In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

BTC Puts bought last week playing their part on the fall in Spot down to 112k on Saturday.

No continued outsized trades, but Fast money continued to buy momentum Puts, some TPd, and Instos/miners selling out OTM Aug+Sep 125k+ Calls.

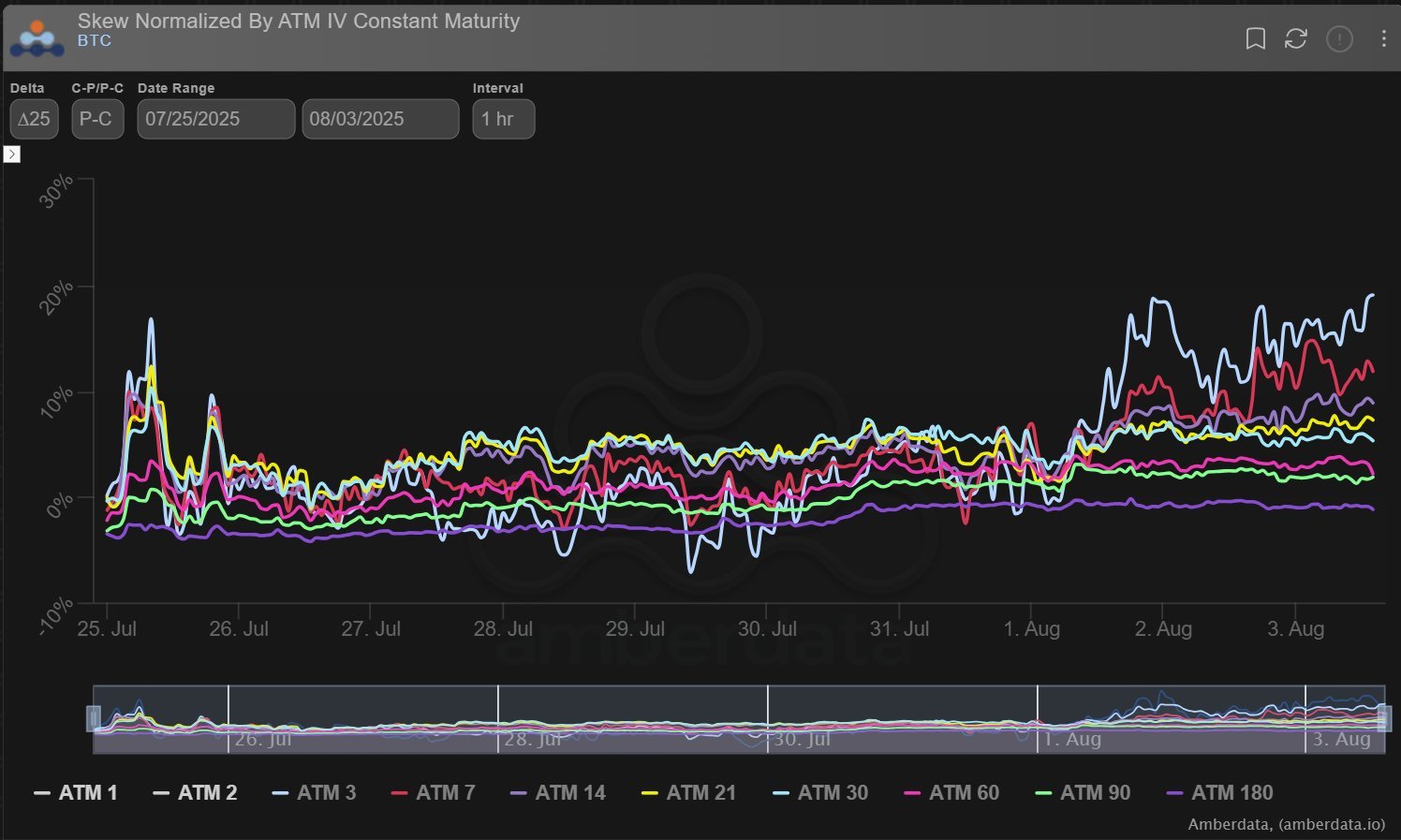

Put Skew firms a little more, but contained.

