Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

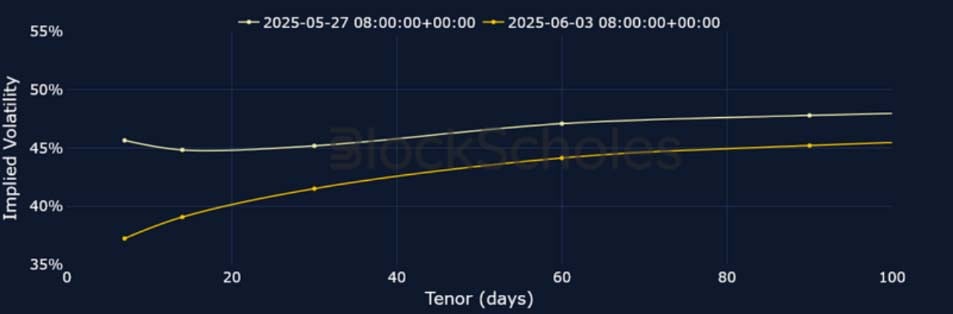

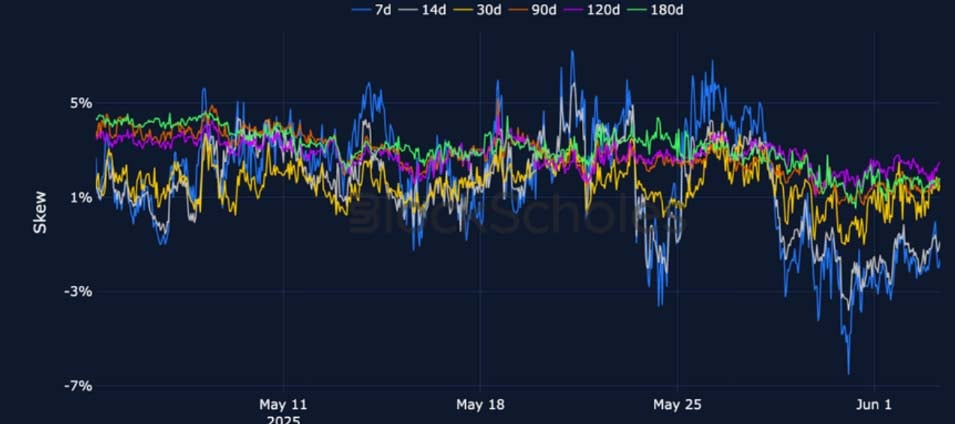

Following a breakout to an ATH of $111K, the abrupt slowdown in BTC’s spot price has brought a shift in derivatives markets sentiment. The bullish skew of volatility smiles across the term structure is now no longer the case, as 7- and 14-day options trade with a volatility premium towards OTM puts. Additionally, the weeks long inverted shape of BTC’s futures curve has now come to an end, and perpetual futures funding rates have come down from their highs of 0.027% following a more than 4% drop in spot price over the past seven days. ETH options markets initially resisted the bearish tilt in short-tenor skew, however ultimately also followed suit as 7-day options are now slightly tilted towards OTM puts.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

