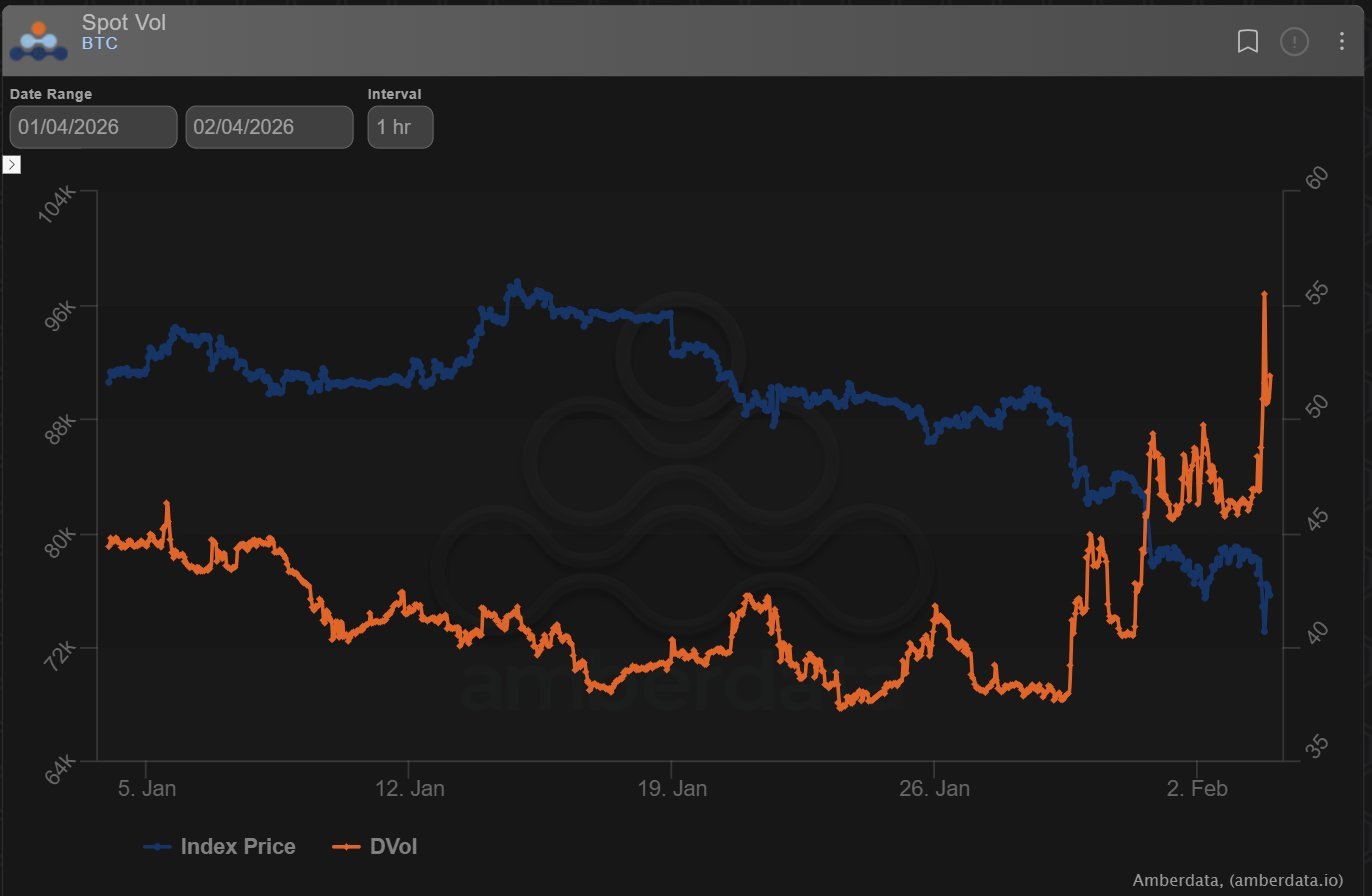

Not surprisingly too, Implied Vol firming, mostly from the desire for Gamma via general optionality.

On previous spikes in IV, there has been a quick retrace with vol sellers dominating.

This time, there was a retrace from the top, but not the ubiquitous vol crush.

