In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movements, and the report release from Matrixreport speculation a decline of the BTC ETF approvals.

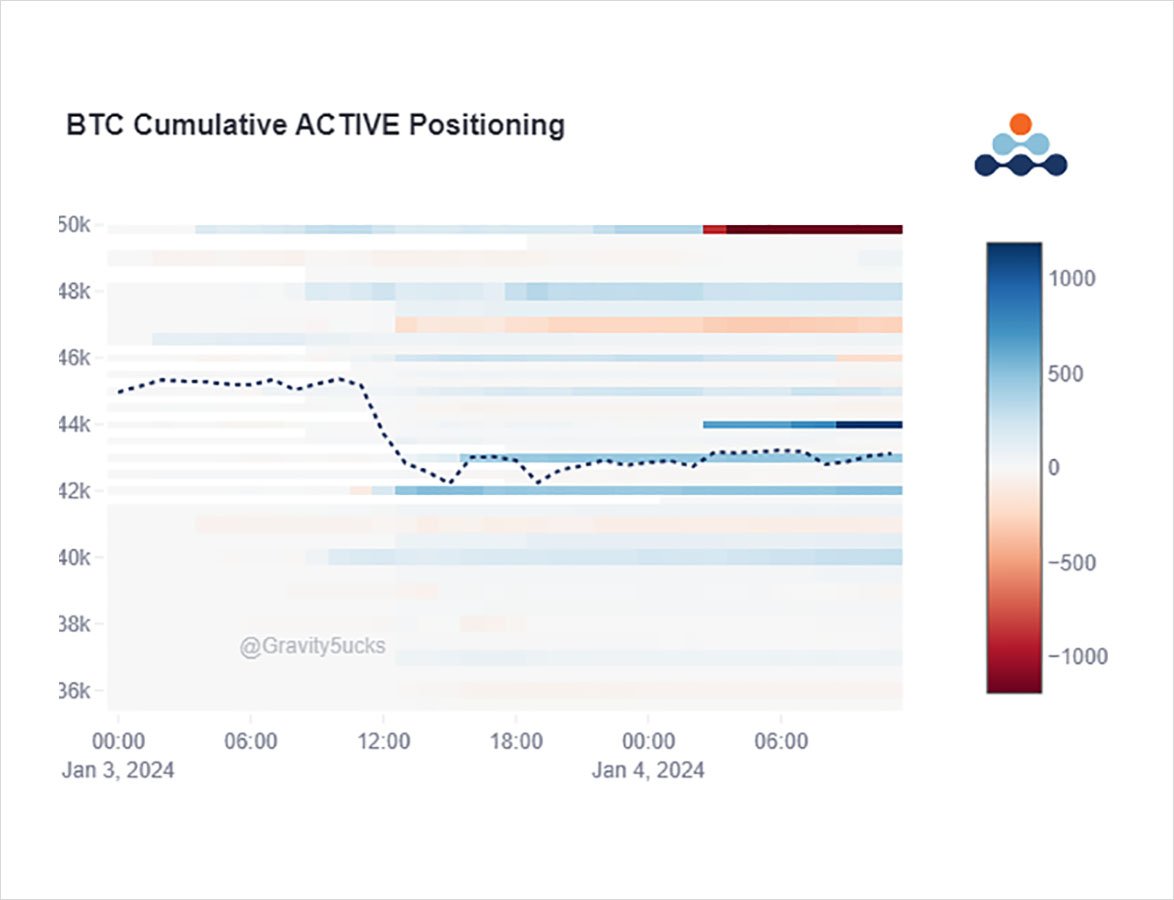

Speculation by a Matrixport independent analyst that the SEC may delay imminent ETF approval was circulated around news sources during a period of high leverage, funding, and positive sentiment, which some argued triggered a 10% BTC cascade.

Bullish Option positions unaltered.

2) All signs so far from SEC, ETF providers, and exchange meetings have pointed to an approval next week, but the market has known this probability lies in the ~90+% bracket, not 100%.