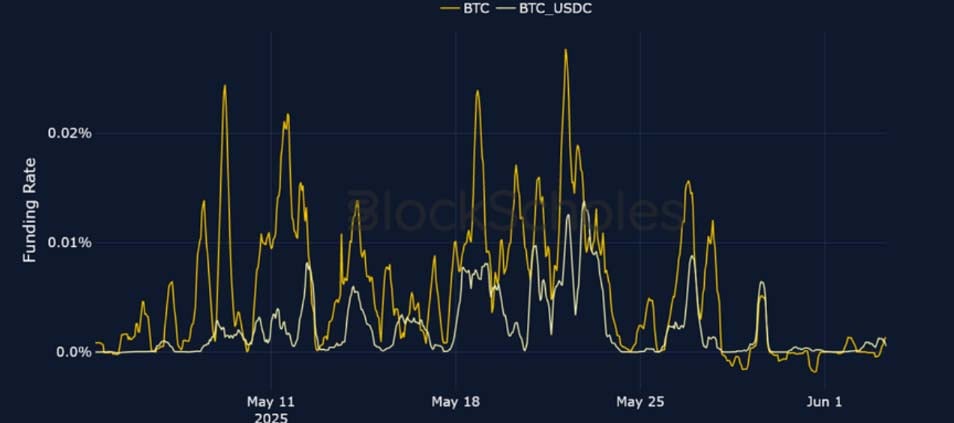

Perpetual Swap Funding Rate

BTC FUNDING RATE – After peaking in line with May 22nd’s ATH, funding rates have generally trended downwards since, now close to a flat 0%.

ETH FUNDING RATE – ETH funding rates have spiked less positively than BTC funding rates on the way up, and have been more negative on the way down.

Futures Implied Yields

BTC Futures Implied Yields – After weeks of being inverted, BTC’s futures term structure now returns to a positive upward slope, mirroring ETH’s.

ETH Futures Implied Yields – 7-day ETH futures-implied yields are currently just under 4 percentage points lower than BTC yields at the same tenor.

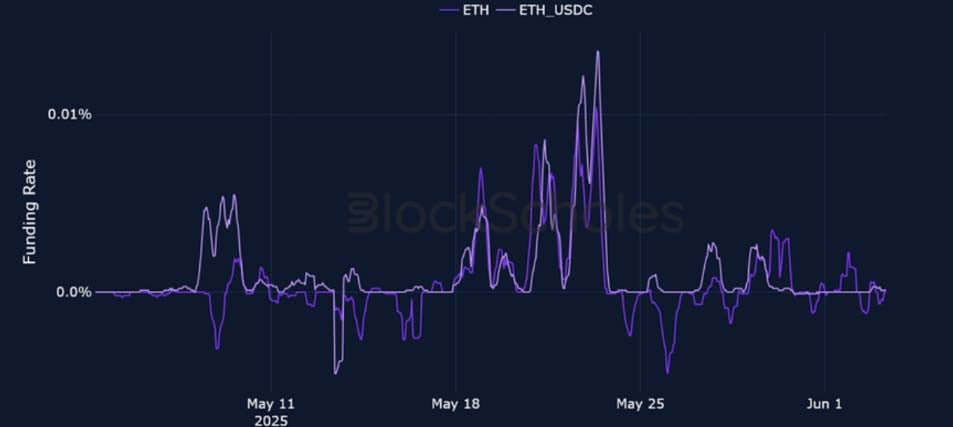

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-term vol expectations have declined in line with a slowdown in BTC spot price and a slowdown in ETF inflows.

BTC 25-Delta Risk Reversal – As spot price trades 4% lower over the past seven days, short-tenor smiles now favour OTM puts.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s volatility term structure has compressed and flattened, while spot price is up 5% on the day.

ETH 25-Delta Risk Reversal – As short-tenor BTC smiles skewed towards downside protection last week, ETH smiles initially resisted. However, 7-day smiles are now also slightly tilted towards OTM puts by 1%.

