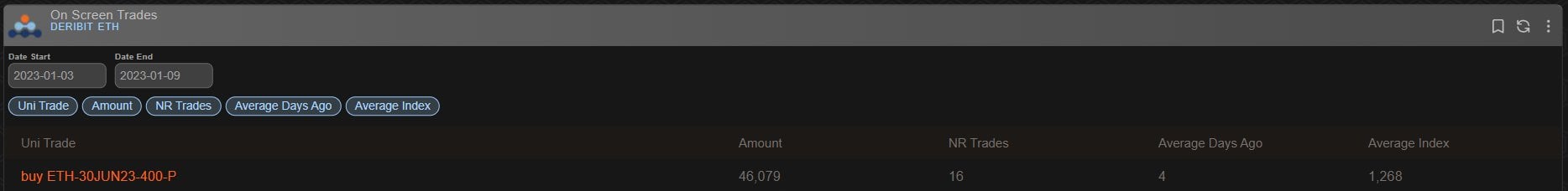

In this week’s edition of Option Flows, Tony Stewart is commenting on the ETH June 400 Puts.

January 11

Let’s talk about the ETH June 400 Puts, which seem to be the most discussed trade of the week, and yet much commentary and narratives promoted are misguided.

2) On 5th Jan, I wrote this.

Facts:

~50k ETH Jun 400 Puts were bought for an outlay of ~$600k via the Deribit Screen Order Book (DSOB).

The order was a resting order, price [0.0095ETH], not Vol defined.

With IV under pressure and ETH rallying, they traded out.

