In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movements.

March 21

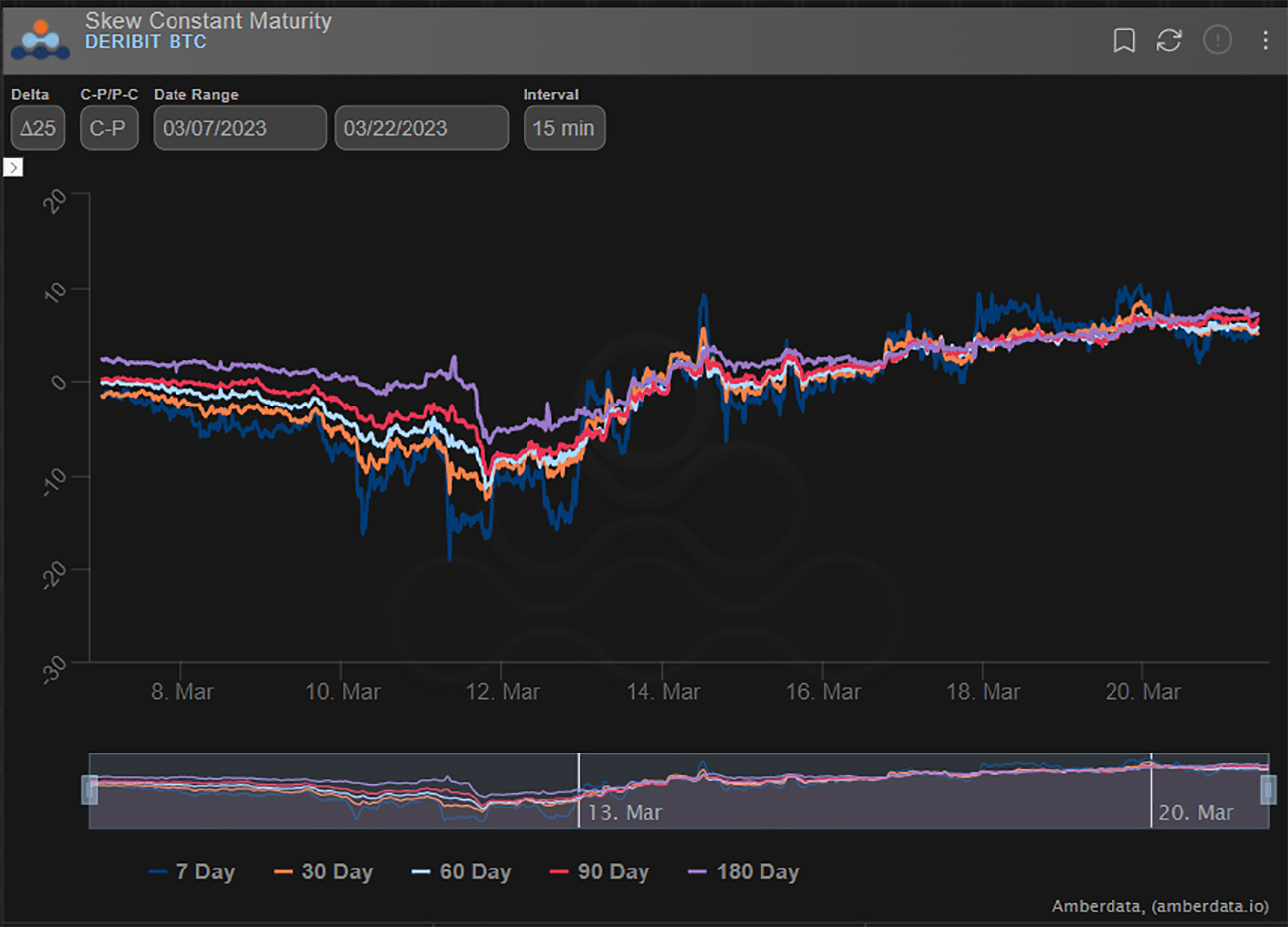

After the most aggressive outright Block buying of March BTC Calls +Gamma we’ve seen in a while pre-weekend, Spot continues to challenge resistance and strategies have turned to Apr+May Call spreads using the higher leg (35-40k) to fund buying 31/32k Call zones. ETH RV+IV lag.

