In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

A sniff of exhaustion as recent Sep 64-67k Call buys struggle to perform, a Fund TPs on ETH Sep 2.4k Calls near the day’s high at 2670, and then BTC Oct 55k + ETH Oct 2.3k Puts are acquired.

So far 63k has held, but tested.

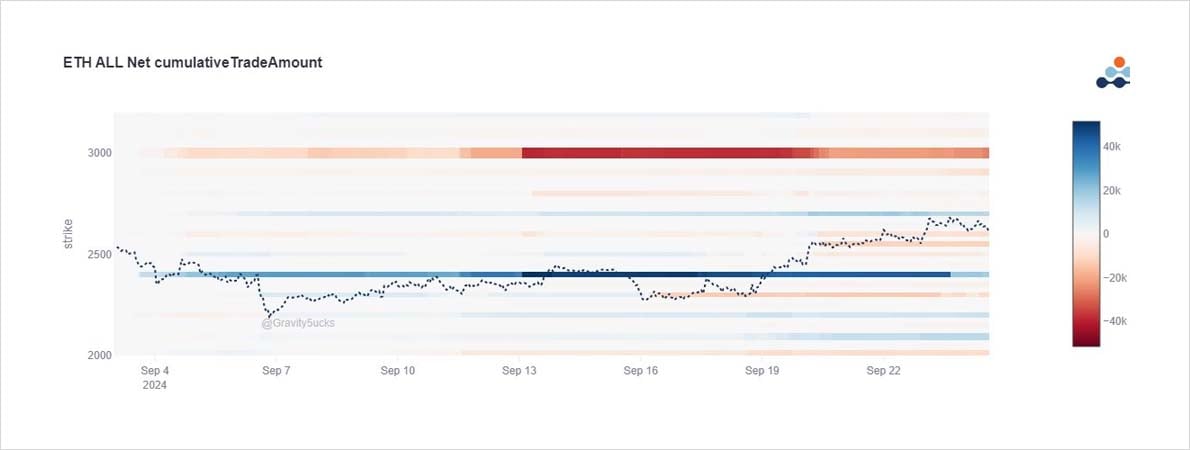

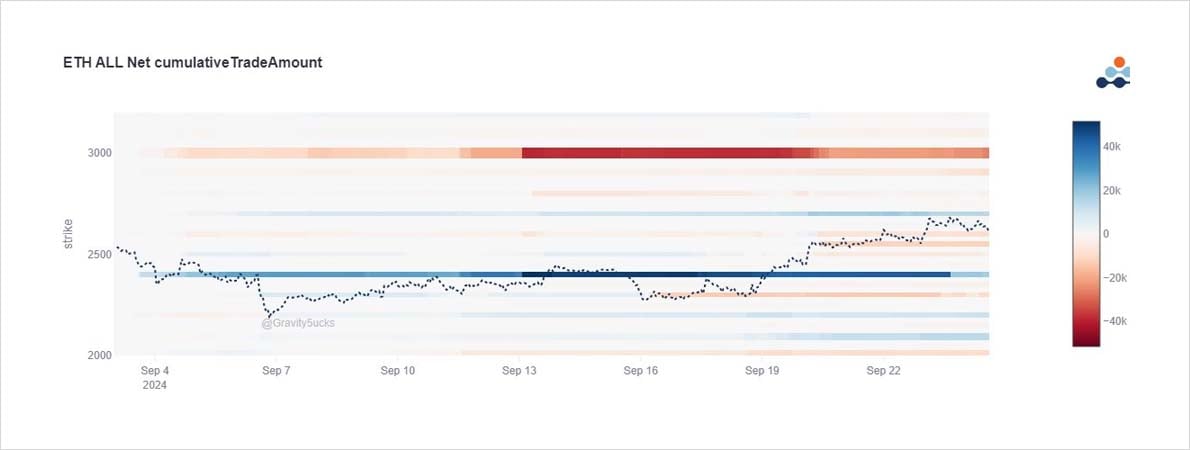

ETH has outperformed, & Dec 2.4-3k x30k still owned.

2) ETH bounced back strongly, with Sep 2.3-2.7k Calls bought within the last couple weeks along with a Dec 2.4-3k Call spread all very productive. The owner of the Sep 2.4k Calls TPd near the day’s high of 2.7k, selling 23k for a gross credit of $6.5m.

Long Dec 2.4-3k CS remains.