Volatility by Exchange

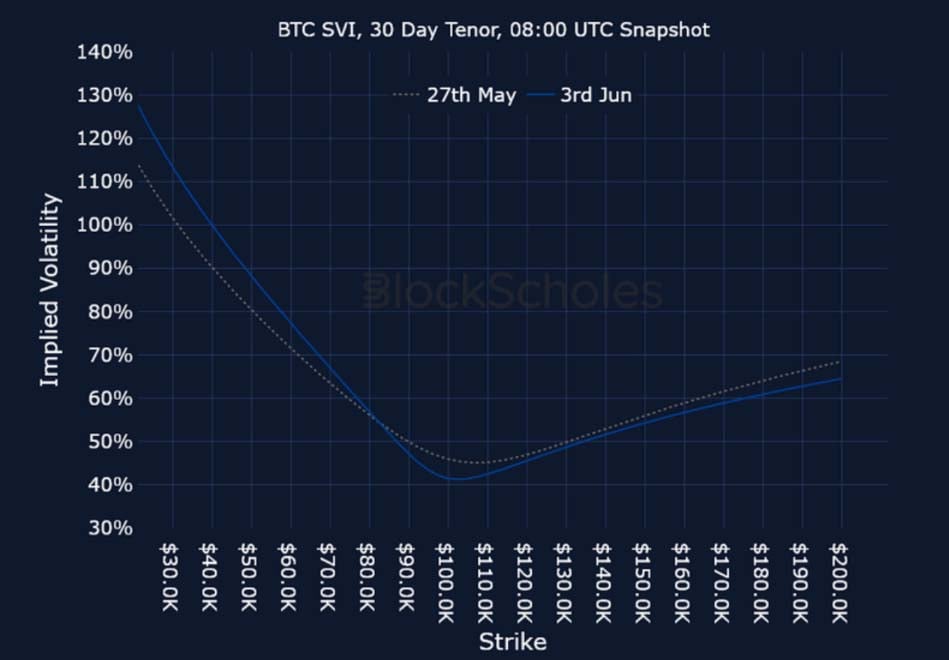

BTC, 1-MONTH TENOR, SVI CALIBRATION

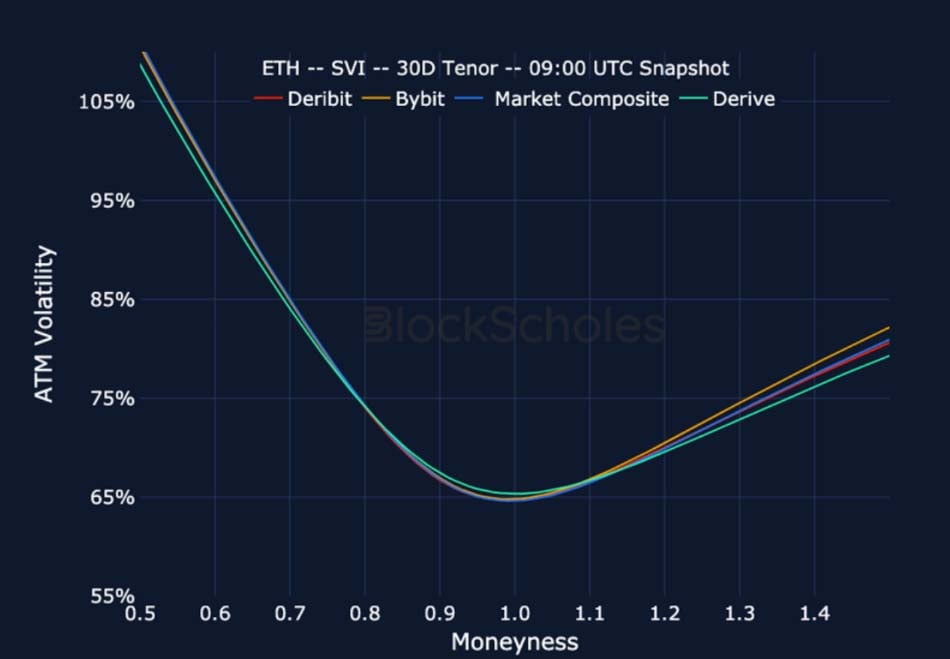

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

