In this week’s edition of Option Flows, Tony Stewart is commenting on the low Vol, selling of Call Skew, and the Spot ETF decision.

July 26

The sun rarely shines on Vol during summer.

Dvol (BTC+ETH) at 38% year lows.

Block activity reduced.

Elevated Call Skew sold on DSOB to exit or yield.

Security-related excitement contained.

Spot ETF decision/delay mid-Aug awaited.

FOMC today 0.25 expected, Pow wording unknown.

2) BTC flows uninspiring this week; an IV drift as 7day RV fails to excite. Sep+Dec+Mar upside Call flow predicts an ETF Spot approval but currently bleeds.

ETH follows a similar path lower but flows engaged.

30k Sep 2.1+2.2k Calls sold on DSOB.

20k Mar 1.9-2.8k Call spread bot.

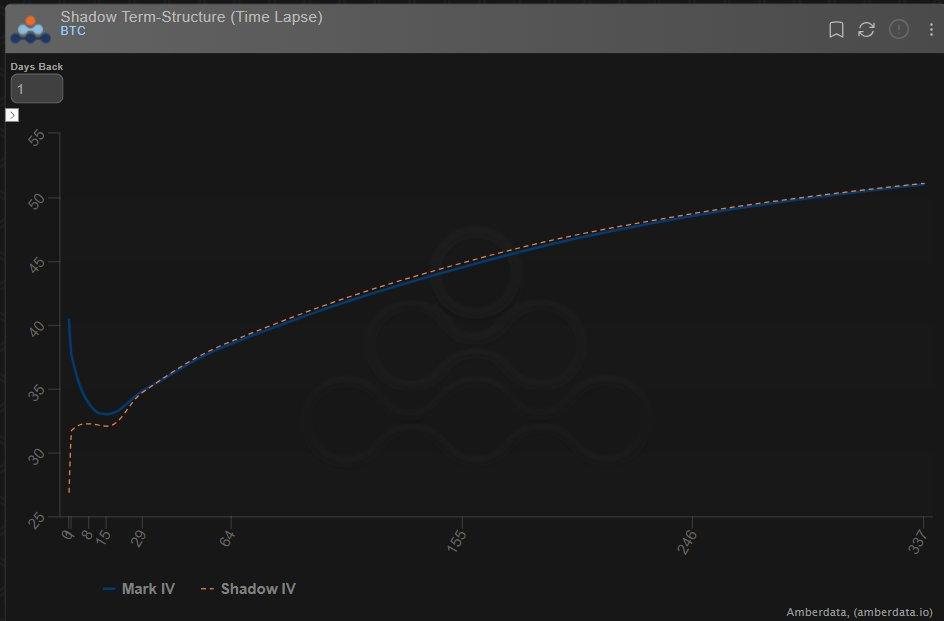

3) A nudge at the front of the curve ahead of FOMC and Powell guidance.

But otherwise, the term structure in perfect contango, with no Aug/Sep bump indicating an ETF Vol play.

Plays exist via upside Calls+Spreads but are counterweighted by sellers due to VRP (7d 10%, 30d 3%).

View Twitter thread.

AUTHOR(S)