In this week’s edition of Option Flows, Tony Stewart is commenting on the market movement after the latest ETF releases in HK.

HK ETF disappointment, front-run of ‘Sell in May’?…perhaps adding to continued poor sentiment.

BTC 61k, ETH 3k.

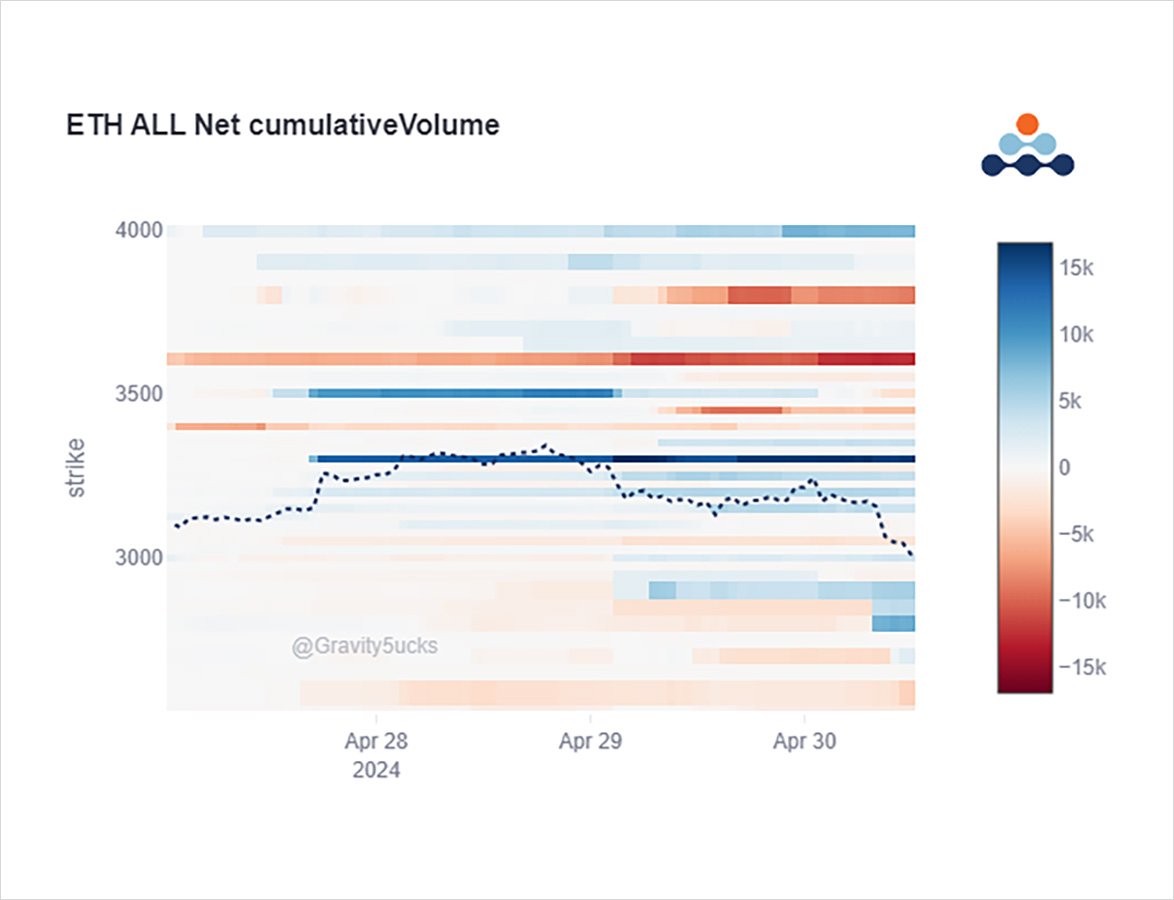

ETH continued selling of 3.5k+ Calls but today May10 2.8+2.85k Puts bought for downside (or hedge).

