In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

After recent large Call buying, BTC consolidated.

With an eye on Macro, views are divergent.

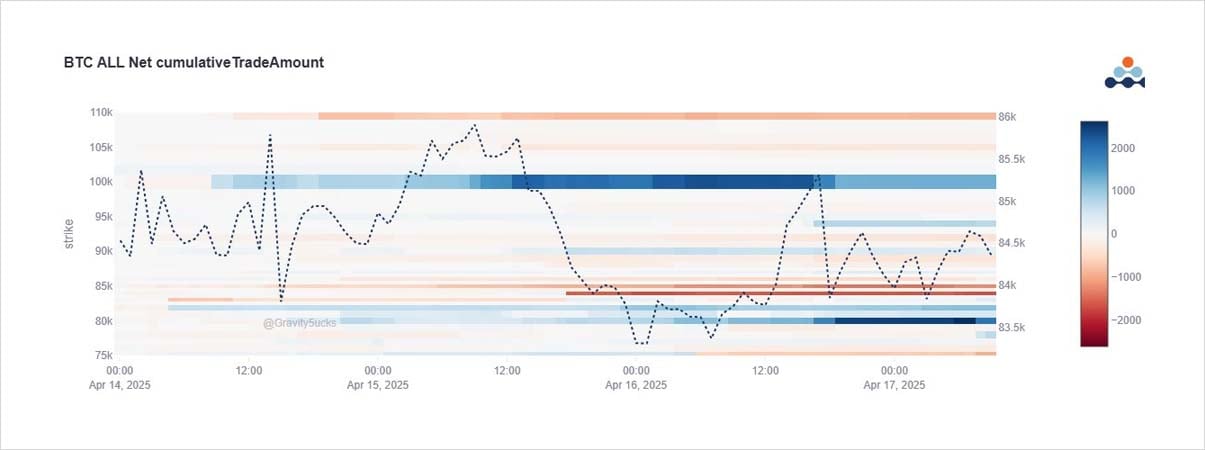

90-100k Call buying continues, some funded by selling 75k and lower Puts, some rolled up from an 84k long.

The opposing view has renewed buying of 80k Puts and selling of 100k+ Calls.

2) An April 84k long was rolled up to 50% size May 90k Calls. Additional May 94+100k Calls lifted.

Above 100k, Jun 105+110k Calls sold.

And the 100k Strike was used to sell in Sep expiry to fund buying the Sep 80k Puts.

Additional 80k April Puts bought.

But May2 75k Puts sold 1k.

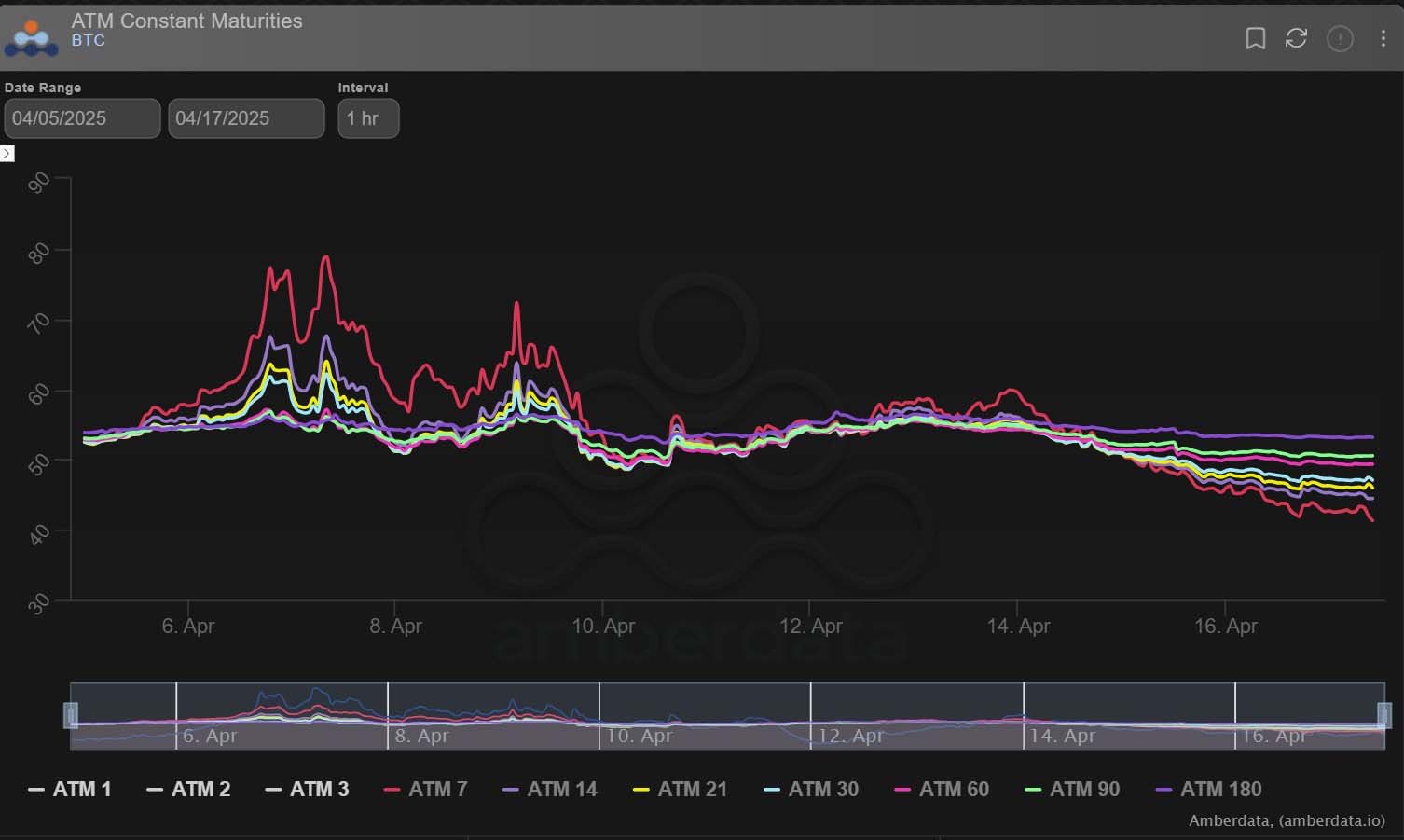

3) VIX has fallen back substantially from 50% to 30%, but 30% is still elevated for S&P risk and warns that the macro situation is still unraveling rather than resolving.

BTC IV has also fallen back, with decent unloading of April 84k Gamma, and Jun Vega wings.

BTC Dvol now <50%.

View X thread.

AUTHOR(S)