In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

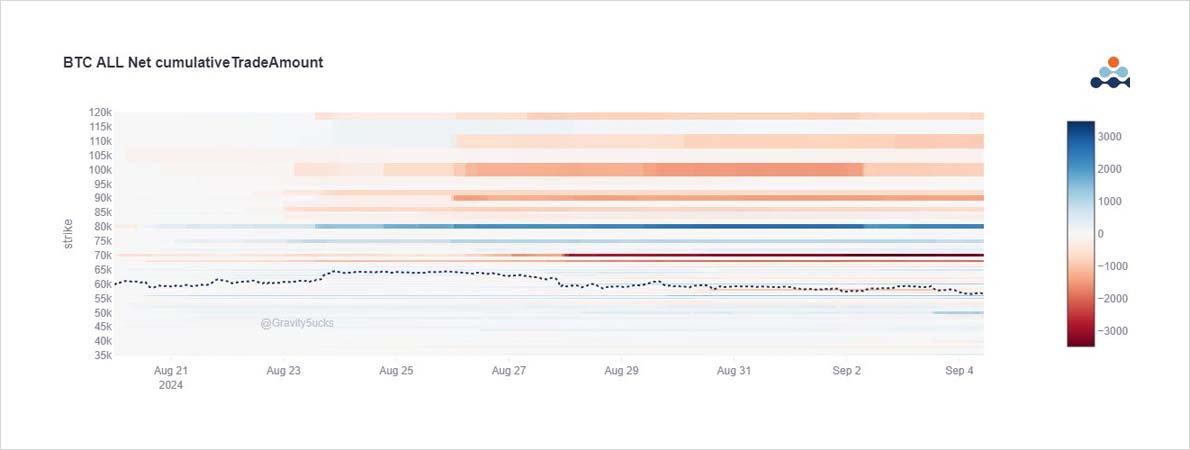

Since the 65k touch after JPow Jackson hole speech, the markets have strongly retraced, now 56k. Cumulative fast money accumulated Puts (Sep 50-58k Strikes) and sold Calls (66-70k Strikes), but there has still been a summer absence of large Fund blocks on the downside plays.

2) Much of the (limited) fund OTC blocks have been reserved for re-organization of upside Dec+Mar Calls (selling far OTM Calls), and an in-and-out of Dec 80-100k Call spreads.

The downside has seen smaller size, but some buying of Sep6 56k, Oct 50k+Nov 35k Puts has been observed.

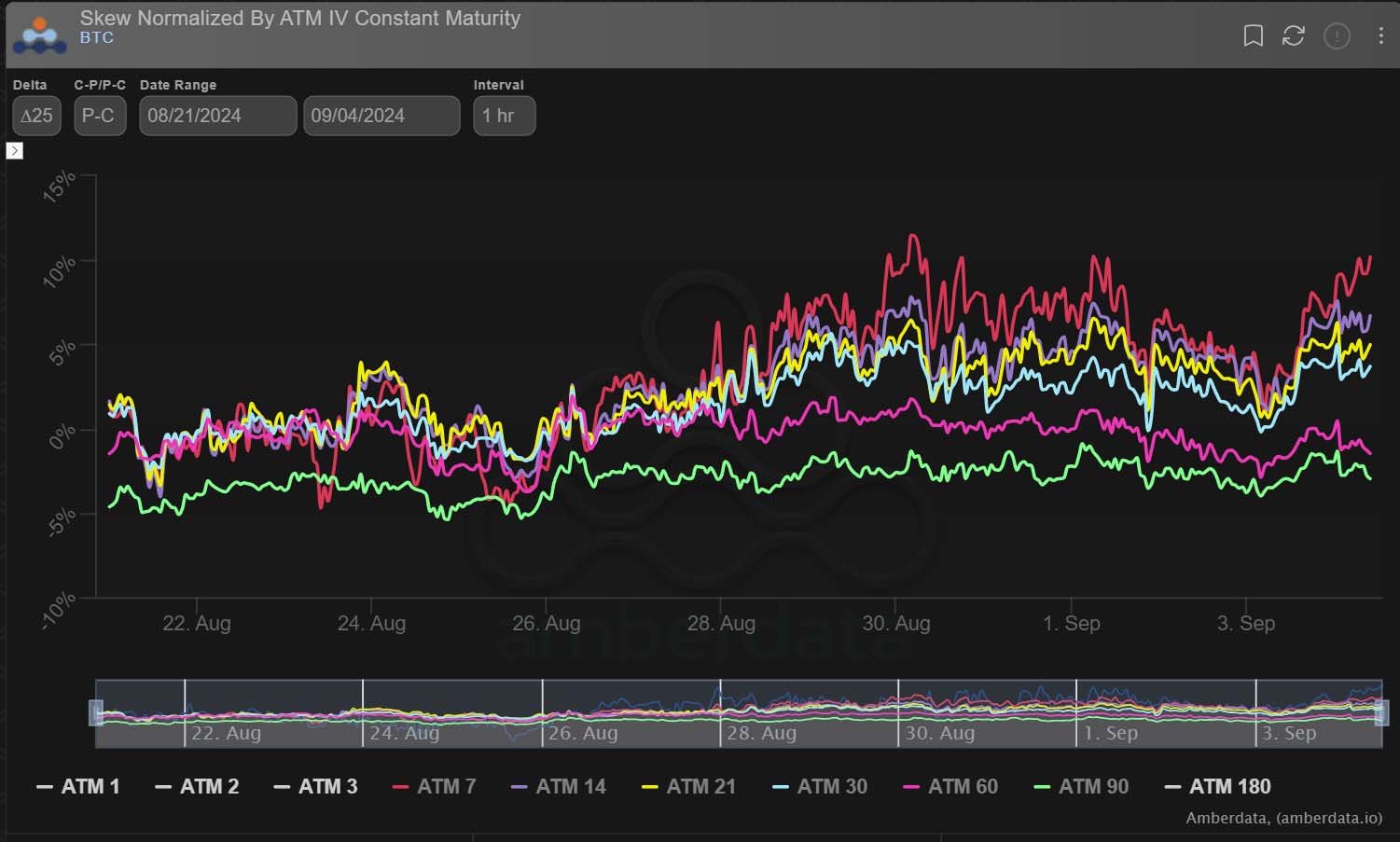

3) The Fast money protective and bearish Put buying in Sep expiries has had an impact on raising Put Skew within the front end of the curve (1-4weeks): the 25delta differential now sitting at 10%.

While elevated, real fear/commitment is tested >20%.

Note the 3month+ bucket calm.

4) Note Implied Vol levels are trading mid-level for the year, despite desperation having taken hold within the CT community. A feeling of acceptance has taken over.

BTC ETFs are now seeing selling.

Nvidia subpoena aside, the next macro catalysts are NFP and Trump-Harris debate.

View Twitter thread.

AUTHOR(S)