In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

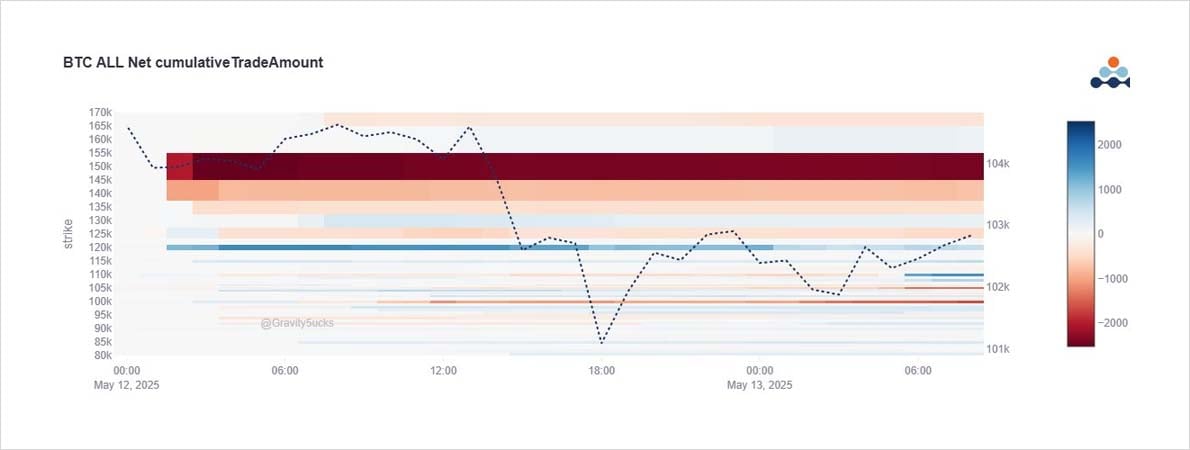

Pre-Bessent US-China trade details, BTC saw large buying of Jun-Sep Call spreads and 1×2 Call spreads.

110-120k Strikes bought, 140+150k Calls sold in Jul+Sep.

Initially, BTC spiked to 106k, but a lack of hashed-out info led to a sell-off.

Some Jun 110k Calls sold softened IV.

2) Data shows Jun 120k focussed buying, funded with selling of Jul+Sep 140k+150k Calls:

- Jun 120k-Jul 150k Call spread bought

- Jul 140k Calls sold.

- Sep 100k-150k 1×2 Call spread bought

- Jun 115k-135k Call spread bought.

- Jun120k-Jul125k Call spread bought.

Jun110k Calls sold.

3) US risk markets (arguably more forward-looking) did not sell-off like BTC, but VIX did retrace <20% as some downside risk is now likely off the table.

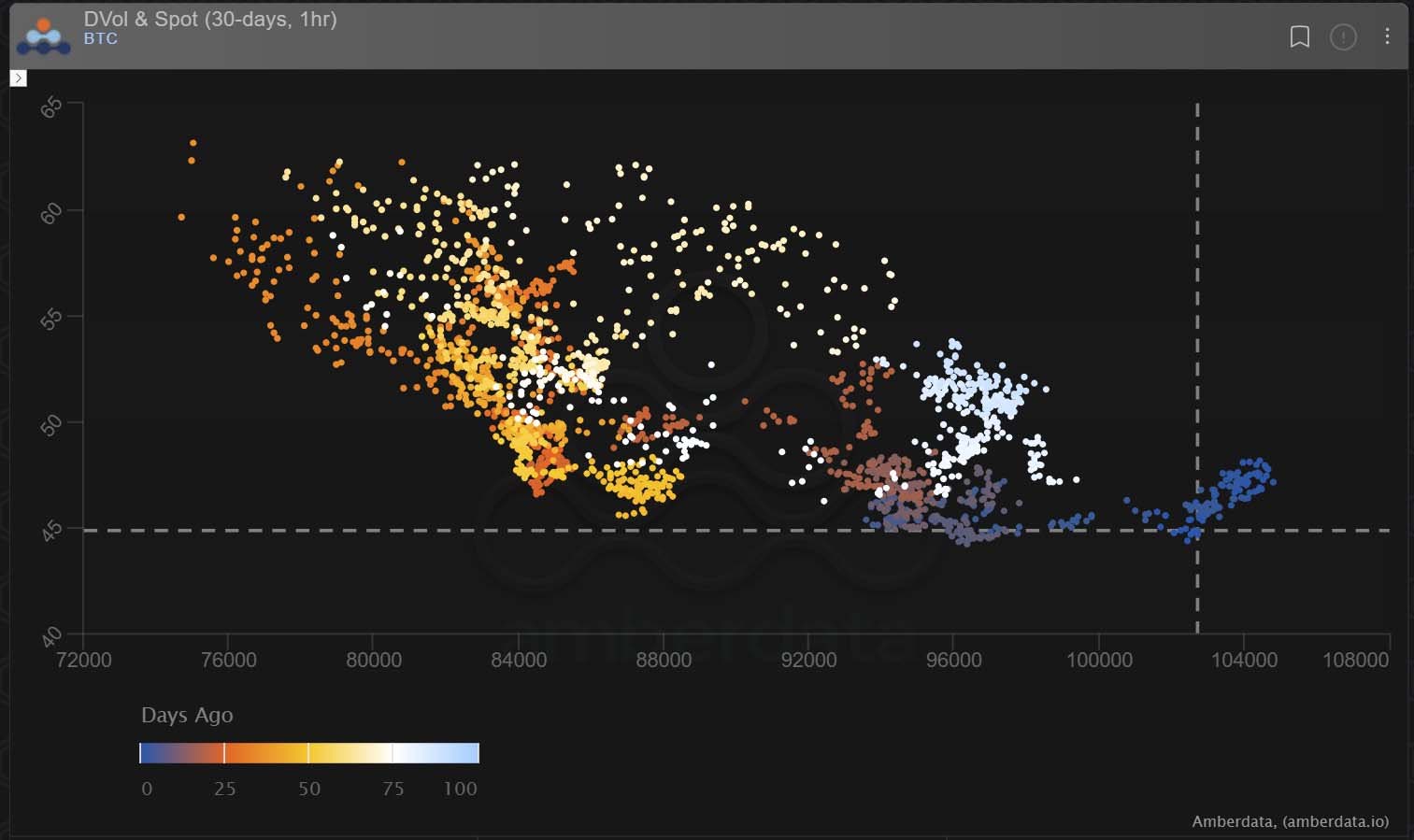

BTC+ETH IV also sold off in the same manner.

It’s possible the below chart gives some indication of future IV on Spot moving.

View X thread.

AUTHOR(S)