In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

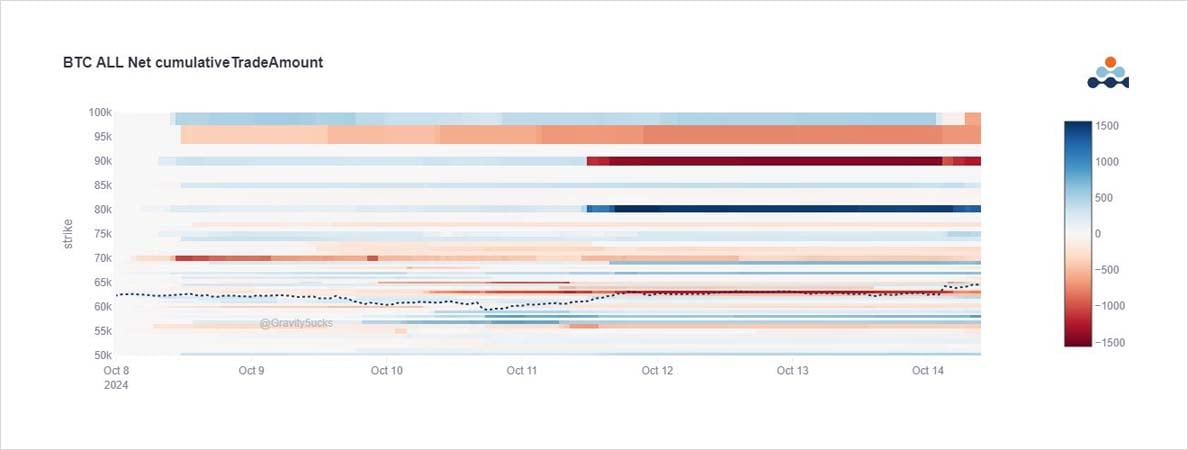

Unloading of Oct+Nov 70k Calls & buying of Oct 57-60k Puts on speculated US govt selling last week was not fully capitalized.

BTC selling halted ~59k, Puts not unwound until rebound >62k, then buyers of Oct 63-65k, Nov 63-69k, Dec 80k Calls.

Recurrent sale of Mar 100k’s today.

2) The chart not only shows the above flows but continued restructuring in Dec+Mar upside:

Large continued move of Dec 90k Calls (2x ratio) to Dec 80k Calls, and a timely recurrent seller of Mar 100k Calls ($3m premium, $160k vega), and further selling of Mar100k into Dec upside.

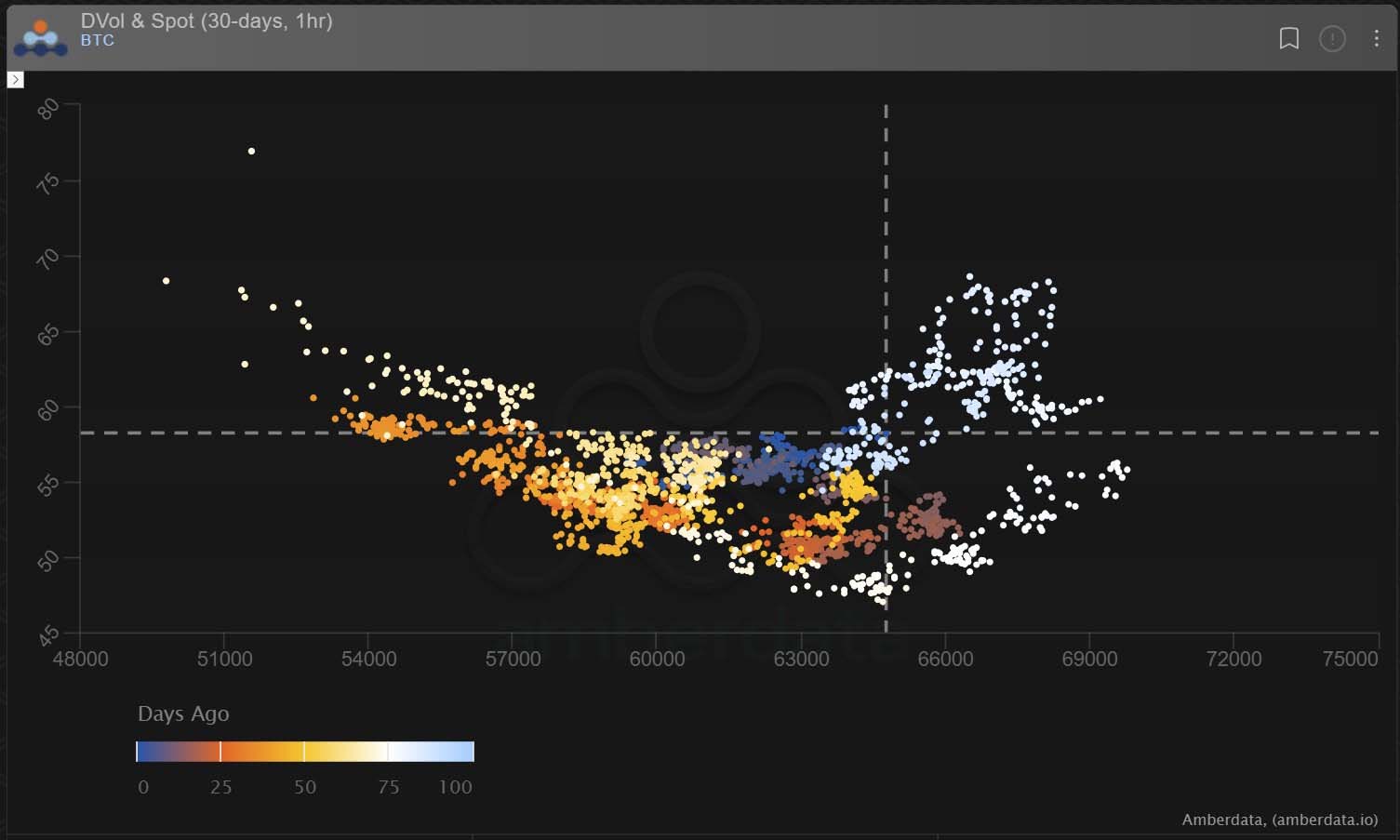

3) For the first time in a while the IV correlation has aligned with the rally in BTC Spot.

Some of that is technical, relating to the ‘Election blip’ kicking into the 30day Dvol measure. But notwithstanding, Dvol has jumped from 52% to 58%, and ETH/BTC Dvol premium is narrowing.

View Twitter thread.

AUTHOR(S)