In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

The dominant Put buying paid off, as BTC dipped to 74.5k.

Mixed flows since with some Puts Tpd, and Calls sold on rallies.

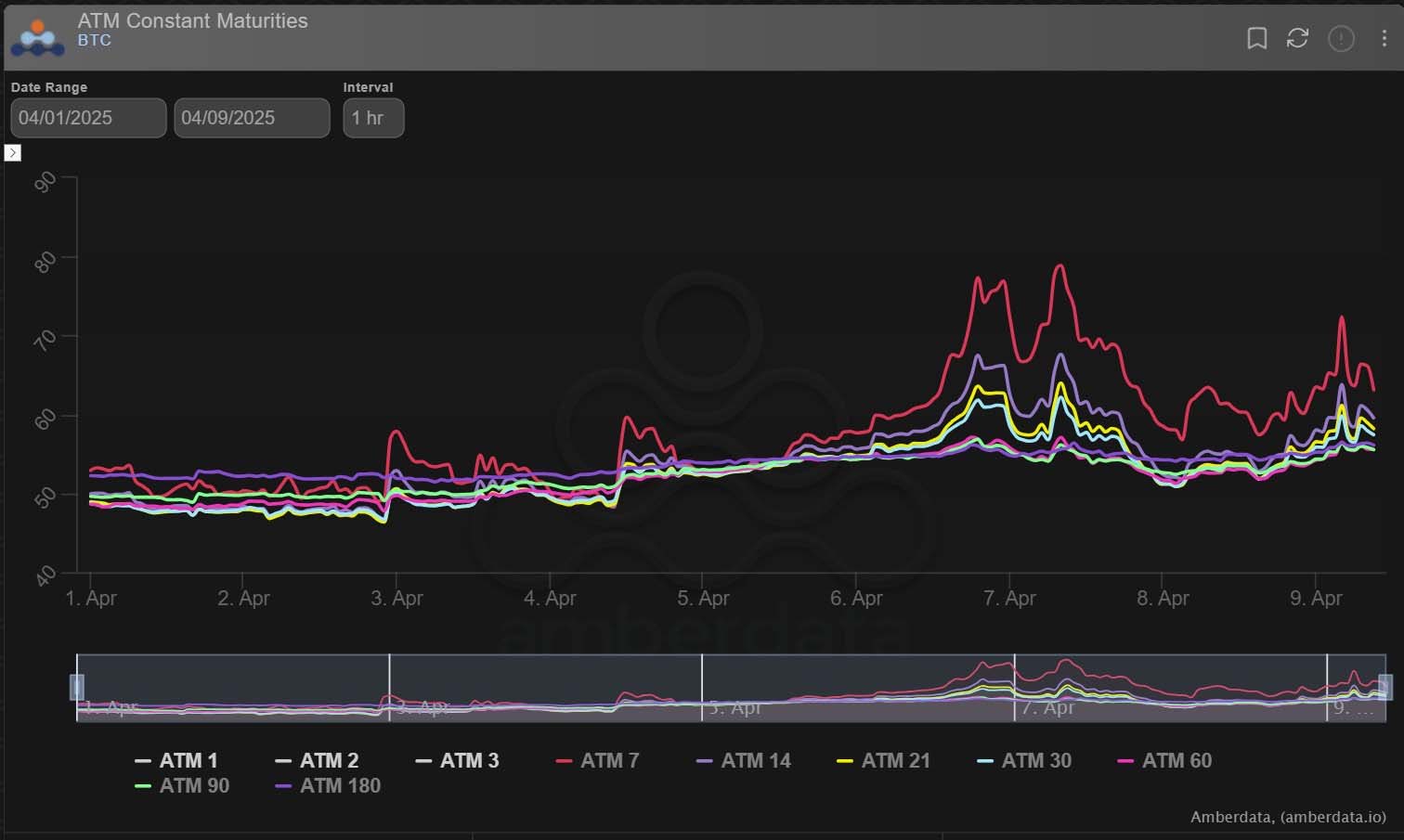

The impact was a retrace in IV, which allowed an opportunity for Option buyers of April 70k Puts +84k Calls on global uncertainty, evidenced by VIX>45%.

