In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

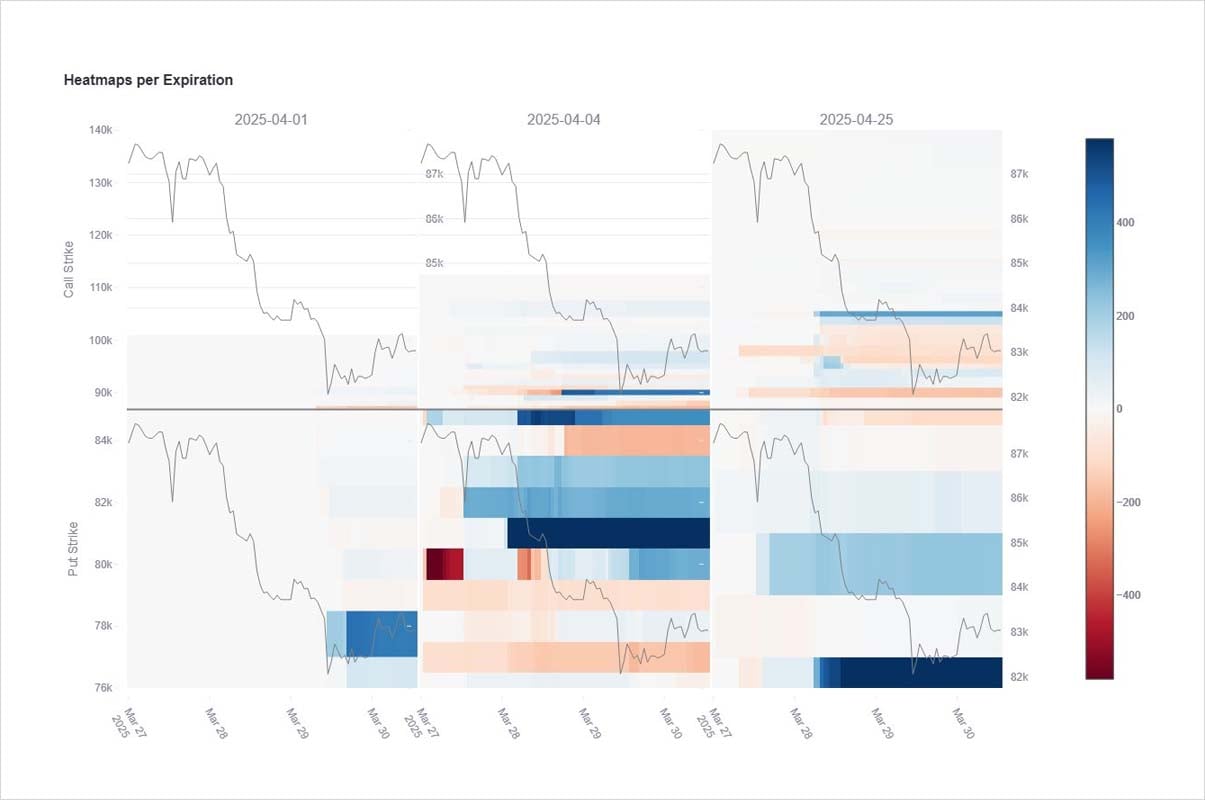

Those blinded by Mar Opex and the ridiculous 100k OI speculation missed the signs of increased accumulation of Apr (Apr 4th focussed) 78-85k Puts been lifted as US tarrif headlines hit (upcoming 2nd April) and unease over risk elevated.

Demand was all short-term Gamma Puts.

2) Flow breakdown:

Fund Block+DSOB purchases of Apr 4th 78-85k Puts dominated from midweek; more aggressive into the end of the week.

As front-end Gamma started to firm, cost-effective strategies came into play.

eg. April 25 76k Puts bought, funded by selling Apr 25 100k Calls.

