In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements after a quiet Easter.

April 11

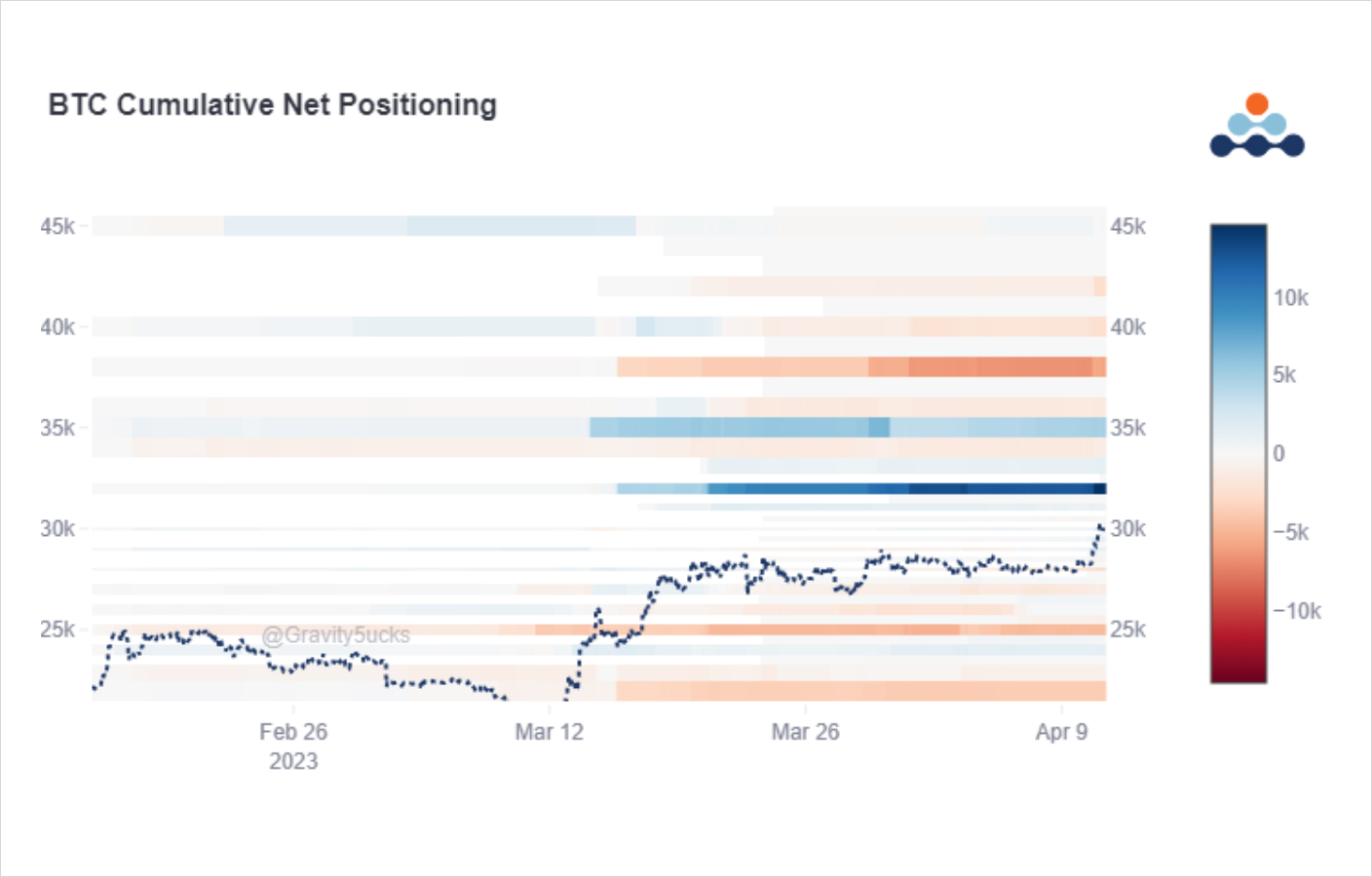

An anticipated quiet Easter Monday resurrected into a buying spree on Spot + Calls, as the 28k magnet lost attraction and the wall of resistance finally fell.

