In this week’s edition of Option Flows, Tony Stewart is commenting on aligned flows in BTC and ETH, and the upcoming ETF decision day.

August 9

Aligned flows in BTC+ETH with fast money accumulation of near-date Aug+Sep Calls Block+DSOB.

ETF delay/approval and Financial Crypto scrutiny headlines buoying both BTC+ETH.

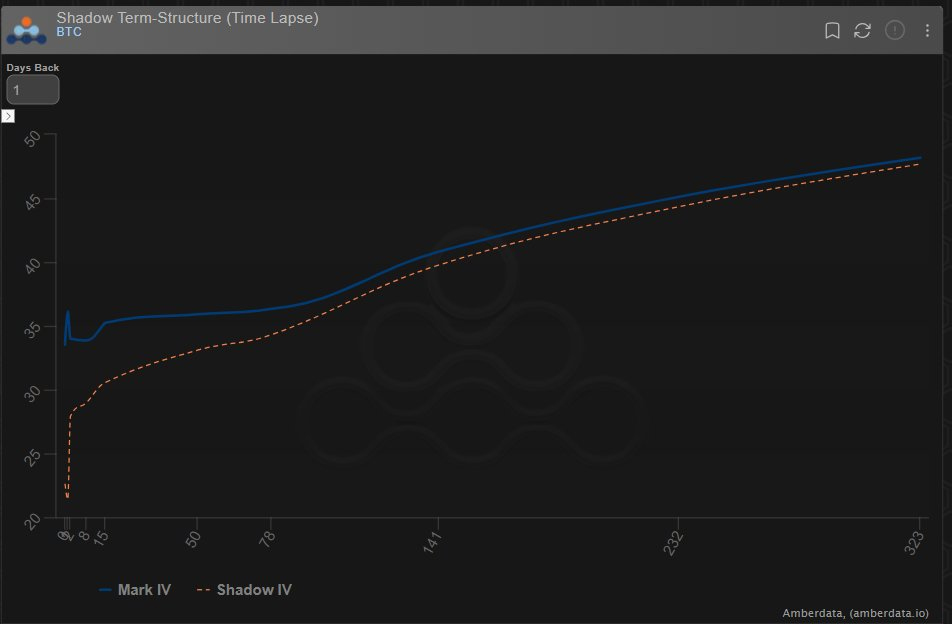

Likely TWAP BTC Spot buyer, and dislike to sell BTC Gamma vs ETH resulting in relative BTC Dvol pump.

2) With BTC Aug 29-32k Calls bought 2k+, dragging up Sep+Oct IV forcing Dvol >40% and BTC Spot+basis firming, while ETH Dvol languishes unmoved at 34% hints at a BTC-centric buyer.

One can’t help but think of MicroStrategy, whether executing or the anticipation of that purchase.

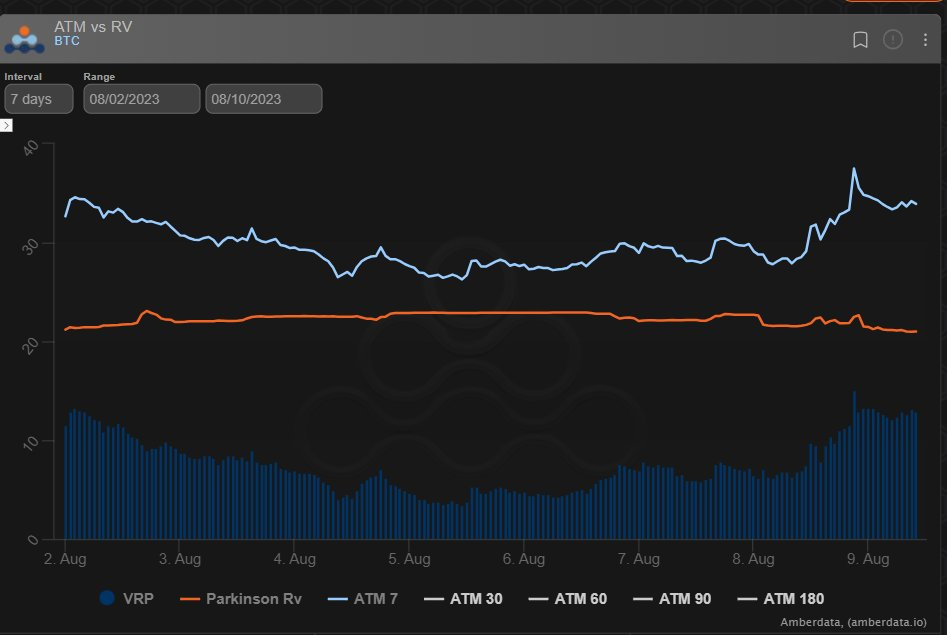

3) With Funds already positioned for ETF approval with Oct-March Calls (+spreads), the IV move in the last couple of days is much more fast-money related.

There has been little follow-through in Dec+further maturities, which in fact has observed copycat Call Yield DSOB sellers.

4) Of course, we have observed these short-term plays before (if this is indeed MSTR related).

The anticipation can often be more than the reality and buyers need to be very right with such a large IV>RV premium, for their Options to pay off sufficiently for the risk-reward.

View Twitter thread.

AUTHOR(S)