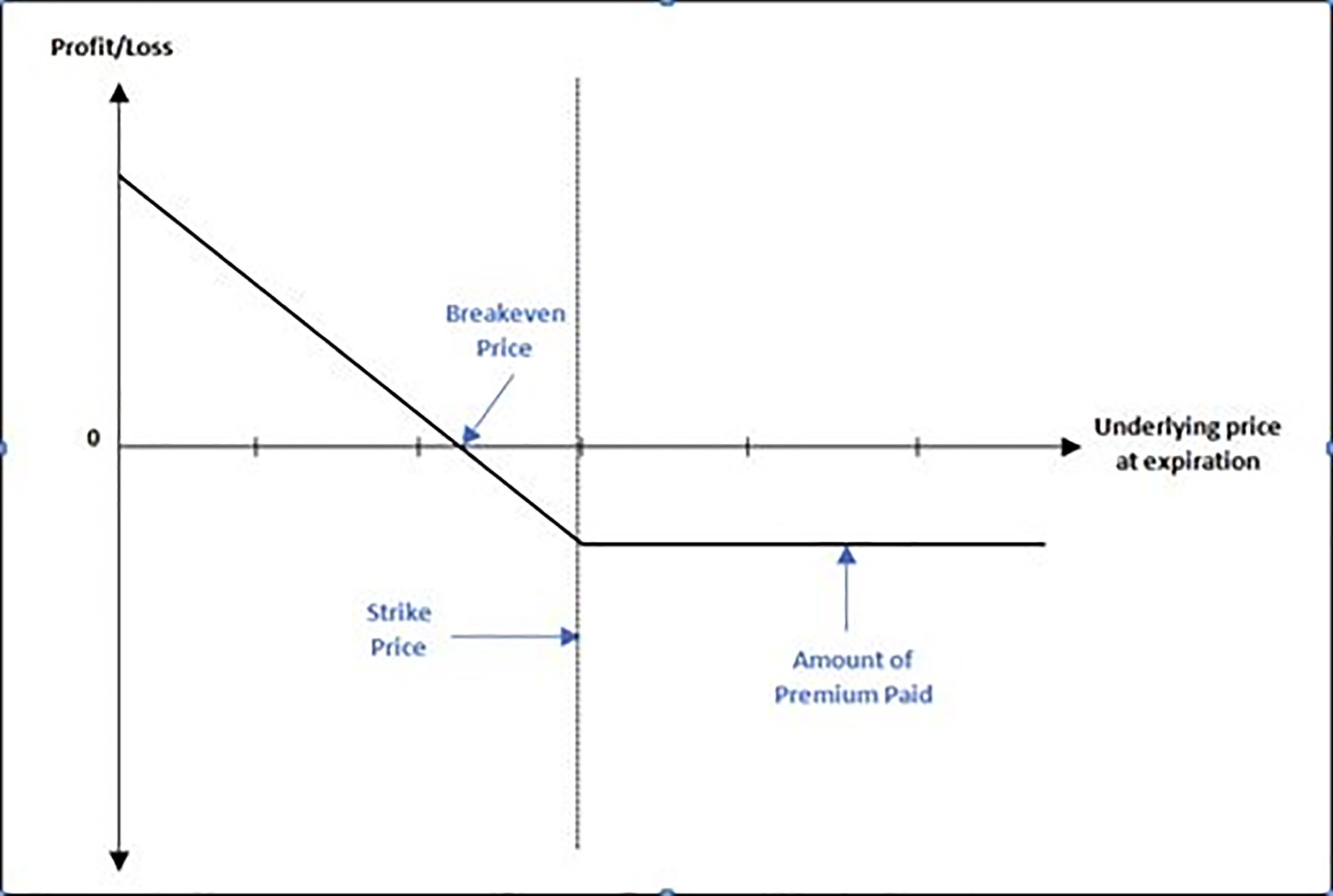

3) The first and most basic misunderstanding I have read is that these Puts will ONLY make money if ETH falls below the Strike price of 400.

A common misconception for those new to Options, who rely on simple Expiry payoff graphs (below).

In reality, Path Dependency is critical.

4) Just because someone spent $600k on a June 400 Put should not mean anyone freaks out.

If the trade related to imminent concern, a shorter maturity, closer to ATM Strike would be more obvious, same premium and higher Gamma ie more reactive if correct.

$600k is a small % AUM.

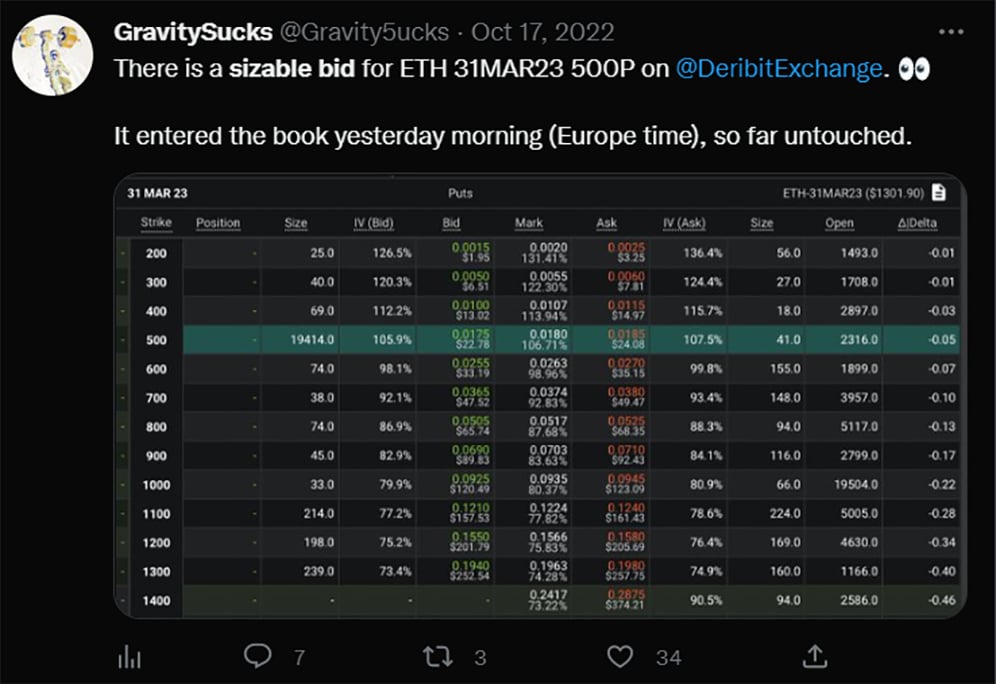

5) Possibly not the first time this actor has employed this strategy.

