Bitcoin Holds Strong As Maturing Macro Asset

Bitcoin remains firm above $102,000, defying pressure from worsening U.S.-China tensions. Trump just doubled steel tariffs and expanded tech sanctions, sparking broad risk-off flows. Even BlackRock’s IBIT ETF, after 34 straight days of inflows, saw $430 million in outflows.

Yet BTC held its ground. Front-end vol compressed, funding normalized, and signs of steady demand persist.

Corporate headlines are heating up too:

- Metaplanet grew its holdings to 8,888 BTC

- GameStop and Trump Media are pivoting into crypto

- Sharplink surged 400% after revealing its ETH treasury strategy

- Canada launched new SOL-focused products

- Reverse mergers and SPACs are bringing crypto holdings public—echoing MicroStrategy’s playbook

On the political stage, Bitcoin featured prominently at the 2025 Las Vegas summit. U.S. VP JD Vance pushed for clearer regulation, while David Sacks proposed ways for the U.S. to accumulate BTC without triggering new taxes. Meanwhile, the GENIUS and CLARITY Acts now pending in Congress could reshape crypto and stablecoin oversight.

Bitcoin is behaving like a maturing macro asset—gaining strategic relevance despite short-term chop. Price may stay rangebound, but structurally, the tide is shifting.

Vols Reset as the Breakout Fades

BTC realized volatility dropped 15 points to 30% after the breakout stalled. ETH followed, falling to 59%;

- Front-end vols were crushed: -9 points on BTC, -6 on ETH

- Carry turned positive again, now around 7–8 vols

- BTC respected its implied ranges cleanly; ETH tested the outer edges a few times

- Markets may be settling into a range—bleeding THETA aggressively here looks unwise

Vol compression + mean-reverting price action = a time to stay nimble, not overextend.

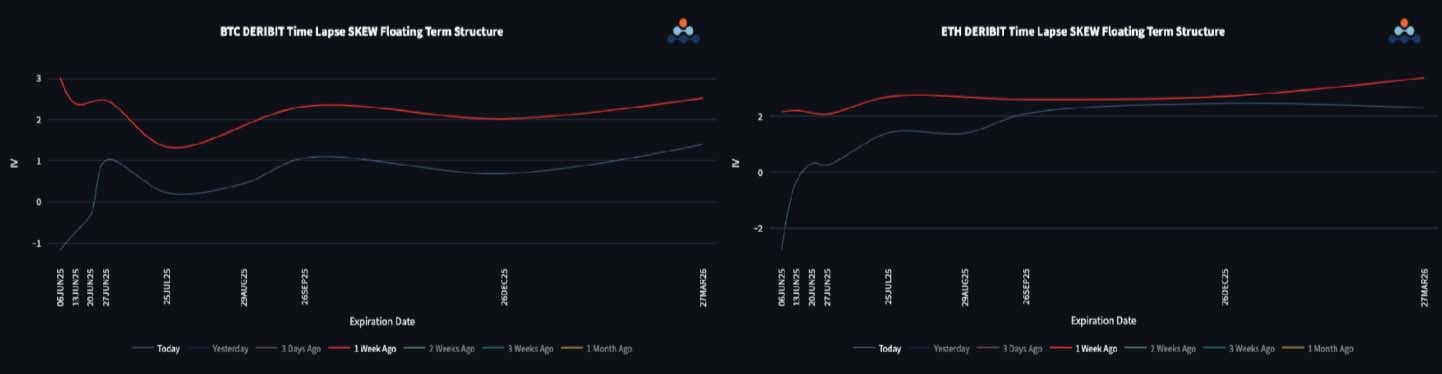

Skew Flips as Crypto Momentum Reverses

Skew curves flattened sharply as crypto cooled off and buyers stepped back;

- BTC front-end skew flipped into put premium, dropping as low as -3 vols near month-end

- ETH saw a similar reversal: short-term skew flipped from +2 vol call premium to -3 vols for puts, hitting extremes over the weekend

- Long-end tells a different story: BTC gave up ~1.5 vols of call premium, and ETH held firm on long-dated skew, showing resilience

In short: the chase for upside dried up. Demand for downside protection has quietly crept back in.

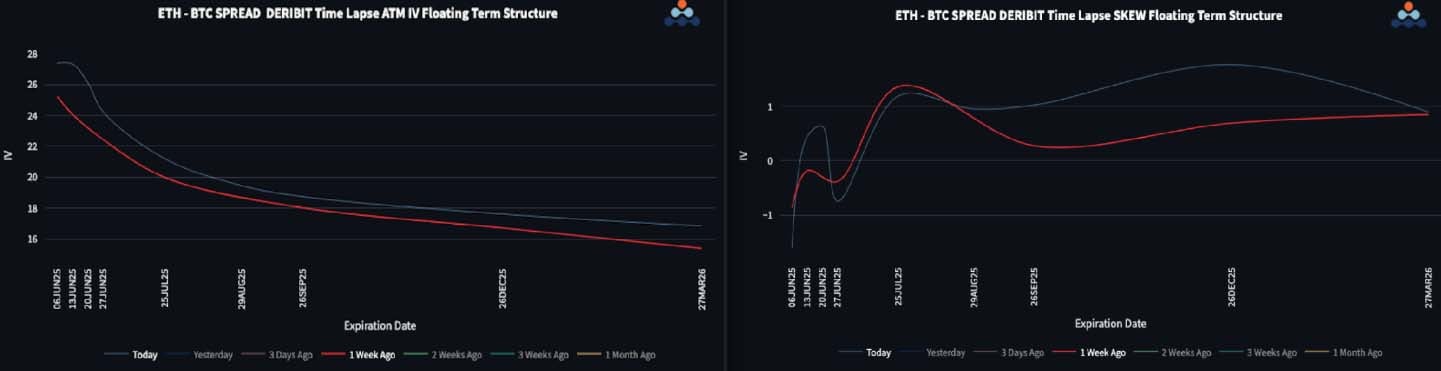

ETH/BTC Signals a Potential Trend Shift

ETH/BTC remains above former downtrend resistance, hinting at a possible rotation in ETH’s favor;

- Front-end vol spread widened—ETH vols holding up better than BTC

- Back-end spread still looks rich, offering VEGA short opportunities on ETH

- Skew between ETH and BTC flattened at the back end to a 1 vol spread

- Realized vol spread remains ~30 vols, but a consolidation phase could compress that further—potentially favouring ETH vol shorts

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)