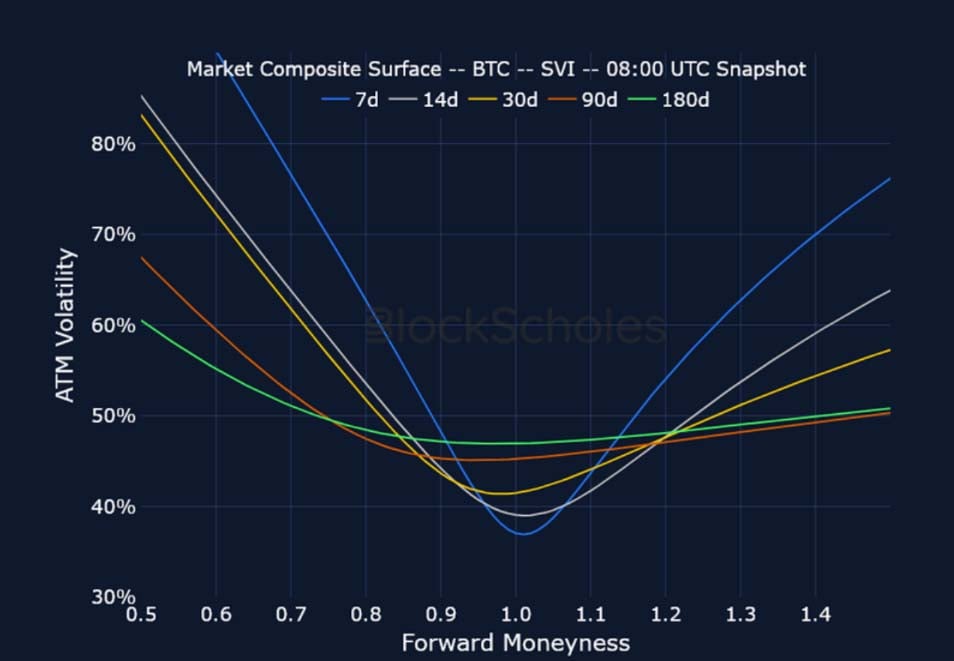

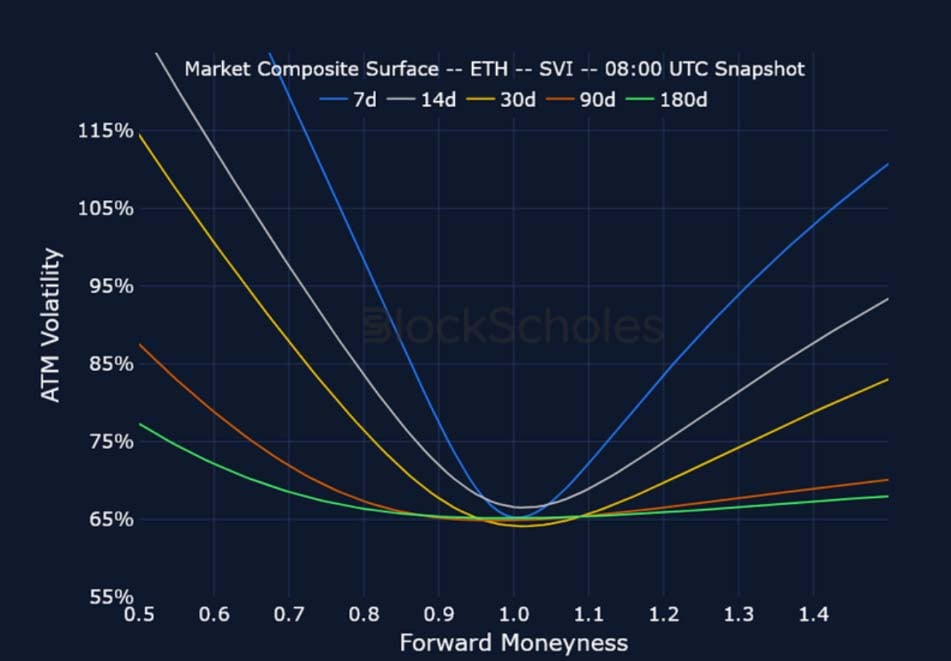

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

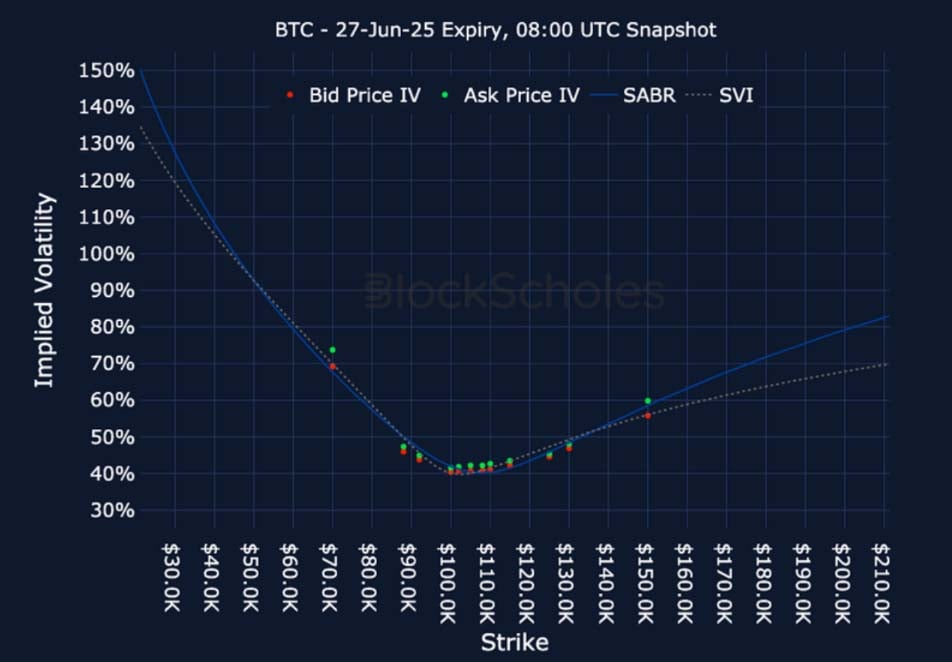