Several attempts such as selling Mar+Apr strangles, but demand absorbed. A glance at 7day RV v IV suggests why.

Large unwinds of BTC+ETH D1 continue to dominate flows and narrative.

Rolling down of protection/bear plays and fresh downside action, combined with steep Put Skew and firm IV are a manifestation of the unknown depth of D1 selling.

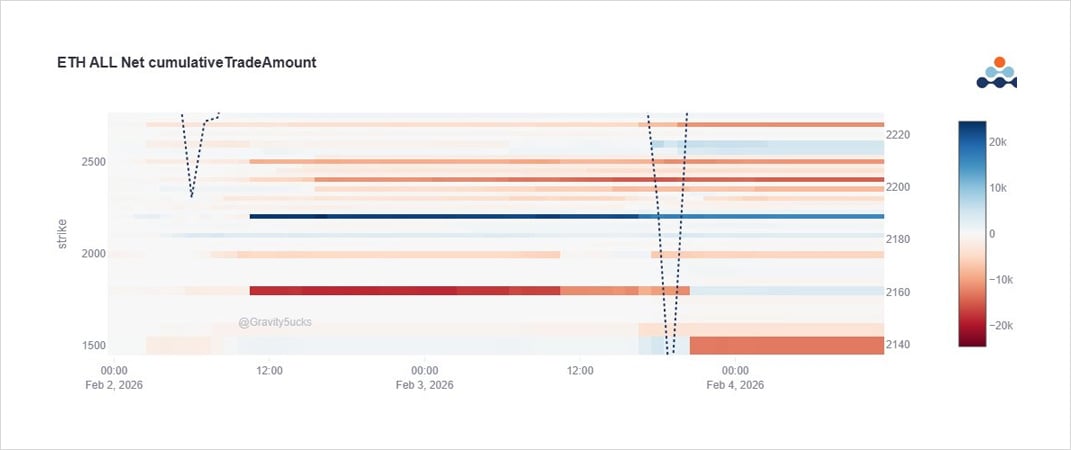

With the large public leveraged Perp long on ETH being pressured last week, similar downside protection and bearish plays were employed.

And now with that Perp position liquidated, the play remains on, ie bearish plays rolled lower to Feb 2k, Mar 2.2k Feb 1.8-1.5 Put spreads.

