In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market news, and movements on the Crypto market.

September 7

The first ETH Spot ETF application landed just as funding turned negative and 25k/1.6k were about to be tested.

The Over-Write-Entity [OWE] had been trying to cover his Oct 2.1k Call and barely had time to flinch before Spot Pumped+dumped.

OWE Strategy+Upside more interesting.

2) As a reminder, OWE sells upside Calls ~2months+ maturities, so far has been fruitful, then buys the short-leg back and sells another further month with more premium.

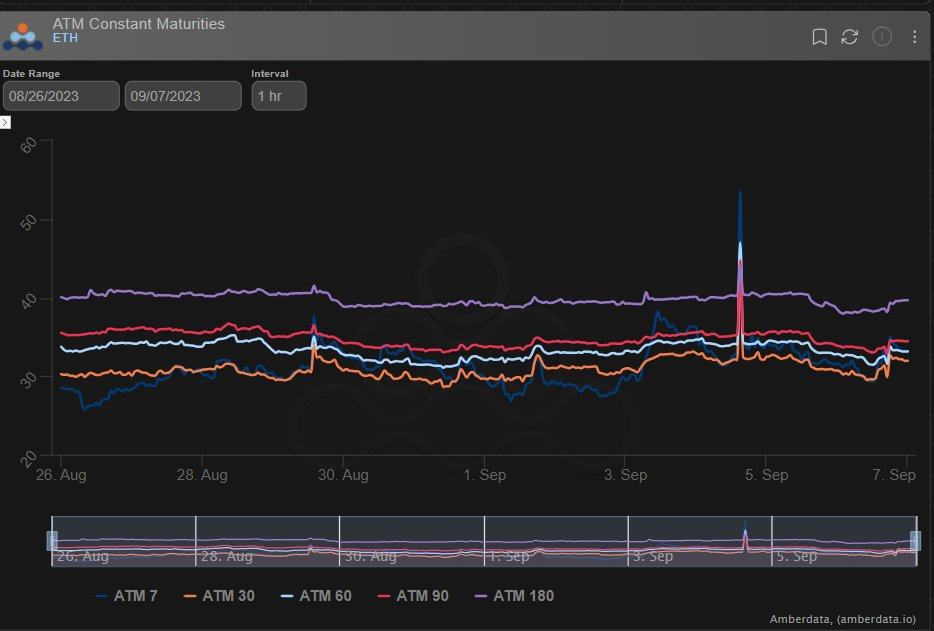

ETH size dominates flow, on BTC it applies constant pressure on Implied Vol.

Hence familiar IV path this year.

