In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Today is the first real Tradfi+Native co-ordinated volume day of 2026, and we’ve seen further accumulation of upside.

In addition to the Jan30th 100k Calls bought on the last two days of 2025 (Spot 88k), we’ve tracked $15m premium Jan+Feb Calls and Jan Call spreads (Spot 93k).

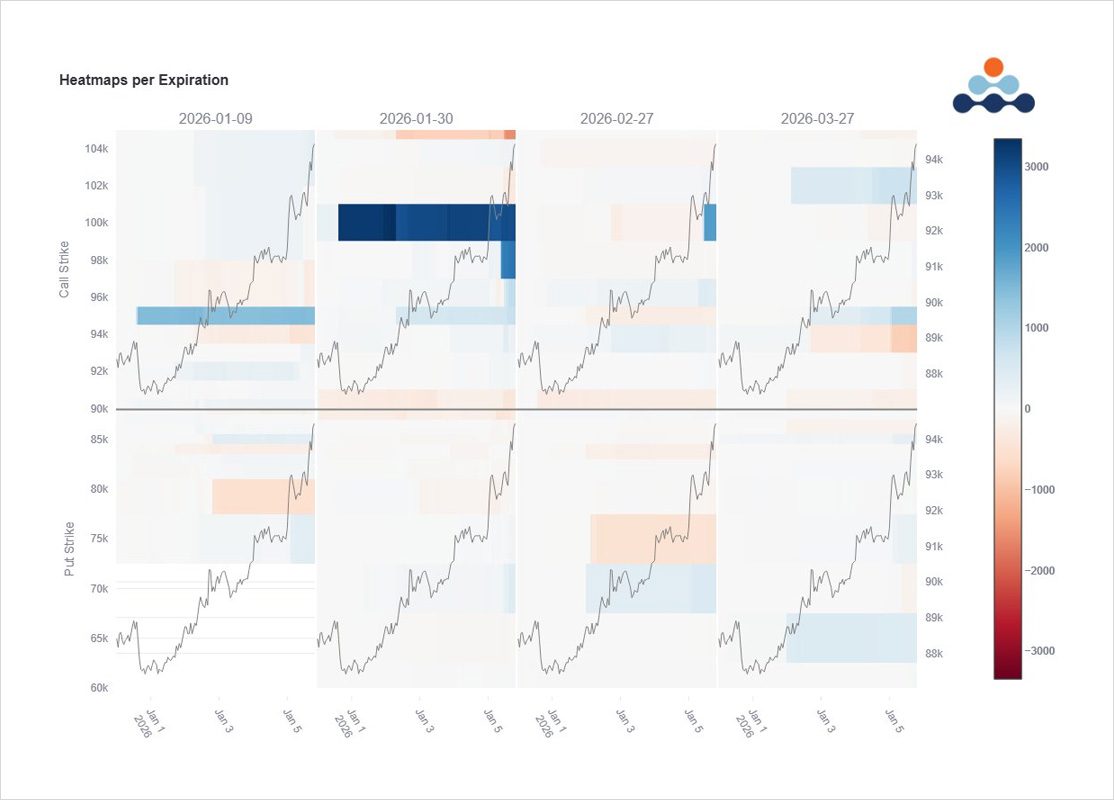

The @Amberdataio Flow Trade Heatmap shows strong topside activity.

Jan16th 94k Calls x1k

Jan30th 98k Calls x2k

Jan 96-105k Call spread x750

Feb27th 100k Calls x2k.

All initiated on the buy-side.

$15m premium spent.

All trade v 93k Spot.

Clear momentum positioning.

Naturally, with the robust buying, implied vols have firmed. Even further out the curve, where there was some convexity wing purchases of eg Dec26 50k-200k Strangles.

Offsetting Call overwriting was small and certainly did not offset the buying today.

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)