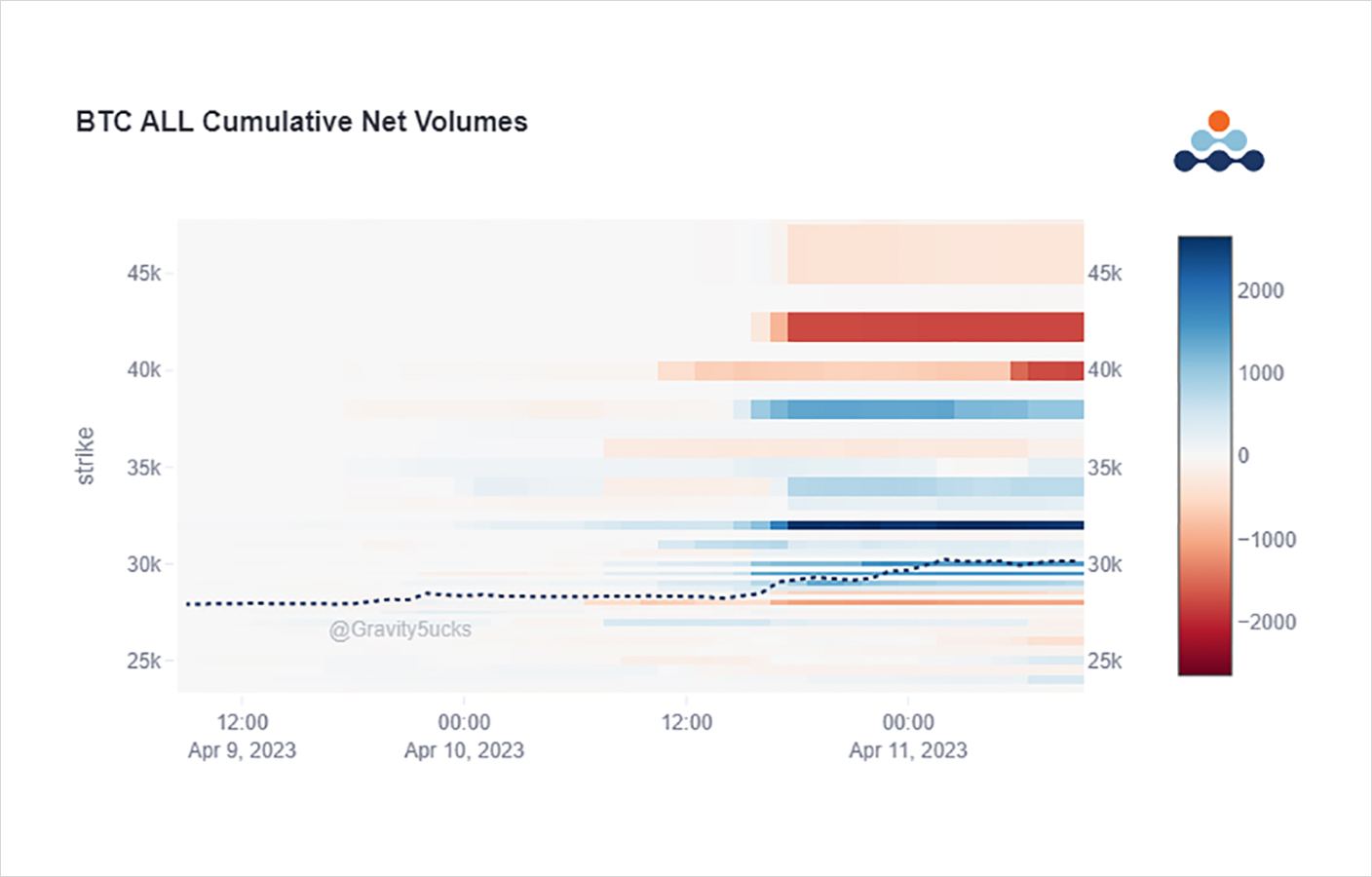

Apr14 29-30k Calls bought 2k on DSOB, May 38k Calls blocked 1.5k+, Apr28 31-34 May 40k+ Call spreads x2.5k+

BTC 30k.

2) While those who awoke early got to cover shorts and go long while IV was still suffering from its long weekend lull, most of the Spot+ Call(+spread) buying came in US hours.