3) On ETH+BTC today, Oct 2.3k Puts ($500k cost) and Oct 55k Puts ($800k cost) acquired.

And a noticeable drop in Call buying today after some decent fast money purchases of Sep 64-66k and Oct 70k+ Calls bought since Friday.

Perhaps exhaustion as the key 65k+ target unrealized.

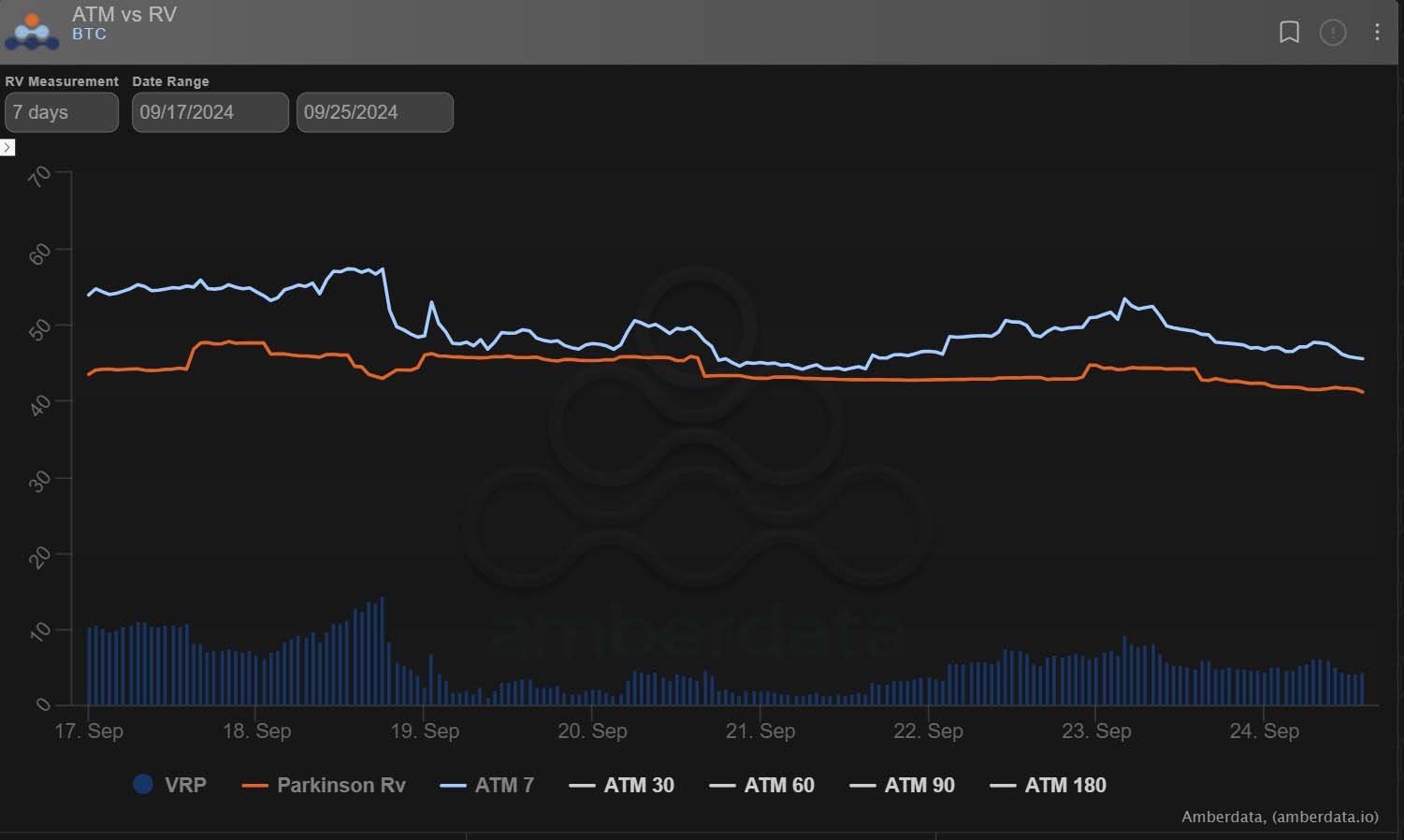

4) While the term structure is in contango, the low BTC range has not resulted in the VRP being crushed. The IV has held firm (BTC Dvol still 51%) as there has been decent demand from near-dated Calls+Puts keeping the IV|RV premium, on hopes/anticipation of a clear break <63k>65k.

View Twitter thread.

AUTHOR(S)