2) Mar24+Mar31 28-30k Calls lifted in large Blocks pre-weekend in low liquidity sessions ahead of certain uncertainty, faced by MMs unkeen to sell mid-60% IV Gamma, therefore, priced wild offers promptly accepted.

Delta+Cover demand Hedges spiked 14d IV 10%.

Wknd Gamma Impact.

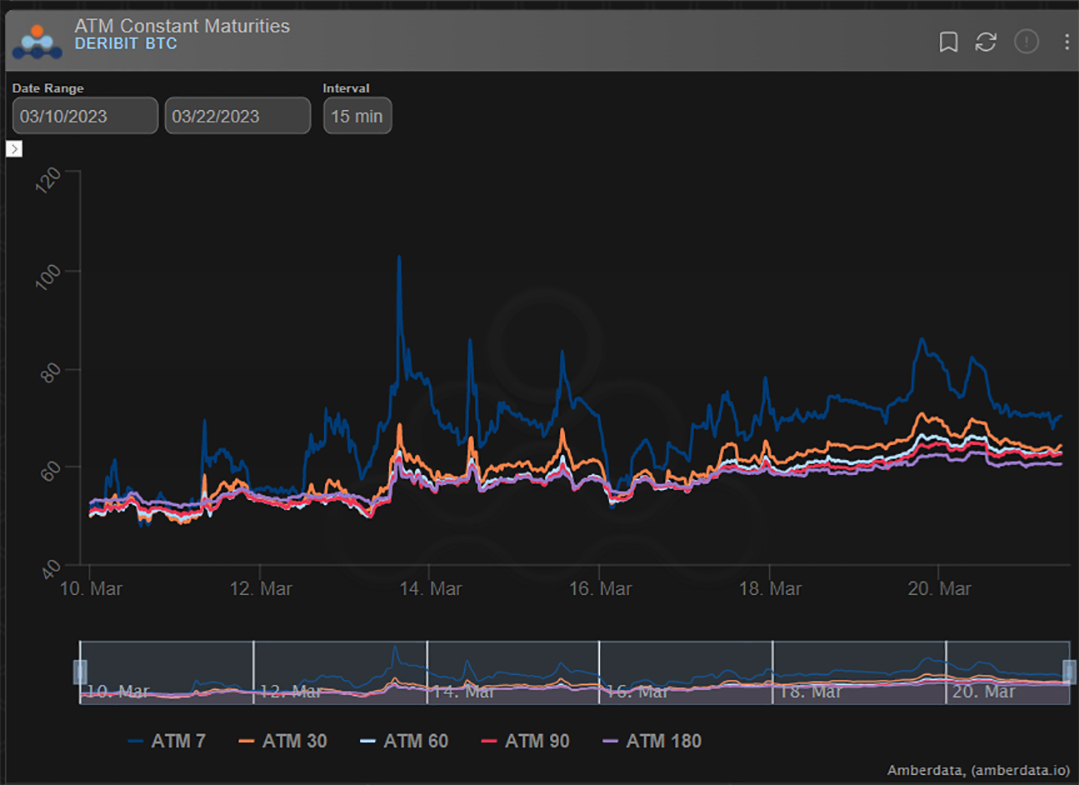

3) With Spot settling in the 27-28.5k range, the 7-14 day Vol-of-Vol has been choppy with each sense of range-bound comfort softening IV only to bounce as break-out FOMO + Gamma impacts to the upside.

The outright Call buying strategy has efficiently moved to Call spread buying.

4) At elevated IV Call spreads limit Theta+Vega.

So Funds have utilized this strategy for exposure:

May 32-36k x2k

Apr7 28-33k x2k

Apr7 33-38k x1k

Apr7 31- Apr28 40k x1

Rolling of ITM to OTM also, eg Jun26-27k into May 31-33k Calls x1.5k

Call Skew continues to react to demand.