Just like in poker, every trader has their tell and when it comes to far OTM Puts bought via resting bids on DSOB there are only a few.

Back in mid-Oct 22, a buyer acquired ~20k ETH Mar23 500 Puts for ~450k.

6) Patrick Chu at Paradigm, made a valid observation: ‘If the entity is willing to buy them, it thinks they have value’.

Despite the fact that $600k is a small % of AUM for a large entity, given the 2022 year performance of many funds, it’s probably not the time to be frivolous.

7) So let’s speculate on possible reasons.

a) the most simple; revert to the expiry payoff.

An entity wishes to be protected below 400 ETH and has concerns.

The entity could have 50k ETH ($65m) or far less; it may have ETH in a discounted asset vehicle – effective Strike closer.

8) The entity is fearful over the next 6months, but sees a severe drop as a low probability, but one with a large payout if proved correct.

This might explain the June expiry and the nature of the Strike delta (~3% chance).

But this is where Path Dependency raises relevance.

9) How these Puts perform is not solely on Spot.

One needs to factor in Fear (level of Skew), overall Volatility (up and down), Liquidity, Gap risk, and Option demand/supply at a minimum.

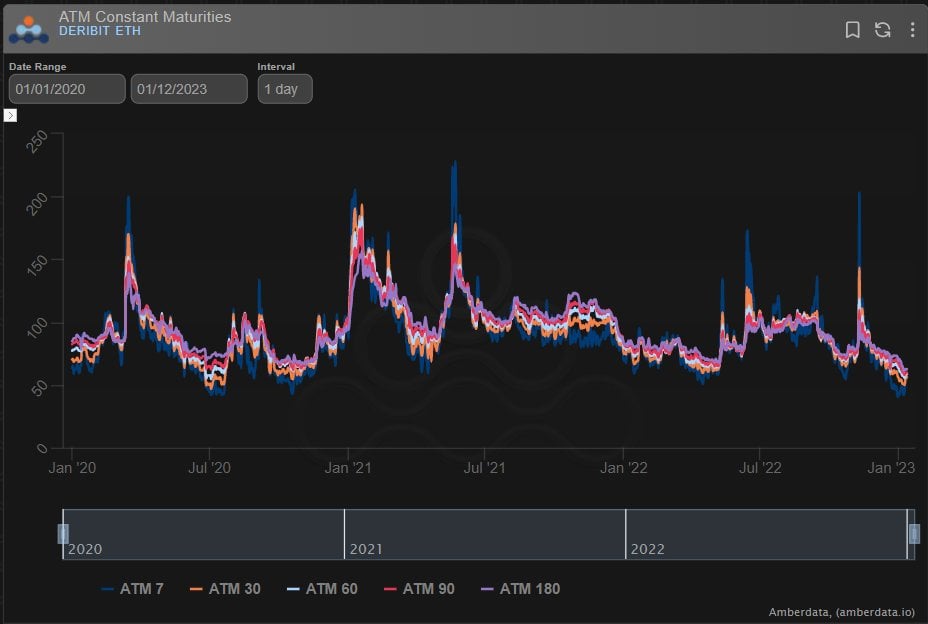

180d 3delta Put Skew sits mid-range 2022/3

180d ATM IV sits at multiyear lows. Likewise RV.

10) Liquidity now is likely better than in a crash situation. The adage ‘buy when you can, not when you need to’ springs to mind.

Below chart is a reminder of IV reaction to a sudden Gap event in March ’20. These charts don’t fully capture the severity of an event when involved.

11) Even when there isn’t a Gap event, should there be an event that increases Skew or Vol (IV or RV), then these Puts are likely to perform and increase in value.