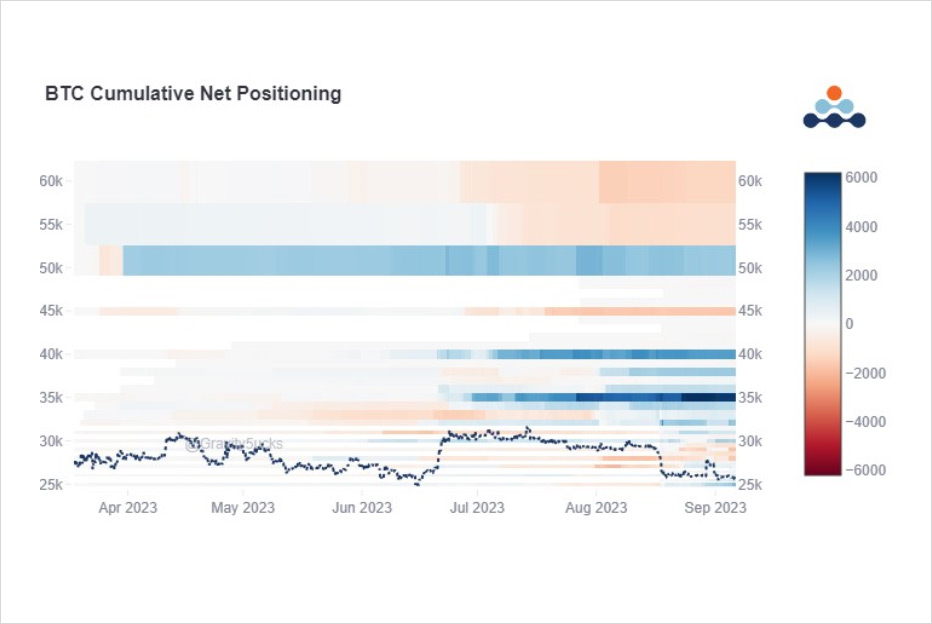

3) On BTC, where there have been sizable opposing flows to buy Dec+ maturity Calls+Call spreads to play for a BTC Spot Approval, the OWE strategy (which is evident in its impact on IV in a low RV environment) is masked in its impact on net upside positioning.

@genesisvol data:

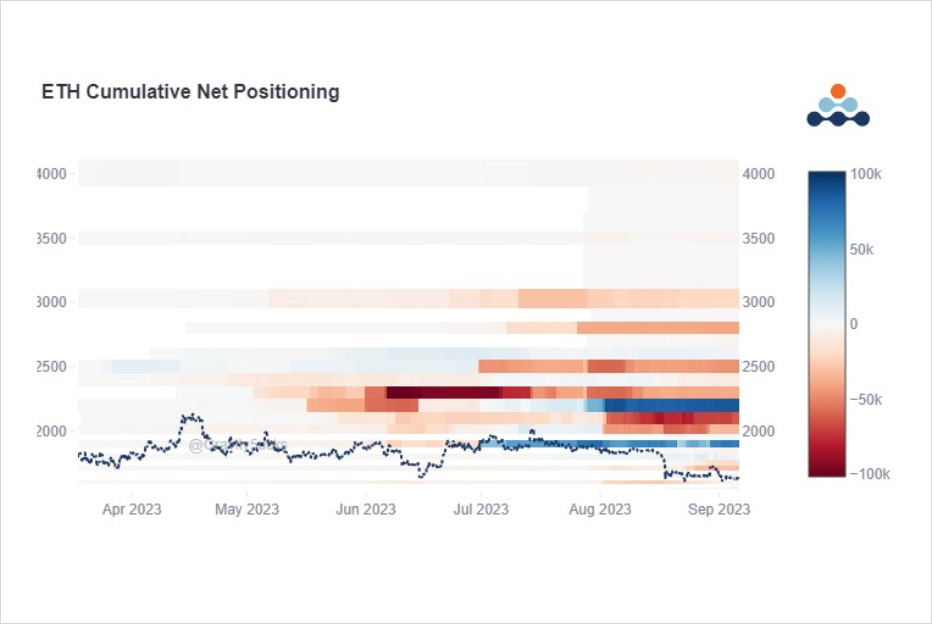

4) Compare this picture to the same on ETH net positioning.

@genesisvol data:

5) OWE wants to buy his short Oct 2.1k Call leg in order to sell further out Call premium, not because he is concerned about a rally.

And yet now that the first ETH Spot ETF has been applied for, and if BTC get approved, ETH likely follows, this strategy may be more considered.

6) The impact has not just been applied to IV but also to Call Skew which trades negative to Puts (25delta).

At some point, perhaps when BTC approval becomes more likely and timely, there could well be a greater demand for ETH upside.

We also saw how OWE reacted post XRP news.

7) This week, however, OWE reacted calmly: sat on the DSOB bid on his Oct 2.1k Calls, and didn’t panic raise bids.

To the bull’s disappointment, ETH acted like a P&D coin, retracing a sharp initial rally with very little time to react thoughtfully. A Gamma squeeze was dismissed.

8) On BTC, a DSOB Dec 22+23k Put seller gave ammo to Gamma+Vega shorts concerned about the downside, and for those that delta hedged, the reward was instant as Spot bounced and Vol ticked up.

While there’s a notable lack of follow-through on heavy narratives, Dvol has plateaued.

View Twitter thread.

AUTHOR(S)