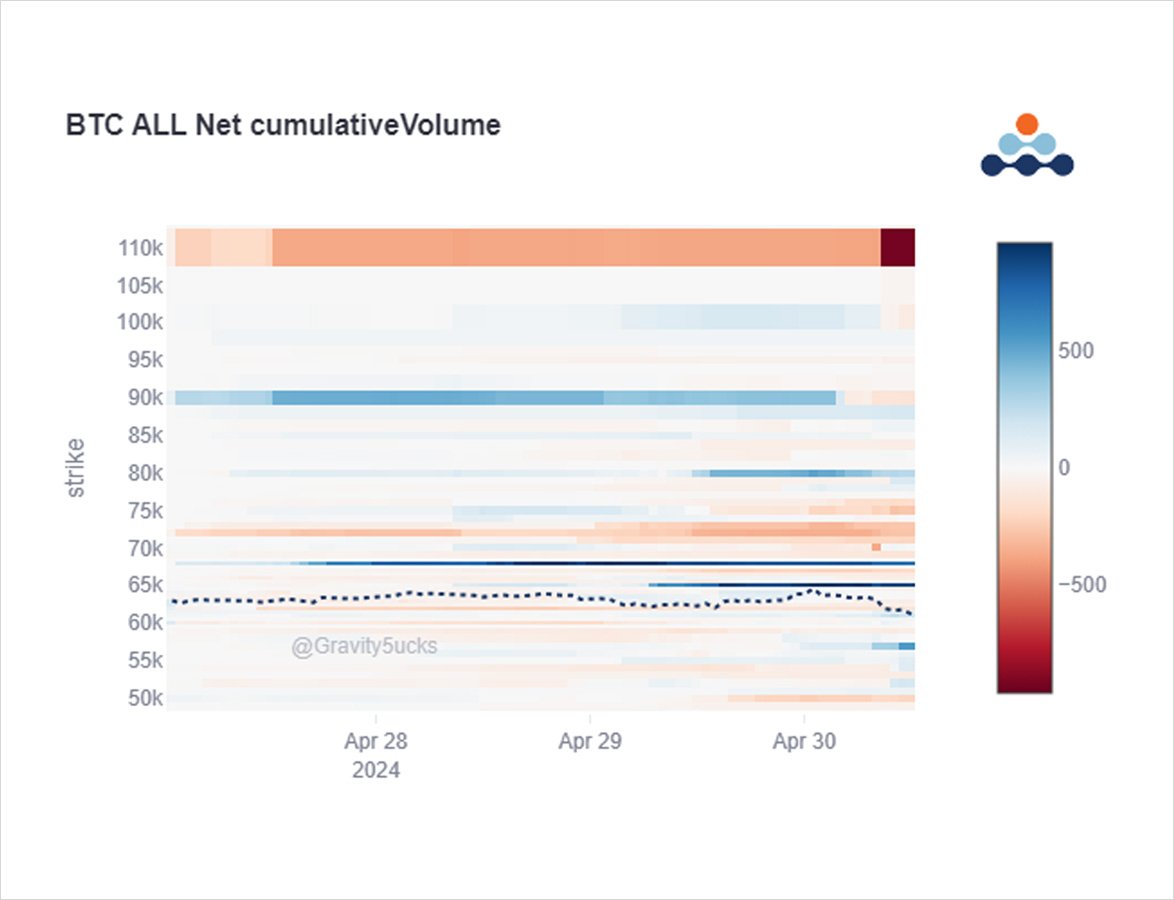

BTC Sep 90+110k Call dumped, but signs of Jun+Dec Vol buying.

2) A weekend push higher on ETH to 3350, and short-covering of May 3.3k Calls pushed ETH Dvol to 70% before both Spot & Vol too plummeted via 3.5k+ Call selling to 60%.

But in the last few hours, May10th 2800+2850 Puts get lifted as <3k looks imminent and Dvol surges back to 68%.

3) BTC has also shown signs of Call selling, some Yield, some giving up.

An example of the latter observed via Sep 90k+110k Calls sold 1k.

Pain from lower spot and IV (Dvol down to 54% at one point) is forcing some hands.

But opportunity benefits some, as Jun 65k+Dec70k lifted.

4) The BTC Jun+Dec Call buyers exhibit some tells that they are one of the same, both in terms of timezone and block size.

Also, both were bought delta-neutral, and perhaps was done to exclusively buy Vol/convexity.

It’s not known publically if the perps were unwound to be naked.

5) BTC Vol in a fairly tight range, but ETH Vol+Spot has whipped 10% as bulls+bears battle out the 3000-3350 Spot range, with hopes and dismay regarding APAC HK ETF inflow and some EigenLayer protocol + general staking news to blame.

BTC Dvol 57.5%, ETH 69.5% now, but volatile.

View Twitter thread.

AUTHOR(S)