In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

A recognized perk of Options over Perps is avoiding liquidations on a sharp move, and therefore being able to sustain a view.

But sometimes the human element steps in to close a position that no longer appears to have momentum.

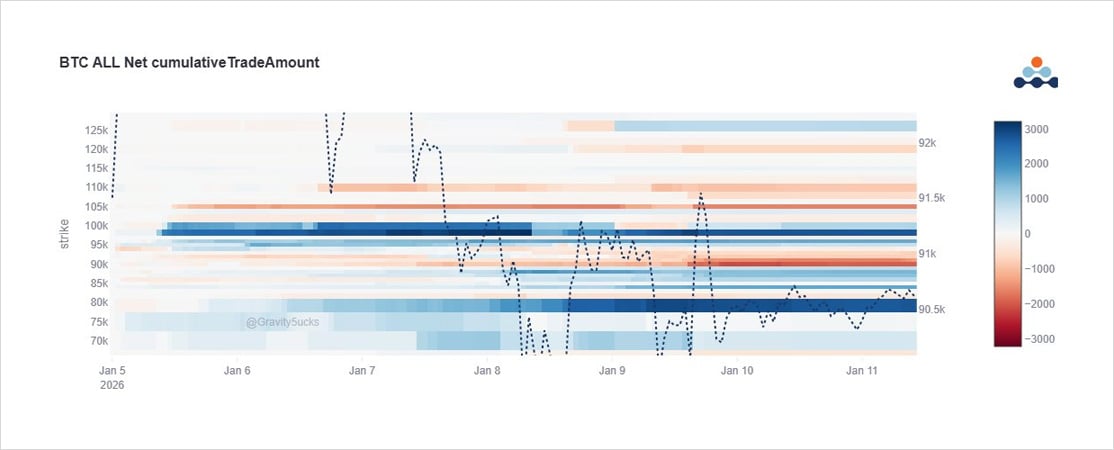

After last week’s Call buys, a chunk is purged.

Looks messy; represents buys last week of Jan16 94k,Jan30 98k+Feb100k Calls, and this week a Jan16 94k dump and partial purge of the Jan30 98+Feb 100k Calls. Some older Jan 100k Calls rolled to Mar 125k.

In addition, downside Mar 70-80k Puts bought, some 110-120k Call funded.

Eli12, a far more cautious and less optimistic positioning for Q1 than the first few days gave promise.

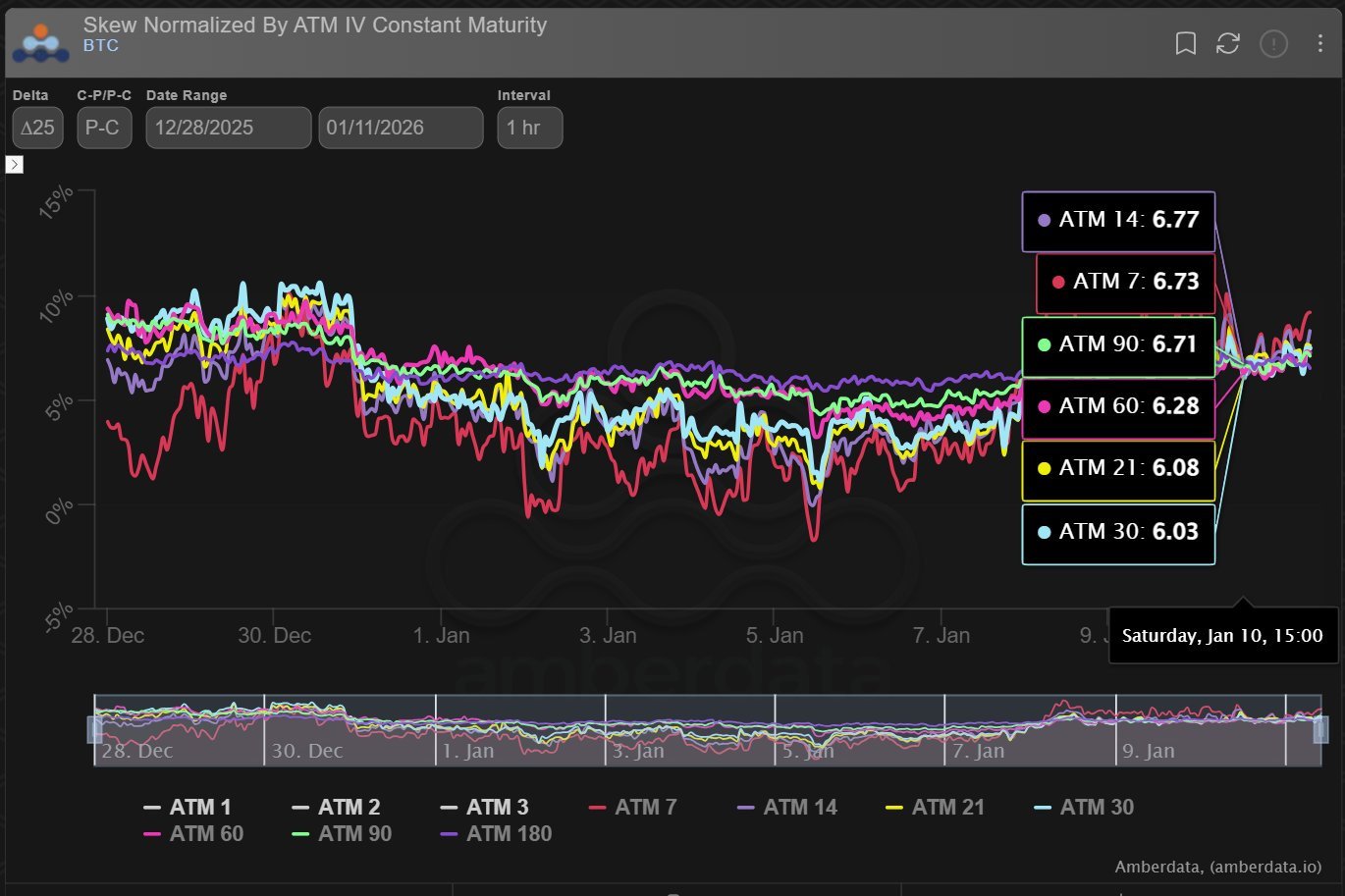

25delta Skew has risen from an average of 4% Put premium back up to 7% as a consequence of the last few days’ flows.

Tied in with US hours BTC selling and macro uncertainty.

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)