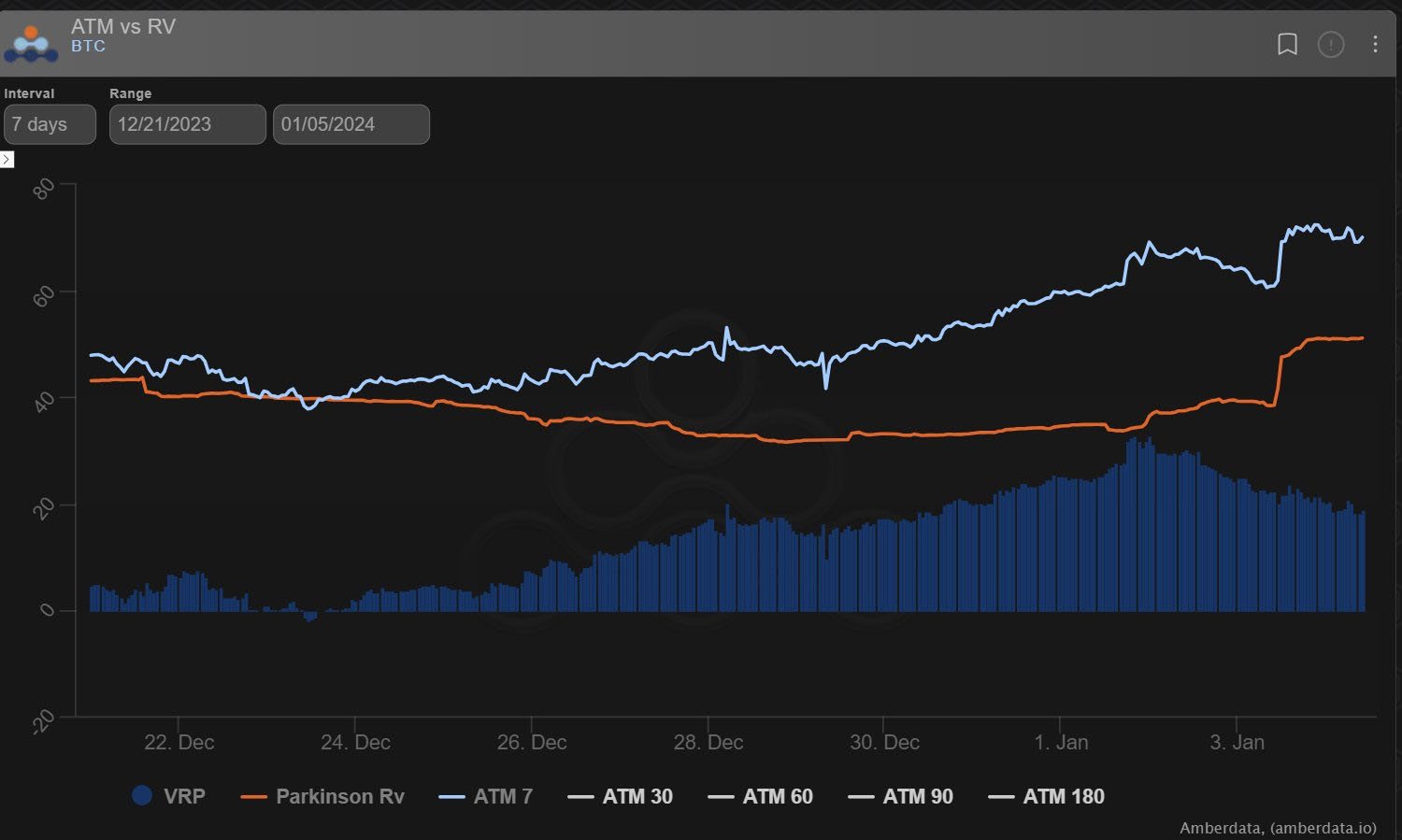

Rumors and reports were bound to be promulgated in advance and this is what has held VRP high.

3) Some well-timed Jan 40-42k Puts were bought before the cascade, but nothing out of the ordinary in terms of size.

During the episode, Vols naturally spiked (1m Dvol 5%, 2week IV 10%), but Option flows were apathetic.

Vol settled back quickly as Spot rallied back to 43k.

