In this week’s edition of Option Flows, Tony Stewart is commenting on BTC still trading within a narrow range with some brief volatility.

May 15

After briefly falling below the hard deck, BTC has been quick to recover to 27.3k, and now sitting just above the Call buyers have returned hoping the level will hold and push upward. Fast Money so far, Gamma Call buyers May 18-26th 28+29k Calls, 28-30k Call spreads, net 2.5k+.

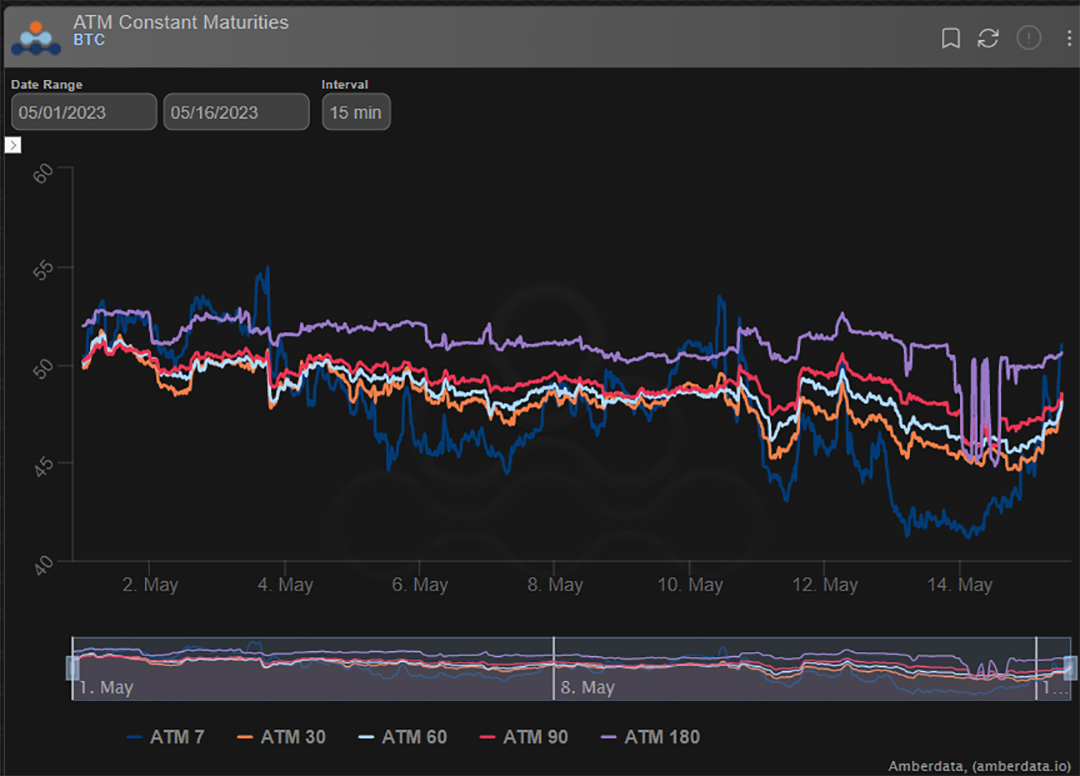

2) This morning’s Call buying, be it very near-dated, has pushed 7-14day IV higher after the weekend lull and pressure from last week.

The 27.3k BTC level is pivotal. Tested a couple times now, a good push-up may compound confidence.

And Vice-Versa ofc; NB Put buying is limited.

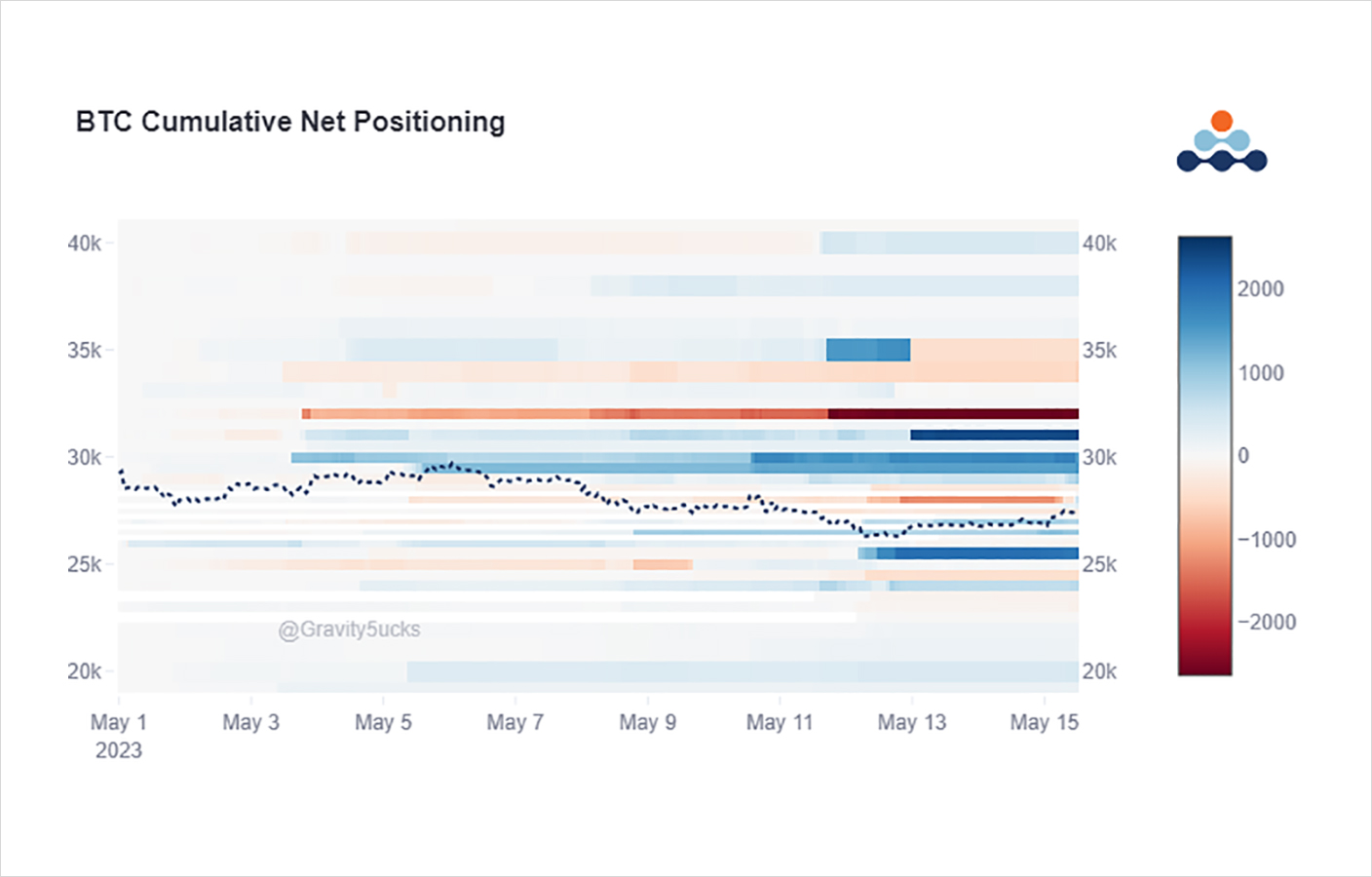

3) Net positioning still appears bullish.

The ‘fake’ Govt selling wallet having dashed hopes temporarily and bulls looking for momentum to rebuild.

A buyer of Jun 31-35k Call spreads x2k at the weekend may well have been covering a recent Jun 32-35k Call spread sale just prior.

View Twitter thread.

AUTHOR(S)