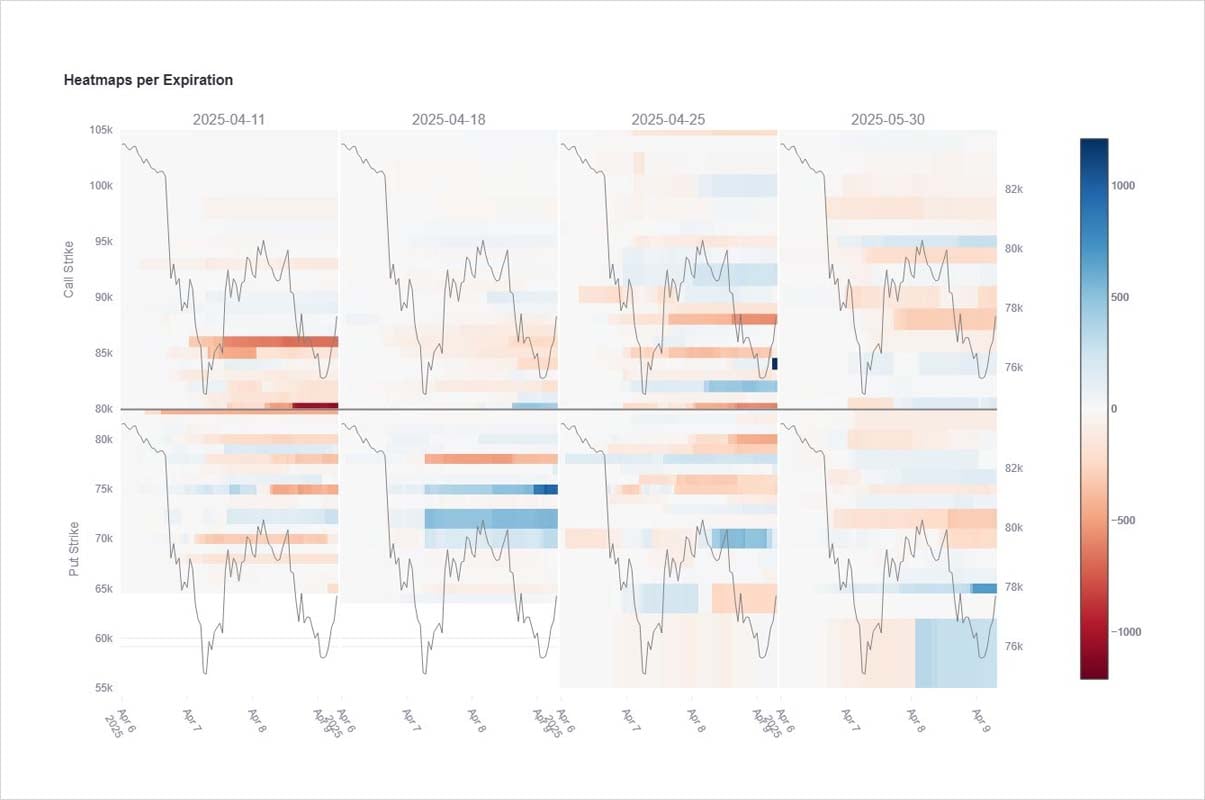

2) A picture normally paints a thousand words but in this case, it could be best described as the uncoordinated work of many separate artists, as no clear pattern has emerged over the last few days with different entities having differing remits and views in global uncertainty.

3) A brief fake headline on tariff delays injected upside force to risk mkts, and BTC rallied to 81.5k.

Although dismissed, this highlighted sidelined money ready to pounce and led to unwinds and TPing of Puts. As the rally faded, Calls were sold too.

BTC IV and S&P VIX dipped.