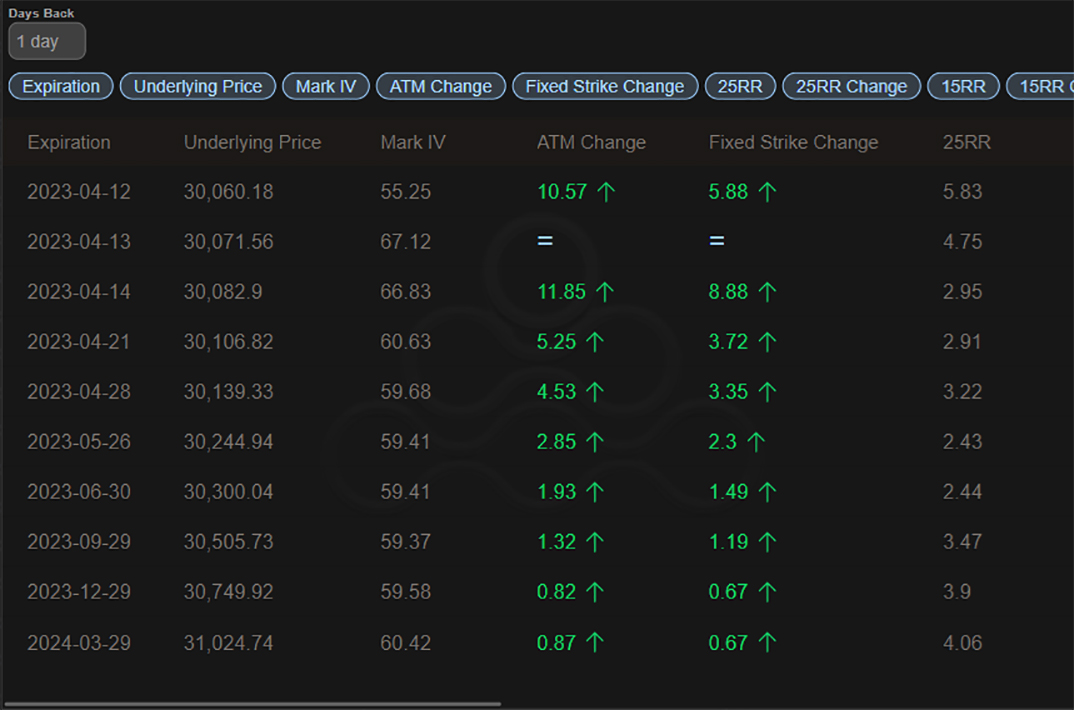

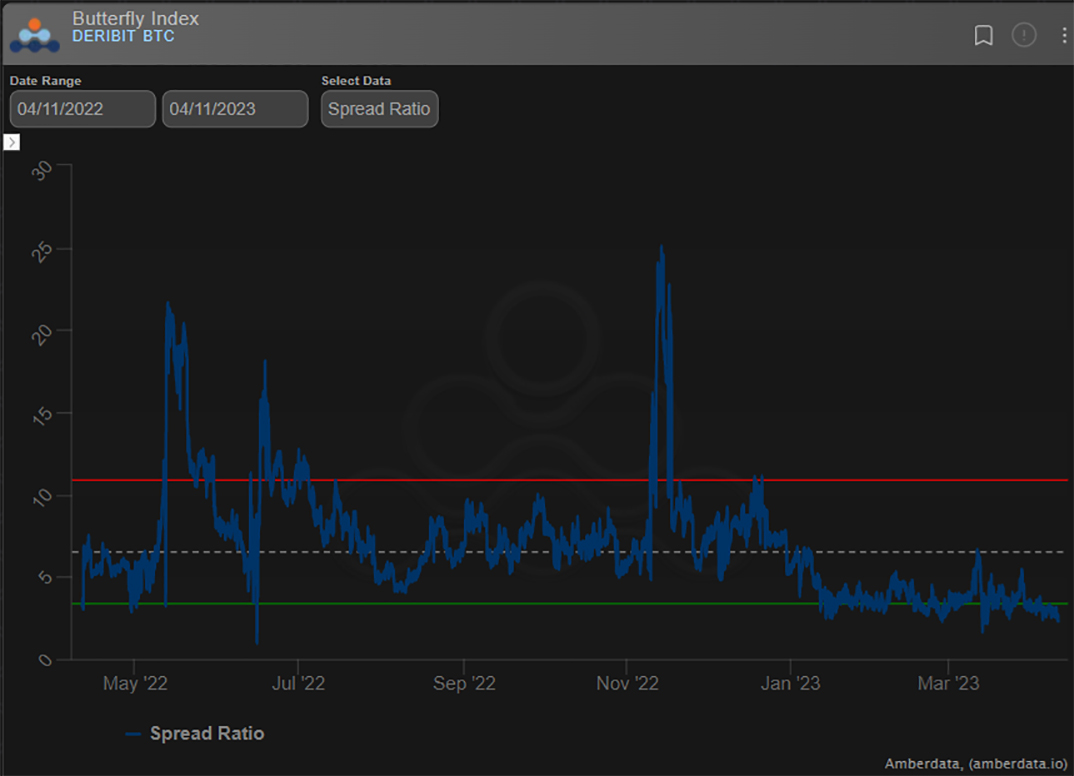

3) With IV trading at a decent premium to 7-day RV, sellers of Options were at first engaged, but once it became clear the one-sided flows and Spot moves were dominating, MMs struggled to cover and IV rose sharply.

4) Interesting dynamics as the (Term) Call spreads which have been employed over the last year to access Gamma by funding with a higher Call eg Apr28 32k Calls bot, funded by selling the May42k Calls – selling far upside convexity – was matched by a large buyer of May 38k Calls.

5) The move from 29.5k to 30k and breach was quick as was an expected stop/entry gap up to 30.5k in early APAC hours, but CT talk of extreme Gamma moves above did not unfold.

European hours have allowed some MM covering of short options as IV drifts a couple vols from the highs.

View Twitter thread.

AUTHOR(S)