Listed Expiry Volatility Smiles

BTC 27-JUN EXPIRY – 9:00 UTC Snapshot.

ETH 27-JUN EXPIRY – 9:00 UTC Snapshot.

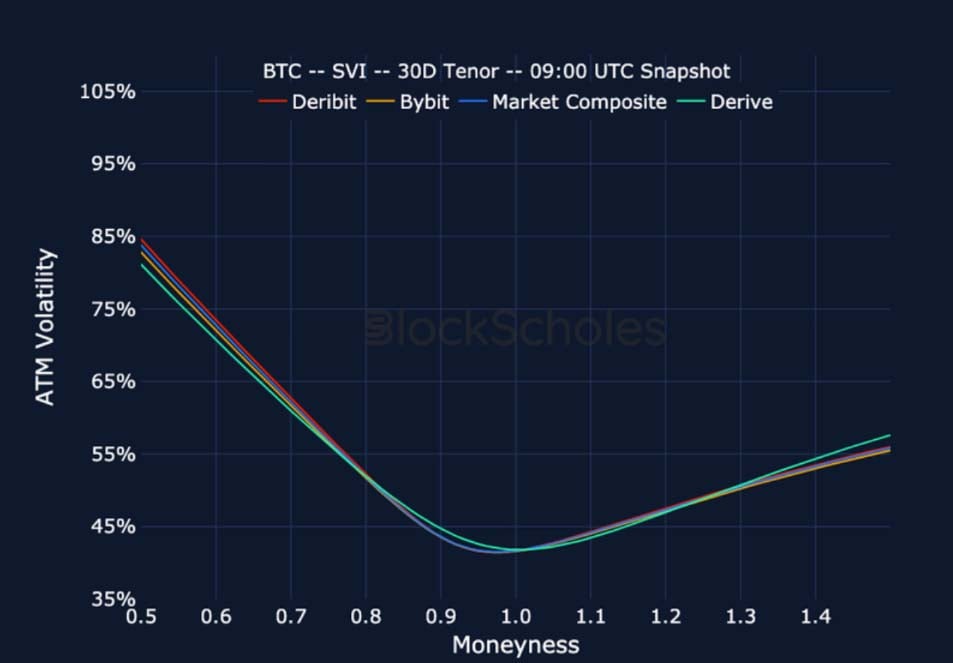

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)