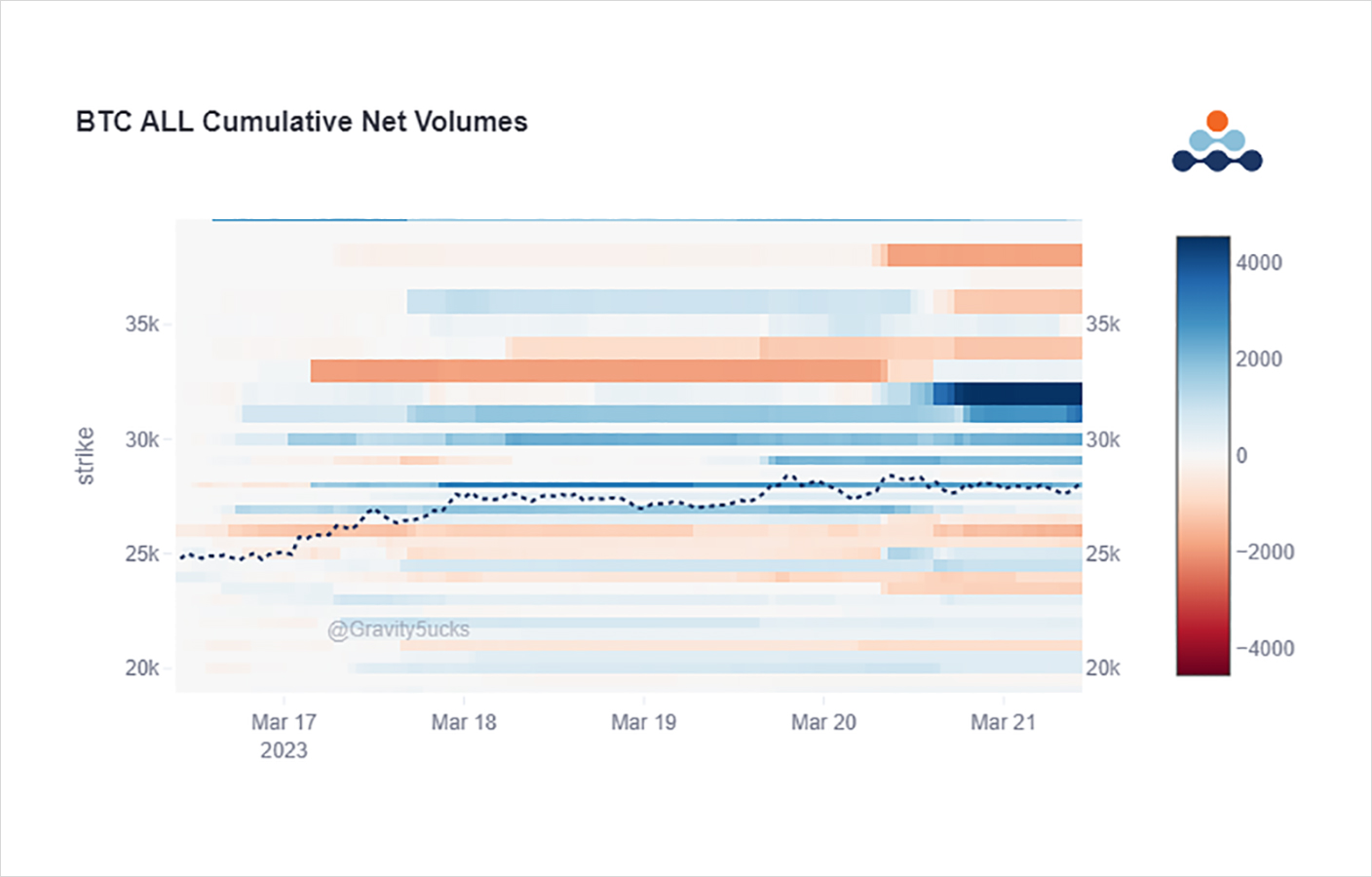

5) Interestingly, Net positioning from Jan1 ’23 is not as clear-cut as many might imagine.

The 26-27k Area is a combination of Long Calls outstanding, but also recent Put hedges.

30+34k Strikes remain Big Shorts.

Unclear how much of this is offset/part of 25-28k Call Strikes.

View Twitter thread.

AUTHOR(S)