In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

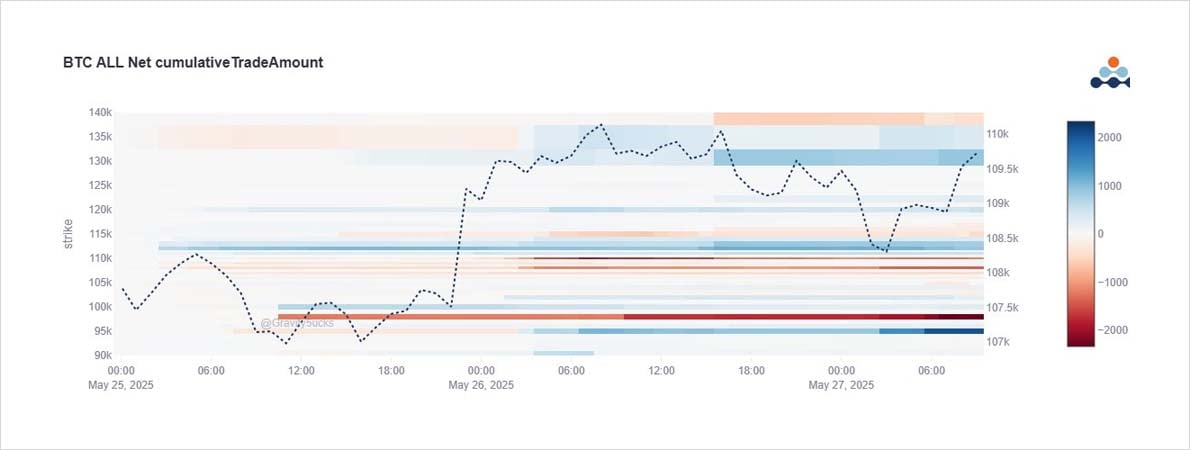

APAC Whales used a quiet weekend period to partially liquidate JW down to 107.5k in the last 12hrs.

An immediate bounce to 110k was supported by continued bullish option flows ahead of the BTC conference this week.

May110-115k Calls, July120k+ Call spread buys, Jun Put sales.

2) EU tariff pushback, Trump media $3bn future investment, Saylor purchase, BTC conference all upside stimulants:

May 110k-115k Calls, May Call spreads bought.

Jul 122-135k, 130-140k Call spreads bought. Jun 95-98k Puts sold.

All +ve delta.

Not outsized, but clear directionally.

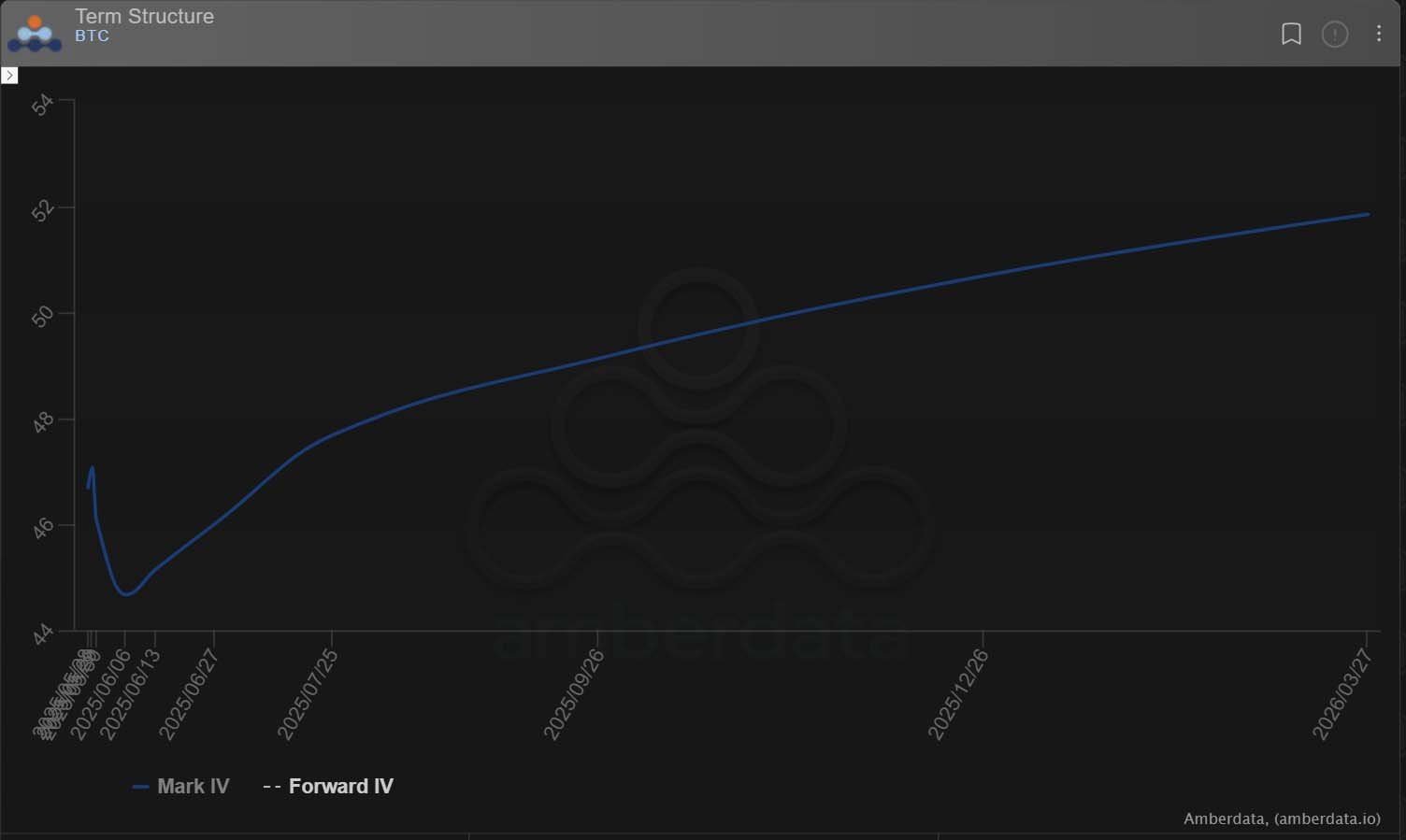

3) A little backwardation at the very gamma-heavy front of the curve acknowledging these factors:

7day VRP zero, 30day VRP still at a premium IV>RV.

25delta Call Skew moving higher into the +ve 3-8% range across the tenors as Call (+spread) demand and Put supply impact the smile.

View X thread.

AUTHOR(S)