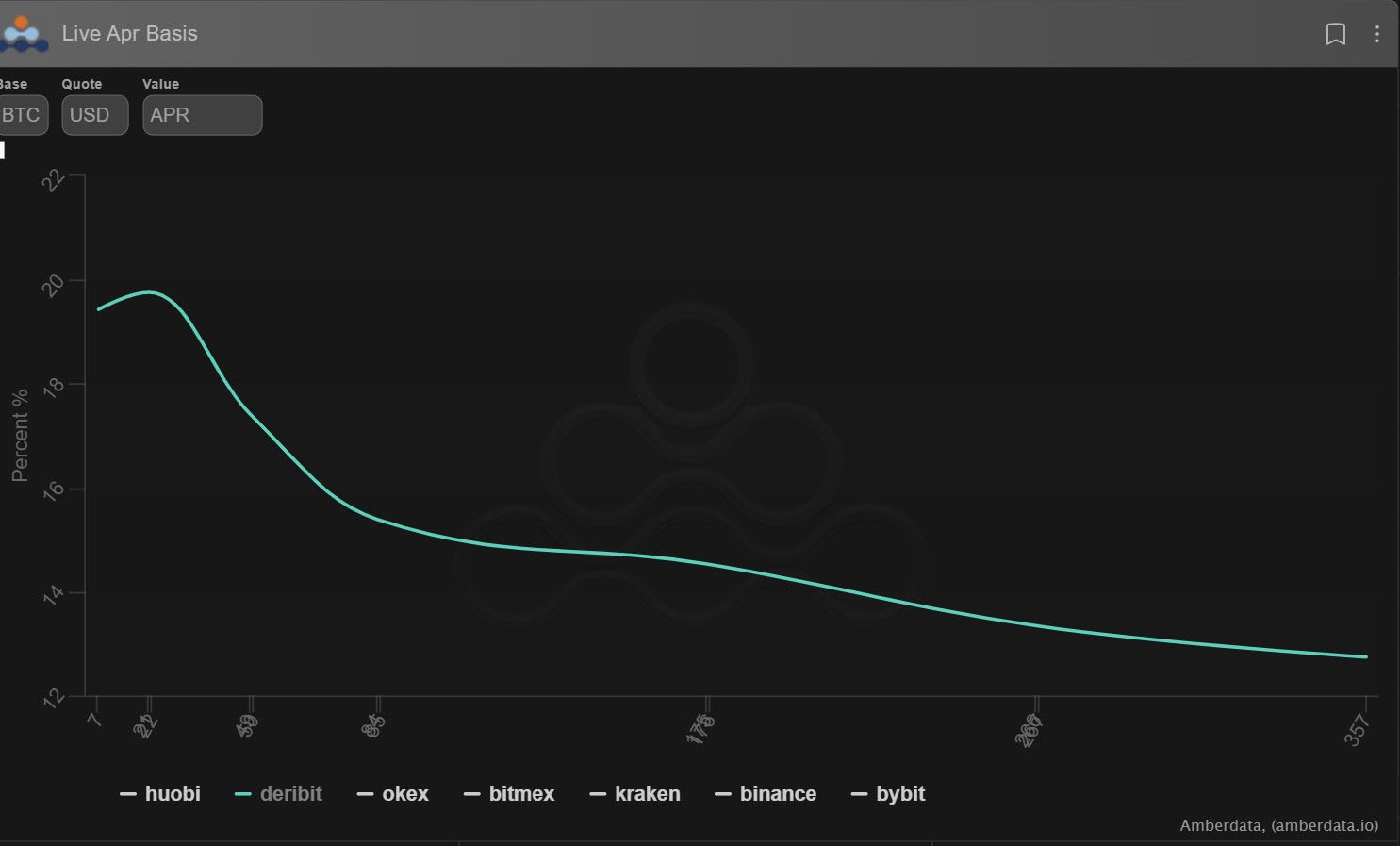

4) Funding did retrace by about 5% annualized eg BTC Mar futures were pricing in 20%+ APR, now ~15%.

Much action – indeed flash crash style – occurred in Alts where funding and leverage were far higher and many Alts saw 50% drawdowns before bouncing back – some up on the day!

5) When part of your AUM is flipping 50%+ it can be ‘quite distracting’ from majors where a 10% move hedged or plays in place for the SEC decision need little supervision.

Bullish Option plays remain intact; very little adjustment.

Fresh buyer of Jan44-50k x1k Call spreads added.

View Twitter thread.

AUTHOR(S)