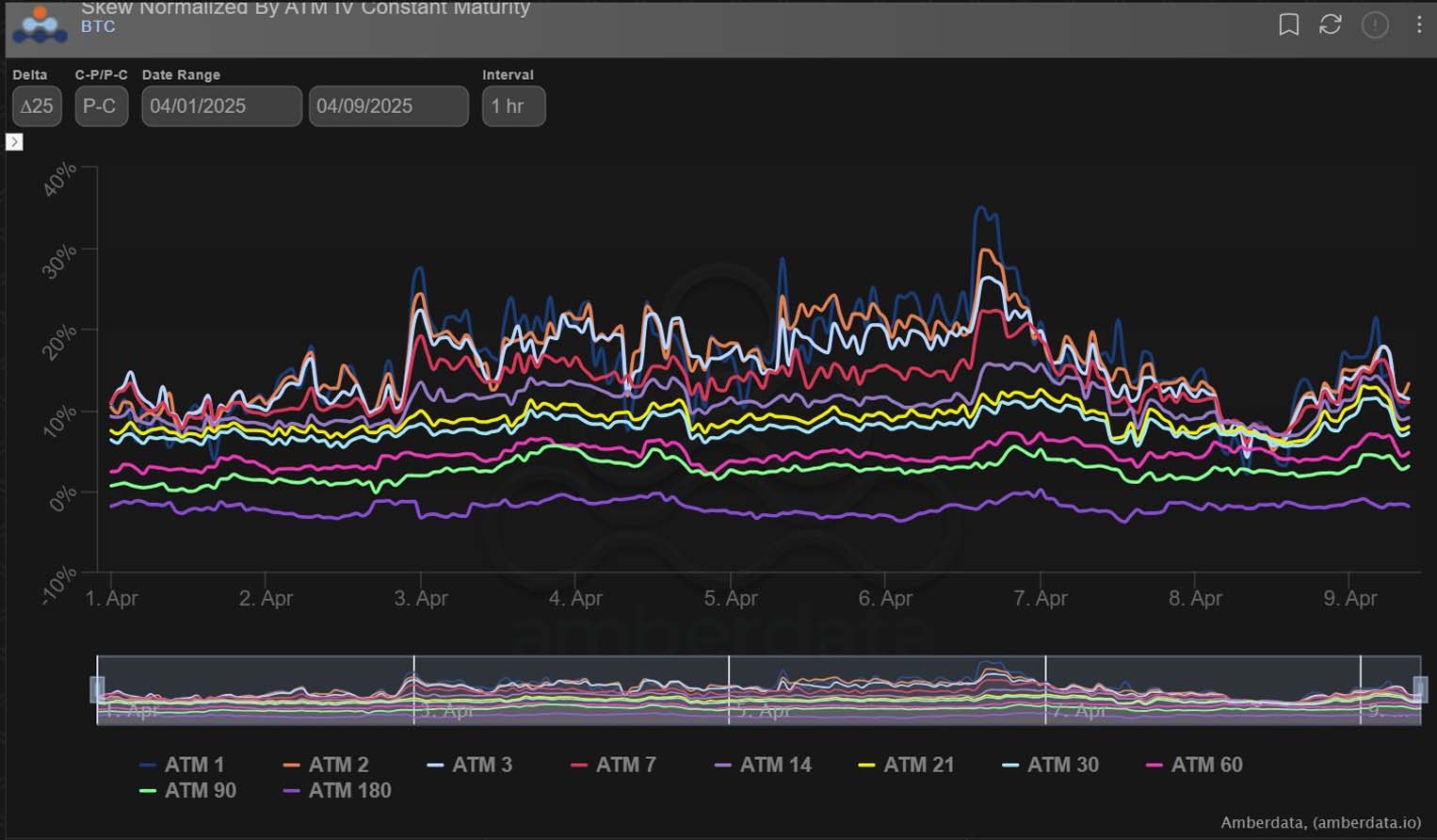

4) Likewise, Put Skew fell back, as downside looked limited.

But as Trump followed through with his 104% tariff on China goods, risk markets retraced, Optionality bought.

VIX>45%, BTC IV and Put Skew followed higher and once again BTC 74.5k and S&P 48xx were double shock-tested.

View X thread.

AUTHOR(S)