If one of the above factors increases more than (the very small) Theta, then win. If Spot declines then double-win.

12) Defined as

c) Purchase of Convexity/Kurtosis,

ie buying ‘Wing’ OTM Options that can outperform ATM Options when markets aren’t moving due to changes in Skew and IV, and have a decent Beta when RV spikes, and subsequent IV reaction; sometimes Beta>1 due to acceleration effect.

13) d) Curve/Term Structure analysis opportunity:

Is the entity buying because he thinks Skew is low? Well, only mid-2022 levels, but perhaps if looking at the given DCG+ uncertainty.

Is the entity buying because IV is low?

Well, IV is low ATM (Jun 60%), but 400Puts are 105%+.

14) e) Buying back Skew+Vol against a Short Option portfolio.

Commentators far too often single out a trade in isolation, but it can be part of an overall Option portfolio risk reduction.

In this case, a less likely scenario as the 400 Puts are so far away on a Risk Slide.

15) There is no doubt that there are many factors that could possibly shift ETH in either direction a large amount this year.

Some of them we know about, and some we would rather not.

I can only speculate on buyer motivation, but there are ample motivations, not just ETH <400.

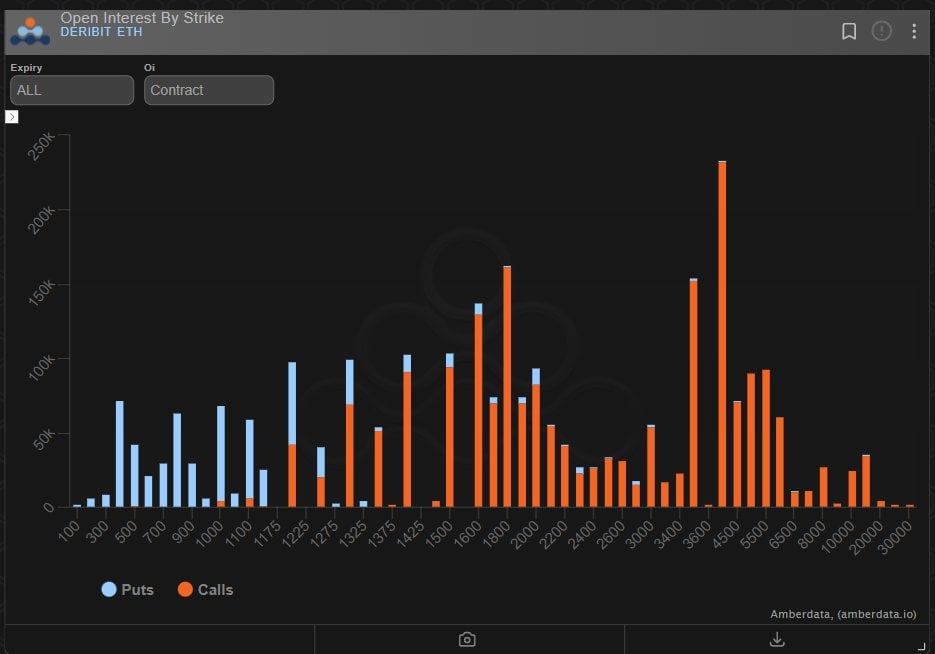

16) Note how the Jun 400 Puts are lost within the overall Open Interest.

Remember all the Calls, Call spreads + Call flys that were bought pre-Merge?

These low-premium OTM plays often go to zero, although there is time left in both these cases.

17) The resting order nature of the trade shows patience and possibly a fixed outlay commitment, no urgency.

The $600k is not large, but 50k ETH Options is not small in notional terms. Clearly, it is not as ‘massive’ as some commentators are terming it.

18) But IF the ETH market was to crash hard, then it becomes a trade of value, of size, Gamma and Vol, in a market that would likely be bereft of normal liquidity.

IV+Skew would explode.

Then we might wish we had given it as much credence as those that are currently misguided.

View Twitter thread.

AUTHOR(S)