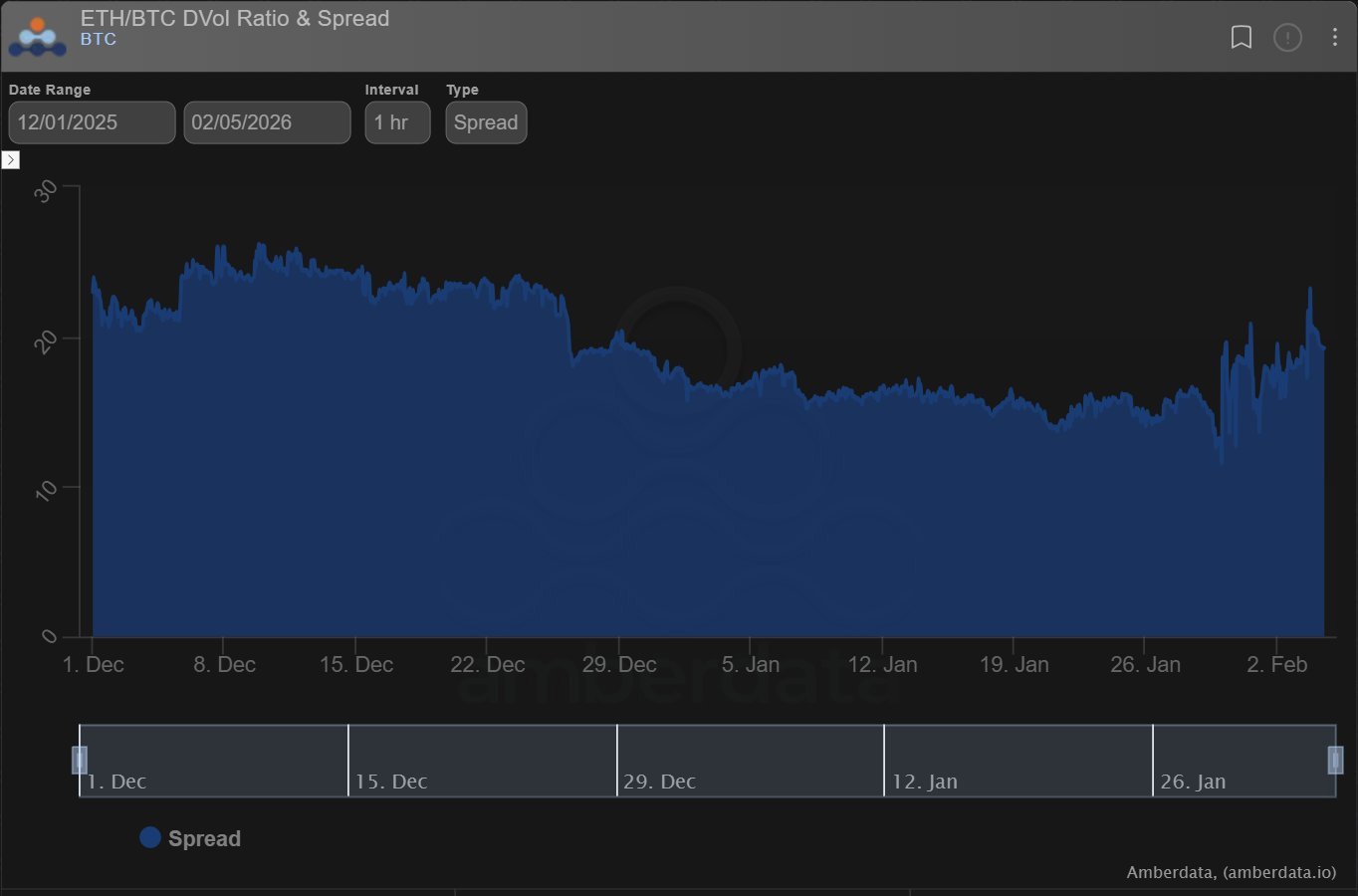

After some ETH-BTC vol spread contraction, the liquidation and Alt hedging has forced the IV spread wider again.

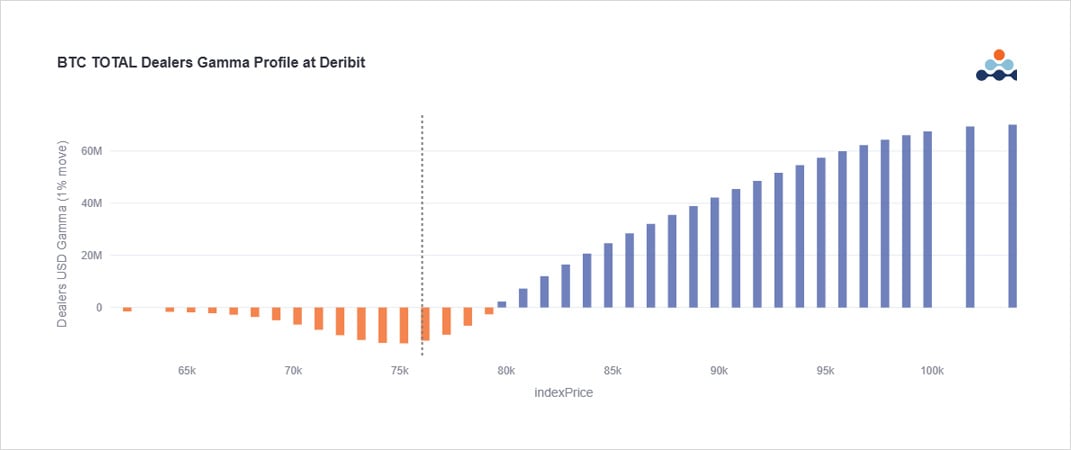

Dealer Gamma is slightly short as you would expect from the downside Put interest.

But naturally, with heightened market risks, parameters have tightened and as a result MMs are not under pressure, nor would there be a gamma shock downside.

More likely are delta stops <70k

Not all is gloom. When such narratives and indicators lean so heavily, counter traders rear their heads.

On dips, there are brave sellers of 65k Puts to acquire 85k+ Calls, taking advantage of Skew.

Not significant to be material, but just enough for me to praise if correct!

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)