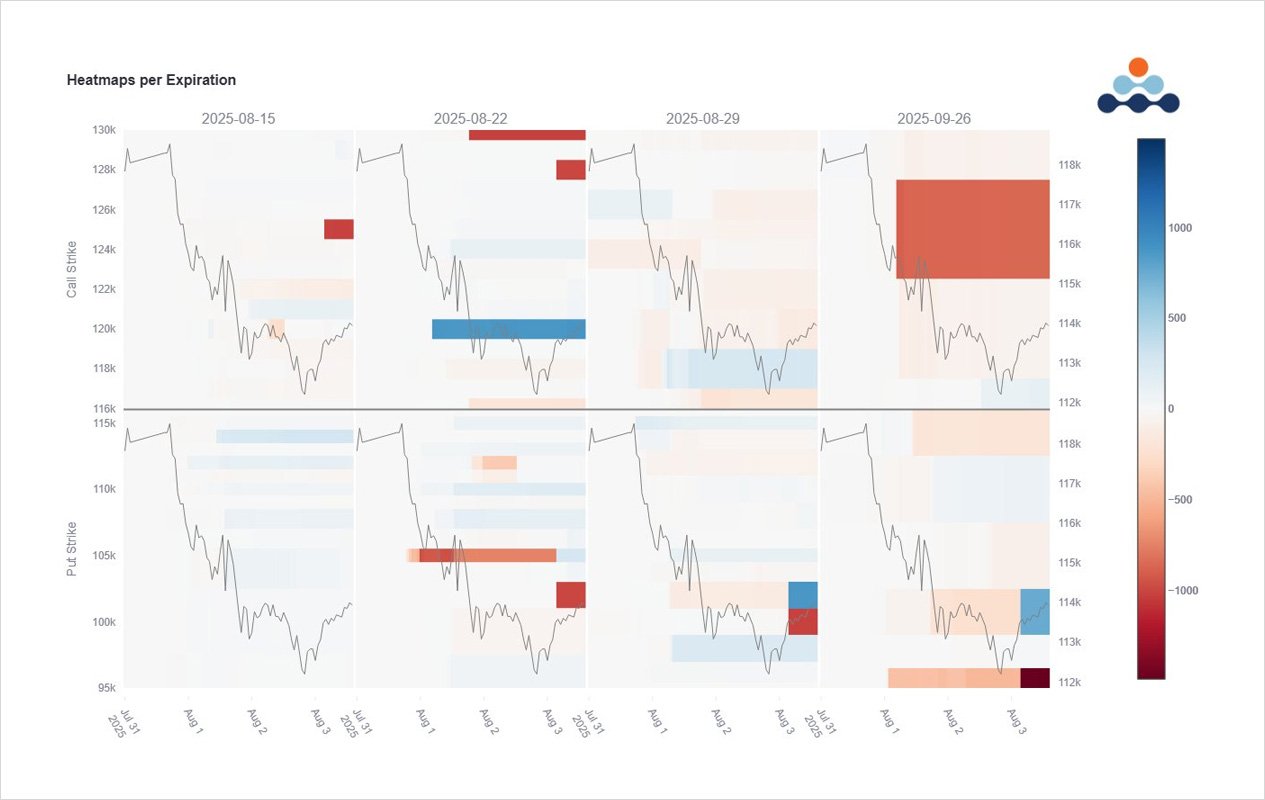

Messy strategy combinations forcing a breakdown by maturity to decipher:

Shorter dated (to the left) Puts bought (bottom left) by Fast money; low premium high momentum plays. A combination of Aug29+Sep (far right) tight Put spreads bought, funded by selling Aug+Sep OTM Calls.

If I charted BTC IV it would be similar to a medical flatline, illustrating a lack of large outsized non-strategy combination flows despite the Spot move.

But Put Skew has firmed, as Put buying and Call selling continue, reflecting downside play/hedges, plus Call dump/writes.

View X thread.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)