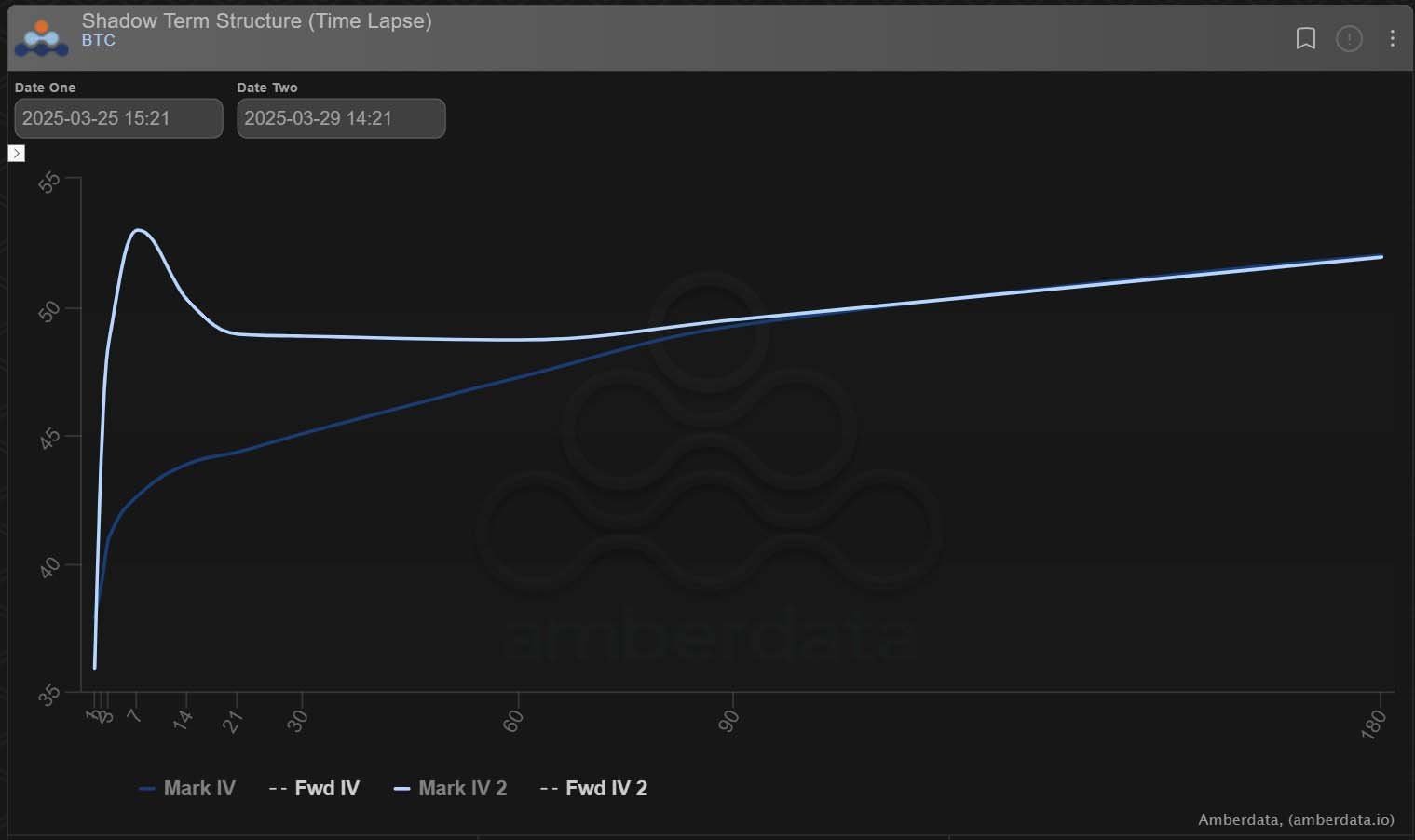

3) As demand was all short-term Gamma Put focussed, only the front-end of the term-structure reacted, 7day IV increasing 10%, while 3month strike IV was static.

The term-structure moved from Contango to Backwardation, very rare into a weekend.

But Apr 2nd is a rare action date.

View X thread.

AUTHOR(S)